Previous Trading Day’s Events (22 Dec 2023)

“It fits with the very slow growth narrative that we’ve seen unfolding,” said Andrew Kelvin, chief Canada strategist at TD Securities.

“From a monetary policy standpoint, the bank has already hit the threshold required for easing to support growth. It really is just a question of when the inflation profile comes a little closer to their targets.”

Canada’s annual inflation rate held steady at 3.1% in November, above the central bank’s 2% target. The bank expects inflation to cool to 2.5% by the end of 2024 and return to the 2% target by the end of 2025.

Inflation, as measured by the personal consumption expenditures (PCE) price index, fell by 0.1%. That was the first monthly decline in the PCE price index since April 2020 and followed an unchanged reading in October. The so-called core PCE price index advanced 3.2% year-on-year, the smallest rise since April 2021, after increasing 3.4% in October. The Fed tracks the PCE price measures for its 2% inflation target.

Source: https://www.reuters.com/markets/us/us-annual-inflation-slows-further-below-3-november-2023-12-22/

______________________________________________________________________

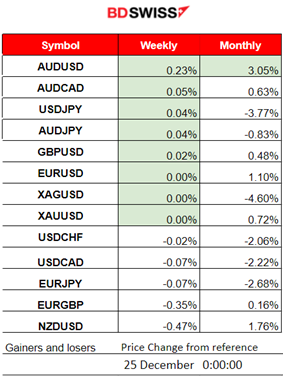

Winners vs Losers

The AUDUSD managed to reach the top of the winners’ list for the week. This month it is the top performer with 3.05% gains.

______________________________________________________________________

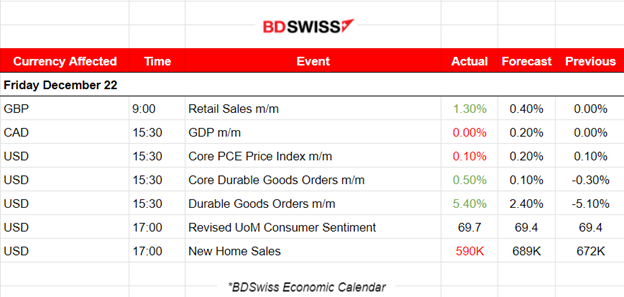

News Reports Monitor – Previous Trading Day (22 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.K.’s retail sales figures were released showing that sales volumes have increased by 1.3% in November 2023, from no growth (revised from a fall of 0.3%) in October 2023. The market reacted with GBP appreciation that lasted for a while and did not have much impact. The GBPUSD jumped 30 pips at the time of the release and reversed to the mean soon after.

Canada’s GDP monthly change was reported 0% despite expectations of an increase of 0.2%. The market did not react too much to the figure release.

The PCE Price index monthly change figure was reported at 0.1%, unchanged despite expectations of an increase, reinforcing the central bank’s pivot toward interest-rate cuts next year. At the same time, the durable goods monthly change figure was reported to be way higher than expected. The dollar appreciated momentarily against other currencies but the effect faded soon, with no big deviations recorded.

The revised UoM Consumer Sentiment figure was reported higher at 17:00. The U.S. expects prices will climb at a 3.1% rate over the next year, according to the final December reading from the University of Michigan. The new home sales figure was reported way lower than expected at the same time. Nevertheless, the dollar appreciated steadily after the release but the volatility levels remained low.

General Verdict:

____________________________________________________________________

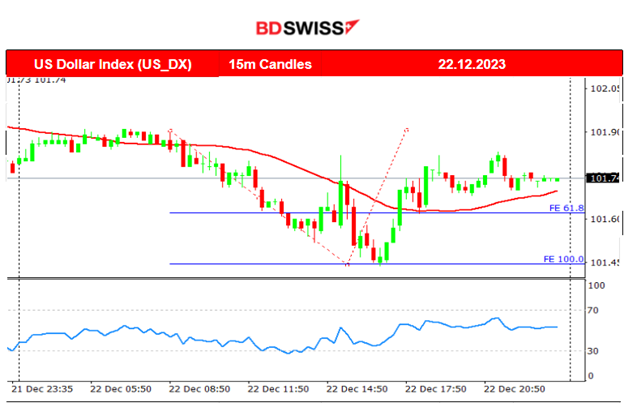

FOREX MARKETS MONITOR

GBPUSD (22.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was experiencing very low volatility and a sideways path until the time the retail sales report was released causing the GBP to appreciate and the pair to experience a moderate shock. The pair reversed to the 30-period MA soon and at 12:00 it started to climb significantly and sharply during the European session. The pair tried several times to break the resistance at near 1.27410 without success. It eventually reversed heavily crossing the MA on its way down and remained low, closing the trading day almost flat.

