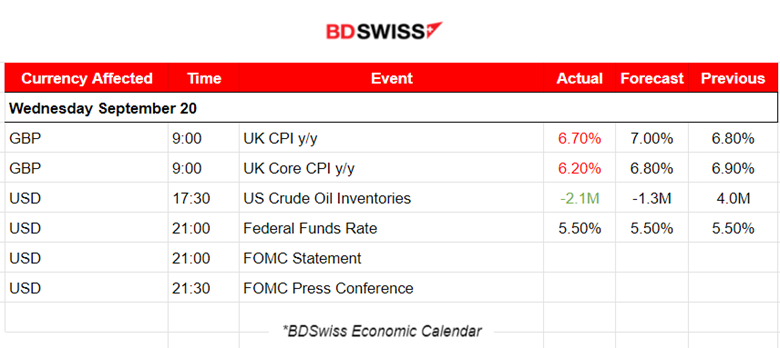

PREVIOUS TRADING DAY EVENTS – 20 Sep 2023

Britain’s inflation rate peak was just above 11% last October but even after the latest drop, it remained among the highest in Western Europe, topped only by Austria and Iceland in August.

“The big downside surprise to core inflation throws the Bank of England a major curveball,” Chris Hare, an economist with HSBC, said. Strong wage growth in recent data meant a rate hike was still the most likely outcome on Thursday but “today’s data raises a risk that the MPC will remain on hold,” he said.

Core inflation fell sharply to 6.2% from 6.9% in July. Service sector inflation slowed to 6.8% from 7.4%.

“Today’s news shows the plan to deal with inflation is working – plain and simple,” as Finance Minister Jeremy Hunt said. “But it is still too high which is why it is all the more important to stick to our plan to halve it so we can ease the pressure on families and businesses.”

Source: https://www.reuters.com/world/uk/uk-inflation-rate-unexpectedly-falls-67-august-2023-09-20/

Fed policymakers still see the bank’s benchmark overnight rate range peaking this year at 5.50% to 5.75%.

Energy markets reacted little to data from the U.S. Energy Information Administration (EIA) and on Wednesday crude inventories fell in line with last week’s expectations.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (20 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The inflation-related figures for the U.K. caused a shock at 9:00. Inflation dropped, quite the opposite of what was expected, in regards to the yearly calculation at least. 6.70% is low and it is the second consecutive fall. Monthly, CPI rose by 0.3% in August 2023, compared with a rise of 0.5% in August 2022. The GBP depreciated heavily after the shock. GBPUSD fell to near 50 pips.

U.S. Crude oil inventory change was reported at 17:30. Again a negative figure of -2M. This summer, the reported changes were negative mostly and in high numbers when looking at August reports, explaining most of the upward movement of oil price. This release had no significant impact on the market but rather caused some volatility at the time.

At 21:00 the FOMC and Fed Rate decision was released meeting the market participants’ expectation of no change. The Committee however stays on its path and declares that it seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. Job gains have slowed in recent months but are strong with the unemployment rate staying at low levels and with inflation still higher than the desired level. At the time of the release USD pairs experienced a shock and the USD started appreciating heavily. EURUSD dropped overall by more than 80 pips and resulted in finding good support only today after a 100 pips drop. The press conference that took place at 21:30 surely played its part in this one.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (20.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move early to the upside because the market had caused the USD to depreciate before the FOMC was released. It is clear that the upward movement was steady and above the 30-period MA. The pair found resistance and then after the announcement at 21:00, the shock took place causing it to reverse. An initial sharp 50 pips drop of the EURUSD due to USD appreciation as a first reaction to the decision from the Fed for an unchanged interest rate. A few minutes later volatility calmed for a while but it continued again following the press conference statements that eventually caused the pair to drop further as the USD appreciated further.

___________________________________________________________________

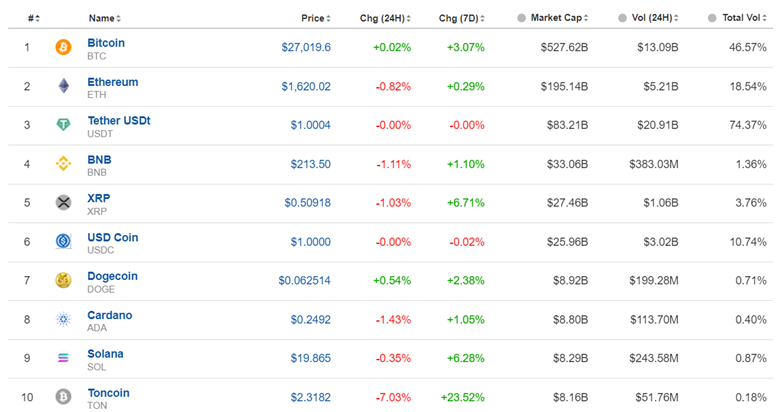

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin had also experienced a fall after the FOMC release but the price was not as volatile as one could expect. It remains on a steady path sideways overall. There is an obvious important resistance currently at 27500 USD and a non-apparent triangle formation as depicted by the black and red lines indicating the support and resistance levels that should be taken into consideration. Breaking those levels could cause rapid one-side moves.

