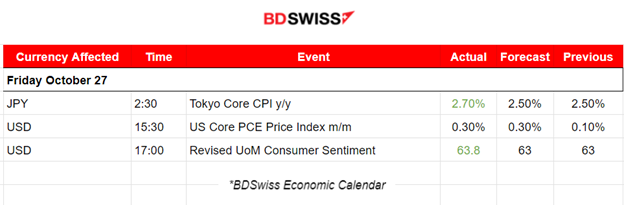

PREVIOUS TRADING DAY EVENTS –27 Oct 2023

U.S. consumer spending surged in September keeping spending on a higher growth path heading into the fourth quarter. Spending is, however, seen cooling off in early 2024 leaving economists convinced the Federal Reserve is done raising interest rates.

Monthly inflation readings of 0.2% on a sustainable basis are needed to bring inflation back to the U.S. central bank’s 2% target, according to economists. The core PCE price index rose 3.7% on a year-on-year basis in September, the smallest gain since May 2021, after increasing 3.8% in August.

The Fed tracks the PCE price indexes for monetary policy. It is expected to leave interest rates unchanged next Wednesday as a recent surge in the U.S. Treasury yields and stock market sell-off have tightened financial conditions. Thus, the probability of keeping rates unchanged is now estimated to be over 90%. But risks of a rate hike remain.

“There is more work to be done to sustainably lower inflation towards the 2% target,” said Pooja Sriram, an economist at Barclays in New York.”

Source: https://www.reuters.com/markets/us/us-consumer-spending-beats-expectations-september-2023-10-27/

______________________________________________________________________

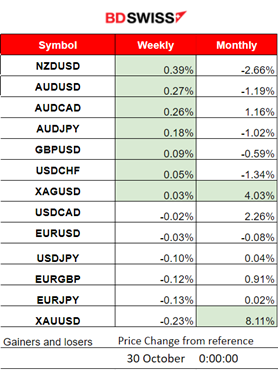

Winners and Losers

News Reports Monitor – Previous Trading Day (27 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Inflation was reported to be elevated for Tokyo. It unexpectedly quickened for the first time in four months in October, indicating that inflation is proving stickier than expected. No major market impact was recorded at the time of the release.

- Morning–Day Session (European and N. American Session)

At 15:30 the PCE data was released as expected. It seems that inflation-related data are pointing to a state of high inflationary pressures in the U.S. giving a hard time for the Fed to bring it down, reaching their forecasts and targets. After the release, the USD weakened for some time. The DXY found support soon near 106.4 before retracing to the mean. It returned to the upside after the Revised UoM Consumer Sentiment report showed a higher-than-expected figure, 63.8 vs 63.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (27.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with low volatility early before the European session started. After that, the pair moved quickly to the downside showing more volatility and eventually reached a strong support before reversing. The reversal was quick and high since it crossed the 30-period MA on its way up after the PCE data release at 15:30 while the USD was losing strength. It found resistance at the end of the move at near 1.05970 and retraced back to the mean and the 61.8 Fibo level. It experienced more volatility soon after and closed the trading day flat.

___________________________________________________________________

___________________________________________________________________

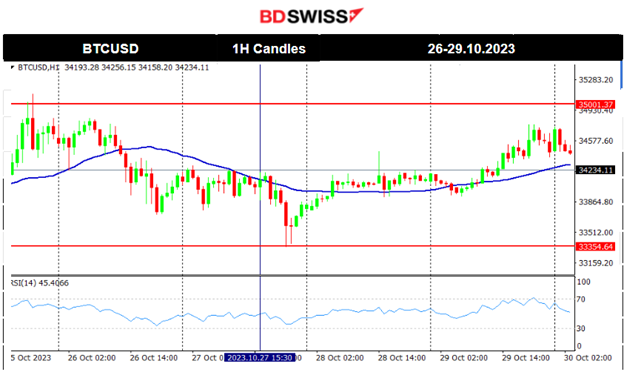

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin and several cryptocurrencies and related stocks such as Coinbase Global (COIN), Marathon Digital Holdings (MARA), Riot Platforms (RIOT) and Microstrategy (MSTR) experienced a surge in value after a U.S. appeals court ordered the Securities and Exchange Commission to review Grayscale’s application for a spot Bitcoin ETF. Bitcoin has moved significantly to the upside breaking all important resistance levels reaching even until near the level of 35,200 USD, clearly visible on the chart on the 24th Oct. That was the level at which the rapid surge in price finally ended with its price soon retracing back to the 30-period MA. Bitcoin remains in consolidation and with low volatility levels, having 35000 USD as an important resistance level. Fundamentals remain the key factors that push the price to deviate significantly from the mean. Important resistance remains at the 35200 USD level.

