Previous Trading Day’s Events (14 Feb 2024)

Services inflation rose slightly to 6.5% but was not as strong as the central bank expected.

Source:

https://www.reuters.com/world/uk/uk-inflation-unchanged-4-january-2024-02-14/

______________________________________________________________________

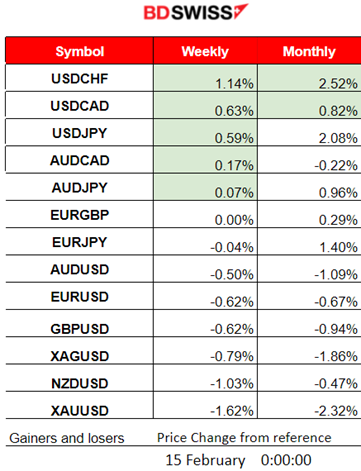

Winners vs Losers

USD pairs (with USD as base) climbed to the top after the U.S. inflation report release on the 13th Feb. Currently, USDCHF is on the top of the winner’s list with 1.14% gains and with the top 2.52% performance for the month so far.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (14 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled figure releases.

- Morning – Day Session (European and N. American Session)

At 9:00, annual inflation for the U.K. was reported at 4%, thus no change. On a monthly basis, CPI fell by 0.6% in January 2024, the same rate as in January 2023. The market reacted heavily to the news with GBP depreciation. The dollar appreciated at 9:00 as well against other currencies. The GBPUSD dropped near 40 pips at that time.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

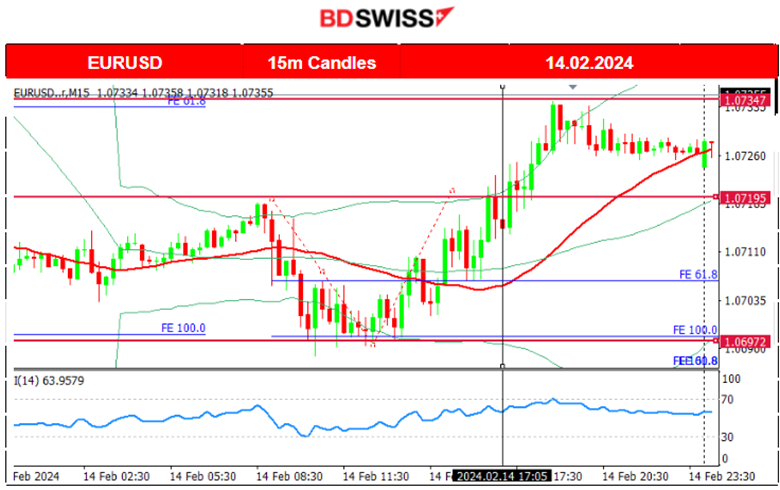

EURUSD (14.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

No major news yesterday, thus no major volatility. The pair moved sideways at the beginning during the European session and around the mean. Later when the N.American session was approaching the pair saw higher volatility levels, following a short-term uptrend until it found resistance at near 1.07340. Retracement followed, however only back to the 30-period MA and not fully back to the 61.8 Fibo level. The uptrend was not rapid enough but rather steady.

___________________________________________________________________

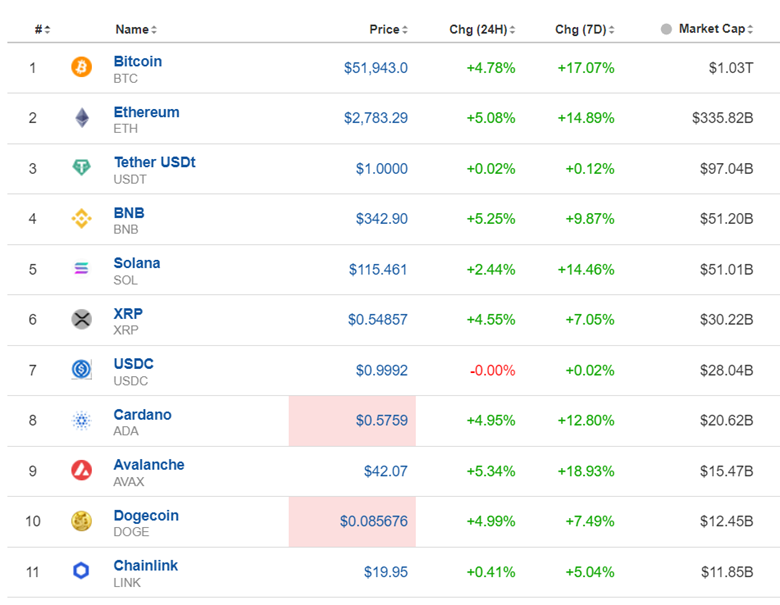

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin surged on the 12th Feb breaking the 49,000 USD resistance, reaching the resistance near the 50,000 USD. On the 13th Feb, the U.S. inflation figure released at 15:30 caused Bitcoin to fall until it found support near 48,300 USD. It soon reversed showing resilience and moved to the upside and back to the 30-period MA. Early on the 14th Feb, Bitcoin climbed again aggressively reaching up to 52,600 USD. Current headlines are such: “Bitcoin briefly climbs above $52K as ETF demand booms”.

