PREVIOUS TRADING DAY EVENTS – 08 May 2023

Announcements:

If the debt ceiling is not raised and no agreement is reached, the U.S. could default on its debt. Treasury Secretary Janet Yellen is reaching out to U.S. businesses, CEOs and financial leaders with a warning, explaining the major disaster the default will cause to the U.S. and global economies according to media sources.

Talks on the issue should not take place “with a gun to the head of the American people,” Yellen said in a pointed reference to Republican lawmakers’ insistence on tying a debt-ceiling increase to sweeping spending cuts that Democrats oppose.

President Joe Biden insists that Congress has a constitutional duty to raise the debt ceiling.

______________________________________________________________________

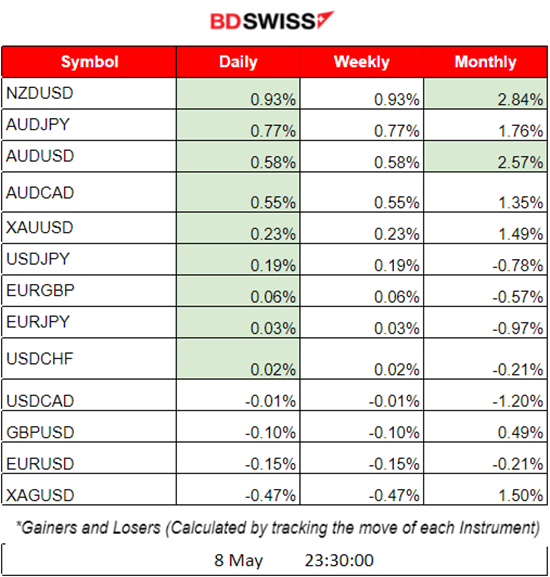

Summary Daily Moves – Winners vs Losers (08 May 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (08 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

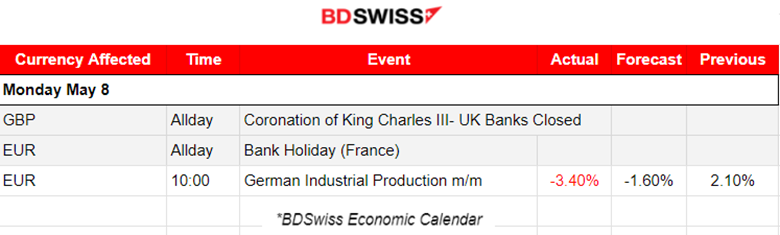

- Morning – Day Session (European)

U.K. banks were closed in observance of the coronation of King Charles III. The EUR was hardly affected by the Bank Holiday in France.

The U.S. could default on its debt, warns Treasury Secretary Janet Yellen and is contacting U.S. businesses, CEOs and financial leaders to explain the dangers and potential catastrophes. The market did not react yet to this news heavily expecting to see more development. Nevertheless, it adds to the recession fears.

There were no other important figure releases.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (08.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The major pair experienced low volatility going sideways around the 30-period MA and resulting in moving overall below the MA and downwards ending the trading day. It is clear that the main driver of the path is USD as per the DXY chart.

EURGBP 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURGBP has been experiencing a downward trend for the past few days and actually, the EUR pairs, with EUR as the base currency, have dropped overall. The ECB raised interest rates last week and declared that rate hikes will continue while BOE is expected to raise the official bank rate by 25 basis points on the 11th of May, as inflation is at extremely high levels. A surprise increase is a possibility.

