Previous Trading Day’s Events (10.05.2024)

Money markets are now fully pricing in a cut in September compared to July before the report was released.

“Certainly this raises the bar for a very near-term rate cut and I think it speaks to how the balance of risks really does support the Bank of Canada potentially waiting until July,” said Andrew Kelvin, chief Canada strategist at TD Securities.

The average hourly wage growth for permanent employees slowed to an annual rate of 4.8% from 5% in March. The slowdown in wages adds to signs that the economy is moving in line with the BoC’s projections.

The bank is looking at a broad range of indicators for evidence that inflation is heading toward a 2% target and said last month that a rate cut in June was possible if a recent cooling trend in prices is sustained.

Stephen Brown, deputy chief North America economist at Capital Economics: “That makes it more likely the Bank will wait until the late July meeting to cut interest rates, as there are three (inflation) reports ahead of that meeting but just one before the early June meeting,” he said in a note.

The larger-than-expected drop in sentiment reported by the University of Michigan on Friday was across all age, income and education groups as well as political party affiliations.

“Consumer confidence is volatile on a month-to-month basis and has not been an important driver of consumer spending in recent years,” said Michael Pearce, deputy chief U.S. economist at Oxford Economics.

“The resilience of consumer spending is dependent on the strong state of household balance sheets and the robust labour market. Only if the latter begins to falter would we expect to see more meaningful signs of economic weakness emerge.”

Economic growth slowed in the first quarter and employers hired the fewest number of workers in six months in April, recent data showed.

The survey’s reading of one-year inflation expectations rose to 3.5% in May from 3.2% in April, remaining above the 2.3%-3.0% range seen in the two years prior to the COVID-19 pandemic. Its five-year inflation outlook increased to 3.1% from 3.0% in the prior month.

Inflation reaccelerated in the first quarter, but economists believe the disinflation trend will reassert itself in the second quarter as domestic demand cools in response to 525 basis points worth of interest rate hikes from the Federal Reserve since March 2022.

“The Fed is unlikely to cut rates, absent the onset of recession unless inflation is clearly headed sustainably to 2%,” Conrad DeQuadros, senior economic advisor at Brean Capital. “Anchored inflation expectations are a key part of this assessment and a 3.1% longer-term expectation is near the high end of the range that the Fed judges as being anchored.”

Source: https://www.reuters.com/markets/us/us-consumer-sentiment-slides-six-month-low-may-2024-05-10/

______________________________________________________________________

Winners vs Losers

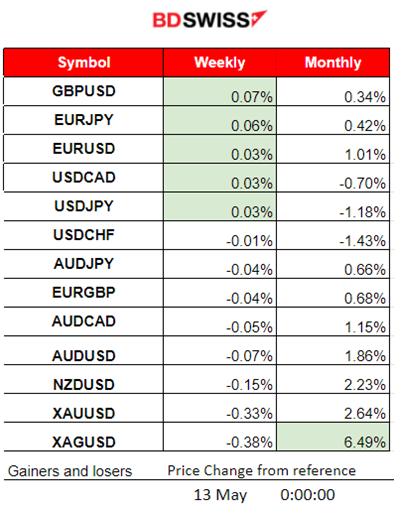

GBPUSD is on the top of the week’s winner’s list with just 0.07%. JPY pairs (quote currency) have climbed while AUD and metals fall currently. Silver remains the top gainer with 6.49% performance for the month.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (10.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

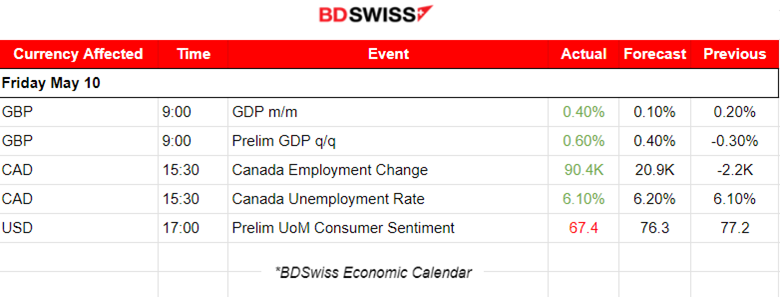

The monthly real gross domestic product (GDP) in the U.K. is estimated to have grown by 0.4% in March 2024, following growth of 0.2% in February 2024 (revised up from 0.1% growth in our previous publication) and an unrevised growth of 0.3% in January 2024. Real GDP is estimated to have grown by 0.6% in the three months to March 2024, compared with the three months to December 2023. On a quarterly basis, this gives growth of 0.6% in Quarter 1 (Jan to Mar) 2024, following declines of 0.3% in Quarter 4 (Oct to Dec) 2023 and 0.1% in Quarter 3 (July to Sept) 2023. The market reacted with GBP appreciation at that time. GBPUSD jumped near 24 pips before retracement took place.

