PREVIOUS TRADING DAY EVENTS –20 Oct 2023

Retail sales volumes were 1.4% lower than a year earlier, the ONS said, compared with economists’ forecasts for a 1.2% decline. That was the smallest such fall since March 2022.

On Thursday, The BoE halted its increase in borrowing costs, saying it saw signs of an economic slowdown.

Source: https://www.reuters.com/world/uk/british-retail-sales-rise-by-04-august-2023-09-22

“The soft report is yet one more reason to expect the Bank of Canada to keep policy rates on hold,” BMO Capital Markets economist Shelly Kaushik said in a note.

Desjardins analyst Tiago Figueiredo: “The cool pace of sales growth in September also suggests a weak handoff for the fourth quarter … this data reaffirms our view that the Bank of Canada is done hiking rates,” he said.

______________________________________________________________________

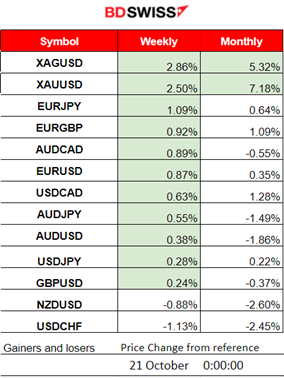

Winners and Losers

News Reports Monitor – Previous Trading Day (20 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

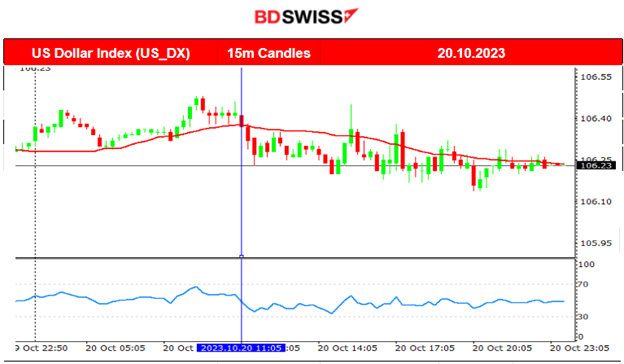

At 9:00 the change in retail sales for the U.K. was released. Retail sales volumes have dropped by 0.9% in September 2023, following a rise of 0.4% in August 2023. Retailers reported that the fall over the month was because of the continuing cost of living pressures, alongside the unseasonably warm weather reducing sales of autumn-wear clothing.GBP depreciated at the time of the release.

Canada’s retail sales figures were released at 15:30. They showed an improvement in core retail sales, however, in general, Canadian retail sales fell in August and were flat in September as consumption slowed. The CAD appreciated momentarily at the time of the release but the direction soon faded.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (20.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

No news for the Eurozone to generate more volatility for EURUSD. The pair remained in range moving sideways and around the 30-period MA. It formed a rising wedge intraday but closed the trading day almost flat.

GBPUSD (20.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair had depreciated early at 9:00 with the release of the monthly U.K. Retail Sales figures. Retail sales fell 0.9% in September, far exceeding expectations of a 0.3% decline. The GBP depreciated but the shock was of a low level bringing the pair down just nearly 30 pips before it retraced to the mean. It later moved to the upside steadily and closed to the 30-period MA as the USD was losing strength.

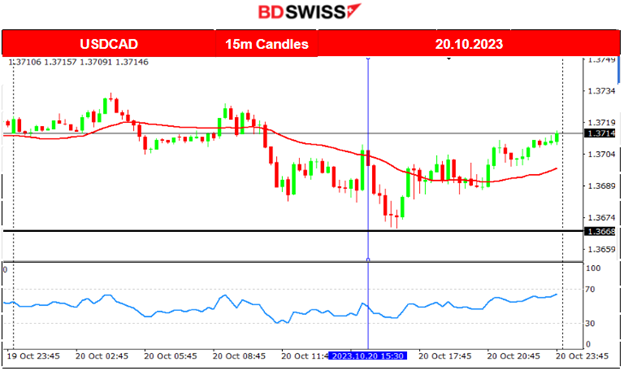

CADUSD (20.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved to the downside early and below the 30-period MA. When the Retail Sales for Canada were released, the CAD experienced appreciation for a while but the pair soon retraced back to the mean. It continued with a sideways path.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

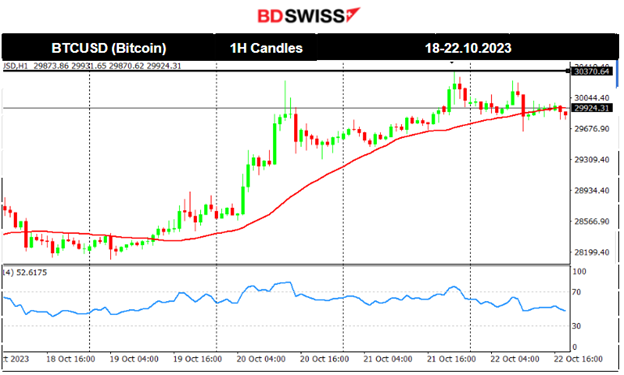

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin continued to the upside leaving the level of 28K USD and going back over the 30K USD after breaking 29800. It even reached levels near 30370 before reversing back to the mean. It is not clear if this upward trend will remain. As people ditch stocks as they are considered risky at the moment due to geopolitical tensions, and funds move to other assets we see some gains for those assets, such as metals and crypto instead.

