PREVIOUS WEEK’S EVENTS (Week 11 – 15 Dec 2023)

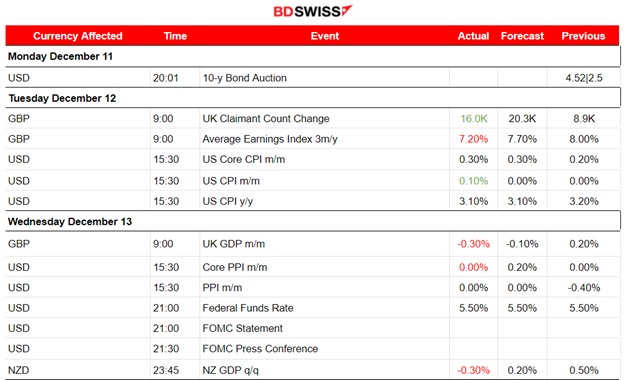

Announcements:

U.K. Economy

The Labor market report for the U.K. was released last week suggesting that the British wage growth slowed by the most in almost two years and the Claimant Count Change was reported less than expected but higher than the previous figure. Labour market cooling is what the MPC wants to see at the moment, however, leaving interest rates high for longer is more possible.

The Bank of England (BoE) raised interest rates 14 times in a row between December 2021 and August 2023. It has since kept rates on hold.

In Britain, the services sector saw another pick-up in growth this month, enough to possibly avoid a recession.

Australia Economy

Australia’s employment figure far outpaced expectations for a second month in November showing a surprisingly higher employment change. Net employment jumped remarkably by 61.5K in November from October. The unemployment rate rose, however, to 3.9%, the highest reading since May last year, from an upwardly revised 3.8% in October.

The Federal Reserve is signalling rate cuts in the year ahead.

Eurozone Economy

The downturn in Eurozone business activity deepens to critical levels according to surveys, indicating that the Eurozone is almost certainly in recession. Reports showed that activity is deteriorating in both Germany and France and across services and manufacturing. We have two consecutive quarters of economic contraction, meeting the technical definition of recession in the Eurozone.

U.S. Economy

The U.S. saw an increase in manufacturing sector output with mixed figures for different categories in November and the economy continued to expand as the year ended. The PMI survey showed business activity picked up in December amid rising orders and demand for workers in the services industry.

The broader economy keeps growing, though manufacturing continues to deteriorate. The survey from the Institute for Supply Management this month found that manufacturers viewed customer inventories as having increased “toward the upper end of ‘about-right’ territory” in November. The ISM’s manufacturing PMI has remained in contraction territory for 13 straight months, the longest such stretch since the August 2000-January 2002 period.

_____________________________________________________________________________________________

Inflation

U.S.

The November Consumer Price Index (CPI) rose 3.1% on an annual basis, in line with the estimated figure. Core inflation, excluding volatile items such as food and energy costs, also matched expectations, showing a 4% annual rise.

The market’s view is that inflation is going to keep declining and that the Fed is going to cut rates next year, counting on more of a soft landing.

The PPI data were reported last week suggesting no change in U.S. producer prices in November amid cheaper energy goods. The related report also showed that services prices remained flat for a second straight month, boosting optimism that overall inflation would continue to subside.

Though inflation remains above the Fed’s 2% target, price increases are less broad-based.

“This report provides another good news for the Fed’s fight to return inflation to 2%”

_____________________________________________________________________________________________

Interest Rates

FED

The dollar suffered a significant drop after the Federal Reserve (FED) kept the Fed Rate unchanged and indicated that its interest-rate hike cycle has ended and that lower borrowing costs are coming in 2024.

Fed Chair Jerome Powell said at Wednesday’s Federal Open Market Committee (FOMC) meeting that tightening of monetary policy is likely over, with a discussion of cuts in borrowing costs coming “into view”.

Expectations that the Bank of Japan (BOJ) could end negative interest rates at its monetary policy meeting on Dec. 18-19 have largely died down.

Other Central Banks

The Bank of England (BOE) and the European Central Bank (ECB), held borrowing costs steady and pledged to keep monetary conditions restrictive as long as necessary. ECB and BOE are reluctant to cut rates, a more tightening view than the Fed.

Eurozone inflation tumbled more than expected to 2.4% in November, while in Britain it slowed to 4.6% in October, also lower than expected. ECB president Christine Lagarde said “underlying” price pressures were moderating more than the ECB expected.