___________________________________________________________________

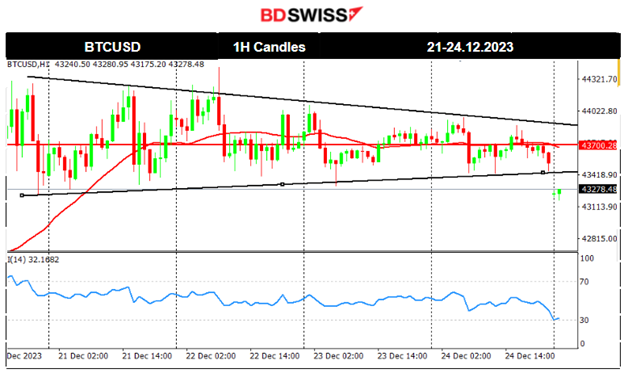

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 21st Dec Bitcoin’s price has been experiencing low volatility and its levels got lower and lower as time passed. This is clear from the sideways path around the mean near 43700 USD that seems to form a triangle formation due to this lowering of volatility levels. Today however the market for this asset opened lower, breaking the triangle to the downside. This signals a downward future path probably to the next support of 42700 USD.

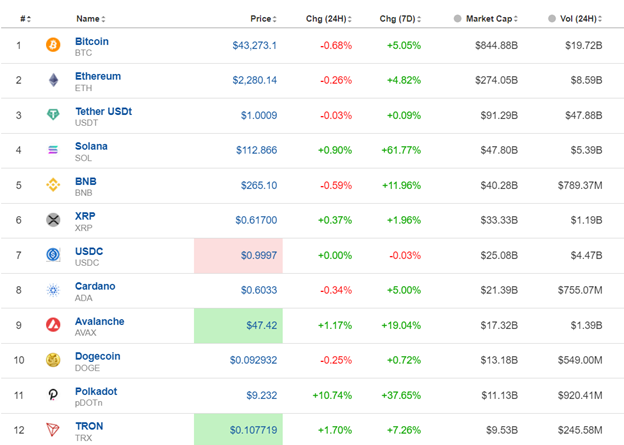

Crypto sorted by Highest Market Cap:

Volatility is low and the upward movement has halted for now. Mixed performance for the above crypto assets for the last 24 hours. The 7-day performance is still strong for all though. Solana reached 61.77% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

NAS100 and other indices were clearly on an uptrend when suddenly indices fell dramatically on the 20th Dec. The NAS100 experienced a near 300-dollar fall before retracing. A triangle formation was apparent after the retracement. Eventually the index broke the triangle and moved further to the upside testing the 16870 USD level before retracing on the 22nd Dec.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 20th Dec, the price crossed the 30-period MA ending an intraday upward but steady trend and now it seems to have great resilience to the downside even when news releases indicate that Angola is leaving the OPEC oil cartel after 16 years, after a dispute over the production cuts. Let’s see if the sideways path will continue. The price tested the support near 72.5 USD/b, on the 21st, and then reversed. On the upside, it tested the resistance near 75 USD/b and reversed again. It is clear that there is no path to one side currently but only a volatile sideways path around the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold was moving to the upside steadily last week and formed an apparent triangle that had the upper band resistance near 2047 USD/oz. That level broke on the 22nd Dec as the price moved higher, which eventually found a short-term resistance at near 2054 USD/oz. Soon it broke the resistance level on the same day confirming that it will move further upwards to the next resistance at 2070 USD/oz. After reaching that resistance it soon reversed back to the 30-period MA and the level 2054 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (25 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases. Cryptos are open, not expecting something significant to happen.

- Morning–Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________