PREVIOUS TRADING DAY EVENTS – 12 Oct 2023

With the labour market still tight, however, reaching the Fed’s 2% inflation target could be difficult, making it likely that the U.S. central bank could keep rates elevated for longer or even proceed to another hike.

“The bigger picture is that the trend is still quite encouraging, but the fight continues,” said Olu Sonola, head of U.S. regional economics at Fitch Ratings in New York. “They (Fed officials) may now want to extend the pause to December, given the recent increase in long-term rates.”

The CPI increased 0.4% last month, with a 0.6% jump in the cost of shelter accounting for more than half of the rise. The CPI soared 0.6% in August, which was the largest gain in 14 months. In the 12 months through September, the CPI advanced 3.7% after rising by the same margin in August. Year-on-year consumer prices have come down from a peak of 9.1% in June 2022.

“We must wait for more data to see if this is just a blip or if there is something more fundamental driving the increase such as higher rent increases in larger cities offsetting softer increases in smaller cities,” said Stephen Juneau, a U.S. economist at Bank of America Securities in New York.

Financial markets overwhelmingly anticipate the Fed will leave rates unchanged at its Oct. 31-Nov. policy meeting, according to CME Group’s FedWatch Tool. They saw less than a 40% chance of a hike in December.

______________________________________________________________________

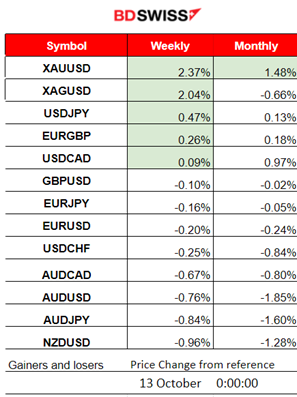

Winners and Losers

Metals are still on the top of the winner’s list. Gold and Silver have close to 2% gains. Gold this month gained the most with 1.48% performance.

News Reports Monitor – Previous Trading Day (12 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

Monthly real gross domestic product (GDP) is estimated to have grown by 0.2% in August 2023, following a fall of 0.6% in July 2023. Services output rose by 0.4% in August 2023 and was the main contributor to the GDP growth. At the time of the release, there was no significant impact recorded.

Major movements took place during and after the CPI data releases for the U.S. Prices increased slightly faster than expected pace in September, keeping inflation in the eyes of policymakers. The consumer price index increased 0.4% in the month and 3.7% from a year ago, according to a Labor Department report. The market reacted with USD appreciation, as per the DXY chart below, the index surged overall yesterday.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (12.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD was following a sideways path with low volatility until the CPI data were released for the U.S. At the time of the release the USD pairs were affected greatly, a shock took place at the time and USD appreciated. The effect lasted until the end of the trading day. Due to USD appreciation, the EURUSD dropped heavily, near 95 pips overall. A retracement is currently taking place today.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Its price was following a clear downtrend as preferences for other risky assets such as stocks have increased, with U.S. indices showing an uptrend instead. Similarly, with Metals. Yesterday that downtrend was interrupted by the CPI news. We see that the path changed sideways with Bitcoin refusing to fall below the support 26500. Will this be the start of a retracement back to the upside? Let’s see.

Crypto sorted by Highest Market Cap:

Bitcoin settles lower but it is steady. The market has not moved much in the last 24 hours. Still, the 7 days column shows that most crypto have suffered losses of over 5% and there were no significant reversals yet.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

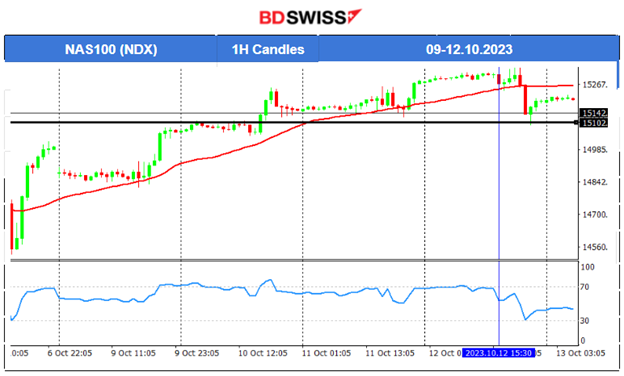

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

All benchmark indices experienced similar upward paths. The U.S. stock market picked up momentum and caused the indices to move to higher levels. Yesterday the CPI news caused a shock in the U.S. stock market. All indices crashed before they retraced again but now giving the signal that the upward trend is finally over since the price remains now under the MA. When the index breaks more important support levels we will be in a position to suggest that a long period of retracement to the downsided started. Currently, that support is at nearly 15100 USD for NAS100.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude on the 11th of October finally broke consolidation and moved to the downside rapidly finding support at near 81.7 USD/b. After that, it retraced back to the mean at near 83 USD/b soon after the drop and continued with remarkably high volatility sideways around the MA before eventually deviating significantly to the upside, breaking important resistance levels. This could turn out to be the long-awaited retracement back to high levels.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold continues to move to the upside. Despite yesterday’s drop at the time the CPI data for the U.S. was released, it eventually reversed crossing again the 30-period MA and showing upward momentum. Currently, it is testing the key level 1885 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (13 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s Consumer Price Index (CPI) figure was reported 0% in September after accelerating by 0.1% in August. The market expected an increase of 0.2% though. Chinese CPI inflation rose to 0.2% over the month in September versus the 0.3% decrease seen in August. At the time of writing, AUD/USD is a little affected by the key Chinese data release, keeping its range at around 0.6325.

- Morning–Day Session (European and N. American Session)

U.S. Prelim UoM Consumer Sentiment report arrives at 17:00. More volatility is expected at that time for USD pairs. The U.S. Stock market could see some more activity today, now being in a reversing situation after a long upward path.

General Verdict:

______________________________________________________________