PREVIOUS WEEK’S EVENTS (Week 24-28 April 2023)

Announcements:

U.S. Economy

The Retail Sales data for March, released on the 14th of April, showed lower sales than expected and also lower than the previous month. Consumers are decreasing their spending further as borrowing costs are higher, due to higher rates and persistently high inflation.

The figures of the consumer price index report showed that the core inflation remained high in March. The Fed is going to increase rates at least once more as inflation is still higher than the target levels. However, the Fed officials stated that soon they will pause their campaign of raising interest rates.

The Federal Reserve Bank of New York’s general business conditions index jumped to 10.8 this month. The New York manufacturing activity unexpectedly expanded in April for the first time in five months. Economists had expected a reading of negative 15, according to a Wall Street Journal survey. Any reading above zero indicates improving conditions.

_____________________________________________________________________________________________

Inflation

U.S.:

This April, U.S. UoM Consumer Confidence Index improves to 63.5 versus the expected 62. The near-term inflation expectations jumped early in the month, the highest in nearly two years. Additionally, consumer sentiment rose too.

Consumers expect that prices will climb at an annual rate of 4.6% over the next year, according to the preliminary UoM Inflation Expectations figure for April.

Canada:

According to the reported figures for the CPI changes, specifically Canada’s monthly CPI change, inflation slows to 0.5%. The Consumer Price Index rose 4.3% in March from last year; that is the lowest headline number since August 2021, backing interest-rate pause decisions. This matched market expectations.

Economists expect headline inflation to fall faster than the Bank of Canada expects this year.

U.K.:

The U.K. has an inflation problem that is worse and more persistent than in Europe and the U.S. Reports showed a 10.1% increase in its headline Consumer Prices Index. This was lower than February’s 10.4% but above the 9.8% forecast by economists.

Its headline inflation rate is now the highest within Western Europe compared to the average of 6.9% in the Eurozone and 5.0% in the United States. The expectations of aggressive interest rate hikes from the BOE in May have been boosted.

Europe:

The Euro area’s annual inflation rate was 6.9% in March 2023, down from 8.5% in February. Consumer inflation was lower primarily on a rapid fall in energy costs, as natural gas prices kept declining after their surge from Russia’s invasion of Ukraine a year ago.

European Central Bank policymakers want interest rates to keep rising. The debate appears to be between a 25 basis point and a 50 basis point increase to be determined at the upcoming meeting on May 4.

New Zealand:

New Zealand’s annual inflation rate declined to 6.7% from 7.2% in the final quarter of 2022. RBNZ is unlikely to pause rate hikes since this level is still high. It is expected that the Official Cash Rate (OCR) will be raised by a further 25 points at the policymakers’ next meeting on May 24, taking it to 5.5%.

Fears of recession also grow in New Zealand with the aggressive increase in borrowing costs. House prices are falling and businesses are downbeat while prices remain persistently high for some goods and services.

Source: https://www.reuters.com/world/americas/canada-annual-inflation-rate-slows-43-march-2023-04-18/

_____________________________________________________________________________________________

Interest Rates

U.K.:

The change in the number of people claiming unemployment-related benefits during the previous month was reported at 28.2K, which was way higher than expected. According to the Office for National Statistics (ONS), the unemployment rate is at its highest level since the second quarter of 2022. There is now more than an 80% chance of the Bank of England (BoE) raising interest rates to 4.5% in May to help bring down inflation, which was above 10% in February.

U.S.:

The number of Jobless claims rises as per the latest data indications. This is something expected since the U.S. labour market is cooling down due to the higher borrowing costs. The labour market slows steadily as a result of the Federal Reserve’s year-long interest rate hikes. The economy is slowing down significantly and recession fears are growing according to the latest statements from economists in the media. Retail sales are down, manufacturing activity is down and banks are tightening lending.

The U.S. central bank still intends to raise rates next month before finally giving a pause to its long-lasting rate hiking campaign.