https://finance.yahoo.com/video/bitcoin-briefly-climbs-above-52k-215744590.html

Crypto sorted by Highest Market Cap:

Cryptos continue to perform very well as the market participants switch their preferences. More demand is apparent. Bitcoin market cap crossed $1 trillion Reuters reported on the 14th Feb. Bitcoin gained 17.07% in the last 7 days.

https://www.reuters.com/technology/total-amount-invested-bitcoin-back-over-1-trillion-2024-02-14/

Source: https://www.investing.com/crypto/currencies

https://www.reuters.com/technology/total-amount-invested-bitcoin-back-over-1-trillion-2024-02-14/

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th Feb, the index did not experience strong volatility closing the trading day almost flat, however, on the 9th Feb, it moved to the upside aggressively reaching the area near the 18,000 level. After 20:00, on the 12th Feb, the market started the downfall amid the important inflation news, risk-off mood. The index went all the way down as the market anticipated that the inflation figure was going to be reported higher than expected. It actually had. That is why after the release the index (and the other benchmark U.S. indices) plummeted. It eventually found support at nearly 17,500 USD before retracing back to the 30 period MA. On the 14th Feb, the index climbed further. All three U.S. benchmark indices experienced the same path.

______________________________________________________________________

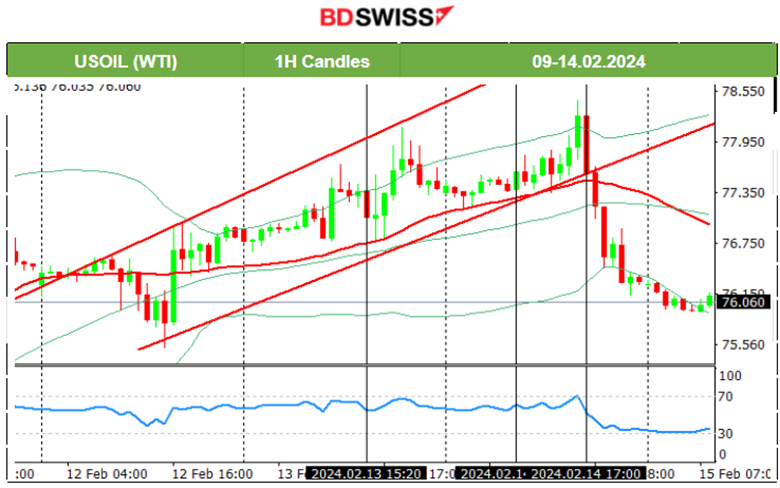

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 12th Feb Crude oil continued with the upward path. Despite the surprising inflation figure reported on the 13th Feb, Crude’s price did not experience major volatility but rather kept moving upwards within the channel as depicted on the chart. All changed on the 14th Feb with the release of the Crude Oil inventories report released at 17:30. The market reacted heavily causing a price drop that extended until the end of the trading day, about 18 USD drop. The reported figure was indeed a high number, 12M barrels, a huge Crude build. U.S. production is back at record highs. More supply, (or less demand) expected is causing its price drop today.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th Feb, Gold broke the upward channel moving to the downside and reaching the support 2020 USD/oz after the USD experienced strong early appreciation. It closed the trading day almost flat since the USD lost strength significantly causing Gold’s price to reverse fully. On the 9th Feb, it experienced another drop testing again that support at near 2020 USD/oz. After an unsuccessful breakout, it eventually retraced to the Fibo 61.8 level. On the 12th Feb Gold dropped further. On the 13th Feb, it finally experienced a rapid upward movement before the U.S. inflation report. After 15:30, the more than expected inflation figure caused USD heavy appreciation and a sharp drop for Gold, passing the support at 2000 USD/oz, moving further downwards until the next support near 1990 USD/oz. Surprisingly, on the 14th Feb, Gold remained in consolidation. No retracement yet and no significant drop. However, all data point to a future retracement currently.

______________________________________________________________

News Reports Monitor – Today Trading Day (14 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Australia’s labour market data released at 2:30 showed that the Unemployment rate jumped above 4% with January recording no significant increase in jobs. Quite weak data for labour. The market reacted with AUD depreciation, bringing down all AUD pairs (AUD as base). The AUDUSD suffered a near 20 pips drop before retracing soon after during the Asian session.

- Morning – Day Session (European and N. American Session)

In the U.K. real gross domestic product (GDP) is estimated to have fallen by 0.3% in the three months to December 2023, compared with the three months to September 2023. On a quarterly basis, this gives two consecutive falls in GDP, with a fall of 0.3% in Quarter 4 (Oct to Dec) 2023. The market reacted to this month’s decline with GBP depreciation. GBPUSD dropped more than 20 pips.

At 15:30, important U.S. data releases are taking place including Retail Sales and Unemployment Claims. Due to their importance, higher volatility is expected with probable shock affecting the USD. Retail sales are expected to be reported lower, indicating that the current Fed’s policy could still have a negative impact on spending and orders. However, it does not coincide with what the recent U.S. PMI reports are telling us, showing growth in both sectors of the economy and, thus, improvement.

General Verdict:

______________________________________________________________