______________________________________________________________________

Sources: https://www.reuters.com/world/uk/uk-regular-wages-grow-by-73-3-months-oct-2023-12-12/

https://www.reuters.com/markets/us/us-manufacturing-output-rises-november-2023-12-15/

https://www.reuters.com/markets/us/futures-edge-higher-with-all-eyes-inflation-data-2023-12-12/

https://www.reuters.com/markets/us/us-producer-prices-unchanged-november-2023-12-13/ https://www.reuters.com/markets/currencies/dollar-takes-dive-after-fed-signals-rate-cuts-next-year-2023-12-14/

___________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 11 – 15 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

Manufacturing and Services PMIs Releases:

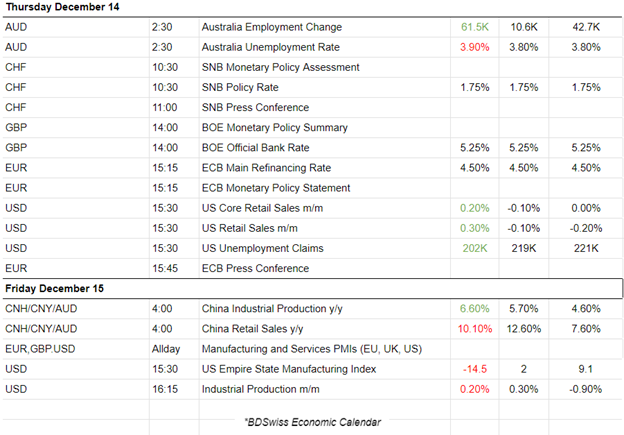

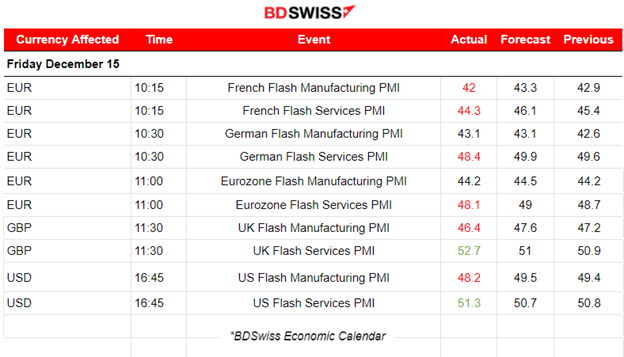

Eurozone PMIs

The French business activity fell at the fastest pace for over three years as PMI reports suggest. The Manufacturing figure was reported to be just 42, lower than the expected 43.3. The decrease in output accelerated for the first time since September and was the steepest since November 2020. The period of decline started at the midway point of the year. Services PMI also reported lower than expected 44.3 points versus the expected 46.

Germany reported the expected low figure of 43.1 points for the manufacturing sector and 48.4 points PMI for the services sector, with manufacturers and services firms each recording slightly faster declines in business activity. It ended the year with a further fall in business activity and a rise in output prices.

Eurozone’s PMIs suggest that activity fell at an increased rate in December, closing off a fourth quarter which has seen output fall at its fastest rate for 11 years. Both business sectors reported further steep falls in inflows of new business, which led to a further depletion of backlogs of work. Jobs were cut for a second month. Book orders worsened.

United Kingdom PMI

In the U.K. the private sector output growth edges up to a six-month high, led by a faster recovery in the service economy. The PMI for the manufacturing sector was reported to be in the contraction territory, however, the services sector PMI was reported to be 52.7 points in the expansion territory. The reports showed higher levels of business activity supported by a renewed improvement in order books.

United States PMI

The reported PMI figures for the U.S. are signalling better conditions in general and for the services sector specifically which experienced expansion, with a recorded PMI of 51.3. A slightly stronger business activity close to 2023 as activity rose at the fastest pace for five months in December. The business sector experienced the sharpest increase in new orders since July. Growth was driven by the service sector, as manufacturers registered a further downturn in new orders and a renewed drop in production.

The market reacted with EUR depreciation upon the PMI releases, for the related economies. All figures and reports showed that contraction in business activity is continuing at a dangerous pace. The U.K. PMI’s release caused the GBP to appreciate at that time instead but the effect soon faded. The USD experienced appreciation and eventually gained a lot of ground against other currencies.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

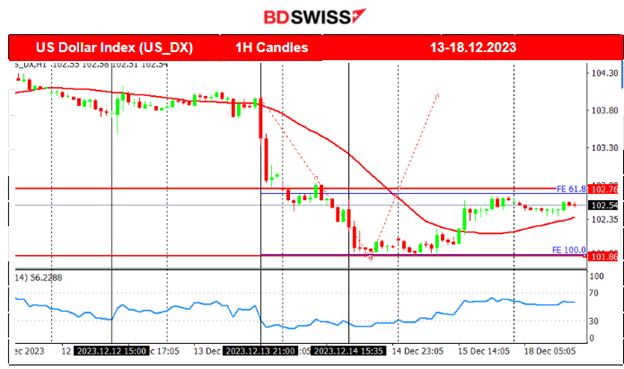

Dollar Index (US_DX)

The dollar suffered strong depreciation last week due to the FOMC statement and Fed rate announcements that took place on the 13rd Dec causing high volatility and one-sided direction movement for USD pairs and other related assets. As expected, the FOMC kept rates unchanged, indicating that hikes are over and rate cuts are coming into effect soon. The dollar index dropped rapidly and found resistance close to 101.8 before retracing back near the 61.8 Fibo level as depicted on the chart.

