Previous Trading Day’s Events (12 Dec 2023)

“But given that annual pay growth is still running at more than twice the pace that would be consistent with the Bank of England’s 2% inflation target, the MPC is likely to stick with its ‘high-for-longer’ message for a little while yet.”

The Bank of England (BoE) raised interest rates 14 times in a row between December 2021 and August 2023. It has since kept rates on hold.

Other central banks are also keeping a close eye on inflation pressures in their tight job markets.

Source: https://www.reuters.com/world/uk/uk-regular-wages-grow-by-73-3-months-oct-2023-12-12/

Expectations for a cut of at least 25 basis points in March fell to 43.7%, from about 50% before the data, according to the CME Group’s FedWatch Tool. The market is now pricing in a chance of about 78% for a cut in May, up from about 75% on Monday.

“The market is certainly assuming that inflation is going to keep coming down, that earnings in this next year are going to show some decent growth and the Fed is going to cut rates,” said Scott Wren, senior global market strategist at the Wells Fargo Investment Institute in St. Louis. “The market is counting on more of a soft landing that would allow the Fed to ease up.”

The Dow Jones Industrial Average rose 173.01 points, or 0.48%, to 36,577.94, the S&P 500 gained 21.26 points, or 0.46%, to 4,643.70 and the Nasdaq Composite gained 100.91 points, or 0.70%, to 14,533.40.

The Dow closed at its highest level since Jan. 4, 2022, the S&P 500 its highest close since Jan. 14, 2022, and the Nasdaq its highest closing level since March 29, 2022.

The S&P 500 posted 74 new 52-week highs and 2 new lows while the Nasdaq recorded 198 new highs and 187 new lows.

Source: https://www.reuters.com/markets/us/futures-edge-higher-with-all-eyes-inflation-data-2023-12-12/

______________________________________________________________________

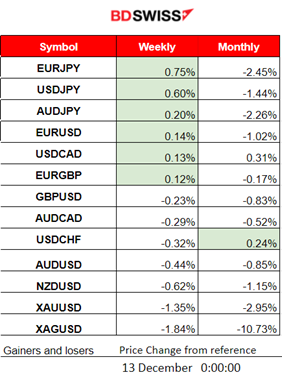

Winners vs Losers

The JPY pairs (JPY as quote) remain on the top since the JPY lost a lot of ground this week against other major currencies. Since the 7th Dec, these pairs have been climbing steadily. The dollar currently remains stable.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (12 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

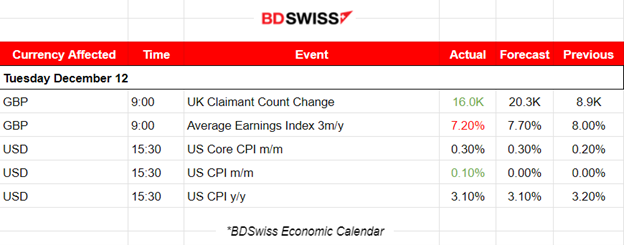

- Morning–Day Session (European and N. American Session)

U.K. Claimant Count Change was reported lower than expected, 16K. The estimated number of vacancies in the UK fell by 45K in the quarter, falling for the 17th consecutive period, the longest consecutive run of quarterly falls ever recorded but still above pre-coronavirus (COVID-19) pandemic levels.

Annual growth in regular pay (excluding bonuses) in the U.K. was 7.3% from August to October 2023. Annual growth in employees’ average total pay (including bonuses) was 7.2%. The market reacted with a moderate shock that caused the GBP to depreciate initially but the effect soon faded. At around 9:30, the GBP started to show depreciation again causing the GBPUSD to drop more than 30 pips during that time.

