PREVIOUS TRADING DAY EVENTS – 15 August 2023

Annual pay growth including bonuses also accelerated, hitting 8.2%, the fastest outside the coronavirus pandemic period.

“It usually takes time for changes in labour market tightness to feed through to wage growth, and several survey indicators now point to slowing wage increases,” he said, adding he expected the BoE’s Monetary Policy Committee (MPC) would hike rates one more time to 5.5%.

Source: https://www.reuters.com/world/uk/uk-basic-wage-growth-hits-record-high-2023-08-15/

“I think we’re getting another round of spiralling upside risks to inflation in Canada,” said Derek Holt, vice president of capital markets economics at Scotiabank. “Hikes aren’t done in my opinion.”

“Given the Bank of Canada has given itself a long time to reach the 2% inflation target, this likely won’t be enough to bring central bankers off of the sidelines,” said Tiago Figueiredo, an economist at Desjardins Group.

“We see it as close to a 50-50 proposition whether they hike or not, although we tend to lean towards a hold given the softening job market,” said Jules Boudreau, a senior economist at Mackenzie Investments.

“As long as core inflation continues to fall rapidly, resilient growth won’t in itself be enough to prompt further rate hikes from the Fed,” said Andrew Hunter, deputy chief U.S. economist at Capital Economics.

“The report dispels any lingering recession fears, and shows how the healthy labour market is paying dividends for consumers,” said David Russell, vice president of Market Intelligence at TradeStation. “There’s a danger that today’s good news for Main Street will become bad news for Wall Street.”

“It is encouraging that non-fuel prices remain subdued, which has offset some of the impact from higher fuel prices, but also signals that disinflationary pressure is widespread,” said Matthew Martin, a U.S. economist at Oxford Economics in New York.

“The momentum for consumers will eventually run out of steam, but this will require a significant loosening of labour conditions, a process which has played out much more slowly than expected this year,” said Ben Ayers, senior economist at Nationwide in Columbus, Ohio.

______________________________________________________________________

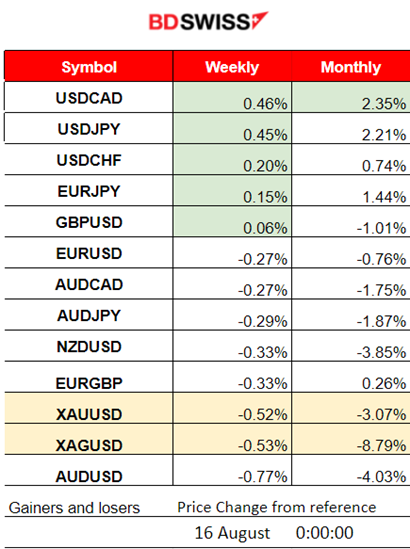

Winners vs Losers

______________________________________________________________________

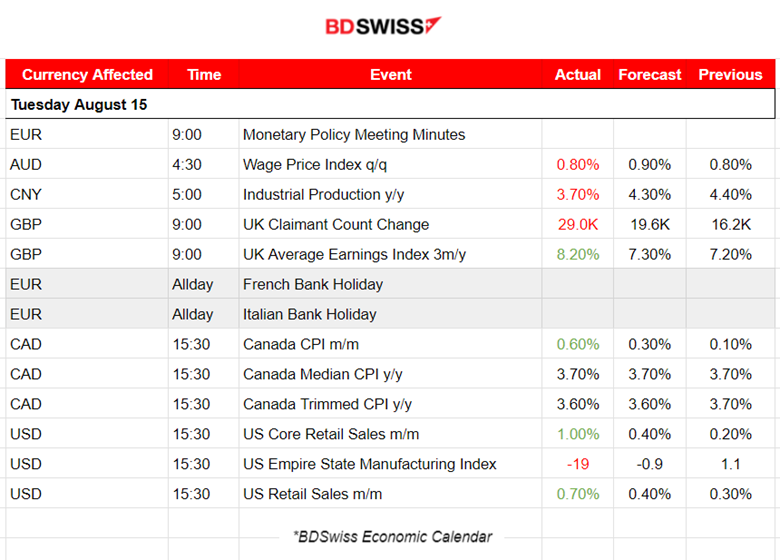

News Reports Monitor – Previous Trading Day (15 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

According to the Wage Price Index report for Australia at 4:30, Q2 Wage Price Index eases to 0.8% QoQ, which was less than expected (3.6% YoY). AUD/USD dropped 25 pips before quickly retracing back to the mean.

At 5:00, annual Industrial production for China was reported lower than expected at 3.70%. No major impact was observed on FX pairs.

- Morning – Day Session (European and N.American Session)

The U.K. Unemployment benefits-related data (Claimant Count) figures were reported lower than expected and had an impact on the GBP pairs, causing GBP appreciation. The Average Earnings were reported as higher than expected. The shock was not great. GBPUSD moved up near 30 pips before retracing back to the mean. Important data are released for the U.K. this week, including key points that could be pivotal for determining how much the BOE will hike at its next meeting such as CPI changes and retail sales figures.

