PREVIOUS TRADING DAY EVENTS – 19 July 2023

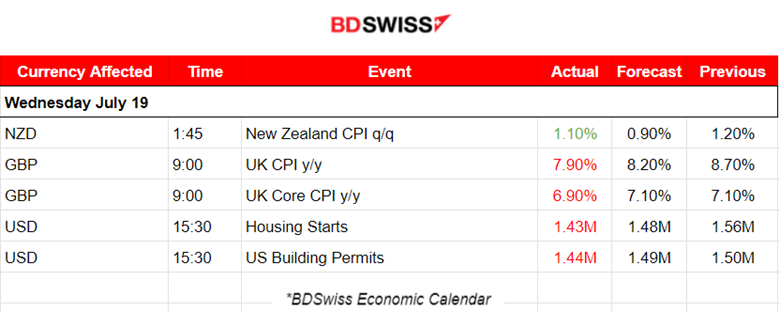

On a quarter-on-quarter basis, CPI grew 1.1%, slightly above the expectations of a 0.90% increase. Expectations shift towards the idea that the Reserve Bank of New Zealand (RBNZ) would hike interest rates further despite signalling a pause earlier this month.

The New Zealand dollar appreciated moderately against the U.S. Dollar after the release but soon reversed during the Asian session.

Inflation might have retreated from the 7.2% high seen last year but still remains well above the RBNZ’s 1% to 3% target range.

“Inflation dipped more than expected, but the gulf between the UK and the Eurozone inflation levels remains. Despite most categories seeing a decline, food & non-alcoholic beverage inflation at 17.3% remains only 1.8% below its peak in March 2023. But in a respite to consumers, while overall energy costs remain high, petrol and diesel prices have dropped over twenty per cent in the last year (-22.3% and -24.3% respectively), contributing significantly to the overall decline we are seeing” as stated by Kevin Bright, Global Leader of McKinsey’s Consumer and Financial Services Pricing Practices.

“Significant sterling upside of late has been driven by the anticipation of yet further rate hikes from the Bank of England, and this morning’s release may challenge the need for such committed hawkish policy. Not only this, but the announcement creates some near-term downside risk as these recent long sterling positions partially unwind. From Joe Tuckey, Head of FX Analysis, Argentex, London.

“There will be sighs of relief all around at the Bank of England this morning, though one slower CPI print is not enough to cause a change in policy. But Andrew Bailey and his team will hope that it is the start of a trend.” From Chris Beauchamp, Chief Market Analyst, IG Group, London.

Source: https://www.reuters.com/world/uk/view-uk-inflation-cools-june-pound-drops-2023-07-19/

______________________________________________________________________

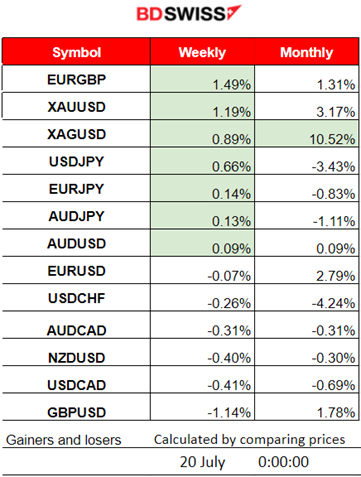

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (19 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

New Zealand’s CPI change quarterly figure was reported lower but higher than expected. The NZD strengthened moderately but the shock was not so great. NZDUSD moved upwards nearly 20 pips before reversing significantly.

- Morning – Day Session (European)

U.K. inflation was reported lower than expected. This was the expected result after BOE aggressively increased rates to respond to the 2-digit inflation, way higher than other rich countries. The GBP inevitably suffered heavy depreciation since the market reacted immediately to the news. 90 pips drop in GBPUSD after the release. EURGBP moves more than 50 pips so far on the upside.

At 15:30 the U.S. Housing Starts figure, the annualised number of new residential buildings that began construction during the previous month, and the Building Permits figures were both reported lower. No impact was observed at that time.

General Verdict:

