PREVIOUS TRADING DAY EVENTS –24 Oct 2023

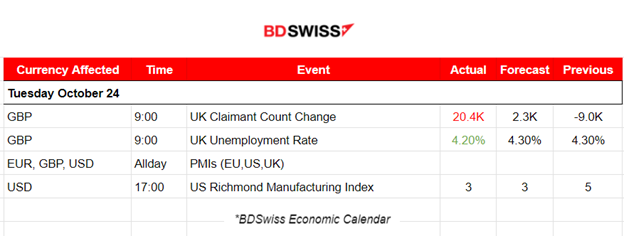

The latest ONS data showed employment fell by 133K in the three months to July, compared with 207K in its previous estimate. The Claimant Count (Change in the number of people claiming unemployment-related benefits during the previous month) was reported way higher than expected.

Source: https://www.reuters.com/world/uk/uk-unemployment-rate-holds-42-ons-2023-10-24/

______________________________________________________________________

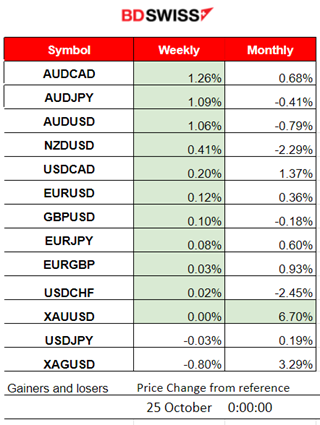

Winners and Losers

News Reports Monitor – Previous Trading Day (24 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

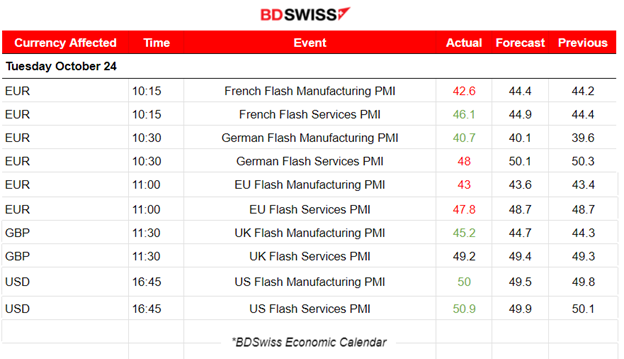

PMI releases for both the Manufacturing and the Services sector:

Eurozone

The French economy starts the fourth quarter with contraction. Another solid reduction in business activity across the eurozone’s second-largest economy in October. The Manufacturing PMI figure is the worst reported at 42.6 points while the services PMI showed some improvement but was still below the 50 threshold. Demand weakness, new orders fell markedly and for a sixth successive month. Sales to non-domestic customers plummeted.

The German economy also remained in contraction in October. Manufacturing PMI still reported at low levels close to 40, while the services sector activity remained close to 50, although October also saw a renewed decline in services business activity since the PMI was reported 48 versus the previous 50.3 points.

The Eurozone downturn deepened in October. The economic downturn accelerated at the start of the fourth quarter. Manufacturing PMIs reported also low at 43 points while the services sector PMI was reported at 47.8 points also in the contraction area. Private sector output is declining at the steepest rate. New orders fell at an accelerating rate as well, a worsening demand environment.

United Kingdom

PMIs for the U.K. were also reported disappointing and in contraction. Ongoing weakness in the UK service sector adds to the case for policymakers to keep rates on hold for a second time. The U.K. private sector output declined for the third month running in October. Also saw reductions in new order volumes and staffing numbers at private sector firms.

United States

The Manufacturing PMI figure was reported to be 50 points, an improvement from the previous figure. The Services sector PMI was reported just above 50 as well. These data suggested a marginal expansion in business activity during October. Manufacturers and service providers alike reported improved activity levels despite the moderate downturn in demand and with inflationary pressures to have eased in October.

The Claimant Count Change (Jobless claims) was remarkably reported at 20.4K versus the expected increase of just 2.3K. That is a further indication that elevated interest rates have a great impact on the U.K.’s labour market. On the other hand, the Unemployment Rate improved to 4.20% against the previous 4.30%

At the time of the release, no significant shock was recorded affecting GBP pairs.