Source: https://www.reuters.com/world/uk/uk-pay-growth-picks-up-three-months-february-2023-04-18/

Sources: https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-moderately-2023-04-20/

_____________________________________________________________________________________________

Energy Market

It seems that Russia’s exports are currently increasing as flows from Russian ports rose by 540,000 barrels a day, climbing back above 3 million barrels a day, in the latest four-week period, according to tanker-tracking data compiled by Bloomberg.

Output was indeed cut for a while but the increase in flows last week shows that the size of the output reduction is rather minimal or short-lived.

The price of Crude has experienced a decline since the 13th of April, from 83.4 USD to 81.08 USD (currently). For the 4th Day in a row, the U.S. Crude oil price is exercising a drop reaching below 77 USD per barrel.

Since the OPEC+ surprise output cut announcement the price has settled moving roughly sideways and around the mean, 81 USD level. Starting from the 14th of April, it moved to a surprisingly lower price level and continued its further and steady downward movement even until today.

Technical analysts see this as a technical correction from abnormal movements. OPEC+ announcements for production cuts caused a gap that needs to be filled, analysts said. As we see above, more supply from Russia may have an impact on this. With lower demand for goods and services and higher supply, the price could fall more than expected in the short term.

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases:

_____________________________________________________________________________________________

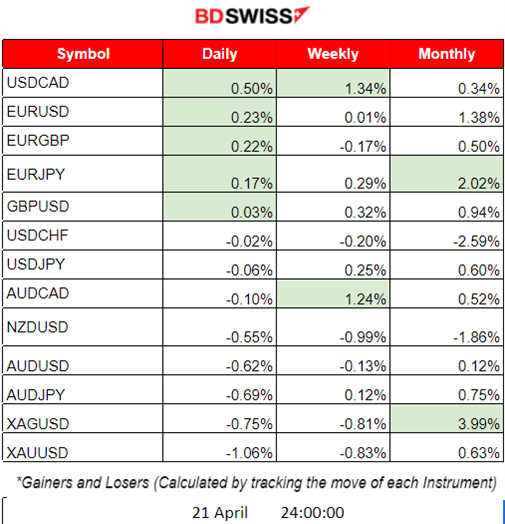

Summary Total Moves – Winners vs Losers (Week 17-21 April 2023)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

GBPUSD

The pair moved sideways with high volatility. GBP appreciated on the 19th of April with the CPI figures release but it did not create any trends. USD is the major driver of the pair. PMI data releases for the U.S. on Friday 21st of April caused the pair to drop intraday with the USD appreciation but later it retracted fully.

USDJPY

The pair is moving around the 30-period MA with high volatility mainly driven by the USD news. There is no clear trend as the USD is experiencing both depreciation and appreciation due to mixed expectations regarding future inflation levels and future interest rate decisions.

Bank of Japan Governor Kazuo Ueda said on Monday the central bank’s inflation forecasts must be “quite strong and close to 2%. BOJ policy rate is currently negative -0.10%. BOJ Core CPI y/y change is at 2.7%.

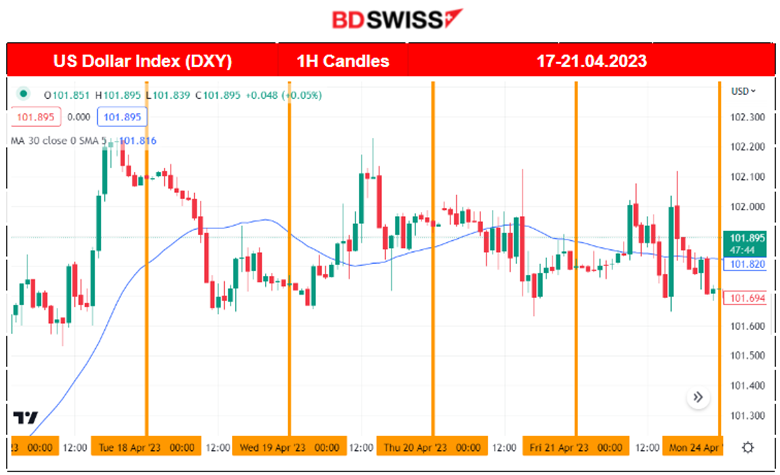

DXY (US Dollar Index)