Canada’s employment grew by 90.4k jobs in April while the unemployment rate remained unchanged at 6.1%. These strong figures for the labour market in Canada caused the CAD to appreciate heavily upon release. The USDCAD dropped near 45 pips at that time.

The report released at 17:00 showed that consumer sentiment plunged to the lowest level in six months as price increases reaccelerated, according to the latest University of Michigan survey of consumers. The relevant index for May posted an initial reading of 67.4 for the month, down from 77.2 in April and well off the Dow Jones consensus call for 76. the outlook for inflation across the one- and five-year horizons increased. In addition, inflation expectations rose. The one-year outlook jumped to 3.5% At the time of the release, the U.S. dollar strengthened sharply. EURUSD dropped around 22 pips at that time.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (10.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

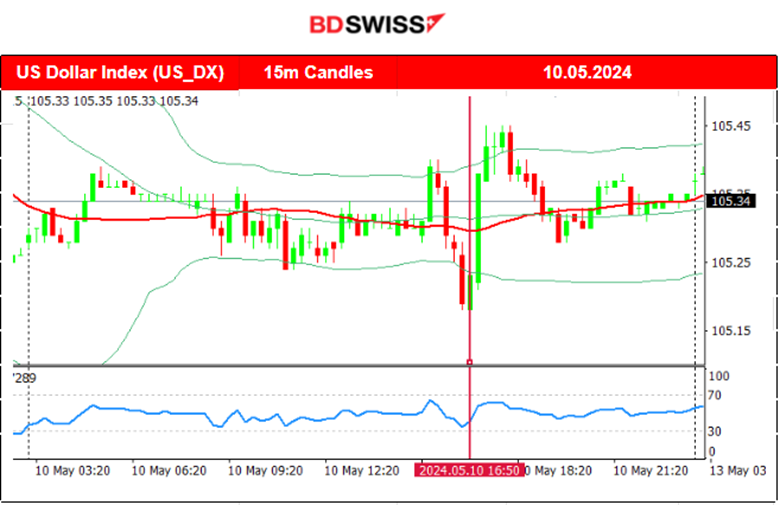

The pair was moving with moderate volatility, around the 30-period MA and started to show higher volatility after the news at 15:30. The market reacted with the depreciation of the U.S. dollar causing an initial EURUSD jump to the resistance at near 1.07885. At 17:00 the release of the Consumer sentiment and inflation expectations report caused an intraday shock. The U.S. dollar appreciated heavily and the EURUSD dropped sharply upon release, to the support at near 1.07610, before eventually retracing to the MA.

USDCAD (10.05.2024) 15m Chart Summary

USDCAD (10.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility sideways around the 30-period MA. At the time of the employment data release at 15:30, the CAD appreciated heavily causing the USDCAD to drop sharply near 45 pips. With the release of the grim preliminary figure of the consumer sentiment report the USD appreciated, eventually reversing to the upside and back to the MA. The pair continued with sideways movement and lower volatility levels.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

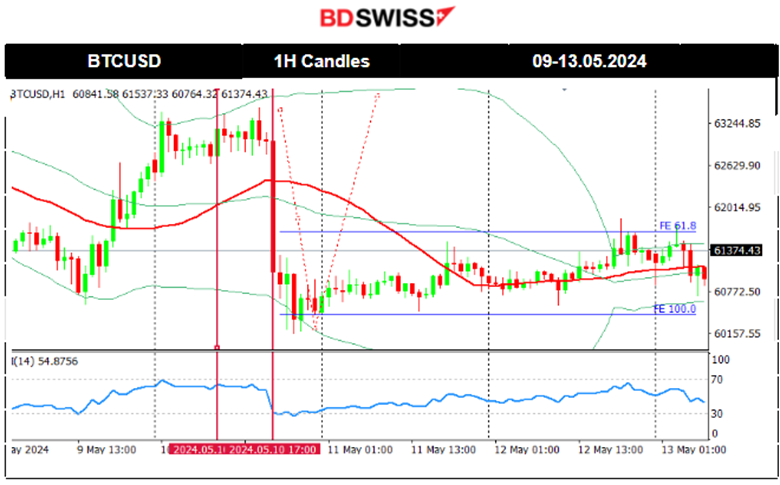

A triangle formation was breached on the 7th of May and this caused its price to drop to near 62K. This downside movement was a retracement to the 61.8% of the rapid large movement that started on the 2nd of May and from the support at near 56.5K USD.

A clear downward channel for Bitcoin and possible triangle formation has been broken on the 9th causing the price to jump to around 63K. On the 10th of May, Bitcoin saw a huge drop after the news release at 17:00 causing the sudden U.S. dollar strengthening and the trigger of a risk-off mood.

