PREVIOUS TRADING DAY EVENTS – 10 May 2023

Announcements:

The U.S. annual consumer price growth fell to below 5%. It slowed down in April for the first time in two years, supporting the idea for the central bank to pause further interest rate hikes next month. The U.S. central bank raised its benchmark overnight interest rate by another 25 basis points to the 5.00%-5.25% range last week and declared that it will probably pause hikes.

“Today’s consumer inflation report supports the case for the Fed to seriously contemplate a pause in rate hikes in June, but does not support any near-term rate cuts,” said Scott Anderson, chief economist at the Bank of the West in San Francisco.

Risks of a recession have increased, because of the Fed’s rate hikes, tightening credit conditions and recent discussions for raising the debt ceiling.

The Consumer Price Index (CPI) rose by 0.4% last month after gaining 0.1% in March, in line with expectations. Inflation remains strong and way above target.

“On balance, inflation is still too high and it is not going to fall back to 2% if it increases 0.4% a month,” said Chris Low, chief economist at FHN Financial in New York. “We need to see steady increases around 0.15% to get there.”

Stocks on Wall Street gained as annual inflation was not reported high, almost in line with expectations, thus, expecting lower future borrowing costs. Recent employment reports showed a resilient and strong labour market.

Source: https://www.reuters.com/markets/us/us-consumer-prices-increase-solidly-april-2023-05-10/

The monthly U.S. CPI figure shows an increase in prices, not in line with the Fed’s expectations as the policymakers’ actions target to lower inflation. Yesterday, Crude fell by more than 1 USD as monthly inflation data is suggesting that the Federal Reserve might revise their intentions and hike interest rates further, even though the yearly inflation was reported lower.

“Oil prices have been depressed by fears about economic growth related to the banking crisis and normal seasonal weakness during the spring as energy demand moderates,” said Jay Hatfield, CEO of Infrastructure Capital Management.

According to yesterday’s U.S. Crude Oil inventories changes’ report, inventories rose by 3M barrels last week (1st-5th May), ending a recent series of negative changes and explaining the price decline during that period.

“We are forecasting that oil prices range from $75-95 during 2023 based on fundamental supply and demand and that oil will rally as we head into the summer driving season,” Hatfield said, CEO of Infrastructure Capital Management.

______________________________________________________________________

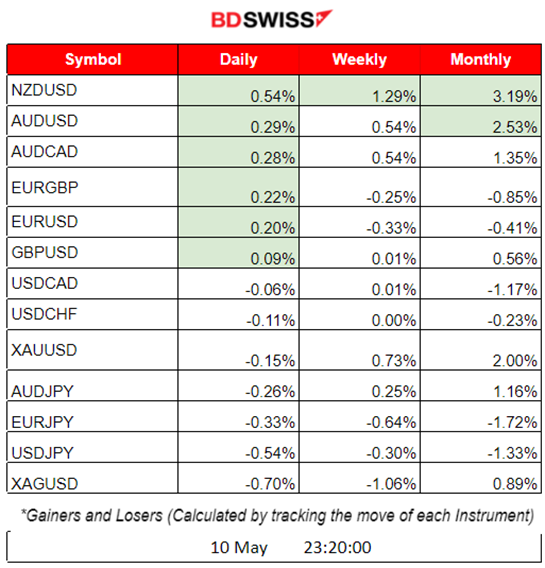

Summary Daily Moves – Winners vs Losers (10 May 2023)

______________________________________________________________________

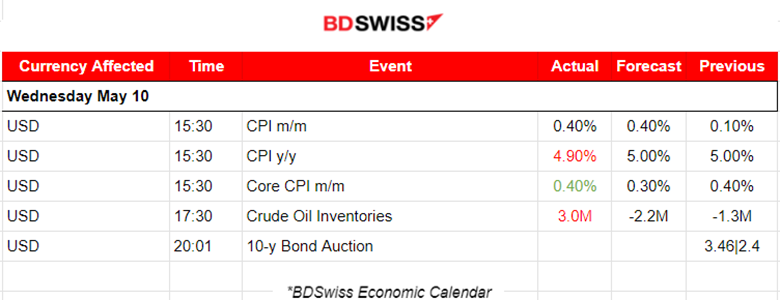

News Reports Monitor – Previous Trading Day (10 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

The Inflation figures for the U.S. came out at 15:30 and caused intraday shocks to USD pairs and other assets, such as stocks and metals. Moves deviating highly from the price at the time and in one direction, at least for some time.

A retracement happened to all affected assets, with some experiencing it 100%. Meanwhile, the USD depreciated at the time of the release of a lower-than-expected yearly inflation figure. However, it appreciated later on.

Crude Oil inventories show a 3M positive change, breaking the series of negative changes since early April.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

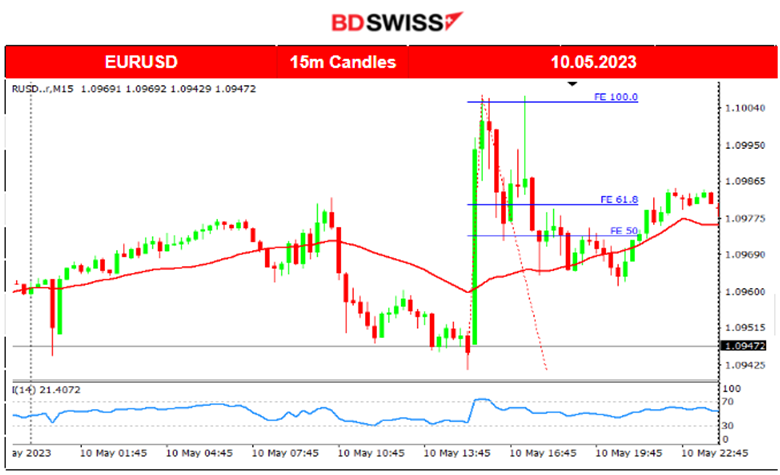

EURUSD (10.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Once more, mainly driven by the USD, the pair moved upwards from dollar depreciation and retraced back slowly towards 61.8% of the move, as indicated by the Fibonacci expansion tool. Due to the volatility and huge market reaction, the pair moved further downwards even higher than the 50% Fibo level as it reached the mean (30-period MA).