The Richmond Manufacturing Index was reported lower as expected. No significant impact was recorded having an effect on USD pairs.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

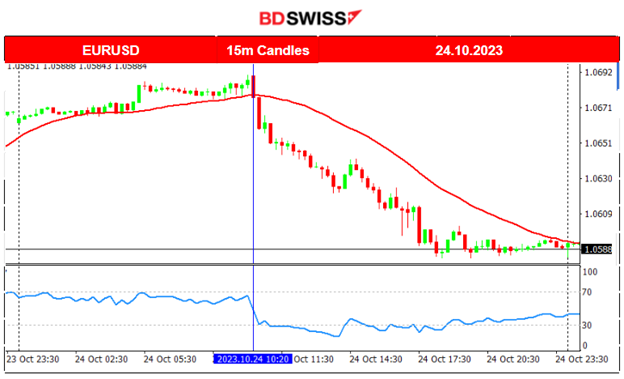

EURUSD (24.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

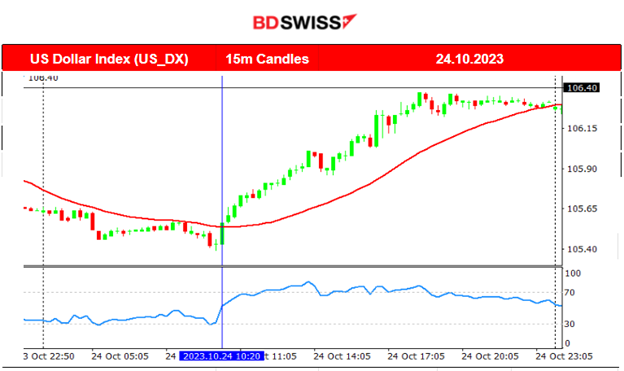

The pair started to move with low volatility until the PMI figures started to come out. The miserable PMI data for the Eurozone brought the pair downwards. At the same time the USD started to appreciate with a steady pace during the trading day.

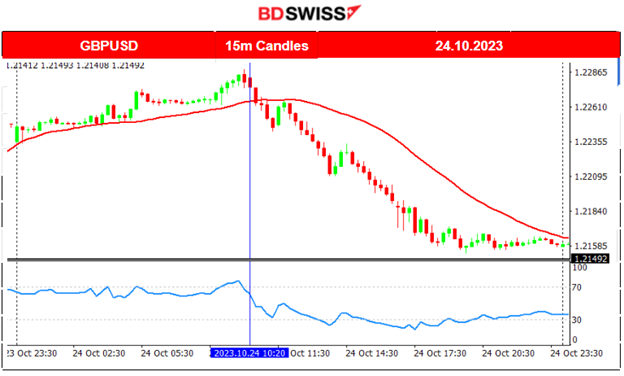

GBPUSD (24.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The GBPUSD followed roughly the same path. With the PMI releases during the day, the market did not experience any apparent intraday shocks but rather a steady downside path, mainly due to USD appreciation. We saw that the PMI picture was more grim for the Eurozone and the U.K. than the U.S.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

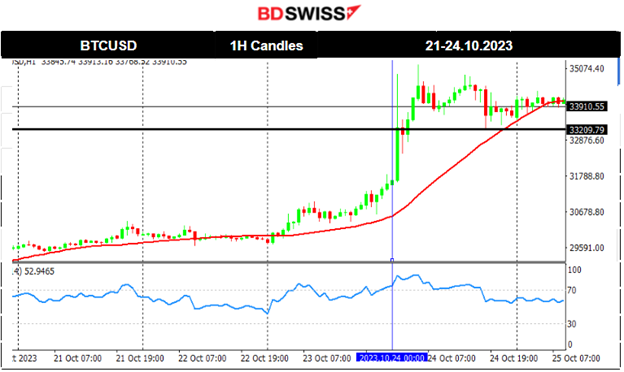

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin and several cryptocurrencies and related stocks such as Coinbase Global (COIN), Marathon Digital Holdings (MARA), Riot Platforms (RIOT) and Microstrategy (MSTR) experienced a surge in value after a U.S. appeals court ordered the Securities and Exchange Commission to review Grayscale’s application for a spot Bitcoin ETF. Bitcoin has moved significantly to the upside breaking all important resistance levels reaching even until near the level of 35,200 USD. That was the level at which the rapid surge in price finally ended with its price soon retraced after that. The price retraced back to the mean eventually near 33.200 USD and settled around the mean (15m) currently.