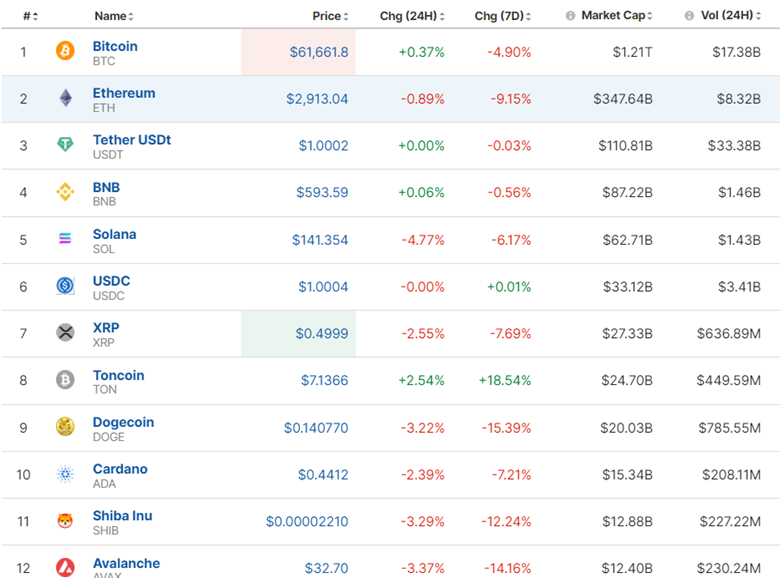

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market is suffering after the news release on Friday that showed how consumer sentiment and inflation expectations are formed. Crypto assets fell sharply in the last 7 days Bitcoin lost 4.90%. Dogecoin lost 15%.

Source: https://www.investing.com/crypto/currencies

_____________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A triangle formation is apparent when moving into the 9th of May. That triangle formation broke as the price moved to the upside after the U.S. Unemployment claims figure release, causing indices to experience a jump. On the 10th of May, the index dropped upon release of the U.S. news for Consumer sentiment and inflation expectations. That news release caused dollar appreciation at that time and the index to fall around 20 dollars. It eventually reversed to the upside steadily after touching the 30-period MA and the 61.8 Fibo level.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It seems that Crude oil was following a downward channel while moving around the 30-period MA. That channel broke with the next support being reached on the 8th of May at near 76.70 USD/b. The price reversed remarkably on the same day to the upside breaking the channel to the upside. The upward movement continued but found resistance at near 79.5 USD/b. On the 10th of May, the price dropped heavily after the U.S. news at 17:00, a near 2-dollar drop to 77.37 before retracement started to take place. An upward movement is expected with a max target level near 78.3 USD/b.

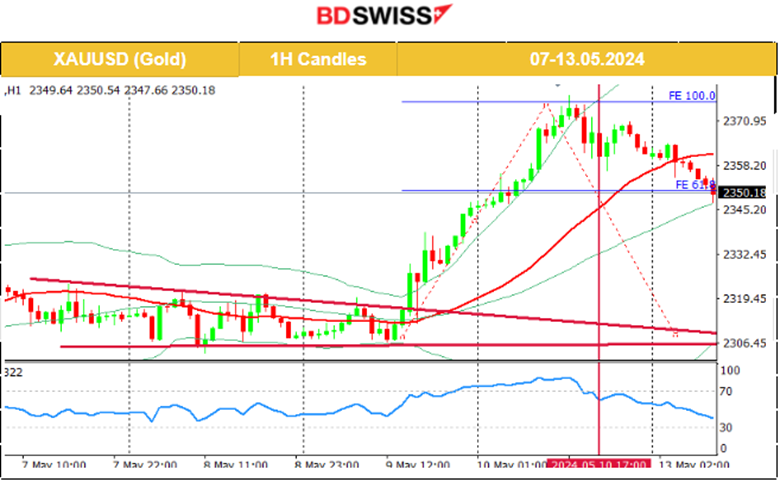

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A consolidation phase had broken on the 9th of May after the U.S. unemployment claims figure release. Gold’s price jumped after USD depreciation took place and broke the consolidation, reaching the resistance of 2,330 USD/oz as predicted in our previous analysis. Later that resistance broke as well causing the price to jump further to the upside. The price reached a peak at 2,378 USD/oz, on Friday 10th of May, before retracing to the 61.8 Fibo level at near 2,350 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (13 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 6:00 the New Zealand expectations for one-year-ahead annual inflation decreased 49 basis points from 3.22% to 2.73%. Two-year ahead inflation expectations decreased from 2.50% to 2.33%. This fall in inflation expectations caused the NZD to depreciate. The NZDUSD dropped near 14 pips upon release before eventually retracing to the intraday mean.

- Morning – Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________