Rates as of 04:00 GMT

Please note a new column in the table today. I’m including the “Bloomberg Relevance Score” as the third column. This is a measure of the popularity of that particular index. It measures the number of alerts set on Bloomberg for that index relative to all alerts set for all events in that country. Of course, not all Bloomberg subscribers are trading FX, and what’s important to an equity trader might not be important to the FX world, but it does give us some objective measure of importance.

Market Recap

Not the “risk-off” trend that I would’ve expected. Stocks were down in NY but this morning most Asian markets are higher and the S&P 500 index is indicated up 0.7%. – perhaps Trump’s little jaunt in his car, endangering the lives of his driver & Secret Service guards, or talk that he’d be discharged today to go back to the White House, convinced people that he’s going to be OK. Or perhaps people are just waiting for more information. Me too (see below)

Also, House Speaker Pelosi Friday suggested that Trump’s illness could change the dynamic and help to speed an agreement on a new stimulus package, but appearing on TV Sunday, she gave no indication that there had been any change.

But maybe it comes down to the NBC-WSJ poll released over the weekend showing Biden leading Trump by 14 points – the biggest lead of the campaign. It’s clear that the US stock market prefers a Biden win – on Friday the market rose when it was announced that Biden had tested negative for the virus.

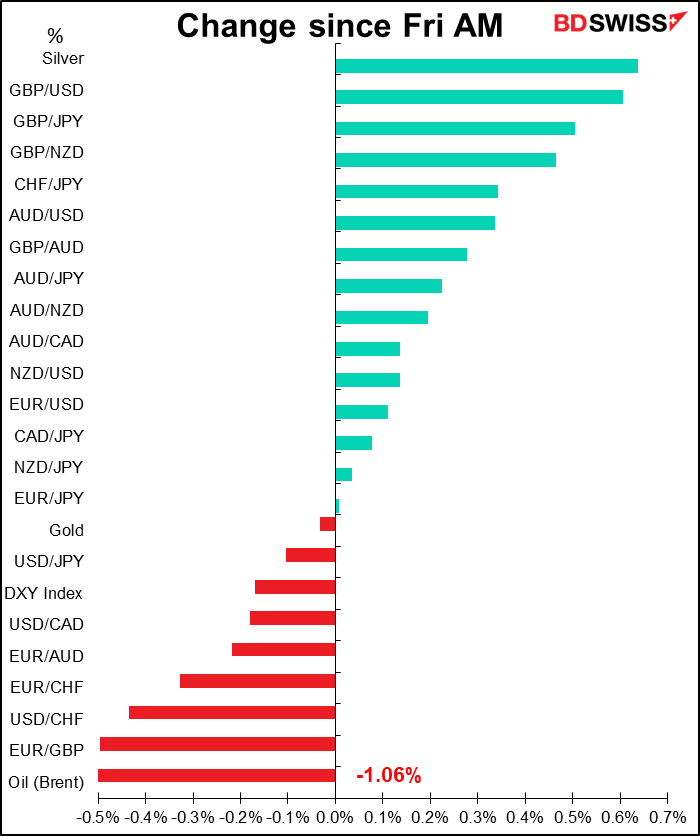

GBP was the best-performing currency as last week’s Brexit talks ended on a positive note with the news that UK PM Johnson and EC President von der Leyen would talk on Saturday. They did, and agreed “to step up negotiations,” according to Reuters – whatever that means. Have they just been chatting amiably over tea & scones without any serious effort up to now? Hard to know.

In any event, there are more talks scheduled for London this week and in Brussels next week before EU leaders meet 15-16 Oct. to assess progress. Fish and state aid remain the main stumbling blocks. Johnson appeared on TV Sunday and said a deal with the EU is “there to be done,” but warned to “difficult issues” yet to be resolved. I think the same thing could’ve been said any time from June 2016 to now. Nonetheless, there was a report in the FT that EU chief negotiator Barnier “is set to hold bilateral talks with ministers from the bloc’s key fishing states to identify ways to break the deadlock with the UK over the sector and accelerate efforts towards a trade deal with London.” This at least shows some effort at finding a compromise, which is good news

