PREVIOUS WEEK’S EVENTS (Week 04 – 08 Dec 2023)

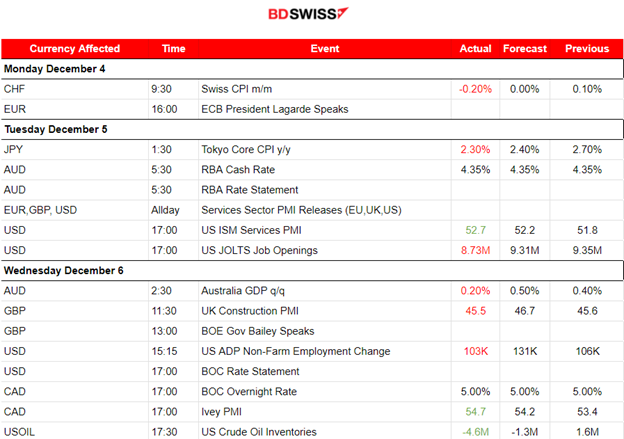

Announcements:

U.S. Economy

Job openings dropped to more than a 2-1/2-year low in October, according to the JOLTS Job Openings report for the U.S. Demand for labour was cooling amid higher interest rates apparently.

This data favour policymakers supporting the view that rates are at a peak. Job openings, a measure of labour demand, fell 617K to 8.7M on the last day of October, the lowest level since March 2021.

The Fed is expected to leave rates unchanged next Wednesday. Since March 2022, the central bank has raised its benchmark overnight interest rate by 525 basis points to the current 5.25%-5.50% range.

According to the ADP report, the U.S. Private employment increased by only 103K jobs last month beating the forecast of a 131K increase. The ADP report was published ahead of the NFP release. A signal that the labour market is slowing down as 525 basis points worth of interest rate hikes took effect, since March 2022.

The labour market conditions are easing and inflation is cooling significantly, leaving financial markets to believe that the Fed’s monetary policy tightening campaign is over.

New claims for unemployment benefits increased moderately last week, suggesting that the labour market is actually cooling and coinciding with the other previous reports that suggest the same thing.

The government reported this week that there were 1.34 job openings for every unemployed person in October, the lowest since August 2021.

Way more jobs were recorded than expected in the U.S., for November, according to the NFP report on Friday, while the unemployment rate fell significantly to 3.7% vs the 3.9% previous figure, signs of underlying labour market strength that puzzled everyone that expected rate cuts early next year. A relatively healthy report showing that rate cuts might have to wait.

Annual wages rose moderately last month and inflation has been cooling in recent months.

The University of Michigan’s survey on Friday showed that consumers’ 12-month inflation expectations plunged to 3.1% in December, the lowest reading since March 2021, from 4.5% in November.

_____________________________________________________________________________________________

Inflation

The Swiss consumer price index (CPI) fell by 0.2% in November compared with the previous month reaching 106.2 points. Inflation has actually increased by 1.4% compared to the same month last year (yearly comparison) according to the Federal Statistical Office (FSO).

The 0.2% is due to several factors including lower prices for hotels and international package holidays. Prices for fuels, heating oil and fruiting vegetables also fell. In contrast, housing rentals and imputed rents for owner-occupied dwellings increased.

_____________________________________________________________________________________________

Interest Rates

RBA

Australia’s central bank (RBA) held interest rates steady as expected, as it needs more time to assess the state of the economy and decide whether to tighten further next year. Rates were kept at a 12-year high of 4.35% allowing more time to assess the impact of the increases in interest rates on demand, inflation and the labour market.

According to the monthly inflation report for October, inflation fell by more than expected, insufficient to provide an update on services. Rates have risen by 425 basis points since May last year.

BOC

The Bank of Canada (BOC) on Wednesday held its key overnight rate at 5% leaving the door open to another hike, as there are still concerns about inflation. Economic slowdown and a general easing of prices is indeed happening though.

BOC is still concerned about risks to the outlook for inflation and is prepared to raise the policy rate further if needed

The slowdown in the economy is reducing inflationary pressures in a broadening range of goods and services prices,” the BOC said, noting that October core inflation was at the low end of a range seen in recent months.