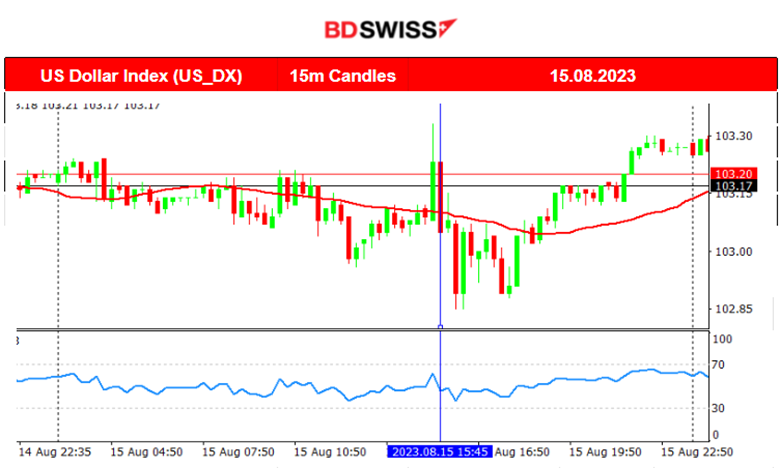

Canada’s CPI data released at 15:30 showed a monthly increase in inflation but an annual unchanged inflation figure. However, the market reacted with an intraday shock for CAD pairs, CAD appreciated greatly during the release. The U.S. retail sales data were released at the same time and were reported way higher than expected causing some short USD appreciation at that time that soon faded. USDCAD eventually dropped nearly 40 pips after these releases before retracing back to the mean.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (15.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD moved early to the upside with steady movement, above the 30-period MA. However, when the U.S. Retail Sales data was released, it caused the USD to appreciate momentarily, bringing the pair rapidly down near 25 pips, and testing the support of 1.09000 before reversing quickly back to the mean. The pair remained close to the mean for a while, showing high volatility and then it eventually moved to the downside and below the MA until the end of the trading day testing again that 1.09000 support.

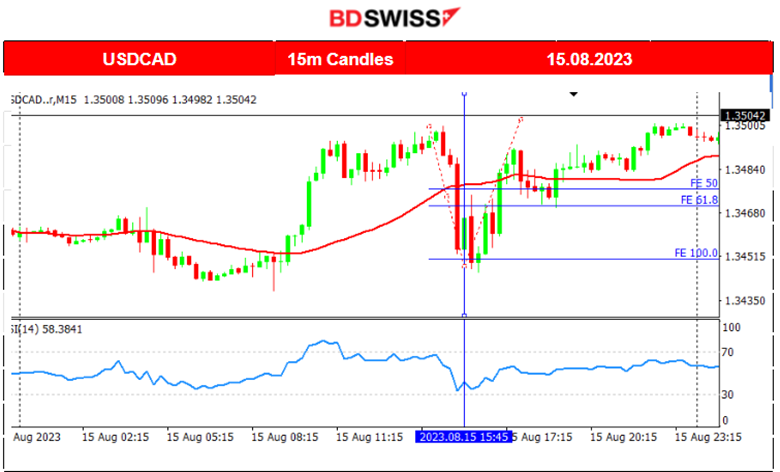

USDCAD (15.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

This pair also moved to the upside early and, of course, experienced a shock at the time of Canada’s CPI data release. Since the monthly figure was higher, the initial reaction was CAD appreciation causing the pair to drop rapidly and find resistance near 1.34470. It eventually retraced quickly back to the 30-period MA and remained on a less volatile and near-sideways path.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 shows clearly high volatility, just like the other benchmark U.S. indices. Important support seems to be the 14972 level. The indices have been on the upside for quite a while recently but eventually, the U.S. stock market was hit by the Fitch and Moody’s Ratings causing it to crash intraday several times. This, however, did not give a strong signal for a downtrend. Support must break to have more evidence for that. Currently is a sideways path and no signs of clear one-side direction.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude reversed from the previous strong upward trend and now moves lower and lower breaking important support levels. The path is steady and under the 30-period Moving Average. It currently tests the 80 USD/b level.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

As the USD is gaining strength, we see Gold moving lower and lower. A downtrend is apparent, the MA is obviously going down. It is again testing support levels; this time, it broke the 1900 USD/oz and even dropped until 1896 USD/oz before reversing quickly. 1900 looks important and might be the turning point to the upside according to the RSI that shows bullish divergence (higher lows).

______________________________________________________________

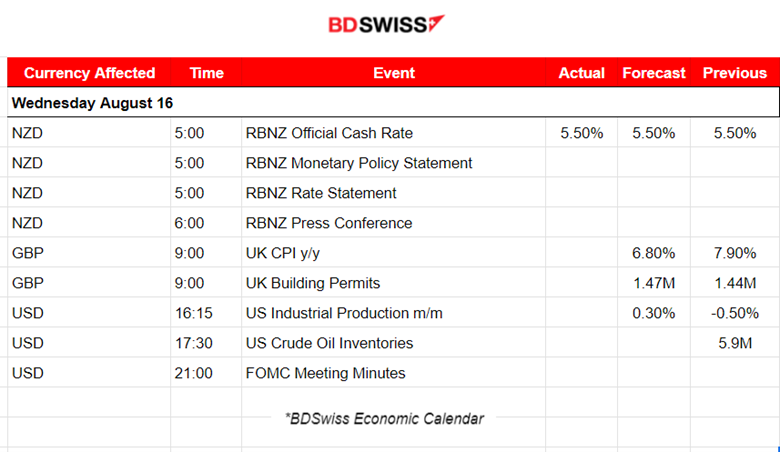

News Reports Monitor – Today Trading Day (16 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The Reserve Bank of New Zealand decided to leave the Cash Rate unchanged, at 5.5%. They assessed that headline inflation and inflation expectations have declined while data regarding core inflation remain too high. There is a risk that the measures taken to counter inflation might not take effect soon, however, policymakers are confident that interest rates remaining at a restrictive level currently will bring inflation down to the target levels. The release had no major impact on the market.

- Morning – Day Session (European and N.American Session)

The U.K. CPI data will probably cause an intraday shock and high volatility upon release at 9:00. The annual inflation rate is expected to be reported lower at 6.8%. Quite an optimistic level I would say, considering the fact that the labour market is not cooling and sticky prices are observed during this period of the year. The U.S. inflation rate had actually increased according to the last report, with the annual rate up by 0.2%.

General Verdict:

______________________________________________________________