PREVIOUS TRADING DAY EVENTS – 06 Oct 2023

- Job growth in Canada reached high levels, more than tripling expectations by adding 63K jobs in September with higher wages. The unemployment rate remained unchanged at 5.5% for a third consecutive month. The average hourly wage for permanent employees rose 5.3% from September 2022, up from the 5.2% annual rise in August.

“That employment report today really blew away market expectations. Wage growth is also beating market expectations,” said Michael Greenberg, a portfolio manager for Franklin Templeton Investment Solutions. “Despite the aggressive rate hikes by the Bank of Canada, clearly demand remains strong and companies continue to hire. This suggests we could well see another rate hike in November or December,” Greenberg said.

“Wages are just going off the charts,” Holt said. “With wage numbers like this and the fact that we haven’t had a soft patch on core inflation measures in Canada like they’ve had in the U.S., I would think we’re still in hike mode in October.”

Source:

- U.S. job growth also surged in September. The actual number of NF Payrolls was reported way higher than expected causing market turmoil. Nonfarm payrolls increased remarkably by 336K jobs last month. This high increase in employment suggests that the labour market remains strong enough for the Federal Reserve to raise interest rates this year, though wages are increasing moderately.

“Not only was this kind of a blowout hot number, basically double what the Street expected but there were a couple of really interesting items to pull from the report. “One of the bigger items would be the revision trend has turned. We had gotten used to seeing a hotter print but then OK, you take that with a grain of salt because we’re revising down when we’re going to get the next two reports. But here we go, we saw a revision of 119,000 jobs added back to July and August. “That’s encouraging about the health of the labour market, but it’s not going to help bond dip buyers by any means just because the yields are just going to continue to ratchet up,” said STUART COLE, CHIEF MACRO ECONOMIST, EQUITI CAPITAL, LONDON. “If we get a stronger inflation report next week it could be a difficult time for the markets.”

“The economy is stronger than expected with more people being hired and higher wages than expected. All of this potentially is inflationary. This may encourage the Fed to raise interest rates again.” “This is a big surprise. It can always get revised down and we won’t know that for another month. We’re at a point where the Fed is slowing its rate increases. This may cause it to change that strategy and increase rates again.” said JASON PRIDE, CHIEF OF INVESTMENT STRATEGY AND RESEARCH, GLENMEDE, PHILADELPHIA.

Source:

https://www.reuters.com/markets/us/view-us-job-growth-far-exceeds-expectations-september-2023-10-06/

______________________________________________________________________

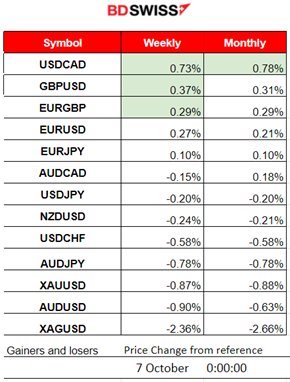

Winners and Losers

USDCAD remained on the top of the winner’s list for the week and month with nearly 0.80% gains, followed by GBPUSD having just 0.37% gains.

News Reports Monitor – Previous Trading Day (06 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

A surprise increase in employment was reported at 15:30, 63.8K jobs in September, following an increase of 40K in August. The employment rate rose to 62.0%, offsetting a decline in the previous month. The unemployment rate was unchanged in September and stood at 5.5% for the third consecutive month. At the time of the release, the CAD appreciated against other currencies. EURCAD dropped nearly 90 pips at the time of the release.

