Previous Trading Day’s Events (20.03.2024)

The Fed left interest rates unchanged and released new quarterly economic projections that showed officials now expect the economy to grow 2.1% this year.

At the same time, the unemployment rate is only expected to hit 4% by the end of 2024, barely changed from the current 3.9% level, while a key measure of inflation is projected to keep falling, though at a somewhat slower pace, to end the year at 2.6%.

The Fed officials held onto their outlook for three cuts in borrowing costs this year. Powell said the timing of those reductions still depends on officials becoming more secure that inflation will continue to decline towards the Fed’s 2% target even as the economy continues to outperform expectations.

“It’s appropriate for us to be careful,” the Fed chief said, reiterating a go-slow approach to rate cuts that has been buttressed by the economy’s ongoing strength, with officials saying they are in no rush to ease monetary policy while the economy and the job market continue to grow.

______________________________________________________________________

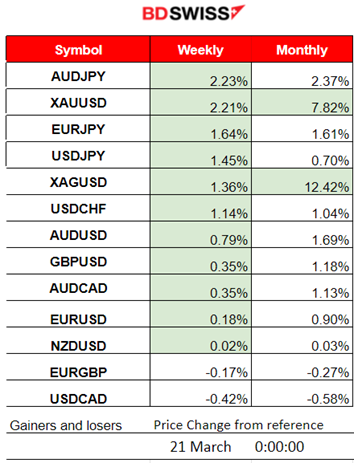

Winners vs Losers

AUDJPY reached the top of the week’s list with 2.23% as the JPY continues to weaken and the AUD gaining strength as the employment data show high figures. Gold and Silver Jumped as well after the FOMC news with Silver now gaining more than 12% this month.

______________________________________________________________________

______________________________________________________________________

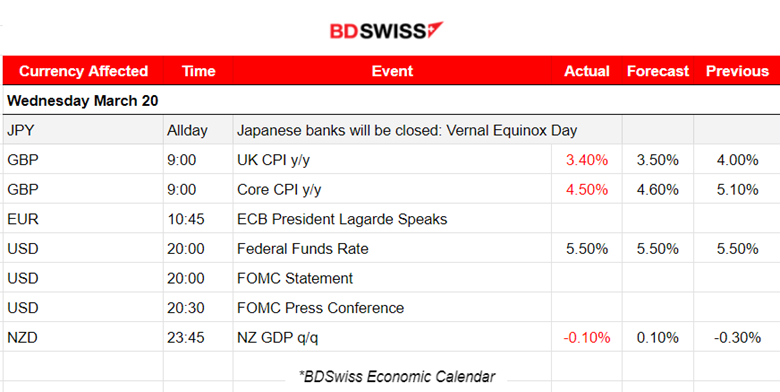

News Reports Monitor – Previous Trading Day (20 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

Inflation lowered in the U.K. according to the CPI numbers released at 9:00 and is now closer towards the Bank of England’s 2% target. Closer but again far away just like the U.S. case. Despite the initial GBP depreciation at the time of the release, the market reversed immediately.

At 20:00 the high-anticipated FOMC statement and Fed Rate were released. The Fed decided to hold rates steady and then volatility exploded. A straightforward expected reaction to the FOMC meeting and press conference yesterday, as the Fed avoided “delay” talks and strengthened expectations of a June rate cut. (Fedwatch tool shows over 70% probability of a cut in June compared with 55-60% seen before the release).

Economic Projections: Fed Officials see 2.4% Inflation at the end of 2024, 2.2% at the end of 2025, 2.0% at the end of 2026.

The U.S. Dollar weakened significantly, and DXY reversed from the upside. The latest uptrend was formed due to the release of the recent higher US inflation report figures, weakening expectations for a cut in June and supporting that of a delay. Now things have changed dramatically.

