Previous Trading Day’s Events (12.03.2024)

From December 2023 to February 2024, the estimated number of vacancies in the U.K. fell by 43,000 in the quarter to 908,000. Starting salaries for permanent staff rose at the weakest rate since March 2021. Expected wage growth for companies in the BoE survey was unchanged at 5.2% for the coming year on the three-month moving average basis which the BoE focused on, although on a single-month basis, it dropped to 4.9%, the lowest since May 2022.

“This month’s survey shows the market slowing, and a concerning increase in the decline in temporary billings,” REC chief executive Neil Carberry said.

The consumer price index (CPI) rose 0.4% last month after climbing 0.3% in January. Gasoline and shelter, which includes rents, contributed more than 60% to the monthly increase in the CPI.

Melissa Brown, managing director of Applied Research at SimCorp, New York:

“Inflation was a little hotter than expected, particularly core inflation which is still significantly above the 2% target. The market seems to be shrugging it off which is a little surprising.”

“With rates higher than they’ve been in years we’ve still managed to have a strong economy. People could be realising that higher than expected inflation isn’t hurting the economy and corporate profits … we seem to be pretty resilient to these numbers that are somewhat high.”

Kimberly C. Forrest, founder & chief investment officer at Bokeh Capital Partners LLC, Pittsburgh: “Came in a little hotter than anticipated and because this is the second month in a row, investors are going to take this as a trend, not just a data point.”

“If we listen to Jay Powell last week, he said he’s data driven … he did say that they feel this is the peak interest rate of this cycle and that is probably what’s keeping a cap on investors’ expectations today where they’re not selling off and getting all freaked out.”

Robert Pavlik, Senior Portfolio Manager at Dakota Wealth Management, Fairfield, Connecticut:

“Inflation is still sticky. It’s kind of what we’ve all been experiencing, higher prices not really coming down that much, but not really increasing that much either, just essentially being where they are and that’s sort of the world we live in and the return to 2% inflation doesn’t seem to be coming around any time soon. So, expectations of 2% inflation are really unrealistic.”.

______________________________________________________________________

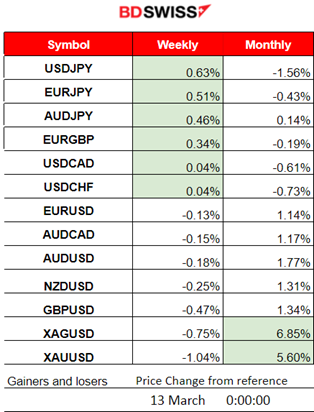

Winners vs Losers

The USDJPY is leading with 0.63% gains this week. Silver remains the top gainer for the month with a 6.85% gain in performance.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (12 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Labour Market Data for the U.K.: Unemployment-related benefits (Claimant Count) are higher (for the February 2024 period) than previous and with lower average earnings reported. The unemployment rate for the U.K. rose to 3.9% from 3.8 %. The market reacted with GBP depreciation. This is a normal reaction to the news as the labour market seems to cool further. From December 2023 to February 2024, the estimated number of vacancies in the UK fell by 43,000 in the quarter to 908,000. Since Aug 2023 interest rate has been kept at 5.25%. Official data showed last month that British inflation unexpectedly held steady at 4.0% in January, defying forecasts of a rise. On March 20th the next CPI figure will be released making it an important date for future decisions of the BOE in regards to any changes in interest rate policy.

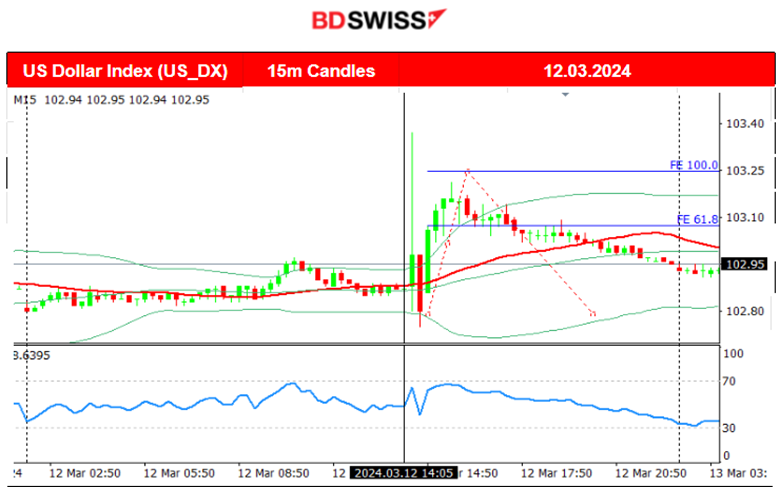

The U.S. inflation report surprised the market at 15:30 as the inflation figures were reported hotter than expected. Core inflation accelerated for a second consecutive month. Headline inflation rose 0.4% last month. Annual inflation rose to 3.2% from 3.1% causing the market to react with a sudden USD appreciation upon release. This result in inflation can be explained by the strong business and labour conditions that the U.S. recently experienced. The U.S. dollar remains stable since the release though, to the same levels, without showing any significant strengthening. One could argue that since delays in interest rate cysts should be expected, the USD could see more strengthening later on. However, the CME’s FedWatch tool still shows the probability for a cut on 12th June above 57%, which indicates surprisingly little change in expectations.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (12.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The EURUSD was greatly affected by the news affecting the USD. Volatility increased after the start of the European session. The dollar has appreciated notably after the hotter-than-expected inflation report release. At the time of the release, the market was more uncertain about making decisions but the end result was the dollar strengthening. The pair dropped until the support at near 1.09020 before retracing to the 30-period MA.