The dollar Index moved sideways the previous week. The 30-period MA shows that the dollar settled around a mean but moves with high volatility. No clear trend though. It is affected by the recent scheduled releases and especially the consumer sentiment regarding future price expectations. 101.650 serves as support while level 102.120 serves as resistance.

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (24-28 April 2023)

Next week we have a consumer confidence-related report, Labor and Sales data for the U.S. Inflation data for Australia, the Bank of Japan Rate decision and Japan’s Inflation report.

25th April Banks are closed due to holidays in the following countries: New Zealand, Australia and Italy.

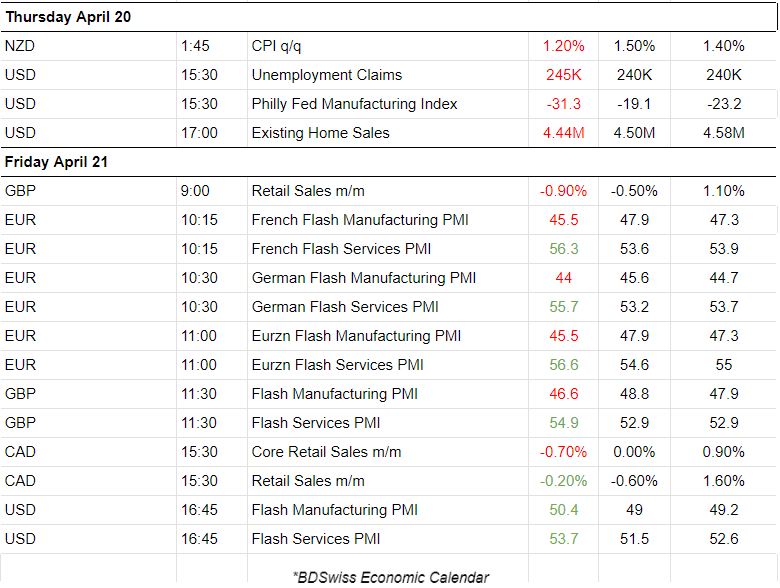

Currency Markets Impact:

_____________________________________________________________________________________________

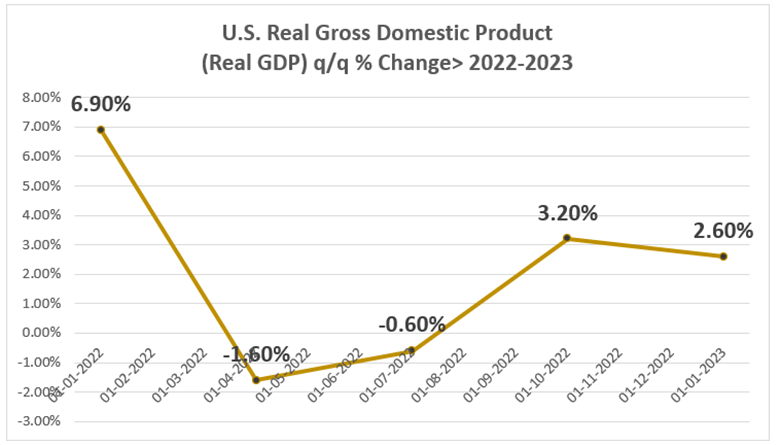

U.S. GDP

Previous Advance GDP q/q figures are as per below. Output for the United States started rising after the end of the summer period of 2022. GDP increased at a revised 2.6% annualised rate last quarter. Estimates for the rate of growth for the first quarter are currently at 2%.