General Verdict:

U.S. indices jumped higher since expectations for lowering borrowing costs in the near future were strengthened.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (20.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving sideways with low volatility until the start of the European session. It moved a bit to the downside as an initial reaction of the market before the FOMC event causing this dollar appreciation. Later after the FOMC, the U.S. dollar eventually depreciated against other currencies quite heavily.

___________________________________________________________________

___________________________________________________________________

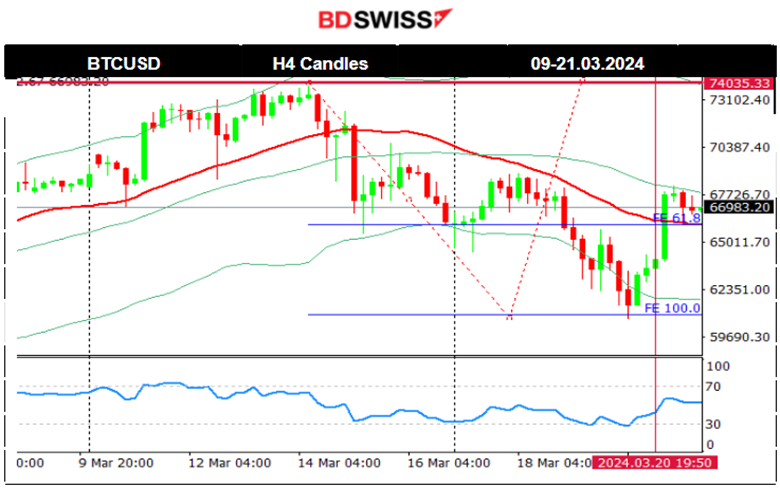

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 4H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin suffered losses recently dropping from the peak at 74K, moving below the 30-period MA of the H4 chart and continuing downwards until the FOMC event. After the news and during the press conference, Bitcoin saw a rise, returning back to the mean.

It currently settles near 67K USD. Crypto sorted by Highest Market Cap:

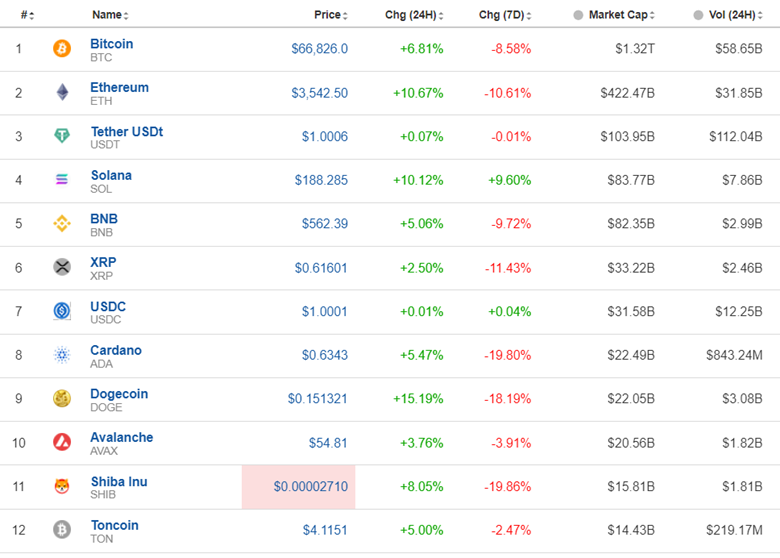

Crypto sorted by Highest Market Cap:

Crypto assets finally see some halt after a long downtrend and seemingly retracement. New gains for the last 24 hours suggest a sideways movement if not the start of a new uptrend, a sling as inflows are coming into the BTC ETFs.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 18th of March though, the index moved rapidly upwards and then retraced again to the MA. On the 19th of March, it moved sideways as mentioned in our previous analysis. After the FOMC event, all U.S. indices saw a jump. The market expects now that borrowing costs will lower soon or as expected this year, sparking this initial reaction.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