____________________________________________________________________

EQUITY MARKETS MONITOR

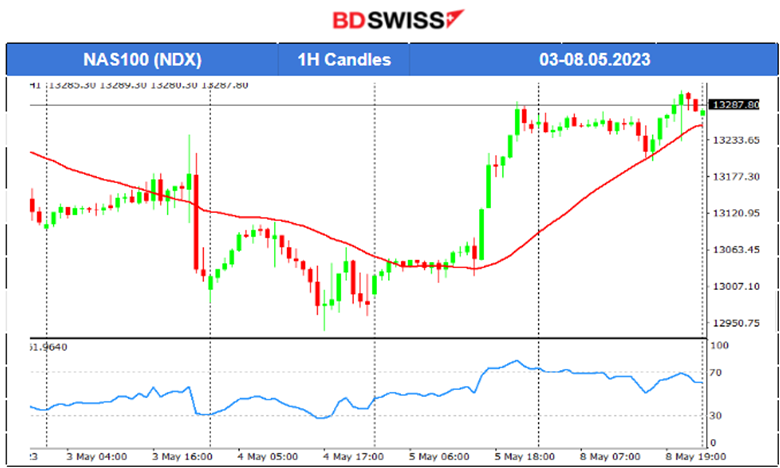

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Recent U.S. labour data showed a high employment change figure. The USD gained and the U.S. Stocks were pushed upwards on the 5th of May, confirming a bullish divergence as well. The market settled high and remained on a sideways path on the 6th of May, experiencing low volatility.

_____________________________________________________________________

COMMODITIES MARKETS MONITOR

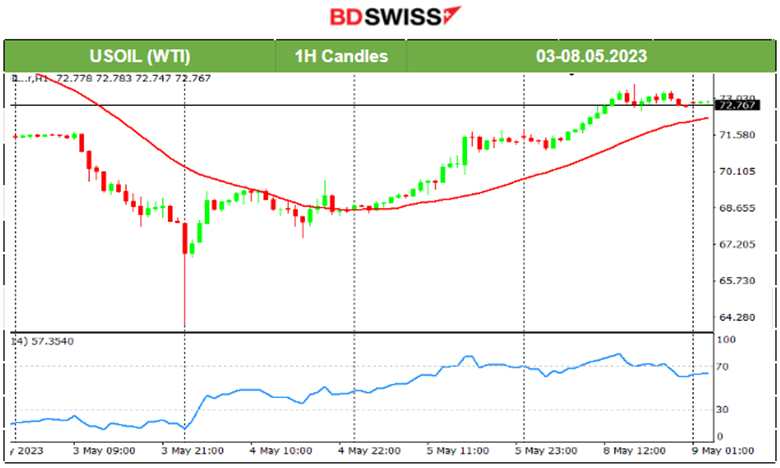

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD depreciation and the pessimistic expectation of future business activity have affected the energy market and Crude experienced a downward movement that ended on the 4th of May. Since the 4th of May, it reversed moving above the 30-period MA and continued with an upward short-term trend. The recent intraday scheduled figure releases for the U.S. have not really affected its price.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

XAUUSD (Gold) has been moving higher because of USD depreciation and investor risk-off mood. On the 5th of May, Gold moved lower and under the 30-period MA ending the upward trend with the NFP data release. The USD appreciated heavily and Gold dropped to the support level of 2000 USD. A retracement followed with the price showing less volatility and moving sideways around the mean until this day.

______________________________________________________________

News Reports Monitor – Today Trading Day (09 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

No important news releases and no major scheduled figure releases.

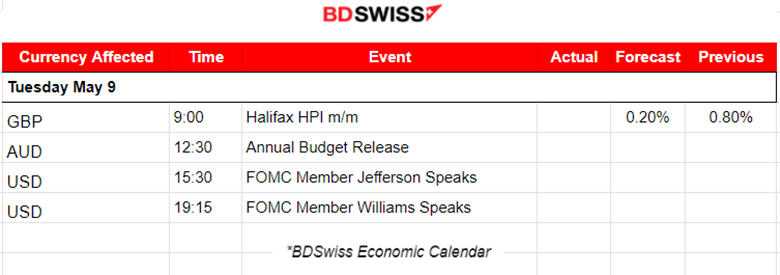

FOMC members are giving speeches today. USD pairs will probably experience higher volatility than typical. Most pairs gain momentum after the European Markets opening.

General Verdict:

______________________________________________________________