The BOC forecast in October that inflation would hover around 3.5% until mid-2024, before inching down to its 2% target in late 2025. The central bank will start cutting rates in the second quarter of 2024 as inflation and the economy slow, according to a Reuters poll.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-private-payrolls-miss-expectations-november-2023-12-06/’

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-slightly-2023-12-07/

https://www.bfs.admin.ch/bfs/en/home/statistics/prices/consumer-price-index.html

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 04 – 08 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

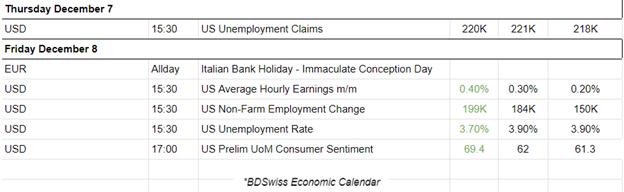

Eurozone Services PMIs

The Spanish PMI recorded a 51 points figure suggesting that the service sector’s moderate expansion was sustained in November. Extra capacity and employment growth were sustained as positive projections for activity were projected during the period.

The Italian PMI figure was improved but again in the contraction area below 50. The Italian service providers experienced once again declining activity as demand weakness continued in Services. Contraction seems to ease though.

The French PMI figure was reported at 45.4. Another solid contraction. The released report indicates that demand for French services fell at the fastest pace in three years. The French expect weak growth expectations for the next 12 months and lay-offs were reported high, as firms tried to reduce costs. Output charge inflation ticked up to a four-month high as input cost pressures remained at historically high levels.

The German PMI figure was reported 49.6, close to 50 but again in contraction. Business activity fell marginally in November with a slower decline in new business, Employment once again showed little change. Service providers expected little growth in activity over the next 12 months. Latest data showed a rise in cost pressures across the service sector as rising wages drove the steepest increase in firms’ input prices for six months.

The Eurozone PMI was reported at 48.7 indicating that the eurozone’s economic activity continues to shrink with declines in new business and backlogs of work being sustained.

United Kingdom Services PMI

In the U.K. the business conditions improved slightly. The PMI figure was reported in the expansion area, 50.9, a modest rebound in business activity across the UK service sector in November. Rising output as new orders were higher, but no significant increase in demand and still low consumer confidence. Service providers suffered an increase in average cost, mainly due to wages and elevated inflationary pressures across the economy.

United States of America Services PMI

The PMI figure was recorded at 50.8, in the expansion area, as U.S. service sector firms signalled further growth in November. Output and new business expanded with a renewed increase in new orders.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

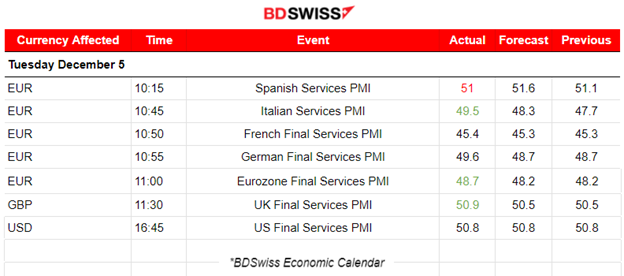

Dollar Index (US_DX)

The dollar index was climbing higher early last week and an upward wedge was formed while the USd kept on gaining strength. The wedge was eventually broken on the 7th Dec when the USD suddenly experienced strong weakness since the labour data released so far were suggesting significant cooling of the labour market. On the 8th the dollar index reversed, gaining more and more strength as the NFP report was approaching. The NFP figure was actually expected to be released higher than the previous figure and that actually happened. On the 8th the shock during the NFP figure release caused the dollar index to experience high volatile up-down movement but overall to close higher for the trading day.

