PREVIOUS TRADING DAY EVENTS – 13 Oct 2023

“Nearly all demographic groups posted setbacks in sentiment, reflecting the continued weight of high prices,” Joanne Hsu, the director of the University of Michigan’s Surveys of Consumers, said in a statement.

The survey’s reading of one-year inflation expectations increased to 3.8% this month from 3.2% in September.

The five-year inflation outlook rose to 3.0% from 2.8% in the prior month, staying within the narrow 2.9-3.1% range for 25 of the last 27 months.

Source: https://www.reuters.com/markets/us/us-consumer-sentiment-weakens-october-2023-10-13/

______________________________________________________________________

Winners and Losers

Metals remain on top this month. Gold reached 3.53% gains and Silver reached 1.74% gains so far.

News Reports Monitor – Previous Trading Day (13 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

China’s Consumer Price Index (CPI) figure was reported as 0% in September after accelerating by 0.1% in August. The market expected an increase of 0.2% though. Chinese CPI inflation rose to 0.2% over the month in September versus the 0.3% decrease seen in August. At the time of writing, AUD/USD is a little affected by the key Chinese data release, keeping its range at around 0.6325.

- Morning–Day Session (European and N. American Session)

The U.S. Preliminary UoM Consumer Sentiment report at 17:00 showed that consumer inflation expectations jumped to higher levels. The U.S. expects prices to rise at a 3.8% rate over the next year, the highest in five months and up from the 3.2% expected in September, according to the University of Michigan’s report. Americans see costs rising 3% over the next five to 10 years, compared to last month’s 2.8%. No major shock or impact on the USD was observed at the time of the release.

General Verdict:

U.S. indices volatility is still high, they struggle not to drop. NAS100 and S&P500 moved lower and US30 stayed flat for the trading day.

____________________________________________________________________

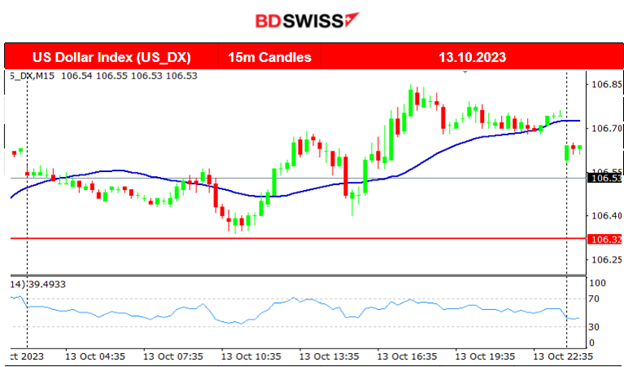

FOREX MARKETS MONITOR

EURUSD (13.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD began to initially move to the upside but after the start of the European session, it eventually changed direction and moved to the downside steadily with a reversal. After it found support at near 1.04965 volatility lowered and it showed signs of retracement until the end of the trading day.

___________________________________________________________________

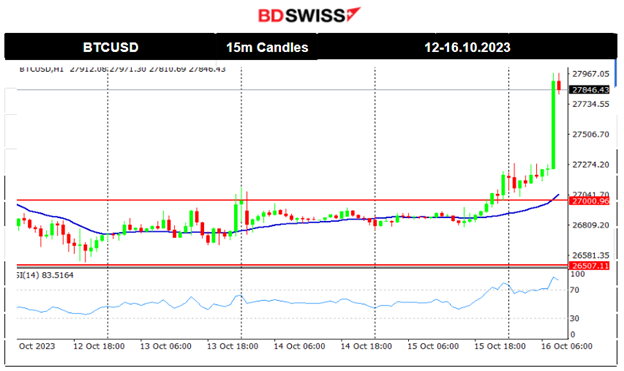

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Its price was following a clear downtrend as preferences for other risky assets such as stocks have increased, with U.S. indices showing an uptrend instead. Similarly, with Metals. Surprisingly there was movement on the 15th and this morning with bitcoin jumping and breaking the resistance at 27000 and later at 27300 moving significantly upwards over 700 USD. Retracement at 27650 is expected.

Crypto sorted by Highest Market Cap:

Bitcoin jumped today, the 24-hour column makes clear that all crypto experienced the same path.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

All benchmark indices experienced similar upward paths. The U.S. stock market picked up momentum and caused the indices to move to higher levels. Yesterday, the CPI news caused a shock in the U.S. stock market. All indices crashed before they retraced again but now giving the signal that the upward trend is finally over since the price currently remains under the MA. When the index breaks more important support levels we will be in a position to suggest that a long period of retracement to the downside has started. Currently, that support near 15000 has been broken but the price remained settled close to that level while being below the MA.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 11th of October, Crude finally broke consolidation and moved to the downside rapidly finding support at near 81.7 USD/b. Soon after the drop, it retraced back to the mean at nearly 83 USD/b and continued with remarkably high volatility sideways around the MA before eventually deviating significantly to the upside and breaking important resistance levels. This upward movement continued on Friday with the price breaking eventually the resistance at 83.85 USD/b and the 85 USD/b getting higher and higher rapidly until the level of 85.5. A retracement is probable as shown by the Fibo tool.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was on an uptrend last week but on the 13th it experienced a rapid movement to the upside near 60 USD. The 1885 level was broken and its price was boosted to the upside before retracing. It eventually returned back to the 30-period MA after reaching the resistance near 1930 as shown by the Fibo expansion tool.

______________________________________________________________

News Reports Monitor – Today Trading Day (16 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

U.S.: Empire State Manufacturing Index figure is going to be reported. Despite the fact that it is a leading indicator of economic health, no major shock is expected at the time of the release today. Slightly more volatility than normal is more probable. Manufacturing activity in New York State accelerated moderately in September, topping expectations for a continued slowdown as new orders and shipments increased.

The markets experienced two shocks last week. The war in Israel with volatile oil prices and a boost in gold prices. The other was the continued deluge of US Treasury supply, the coupon auctions that tailed and higher than expected PPI and CPI.

General Verdict:

______________________________________________________________