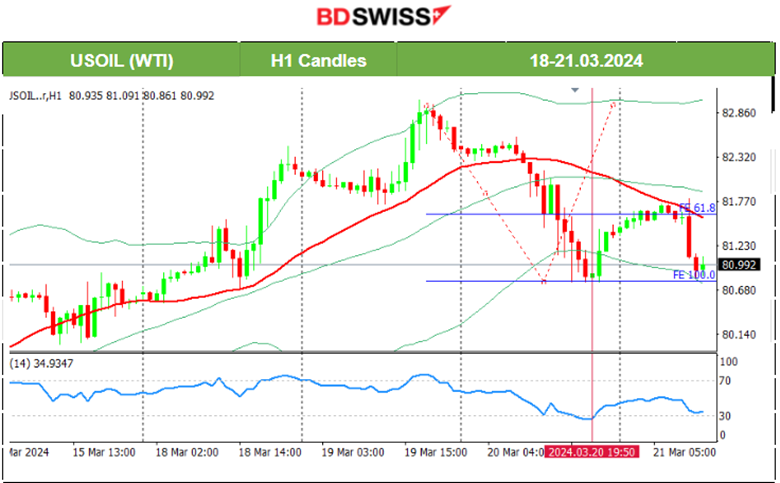

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 18th of March, the price reached the next resistance at near 82.5 USD/b before retracing again to the MA. The price slowed after reaching a peak at 83 USD/b and then dropped. It moved below the MA signalling that the uptrend might have ended. Since the 11th of March, it has been a 6-dollar upward trend (as far as volatility is concerned it might have reached its upward peak). Retracement followed with a price drop at near 81 USD/b. After the FOMC the price went to the upside, correcting from the drop but remained under the 30-period MA showing high volatility.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold remains high and sees resilience for the downside. The win-win view for Gold seems to hold as it indeed shows resilience to the downside, and it is apparent, considering that the dollar continued to appreciate ahead of the FOMC meeting.

Powell decided yesterday to ignore the inflation data and their statements gave even a hint that rate cuts will proceed as expected. Gold Jumped near 65 USD as the USD depreciated heavily during the press conference.

______________________________________________________________

______________________________________________________________

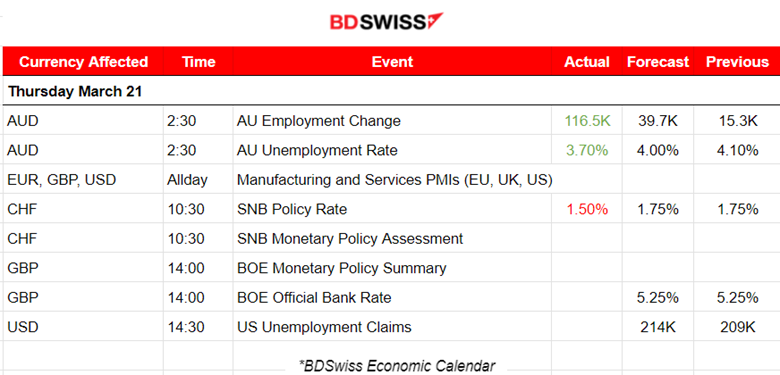

News Reports Monitor – Today Trading Day (21 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

Employment data for Australia were reported at 2:30. Australia’s Employment: 116.5K change against the expected 39.7K! This caused AUD appreciation but the jump in the AUDUSD was roughly 30 pips this morning, it obviously continued higher after the event. As the U.S. dollar is currently strengthening the pair reverses to the downside again.

- Morning–Day Session (European and N. American Session)

At 10:30, the Swiss National Bank (SNB) eases monetary policy and lowers the SNB policy rate to 1.5%! We have interest rate cuts! Swiss National We have cuts! SNB SEES 2024 INFLATION AT 1.4%, 2025 AT 1.2% AND 2026 AT 1.1%. Swiss National Bank is lowering the SNB policy rate by 0.25 percentage points to 1.5%

BOE next with expected rates to be unchanged at 5.25%. Decision release at 14:00.

General Verdict:

______________________________________________________________