EURUSD

While the dollar was experiencing strength at the beginning of last week, the EURUSD pair was steadily moving to the downside while being below the 30-period MA. A short-term downward trend. On the 7th the pair reversed significantly crossing the MA on its way up since the USD experienced depreciation. After that reversal, on the 8th, the path continued downwards while the USD started to gain strength again. After the NFP shock, the pair settled on a sideways volatile path forming a triangle that is currently waiting to be broken.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin fell significantly today during the Asia session, falling under 41K USD wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

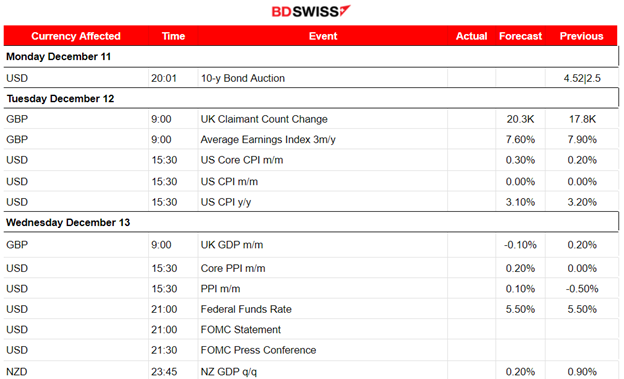

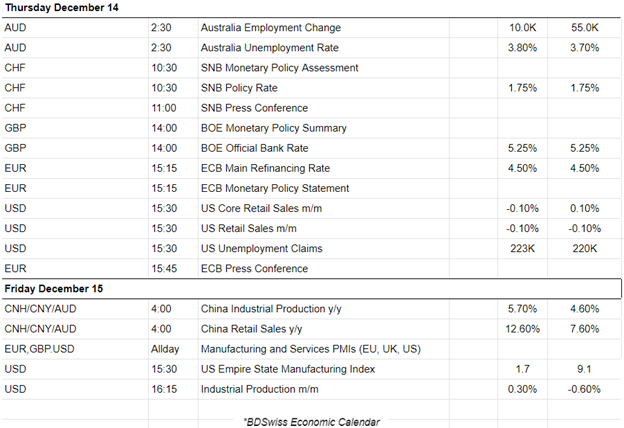

NEXT WEEK’S EVENTS (11-15.12.2023)

This week the U.S. inflation related figures will be released, both the CPI and PPI reports.

We have also 4 monetary policy and rate decision announcements from key central banks: FED, SNB, BOE, ECB, along with the Norge Bank and a number of emerging market central banks too

On Friday both the Manufacturing and Services PMIs are to be released for the major regions.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

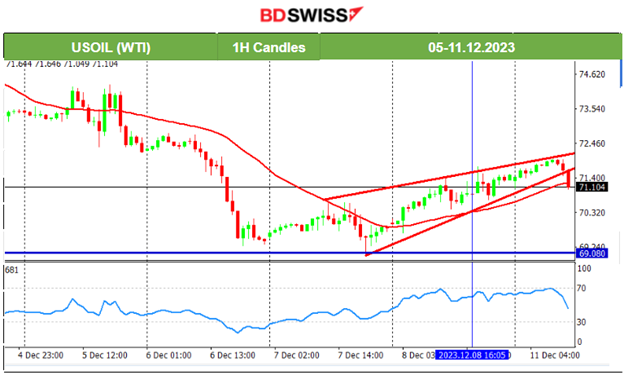

Crude oil finally reversed last week after testing the support near 69 USD/b. It eventually retraced back to the 61.8 Fibo level and settled at near 71 USD/b. Yesterday it eventually kept moving steadily upwards reaching eventually the 72 USD/b level. An upward wedge was formed that seems now to have been broken while the price moves downwards today. This might be a signal for a further intraday drop.

Gold (XAUUSD)

Gold eventually broke the consolidation. A triangle formation was apparent as well as depicted with the red and blue lines as discussed in our previous report. When the NFP report was released Gold’s price dropped heavily near 30 USD, reaching 1995 USD/oz, before eventually retracing back to the 61.8 Fibo level. Now it currently remains close to the support near 1994 USD/oz and quite away from the 30-period MA. Even though the RSI shows higher lows, we still need more evidence to support a reversal again back to the mean, thus an upward movement. Let’s see.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

In general, all benchmark indices were recently in a state of consolidation that from yesterday seems to not hold anymore. The market eventually broke the consolidation by moving further upwards. The index broke the 16000 USD resistance level and moved further upwards reaching the 16100 USD level. However the RSI shows lower highs indicating that the volatile up-and-down moves might continue, thus causing the price to reverse significantly.

______________________________________________________________