Previous Trading Day’s Events (22.03.2024)

- On the 20th of March policymakers decided to keep the benchmark short-term policy rate steady. After that meeting, Powell said policymakers expect to cut interest rates later this year, but only once they have greater confidence that inflation is under control.

Starting in March 2022 the Fed raised interest rates rapidly to fight decades-high inflation, bringing its short-term benchmark rate to the 5.25%-5.5% range where it has kept it since last July.

Friday’s panel made clear that for some Americans, that time cannot come soon enough.

Rising borrowing costs coupled with higher energy and transportation prices as well as rising wages are squeezing profits for small and medium-sized manufacturers, said Cara Walton, director at Southfield.

Other panellists gave accounts of the impact of continuing pressures from higher prices, even as the rate of increase – inflation – has slowed under pressure of the Fed’s interest-rate hikes.

______________________________________________________________________

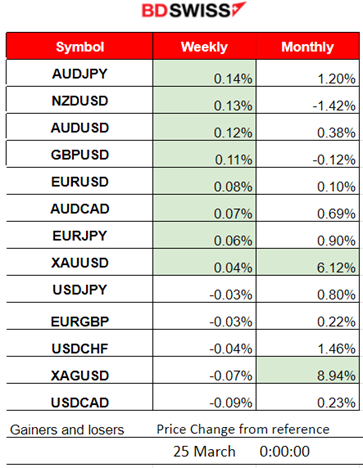

Winners vs Losers

Week starts with AUDJPY on the top, leading with 0.14% gains so far. Metals are on the top for this month still, with Silver gaining 8.94% so far.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (22 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.K. Retail sales had no increase as the change was reported with a figure of 0%. Sales volumes in clothing and department stores grew because of new collections but falls in food stores and fuel retailers offset this growth. The market reacted little to this release. The GBPUSD pair moved to the downside due to strong USD appreciation.

Retail sales fell in Canada. However, Canada’s core retail sales figures showed an increase instead. No significant impact was recorded in the market.

General Verdict:

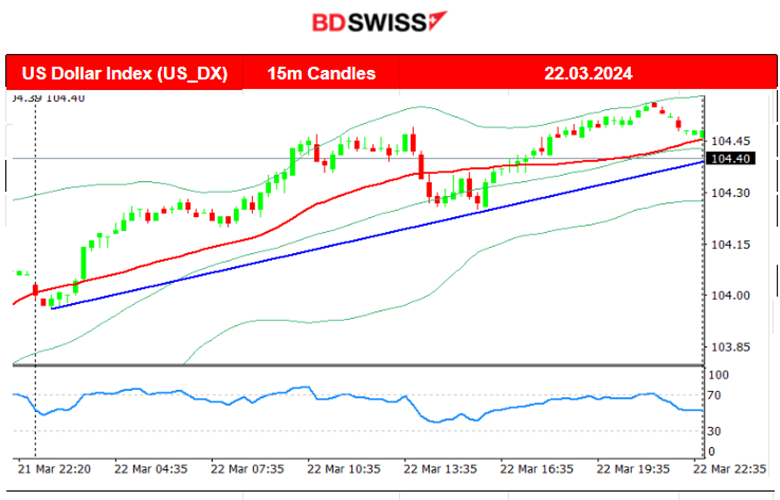

- Volatility continued to be high on Friday as the dollar continued to gain traction and strength. The FX market experienced a drop in major pairs with the dollar as a quote currency.

- Gold closed lower.

- Crude oil closed almost flat.

- U.S. indices closed lower in general. The US30 showed the most price decline on Friday.

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (22.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the downside due to the dollar strengthening. Before the FOMC the market expectations caused the dollar to experience strengthening as inflation in the U.S. seemed to be quite persistent. After the FOMC the dollar suffered strong depreciation causing the EURUSD to jump to the resistance near 1.09450. The market had reacted to the Fed’s comments reassuring that cuts will indeed take place and to the future inflation projections that see prices lower. It later reversed from that level as the dollar started to appreciate heavily. This is probably due to the interest rate differential making dollar holdings attractive and could also be explained that some market participants do not believe that there will be no delay in cuts.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin suffered losses recently dropping from the peak at 74K, and continuing downwards until the FOMC event. After the news and during the press conference, Bitcoin saw a rise, returning back to the mean.

Since the 22nd of March, it actually experienced a good comeback with the price moving upwards crossing the 30-period MA on its way up and showing upward momentum. The 68K USD level is now an important resistance.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Crypto assets finally see some halt after a long downtrend and seemingly retracement. Bitcoin’s market cap dropped to 1.27T from 1.44T seen on 14th March.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 18th of March, the index moved rapidly upwards and then retraced again to the MA. On the 19th of March, it moved sideways as mentioned in our previous analysis. After the FOMC event, all U.S. indices saw a jump. The market’s initial expectation was that borrowing costs would lower soon or as expected this year, sparking this upward movement and resilience to the downside. Soon, however, expectations changed. The dollar saw massive strengthening and the U.S. indices started to drop since the 21st March. The Dow Jones fell rapidly from the 21st March’s peak near 40,000 down to 39,500 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil found a peak at 83 USD/b on the 19th of March and then retraced to near 80 USD/b following the FOMC. It could be the case that it moves above the MA and reaches the next resistance at 82 USD/b. The RSI currently supports a bullish divergence (higher lows) and the 30-period MA seems to turn sideways. Important resistance is near 82 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

FOMC: Powell decided yesterday to ignore the inflation data and their statements gave even a hint that rate cuts will proceed as expected. Gold Jumped near 65 USD as the USD depreciated heavily during the press conference. The dollar showed unusual strength after the FOMC event causing Gold to wipe out the gains since the FOMC news. Since the 21st March Gold moved below the 30-period MA and remained on a downtrend until today 25th March seemingly stabilising sideways as volatility levels lower.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (25 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

- Monday mood. Week starts with dollar depreciation. Volatility looks moderate for now.

- Gold saw an early jump but reversed.

- Crude oil climbed.

- U.S. indices are moving to the downside.

______________________________________________________________