At 15:30 the U.S. inflation rate data was released causing volatile market conditions. The Core CPI monthly change was reported higher and as expected while the CPI monthly change overall was reported 0.10%, higher than expected. Nevertheless, the yearly calculation was reported to be 3.10%, lower as expected. The market reacted with USD depreciation at first followed by a quick and long appreciation. The dollar index moved higher, crossing and deviating from the 30-period MA and, soon after, it experienced a retracement back to the mean.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (12.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced an unusual upward and steady movement early with volatility rising at the start of the European session. The path was driven obviously by the USD which was greatly affected by the inflation-related figures released at 15:30. Up-down effect with high volatility and with the USD depreciating against other currencies overall. The EURUSD remained on the sideways and close to the mean after the news.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

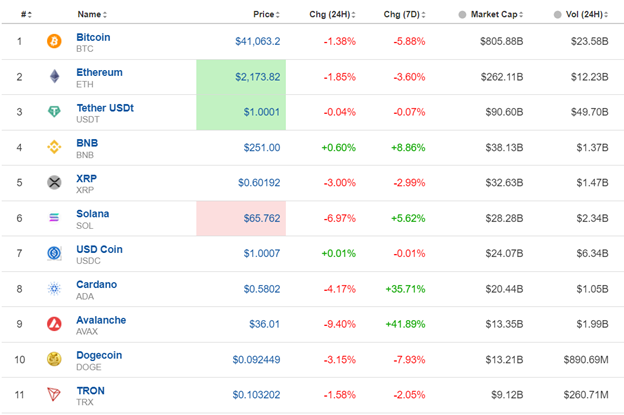

Bitcoin fell significantly during the Asian session on the 11th Dec, falling under 41K USD wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn. After a quick retracement, it dropped again, testing the 40300 USD level once more before finally retracing to the 30-period MA and the 61.8 Fibo level. Currently, the price shows lower volatility levels as time goes by forming a triangle. Waiting for triangle breakouts is apparently the next step.

Crypto sorted by Highest Market Cap:

All cryptos suffered losses recently the same way as Bitcoin, however, they also experienced a correction in the last 24 hours. Volatility levels get lower and lower and prices settle for now. Most gains were wiped out from the high drop on the 11th Dec.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

In general, all benchmark indices were recently in a state of consolidation that from yesterday seems to not hold anymore. The market eventually broke the consolidation by moving further upwards. The index broke the 16000 USD resistance level and moved further upward reaching the 16100 USD level. The consolidation breakout was strong enough to cause the index to continue the uptrend.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

An upward wedge was formed that eventually broke on the 12th Dec causing the price to drop heavily. The price was dropping during the inflation-related figure releases for the U.S. but found support near 69.5 USD/b where it eventually settled for only some time. It soon broke that support and the price reached 68.5 USD/b before retracing only a bit until the end of the trading day. Today Crude’s price went even lower reaching 68 USD/b and it now seems that this is the turning point to the upside. We might see a retracement completed after this long and rapid fall.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

When the NFP report was released last week, Gold’s price dropped heavily near 30 USD, reaching 1995 USD/oz. It soon continued with another drop reaching the next support at near 1975 USD/oz before retracing to the 30-period MA. The RSI was showing higher lows and a bullish divergence was suggested that eventually took place. As per the Fibo expansion tool, the 61.8 Fibo level was reached when the inflation-related data for the U.S. were released. Gold’s price found resistance at that point causing it to reverse significantly. The RSI however shows that we might see further upward movement considering that the price crosses and remains above the 30-period MA.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (13 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

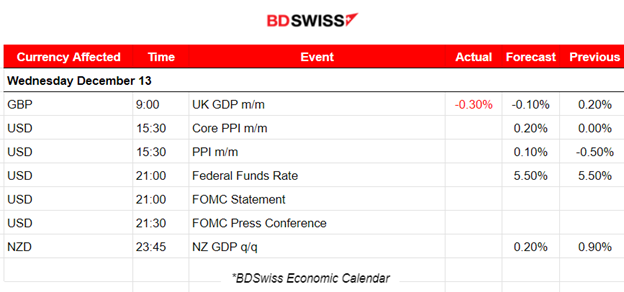

- Morning–Day Session (European and N. American Session)

Monthly real gross domestic product (GDP) is estimated to have experienced a negative change of -0.30%, a more negative figure than the one expected, in the three months to October 2023, compared with the three months to July 2023. The market reacted with GBP depreciation at the time of the release.

At 15:30 the U.S. inflation-related figures, PPI data, will be released expecting to show volatility and possible shock for the USD pairs.

Tonight the FOMC statement and Fed rate announcement will take place affecting the markets and especially the USD pairs. It is expected that the Fed will keep rates stable.

General Verdict:

______________________________________________________________