Crypto sorted by Highest Market Cap:

The market has started to show less volatility which turned to the downside. The USD gained strength yesterday because of the market’s reaction to the Fed decision causing most Crypto to suffer losses as shown above in the 24-hour change column. Bitcoin remains resilient with a 3% positive change in the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the release of the Fed’s decision yesterday at 21:00 the index finally moved out of range and broke the support on its way to the downside. The other benchmark indices have similar paths. The USD experienced strong appreciation while the U.S. stocks lost significant value in general as per the chart.

______________________________________________________________________

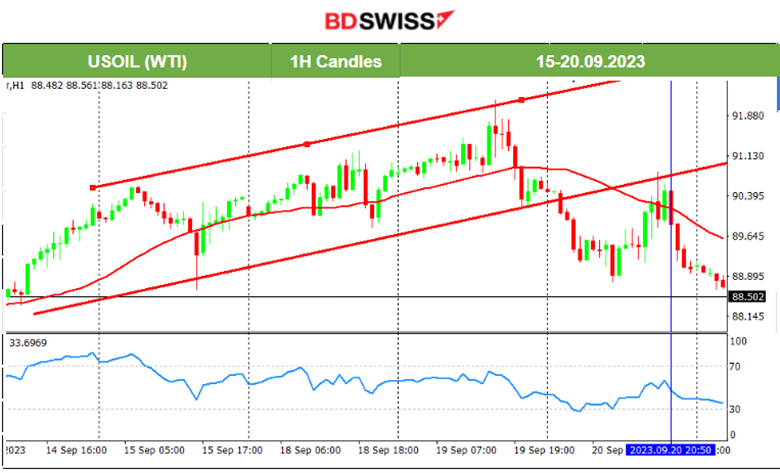

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude price has been following a long-lasting upward trend and it went over 90 USD/b. It remained above the 30-period MA for some time. An ascending triangle was formed and this was broken, eventually causing the price to move significantly to the downside justifying the indication of a bearish divergence. The current oil price remains below 90, moving with high volatility to lower and lower levels until it finds good support. RSI is not helpful enough to give us good technical signals at the moment.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold started to move significantly upwards since the 14th, reversing and crossing the 30-period MA as it went upwards. Technically, the RSI was showing lower highs indicating a bearish divergence that eventually seems to hold. On the 20th Sept, Gold moved to the upside because the market caused USD depreciation before the Fed reports. Later though when the release of the Fed Rate took place, the USD weakened heavily and the Gold price dropped moving downwards towards the support near 1923.

______________________________________________________________

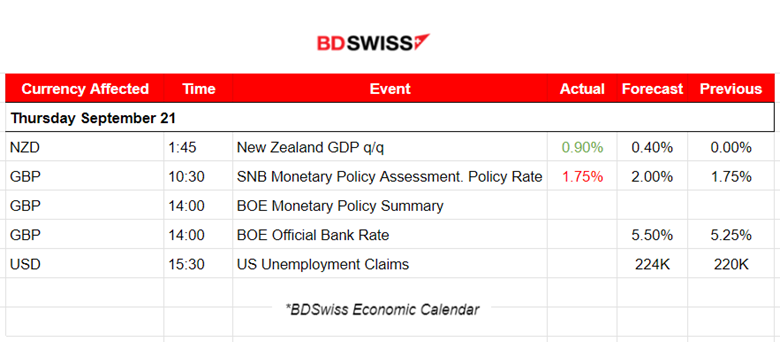

News Reports Monitor – Today Trading Day (21 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The quarterly report for New Zealand’s GDP showed a 0.90% increase beating economist expectations, pulling the country out of recession, and bringing the annual growth rate to 3.2%. No major impact was recorded at the time of the release for the NZD pairs.

- Morning–Day Session (European and N. American Session)

The Swiss National Bank (SNB) left the SNB policy rate unchanged at 1.75% according to the release today at 10:30. A shock for CHF pairs has initiated and currently causes the CHF to depreciate heavily against other currencies. USDCHF and GBPCHF for example have jumped significantly.

The Bank of England (BOE) is also reporting the decision on rates at 14:00. This will probably cause the GBP pairs to experience a shock as well no matter the decision. It seems that this week there is unusual activity with more volume traded and more volatile market conditions to be experienced. The latest CPI report showed less inflation for the U.K. meeting the central bank’s expectations and the market expects its hike policy to remain steady, therefore continuing with another 25 basis points increase, bringing the OBR to 5.5%.

The unemployment claims release for the U.S. is released at 15:30 and usually causes more volatility for USD pairs. Surprises in reported versus expected figures can cause moderate shocks intraday that can create trading opportunities.

General Verdict:

______________________________________________________________