PREVIOUS TRADING DAY EVENTS – 16 June 2023

Announcements:

Annual consumer and producer prices retreated significantly in May, mainly because of lower energy costs. The Fed on Wednesday left its policy rate unchanged. However, policymakers stated that borrowing costs should remain high. Increases in interest rates are likely to continue after this pause since inflation is still above the Fed’s 2% target. Financial markets are betting that the central bank will raise interest rates only one more time this year, according to the CMEGroup’s Fedwatch tool.

So far the data pointed out that consumer spending is likely to continue at a steady pace. Higher prices and borrowing costs did not have too much impact on spending since wages rose higher. Retail sales figures last week were actually supporting this fact.

“Consumers are becoming believers in an economy now marked by strong job growth and lower inflation,” said Robert Frick, corporate economist at Navy Federal Credit Union in Vienna, Virginia.

Source:

https://www.reuters.com/markets/us/us-consumer-sentiment-rises-four-month-high-june-2023-06-16/

______________________________________________________________________

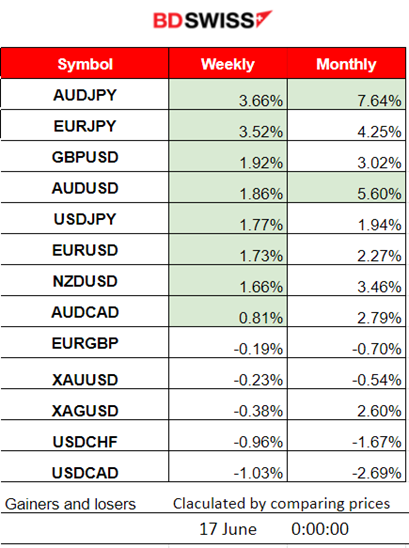

Summary Daily Moves – Winners vs Losers (16 June 2023)

- The JPY pairs have managed to climb up to the winners’ list. AUDJPY and EURJPY moved the most with 3.66% and 3.52% gains respectively.

- The AUDJPY is the top winner this month with a 7.64% overall price change so far.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (16 June 2023)

Server Time / Timezone EEST (UTC+03:00)

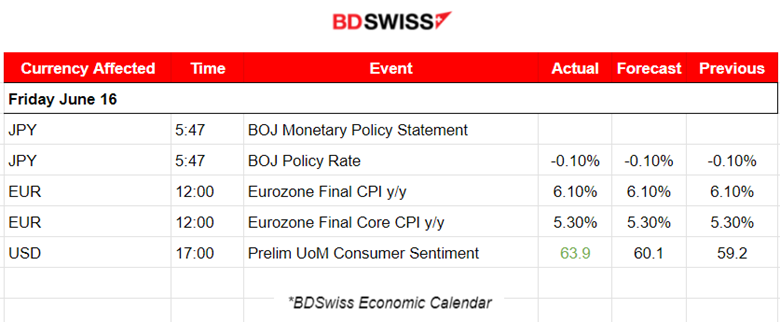

- Midnight – Night Session (Asian)

The Bank of Japan (BOJ) decided to leave rates unchanged at -0.10%, a decision released at 5:47. At that time the JPY depreciated against other currencies. An intraday shock took place and pairs soon retraced after a near 40-50 pips jump (EURJPY, USDJPY). However, the JPY pairs reversed again and continued with their upward and steady movement until now.

- Morning – Day Session (European)

Final Eurozone CPI change data were released as expected without having a notable impact.

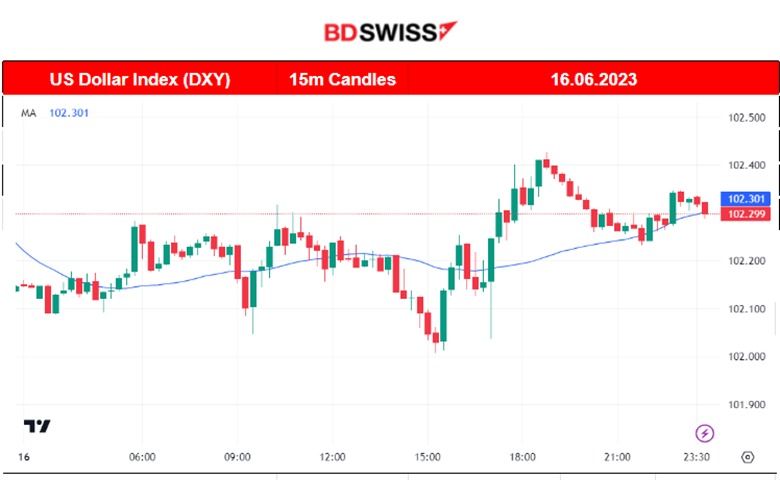

At 17:00 the Prelim UoM Consumer Sentiment result was released and the figure was more than expected, 63.9. The U.S. short-term inflation expectations fell in early June to a more than two-year low bringing the consumer sentiment higher. An intraday shock for the USD pairs took place at that time but at a low level. The USD strengthened after the release but reversed soon after, as per the DXY chart.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (16.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD was moving sideways around the 30-period MA with low volatility until the start of the European session when more volatility kicked in. At 17:00, the preliminary report for the U.S. consumer sentiment was released pushing the pair downwards with USD appreciation at that time. It was actually a reversal of the price crossing the MA and rapidly falling. It was a slow day and retracement was almost certain after that event. The pair found support eventually at near 1.09180 before retracing back to the mean.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Fed had previously decided that it has done enough with hikes and left the Fed rate unchanged. The data are mixed. A strong labour market while inflation drops. This is puzzling for policymakers since they have to decide if they are going to keep the hike pause. Stocks are still climbing but at a diminishing rate as it seems. High retracements take place intraday. Still, the index is not reversing significantly in order to signal a stop for the upward trend. Sideways or even upward continuation is still on, as well as the risk-on mood as it seems.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude remained above the 30-period MA. It moves upwards as it climbs the support levels. However, the RSI is still showing signs of bearish divergence. At this point, the potential drop in price may not be so high since the MA is not so low. Considering Crude’s volatility though, retracements are almost impossible not to happen. Should the price experience a reversal crossing the MA downwards, that would be a great opportunity for long positions after a good support level is found strong enough intraday.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold reversed significantly during the week, specifically on the 15th of June. The price moved upwards crossing the 30-period MA and remained above it. It later moved to higher levels as it broke some resistance levels but soon retraced back to the mean. Volatility is quite strong but the price is obviously USD driven. Currently, the USD is losing strength. U.S. Stocks are not climbing fast and oil starts to climb as well. Fed decisions in July will be critical for market movement direction.

______________________________________________________________

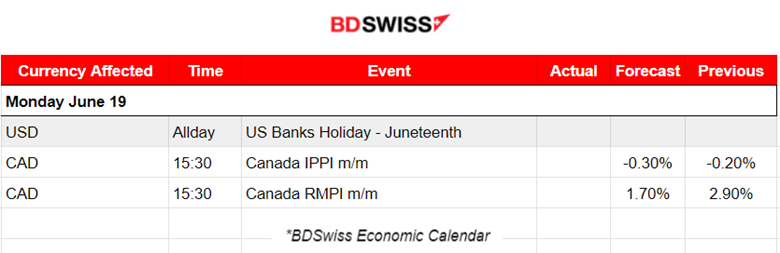

News Reports Monitor – Today Trading Day (19 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

No significant news announcements, no special scheduled releases.

Canada’s monthly changes in the price of goods sold by manufacturers could have an impact on the CAD pairs but not great.

General Verdict:

______________________________________________________________