_____________________________________________________________________________________________

Canada GDP

Slow economic growth in Canada yet the country is considered to be performing well economically. In 2022, the nominal gross domestic product of the country was worth $2.2 trillion. Its economy kept growing at the start of this year, defying expectations since it experienced the highest interest rates for years. GDP rose 0.5% in January and it is expected that it grew at the same rate in February.

(Note: Released monthly, about 60 days after the month ends).

_____________________________________________________________________________________________

U.S. Unemployment Claims

Weekly jobless claims increased by 5,000 to 245,000 suggesting the U.S. labour market is cooling. The next expected figure is higher at 249K.

Australia’s Inflation

The Reserve Bank of Australia (RBA) has been hiking interest rates since May 2022 in response to a rising inflation rate. Official inflation figures showed consumer prices rising at an annual rate of 7.8%in the December quarter.

The RBA expects inflation to simmer down during 2023 as they say that it probably passed its peak.

_____________________________________________________________________________________________

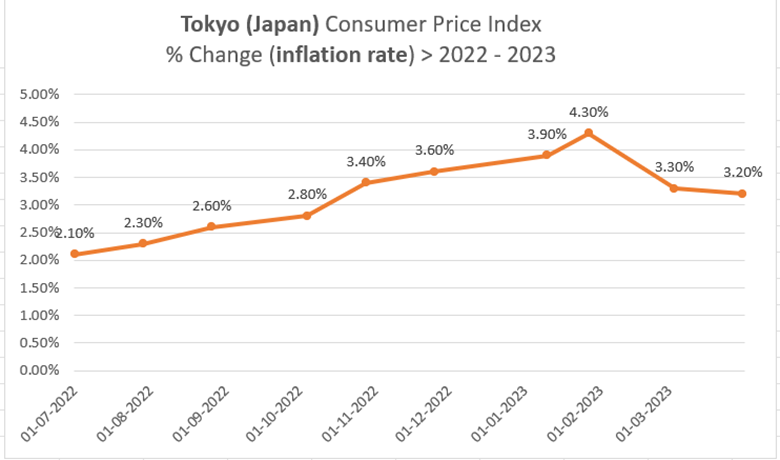

Tokyo Core Inflation

Tokyo is Japan’s most populated city and releases CPI data a month ahead of National CPI. It is released monthly, usually on the last Friday of the current month. This inflation figure was reported negative on May 28, 2021 (-02%) for the last time. Since then prices started rising with reports showing positive figures. On Jan 27, 2023, it reported the highest figure for the year, at 4.3%.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

US Crude Oil

Finally, after a week of downward movement below the 30-period MA, Crude has finally shown signs that the trend might have stopped. On Friday, its price showed significant resistance to the downside, moving eventually upwards, crossing the MA and moving above it. This does not mean that the price will move upward, however, it only indicates that the trend will probably not continue. Since the downward movement was relatively rapid, we might see a retracement actually happening next week, with the 79 USD level acting as the next target support level.

Latest Crude oil change in inventories report showed -4.6M. During late March and early April it is clear that less oil stays in inventories explaining some of the price decline.

Gold (XAUUSD)

Gold is moving sideways in a unique volatile way. Despite the frequent various shocks with USD appreciation, its price retraces back to the 30-period MA which trades close to the 2000 USD level. On Friday, it actually moved lower and closed the day at 1982 USD as the USD appreciated heavily due to the PMI figure releases that showed U.S. Economy expansion in business activity.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

U.S. stocks continue their sideways movement. All main three U.S. indices are moving around the 30-period MA with no signs of trends forming, at least downwards. In fact, the RSI shows higher highs while the price shows lower lows. This might confirm that the index is experiencing significant resistance. According to the latest U.S. PMI data, business activity unexpectedly climbed this month to nearly a one-year high, bolstered by stronger services and manufacturing. Firms saw new orders jump to the highest rate in 11 months, especially in the service sector.

______________________________________________________________