Related TradingView Retracement idea:

https://www.tradingview.com/chart/EURUSD/z1DlCQJx-EURUSD-Quick-retracement-10-05-2023/

USDJPY (0.5 – 10.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

An upward wedge was formed while the pair was testing the resistance levels of the pattern over the last couple of days. The market was expecting the CPI figures to react with significant trading decisions. With the release of the less-than-expected change in CPI Y/Y, the USD depreciated causing the pair to drop and break important support levels that eventually pushed it lower, however in line with technicals.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

With the release of the U.S. inflation-related figures yesterday, U.S. stocks moved higher at the beginning as volatility started to rise. Price action was mixed as the index was experiencing “up-down rapid moves”. It eventually reached higher levels at the end of the trading day.

US30 (Dow Jones) also experienced higher volatility with significant moves in one direction, followed by retracements back to the mean. However, blue-chip stocks did not move higher overall as per the index, which resulted in closing lower for the trading day.

______________________________________________________________________

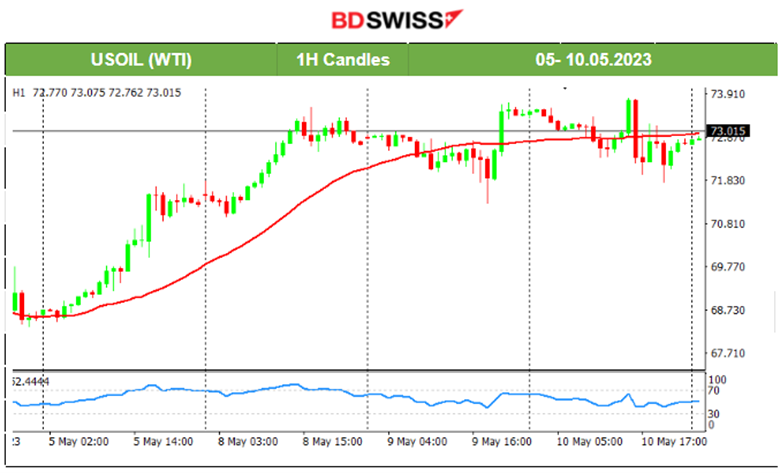

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Yesterday, Crude experienced higher volatility too but eventually moved lower reaching 72 USD before retracing, completing our last forecast in the previous daily analysis. It showed no clear trend or short-term direction and is currently moving sideways around the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moved lower with the release of the U.S. inflation figures after experiencing high volatility. Mainly driven by the USD, it firstly experienced an upward sharp move with the USD depreciation and then retraced downwards, more than 100% of that move returning back and moving alongside the mean. RSI indicated Lower Highs while price Higher Highs. A possible further drop is due to take place since U.S. Stocks seem to gain ground, signalling that a risk-on mood might be on.

______________________________________________________________

News Reports Monitor – Today Trading Day (11 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

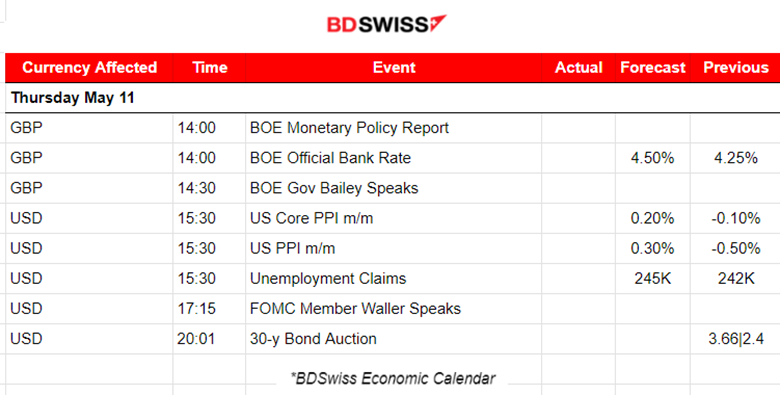

The long-expected BOE rate decision and monetary policy take place at 14:00. The U.K. faces a high inflation rate of over 10% and the Bank of England is expected to hike interest rates for the 12th consecutive meeting. It is unlikely that they will reach their target soon and while the labour market is still hot, we might experience an upward surprise.

The GBP movement is priced in due to expectations, however, the market will likely experience intraday shock for GBP pairs, especially in the case of a surprise.

The U.S. PPI reports releases at 15:30 will play their role in intraday volatility as the changes in the price of finished goods and services sold by producers, excluding food and energy, will further enhance expectations regarding future inflation and rate decisions. USD might experience an intraday shock lasting short. Unemployment claims for the U.S. will also have their impact at that time but are expected to be reported roughly the same as last time.

General Verdict:

______________________________________________________________