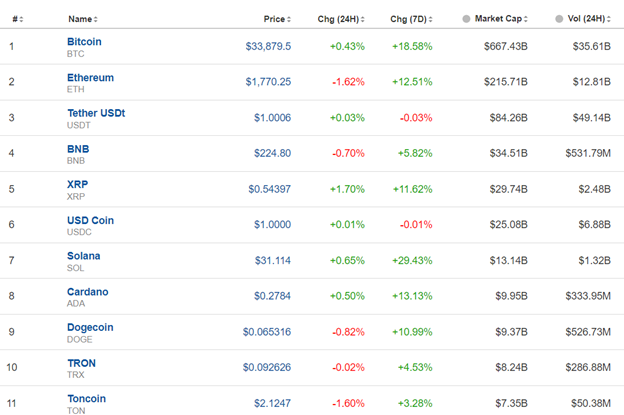

Crypto sorted by Highest Market Cap:

Activity for Crypto is lower. We see mixed performance for the last 24 hours while 7days gains remain high.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

All benchmark indices followed the same path to the downside recently. NAS100 crashed when it broke significant support levels. On the 23rd of Oct. it moved significantly to the upside with a strong reversal. It crossed the 30-period MA on its way up signalling that probably the downward trend has ended. Indeed the index moved sideways after that but showed high volatility. The price remained above the 30 period MA but today it moved below the MA showing signs that it might test the lows.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

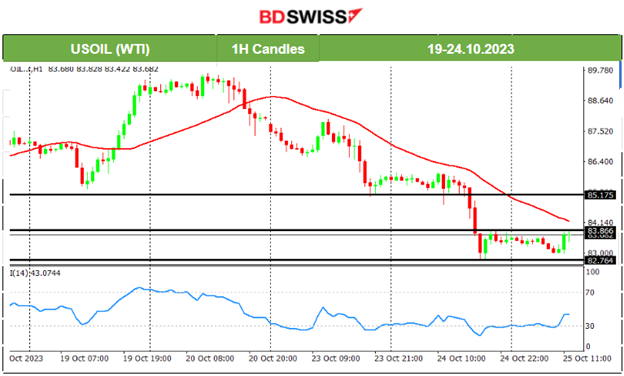

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 19th of Oct, Crude’s price moved rapidly to the upside reversing significantly and crossing the MA on its way up reaching the next resistance at 89.4 USD/b. It eventually retraced to 88 USD/b. After that, the path downwards continued and the price dropped aggressively, reversing and crossing the 30-period MA on its way down until finding support at near 85.10 USD/b. On the 24th of Oct., the price broke the support and moved rapidly lower until the support at near 82.80 USD/b. Retracement followed. A clear downtrend for now.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price was moving to the upside rapidly reaching the next resistance at nearly 1960 USD/oz by the 18th of Oct. That resistance broke and Gold moved further upward reaching 1980 USD/oz. On Friday, it continued with the upside movement until it reached near the important psychological resistance level at 2000 USD/oz before retracing. The price of gold formed a triangle as volatility eased. After settling near 1975 USD/oz it broke the triangle formation going downwards with a rapid movement after the breakout reaching near the support 1954.5 USD level on the 24th Oct. Retracement followed after the drop, upwards back to the mean.

______________________________________________________________

______________________________________________________________

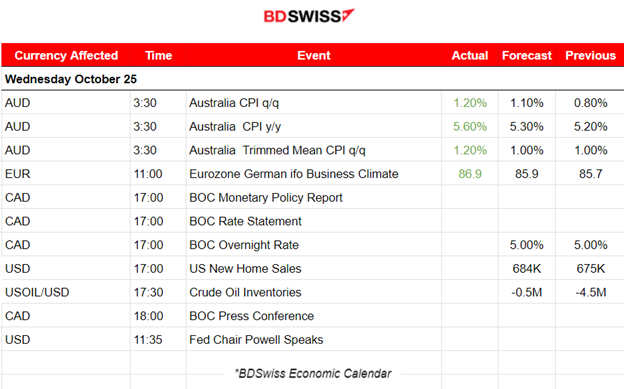

News Reports Monitor – Today Trading Day (25 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s inflation figures were reported higher than expected. The market experienced a shock with the AUD appreciating for a while but soon the effect reversed. The AUDUSD jumped 40 pips at the time of the CPI data release and it steadily moved to the downside soon after retracing back to the mean.

- Morning–Day Session (European and N. American Session)

The German Ifo business climate report showed improvement in morale, more than expected in October, following five consecutive months of decline. The Ifo Institute said its business climate index stood at 86.9 versus the 85.9 reading forecast by analysts. No major impact was recorded affecting the EUR. Slight appreciation at that time.

The Bank of Canada is going to decide on rates later in the afternoon. It is expected that it will leave rates unchanged. Regardless of the outcome, the market is probably going to be affected by an intraday shock affecting CAD pairs mostly.

General Verdict:

______________________________________________________________