____________________________________________________________________

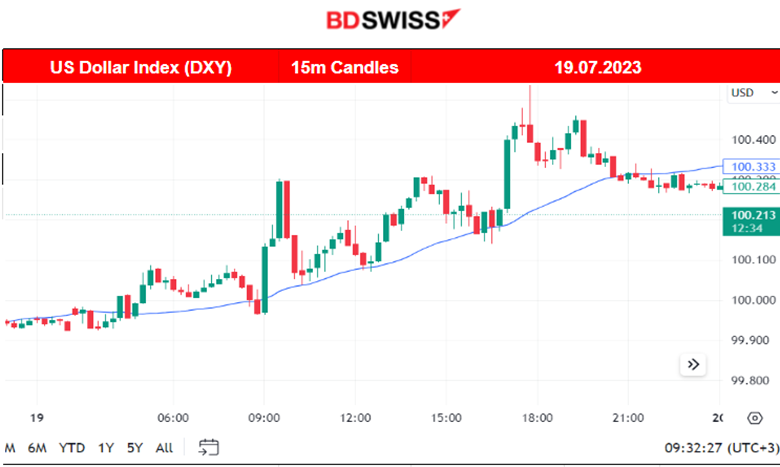

FOREX MARKETS MONITOR

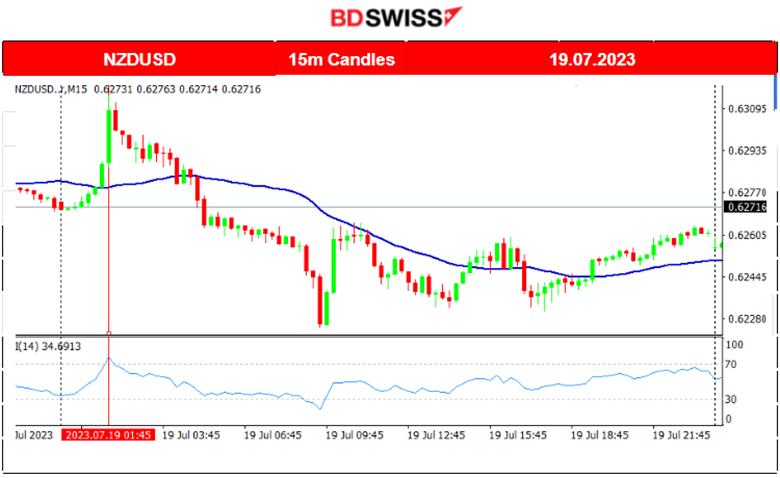

NZDUSD (19.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

We see that at 1:45 the NZDUSD jumped as the market reacted to the quarterly CPI data release for New Zealand. It found resistance and soon reversed, something common during the Asian Session. The U.S. dollar was appreciating significantly for the whole trading day and gained against the NZD causing the pair to move under the 30-period MA and remained on the downside until it found strong support levels and changed to a more sideways path as the start of the N. America Session was approaching.

EURGBP (19.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

At 9:00 we clearly see the effects of the U.K. CPI data release. Inflation was reported significantly low for the U.K. and that caused the market to react with heavy GBP depreciation and the pair to jump. During the European Session, it continued the upward movement with a more steady pace but at some point, it had to find resistance. It reached the level of 0.87000 before finally retracing back to the mean and even beyond the 61.8 Fibo level.

GBPUSD (19.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It is quite apparent that the driving force for the pair is the GBP as it depreciated heavily after 9:00 when the U.K. Inflation data was released. The chart mirrors the EURGBP chart. We see that in this chart where the GBP is the base currency the pair dropped heavily with a lasting effect before finding strong support. It eventually retraced back to the mean during the N.America Session.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. labour market data and the inflation-related data have caused an unusual uptrend for the benchmark indices lately and a market reaction that seems to keep indices high enough. The RSI showed signals of bearish divergence and on the 18th of July, the index moved to the downside at first as soon as the NYSE opened. It however found strong resistance and reversed fully, surprisingly climbing to higher and higher levels. On the 19th, the index moved early upwards but during the N. American Session, it dropped heavily sometime after the NYSE opening. The other U.S. benchmark indices have shown the same resistance and even reversal. Will it be strong enough for the stock market to stop this uptrend in performance? On the 26th July, we have the FOMC and decision on rates that will probably have an interesting impact on this path.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

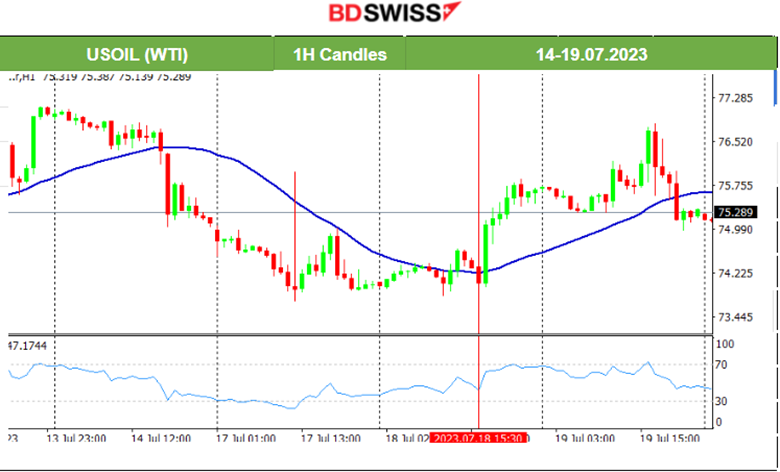

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On Monday, 17th of July the price continued the downward movement. Weaker-than-expected Chinese economic growth raised doubts over the strength of demand for that region. It eventually found support showing higher lows as it moved to the 18th of July when we see a rapid upward movement after the start of the N. American Session and stock exchange opening for the U.S. On the 19th, Crude moved upward early and reached resistance at near 76.80 USD/b before retracing fully reaching the mean. It is clear that the path is quite volatile and price experiences high medium-term reversals.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 17th of July, the price of Gold reversed crossing the MA on its way up and continued on the 18th of July with an exponential increase until it reached the resistance near the 1984 USD/oz. It of course retraced after that level back to the 61.8 Fibo level which is close to the mean (30-period MA on the hourly chart). On the 19th, the price followed a sideways path with low volatility, remaining in that consolidation phase until the end of the trading day.

______________________________________________________________

News Reports Monitor – Today Trading Day (20 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Early at 4:30, the Employment data for Australia were released showing fewer jobs but more than expected. The unemployment rate remained unchanged. The figures caused the market to react with AUD appreciation and an intraday shock for AUD pairs. The AUDUSD jumped over 50 pips.

- Morning – Day Session (European)

At 15:30 we have the weekly release of the U.S. unemployment claims along with the release of the Philly Fed Manufacturing Index figure. Claims are expected to increase slightly suggesting that analysts expect that data will be more related to labour market cooling. The USD pairs might experience an intraday shock in case of a big surprise as the market participants react greatly to these types of figures that the Fed has eyes on.

At 17:00 the U.S. Existing Home Sales figures might also cause slightly more volatility than normal.

General Verdict:

______________________________________________________________