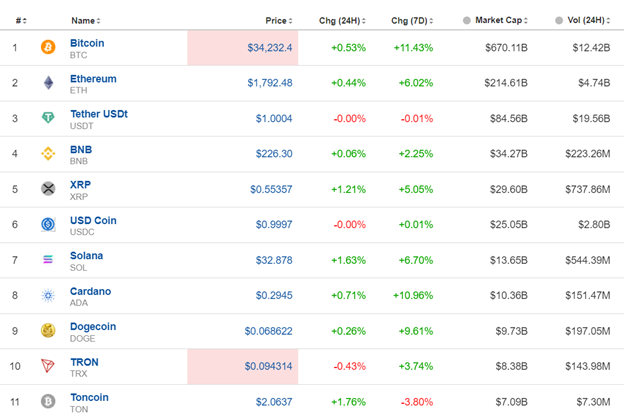

Crypto sorted by Highest Market Cap:

Volatility levels are lower and the markets for Crypto are not moving much. In the last 24 hours, there was not much movement. Overall for the last week, gains remain high as depicted in the 7-day column.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The index tries to recover from the massive drop since the 25th Oct. It found strong support currently at near 14070 USD and remained close to the 30-period MA without experiencing for now any other sudden moves to the downside. Other benchmark U.S. indices have actually experienced more movements to the downside instead. Risk-off mood.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

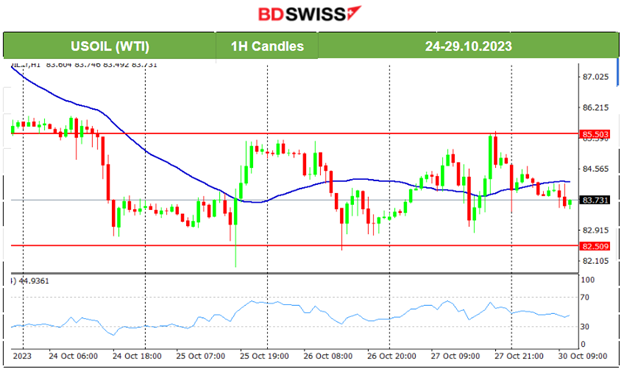

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude remains in consolidation and in a range that has support near 82.5 USD/b while resistance is near 85.5 USD/b as the peaks suggest. It is moving with high volatility sideways around the mean currently and is heavily affected by the fundamentals. War-related: The Gaza war rages currently. Israeli forces expand ground operations.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The price of gold moved to the upside as mentioned in our previous report. Gold jumped over the 2000 USD/oz reaching the resistance near 2009 USD/oz before it retraced to the mean after the market opening today. The risk-off mood is still on as war is ongoing. Gold performance is over 8% for this month so far.

______________________________________________________________

______________________________________________________________

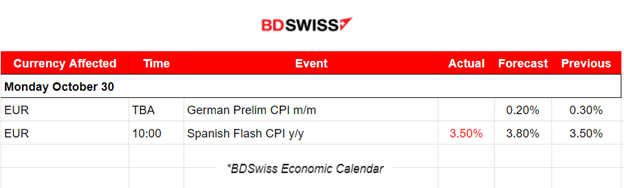

News Reports Monitor – Today Trading Day (30 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements. No special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

EUR-related news might cause the market to move. We have inflation-related figure releases and German and Spanish CPI data that seem important. However, we already know, and so do the market participants, that the business conditions in the Eurozone are deteriorating significantly with inflation getting lower and lower. This news had little effect on EUR pairs.

General Verdict:

______________________________________________________________