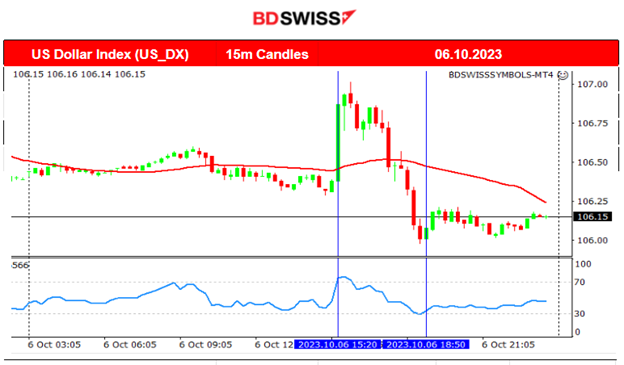

According to the Non-Farm Employment data, U.S. employment growth unexpectedly gained with 336K jobs added in September. A sign that the labour market can still surprise the markets despite the Federal Reserve’s interest rate hikes. Jobs are still being added and the unemployment rate still remains low, at 3.8%. The Average Hourly Earnings figure was reported unchanged at 0.20%. At the time of the release the USD appreciated against other currencies. USD JPY jumped about 40 pips.

Both effects on USD and CAD soon faded and the affected pairs soon experienced retracements after the releases. The USD experienced strong depreciation during the N. American session.

General Verdict:

- The market experienced high volatility only after the Labor data releases. USD and CAD pairs experienced the expected shocks followed by retracements back to the mean and even beyond.

- The U.S. indices experienced a sharp drop at the time of the NFP release that was soon followed by a strong reversal in price after the NYSE opening.

- Crude oil remained in range after a false breakout at the time of the NFP release.

- Gold moved to the downside at the beginning, with also a false breakout and later reversed after the USD experienced strong depreciation, moving upwards significantly.

____________________________________________________________________

FOREX MARKETS MONITOR

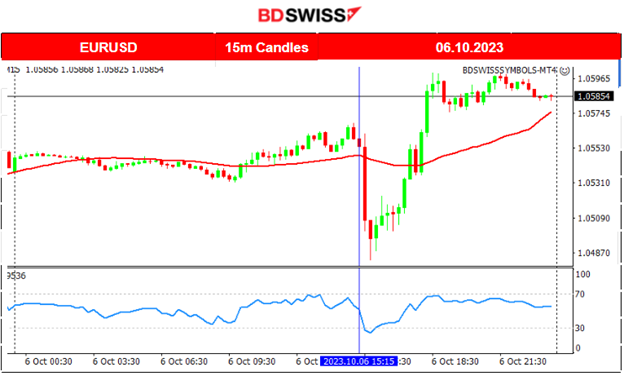

EURUSD (05.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to move sideways and around the 30-period MA with very low volatility until 15:30. The news at that time caused the pair to drop sharply after the USD appreciation due to the market’s reaction to the high employment change figure. The pair found support eventually at near 1.04870 before reversing. It later reversed and crossed the MA on its way up since the USD started to depreciate rapidly. The pair eventually reached significantly higher levels for the trading day reaching the resistance near 1.06 and remained close to those levels until the end.

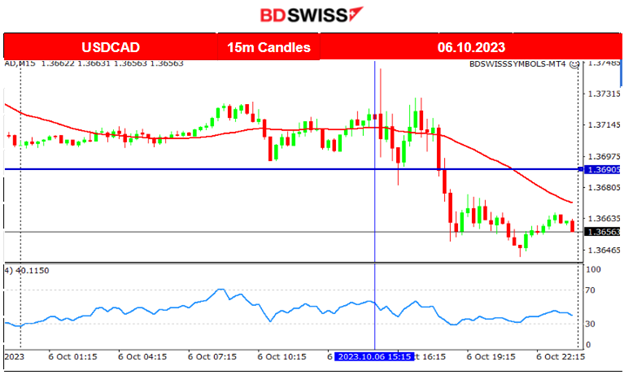

USDCAD (06.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD was moving sideways before the big news with low volatility and around the 30-period MA since the market participants were waiting to act after the labour market data release. The unexpected high and positive employment change figure caused the CAD to gain strength, but due to the fact that at the same time the USD was affected positively as well the pair experienced a shock but remained close to the levels before the releases at 15:30. It later experienced a drop though after 16:00, breaking away from the intraday range to the downside.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A sudden jump on the 2nd of October caused Bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that, moving to lower levels. No other important movement was recorded recently, and the path keeps the sideways direction. Despite the highly volatile market conditions on Friday during the most important news for the month affecting the USD, the price of bitcoin did not deviate much from the MA. There was a drop at 15:30 but soon after, bitcoin’s price reversed. It continued to move sideways within a range and around the mean. Significant support now is at 27150 and the resistance level at 28200.

