Previous Trading Day’s Events (15.03.2024)

“Consumers perceived few signals that the economy is currently improving or deteriorating,” said Surveys of Consumers Director Joanne Hsu in a statement. “Indeed, many are withholding judgment about the trajectory of the economy, particularly in the long term, pending the results of this November’s election.”

The survey’s reading of one-year inflation expectations was unchanged at 3.0% in March. The survey’s five-year inflation outlook held steady at 2.9% for the fourth straight month.

______________________________________________________________________

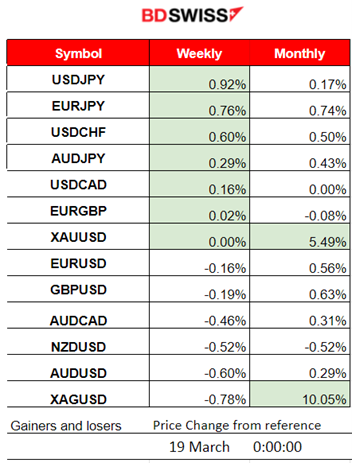

Winners vs Losers

USDJPY currently leads with 0.92% for the week followed by other JPY pairs (JPY as Quote) as the JPY is weakening as the Bank of Japan raised interest rates, a pivotal change in monetary policy.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (15 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

According to firms responding to the March 2024 Empire State Manufacturing Survey, business activity continued to decline in New York State, with a reporting index figure of -20.9. Demand softened as new orders declined significantly, and shipments were lower. Unfilled orders continued to shrink, and delivery times were little changed. Inventories declined.

The preliminary consumer sentiment report from the University of Michigan showed that US consumer confidence dropped slightly in March. The report said: “Small improvements in personal finances were offset by modest declines in expectations for business conditions.”

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

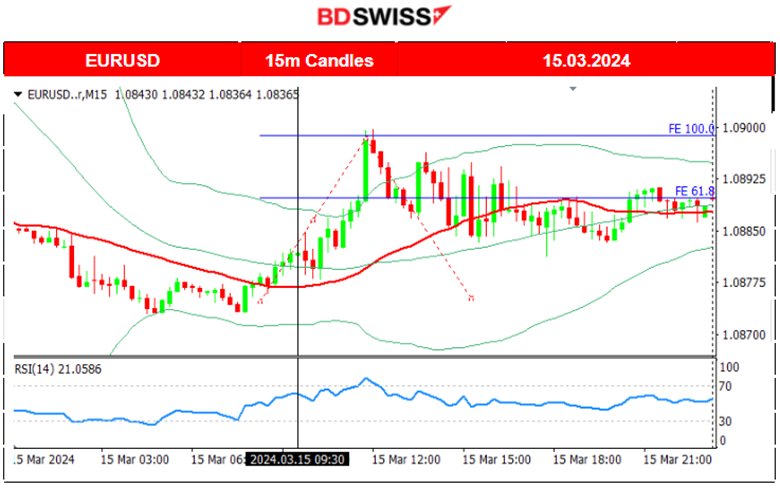

EURUSD (15.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the upside near the start of the European session. EUR’s strengthening caused the sharp movement upwards and retracement followed. News for the dollar was not in its favour as the manufacturing sector seems to suffer and since consumer expectations lowered. This caused the EURUSD pair to remain high.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

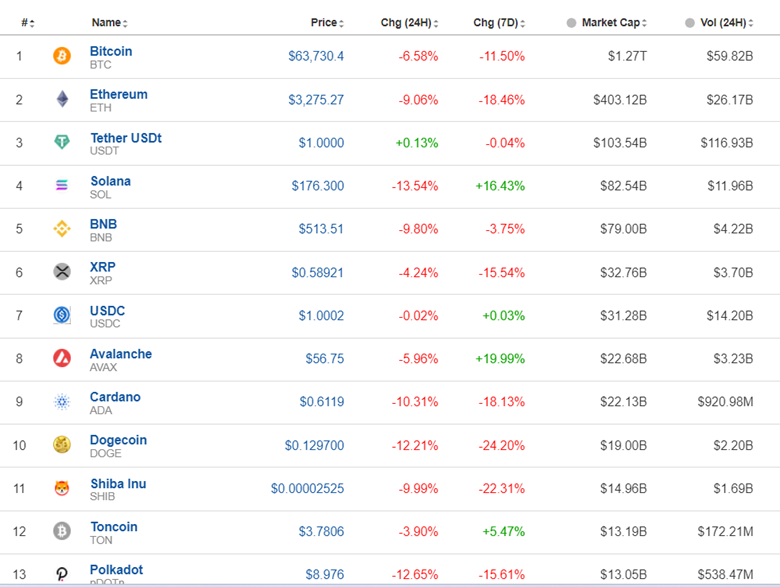

Bitcoin started to retreat significantly yesterday 14th March, especially after the news release for the U.S.

It reached near 74,000 USD this week but dropped heavily. Is this volatile downward movement a sign that the uptrend is over currently? Probably for some time.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market suffers ahead of the FOMC report.

The crypto market suffers ahead of the FOMC report.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 13th of March, the upward wedge was broken to the downside and the index dropped until the support at near 18,040 USD, moving below the 30-period MA on its way down. With the dollar appreciating further the drop continued on the 14th of March reaching the support near 17,950 USD before retracing to MA again. The 15th of March noted the confirmation of a downfall for U.S. indices as fears that there will be a cut delay grew, with borrowing costs to remain high in the future, and amid the U.S. dollar strengthening.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

A breakout of the resistance on the 13th of March caused its price to move away from the 78 USD/b level and reach higher at 79.5 USD/b. On the 13th of March, it started to see a price rise that was kept steady for two consecutive days causing the price to reach a peak near 81 USD /b. Retracement followed, back to near 80 USD/b. On the 14th March Crude oil continued to show that the trend is likely to continue upwards and after reaching the resistance near 81 USD/b it retraced to the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold will be pushed to the downside only if the Fed hints that there will be cut delays, following the hooter than expected inflation. Gold remained high as it moved to the upside on the 13th of March. The U.S. dollar (USD) weakened and Gold moved to the upside crossing the 30-period MA on its way up. A triangle formation was visible as volatility was lowering for Gold. On the 14th of March, Gold lowered due to the USD appreciation and reversed soon. Waiting for a triangle breakout. After a volatile Friday (15th March), significant support remains at 2,150 USD.

______________________________________________________________

______________________________________________________________

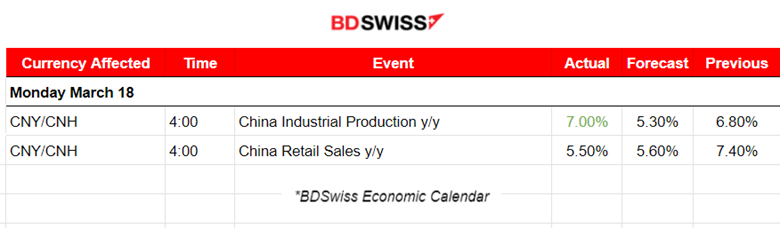

News Reports Monitor – Today Trading Day (18 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

No important announcements, no special scheduled releases.

General Verdict:

______________________________________________________________