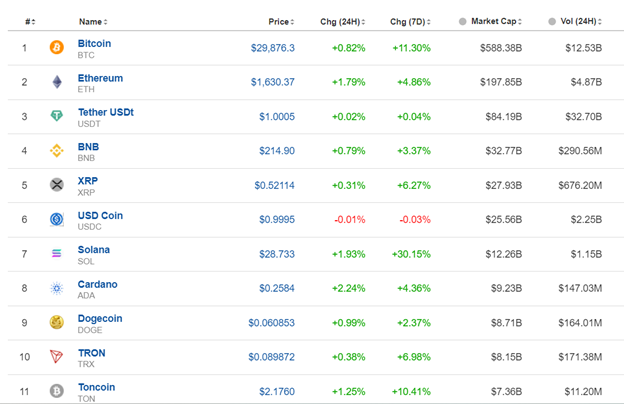

Crypto sorted by Highest Market Cap:

We notice an improvement in gains for all crypto for the last 24 hours and the last 7 days as well. Solana gained a remarkable 30.15% gain since last week followed by Bitcoin which gained 11.30%.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 17th of Oct., the index eventually dropped heavily until the support at 14940 USD before a remarkable full retracement that took place soon after. It showed amazing volatility with big deviations from the mean. Eventually, we see that the downside prevails as the stock market is currently suffering losses. All benchmark indices follow the same path to the downside. NAS100 crashed when it broke significant support levels yesterday such as the 14945 USD and moved lower even to 14825. After Powell’s speech last week, the market crashed again. It dropped near the support 14700 and after breaking that support it dropped rapidly to the downside. While risky assets such as stocks are not preferred currently, metals gain instead.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

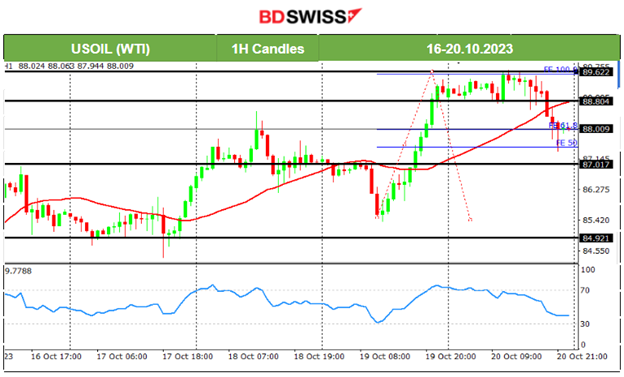

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After a period of retracement back at 84.5 USD/b, Crude finally moved higher breaking the channel that was formed. On the 17th of Oct., it crossed the 30-period MA on its way up and moved higher, reaching the next peak for the week at nearly 88.5 USD before retracing again to the mean. Volatility seems high. On the 19th of Oct., its price moved rapidly to the upside reversing significantly and crossing the MA on its way up reaching the next resistance at 89.4 USD/b. It eventually retraced to 88 USD/b as per the forecast in the previous report.

Technical Analysis on TradingView:

https://www.tradingview.com/chart/USOIL/Z1M6Xu6K-USOIL-Reversal-Retrace-20-10-2023/

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price was moving to the upside rapidly reaching the next resistance at nearly 1960 USD/oz by the 18th of Oct. That resistance broke and Gold moved further upward reaching 1980 USD/oz. On Friday, it continued with the upside movement until it reached near the important psychological resistance level at 2000 USD/oz before retracing. It is quite remarkable that fundamentals are pushing Gold to higher and higher levels. While tensions and warfare still exist, market participants are buying more safe haven metals, ditching risky assets such as stocks.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (23 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major announcements, no significant scheduled figure releases.

- Morning–Day Session (European and N. American Session)

At 17:00 Eurozone’s Consumer Confidence report will be out. Released monthly, around 22 days into the current month. A leading indicator of consumer spending, which accounts for the majority of overall economic activity. It is not expected to have much impact on the EUR pairs regardless of the outcome.

General Verdict:

______________________________________________________________