GBPUSD (12.03.2024) 15m Chart Summary

GBPUSD (12.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair lost against the USD overall. At 9:00 the labour data was released indicating further labour market cooling had caused GBP depreciation and a drop of the pair with retracement following soon after. The pair dropped again after the U.S. inflation report release caused the dollar to appreciate against major currencies. Retracement followed back to the MA and the 61.8 Fibo level.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

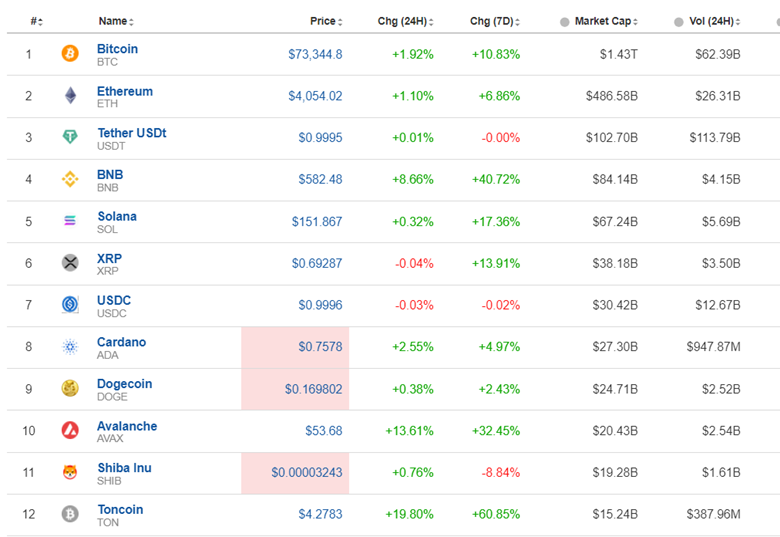

Bitcoin continues with the uptrend. It broke the 70K resistance aggressively and jumped further breaking all-time highs reaching over 73K USD.

Flows of capital into the 10 largest U.S. spot bitcoin exchange-traded funds slowed to a two-week low in the week to March 8th but still reached almost 2 billion USD, LSEG data showed.

Supply of bitcoin, which is limited to 21 million tokens, is set to get tighter in April when the so-called “halving” event takes place and this event tends to support the price.

The Financial Conduct Authority (FCA) became the latest regulator to pave the way for digital asset trading products after saying on Monday it will now permit recognized investment exchanges to launch crypto-backed exchange-traded notes. The UK regulator said these products would be only available for professional investors such as investment firms and credit institutions authorised to operate in financial markets.

Source:

https://www.reuters.com/technology/bitcoin-hits-new-record-high-above-70400-2024-03-11/

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Crypto markets still amaze with more gains, news is pushing it as well. Toncoin records over 60% gains in the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 7th of March, the market moved to the upside as future borrowing costs could lower significantly. As predicted in our previous analysis, the index moved higher before the NFP report release on the 8th of March and soon later after the exchange opening (after 16:30) it fell rapidly and heavily to the support near 17,980 USD. On the 11th of March, the USD actually showed strength and indices fell further downwards with NAS100 reaching the support at 17,890 USD before retracing to the 30-period MA and back to the 18,000 USD level. On the 12th of March, the inflation report release figures had actually caused the U.S. Indices to climb. An upward wedge is visible, however, a clear resistance level is at nearly 18,265 USD. With the dollar expected to strengthen and more delays in cuts to be announced, it is quite unlikely that U.S. indices will move to the upside for now before any further Fed announcements take place. The RSI turns bearish as well. However, the alternative scenario with breakouts of this resistance to the upside, could cause a short-term rally to occur.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Demand from China looks to be lagging causing the dive, however, supplies have remained on the tighter side given OPEC’s production cuts and Russian sanctions slowing exports causing price resilience excluding the probabilities of sharp drops, keeping prices in balance. Crude oil retraced on the 11th of March and continued trading in range during the inflation report on the 12th of March. Now it shows signals of breakout resistance moving away from the 78 USD/b level. A triangle formation is visible, however, is the resistance going to hold? If not, the next resistance is at 79.45 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 8th of March, Gold climbed further aggressively upon the NFP release and after it found resistance it retraced to the 61.8 Fibo Level. Gold on the 12th of March got out of the short-term consolidation phase with a breakout to the downside. With the price moving below the MA, this could be a strong signal for an upcoming downtrend. We have a high deviation from the MA (& BB median), on the Daily chart, and a possible price downtrend (part of a gigger retracement). Gold will be pushed to the downside only if the Fed gives hints that there will be delays in cuts, following the hooter than expected inflation. Demand for Metals seems to have eased as well. Let’s see.

______________________________________________________________

______________________________________________________________

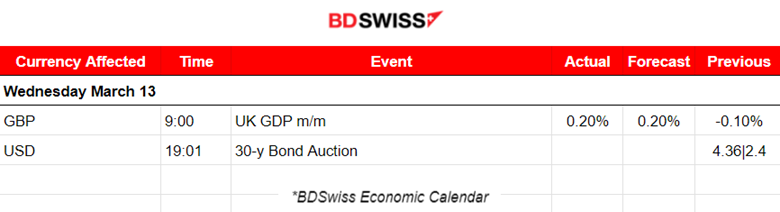

News Reports Monitor – Today Trading Day (13 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The monthly real gross domestic product (GDP) for the U.K. is estimated to have grown by 0.2% in January 2024, following a fall of 0.1% in December 2023. Real GDP is estimated to have fallen by 0.1% in the three months to January 2024, compared with the three months to October 2023. Services output grew by 0.2% in January 2024 and was the largest contributor to the rise in GDP, but in the three months to January 2024, services output showed no growth. The market reacted with slight GBP depreciation upon release.

Source: https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/january2024

General Verdict:

______________________________________________________________