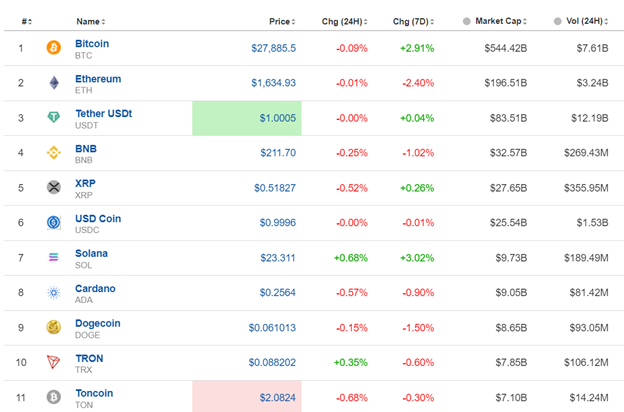

Crypto sorted by Highest Market Cap:

Some mixed figures for the last 7 days regarding the above cryptos. It seems that none had experienced a significant movement in one direction. They seem to follow a sideways path for now with relatively low volatility.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. stock market was in downfall recently after some significant performance this year reaching the previous year’s early highs. It reached critical support levels and that is the reason why it remained in consolidation for a while moving sideways with high volatility. The previous week it moved around the 30-period MA and sideways with volatility getting lower and lower until the release of the NFP news. After the NFP release the NAS100 index moved to the downside but soon reversed and got out of the range with a breakout to the upside instead reaching to near 15000. All benchmark indices experienced similar paths.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

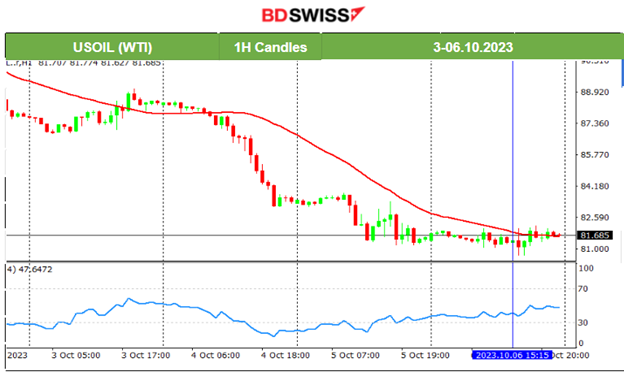

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude oil settled near 81.20 and remained close to that level until finally, the NFP came out affecting the USD. A breakout seems to have occurred but the price kept a strong support there. It did not start to fall rapidly but instead, the price of Crude remained settled to the same levels as before the news. The RSI is forming a bullish divergence since it has higher highs while the price remains low. Is this a strong signal for a reversal to the upside? Possibly.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold’s support at near 1814 USD/oz eventually held even during the NFP and the following USD appreciation at that time. Gold’s price moved to the downside rapidly but after testing again the support it eventually reversed. It managed to break out from the resistance near 1830 USD/oz and reach to higher levels. Could this be a sign of a further movement to the upside after breaking consolidation? By looking at a H4 chart this coincides with a possible retracement since Gold experienced a large drop with our retracement so far.

______________________________________________________________

News Reports Monitor – Today Trading Day (09 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

No scheduled special figure releases.

Middle East stock markets fall on Israel-Gaza violence. This was the market’s sharpest fall in more than three years. Other stock markets beyond Israel also felt the shock waves.

General Verdict:

- Volatility is expected to be low for the FX market.

- Crude might be affected by the recent turmoil in stock markets due to the Hamas-Israel conflict. Gold could see more demand as a safe-haven asset.

______________________________________________________________