EURUSD

The pair obviously was driven mainly by the USD. It moved on the path as set by the USD depreciation that started to take effect greatly on the 13th Dec after the FOMC news. The pair jumped higher and higher until it found resistance near 1.10. It then experienced a retracement of even more than the 61.8% of the previous long upward movement while the dollar was appreciating against other currencies correcting from the previous “negative” effect.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin fell significantly as 41500 was a critical support. We see that eventually due to low volatility, the price formed a triangle that was broken today after the price of bitcoin experienced this huge drop, reaching near 40700. A correction phase is the cause, most likely.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

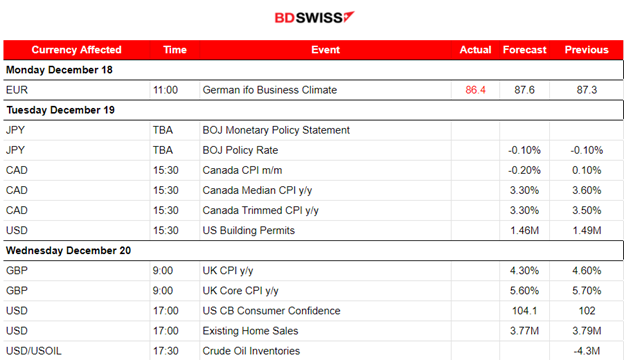

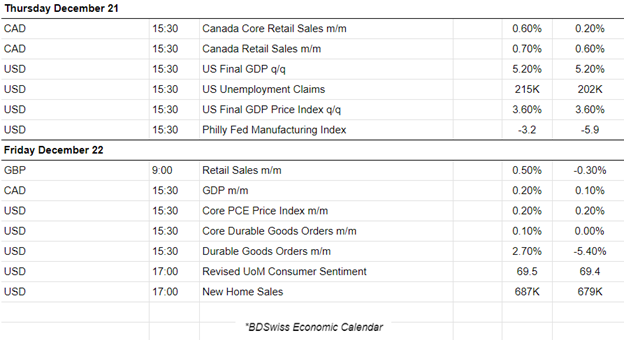

NEXT WEEK’S EVENTS (18 – 22.12.2023)

This week the Bank of Japan (BOJ) is deciding on interest rates on the 19th Dec and estimated that there will be no change keeping them negative.

We have inflation-related reports for Canada, the U.K. and the U.S.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

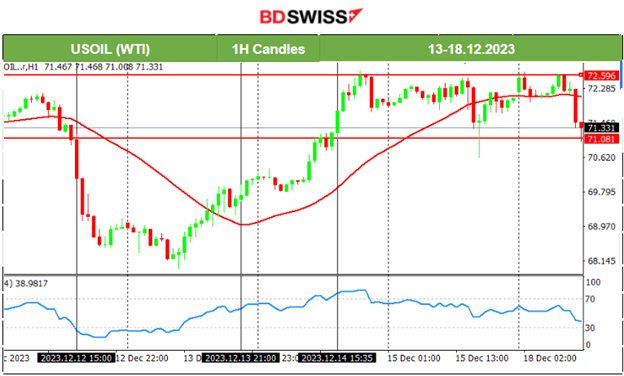

U.S. Crude Oil

Crude moved upwards last week after central bank news and statements. The USD also experienced further weakening. Its price eventually reached 72.5 USD/b which served as a critical resistance level. This level was tested many times without a breakout. The path eventually remained sideways, experiencing high volatility and consolidation, however today the price seems to test the low at near 71 USD/b.

Gold (XAUUSD)

With the FOMC and Fed Rate release the dollar had depreciated greatly enhancing the upward path. Gold jumped until it reached the resistance at 2040 USD/oz and remained settled, around that level. The RSI signalled a bearish divergence and eventually price fell as indicated to the 61.8 Fibo level as depicted on the chart. It remains stable for now near 2020 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

Risk-on sentiment as market participants are pushing U.S. stocks higher and higher. NAS100 and other indices are clearly on an uptrend. This month has been good for stocks especially since the Fed is discussing rate cuts, thus future lower borrowing costs for businesses. During the FOMC news, their statements caused huge volatility in the market causing the indices to jump. After the retracement that took place on the 14th Dec, the market still is bullish and is reaching the highs again. Volatility levels seem to drop, forming a triangle, with the obvious important resistance level at near 16700 USD.

______________________________________________________________