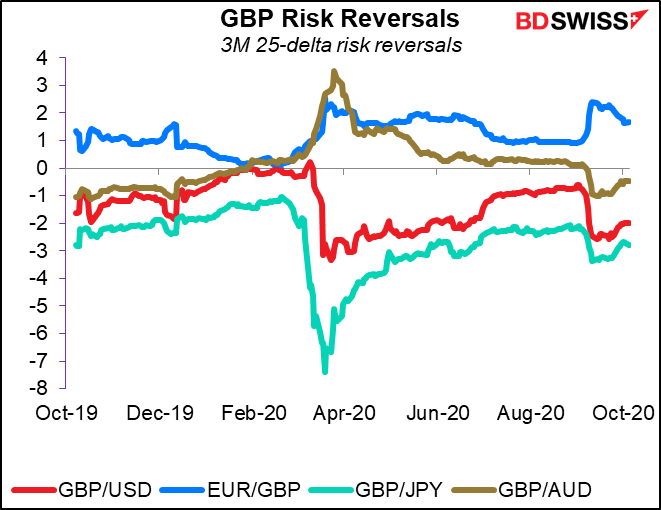

GBP risk reversals generally trended higher last week (except for EUR/GBP of course), confirming that the market’s view on GBP is improving. I’d agree. I’ve been pretty negative on sterling, but it seems that they are making a last-ditch effort to find some solution. We’ll have to see whether it’s enough, though.

CHF was the second-best-performing currency. This was not however a sign of a “risk-off” mood. Rather, it was due to speculative buying following NEC Corp’s purchase of Swiss banking software firm Avaloq Group for $2.23bn.

Background stuff

And now was acknowledged the presence of the Red Death. He had come like a thief in the night…And Darkness and Decay and the Red Death held illimitable dominion over all.

Edgar Allen Poe, The Masque of the Red Death

I used that quote back in March. Poe’s story is even more relevant now – the story of a Prince whose country is ravaged by the Plague. He decides to seal himself off in a palace with a thousand favored courtiers and “bid defiance to contagion.” “The external world could take care of itself. In the meantime it was folly to grieve or to think.” But the attempt to isolate doesn’t work, the Red Death manages to penetrate the sealed gates, and Prince Prospero and his retinue fall victim just like everyone else. Sound familiar?

I could write endlessly about his condition, but we don’t know, because the doctors admit they’re lying to us. I could write about who might else get it – he held numerous meetings with supporters without taking any precautions, even though he apparently knew he was infected. (This is probably why he and his minions showed up late for the debate Wednesday, so there wasn’t time to be tested – Melania was the only one in Trump’s retinue wearing a mask.)

But I’d just like to say four things. First off, he’s probably worse off than we know. The drug they gave him, dexamethasone, is only for use in serious cases. According to the New York Times, it “does seem to help patients in dire straits, the data suggest. But it also may be risky for patients with milder illness, and the timing of the treatment is critical.” The drug was beneficial “for those who had been sick for more than a week,” but actually seemed slightly harmful for patients “who were not receiving respiratory support.”

(This of course calls into question the timeline we’ve been given for his infection. It now seems that the real date for his infection was 26 Sep, when the White House held a celebration for their Supreme Court nominee, Judge Amy Coney Barrett.)

As one lung specialist pointed out, “You don’t start dexamethasone, Remdesivir, and give an experimental antibody cocktail to the President in the setting of low oxygen “dips” unless there’s COVID Pneumonia.” So it seems likely that they found evidence of pneumonia or other manifestations of Covid lung involvement or inflammation, which is serious and raises the level of concern and risk.

Also, dexamethasone can cause agitation, paranoia, mania, and even psychosis. Isn’t it nice to know the person with access to the nuclear trigger may be having psychotic episodes?

My third question is, is Vice President Pence really safe? The photo below shows where he was sitting (circled in yellow) at that White House gathering for Judge Barrett. This turned out to be a “super-spreader” event, with many people (circled in red) falling sick. So far Pence has tested negative, but it can take a few days before a test turns out positive. I wonder if he’ll be able to show up at the debate on Wednesday.

FYI, I heard that Pence has been moved to Trump National Golf Course in case he needs to assume Trump’s duties.

Finally, is Joe Biden safe? So far he’s tested negative, but he was on stage with Trump for 90 minutes when Trump was infected, It’s possible that Biden, age 77, was infected as well. (On the betting site Predictit.org, the odds of his running mate Kamala Harris becoming the next President have doubled since last week, admittedly still at a low 4%.)

Reading the chit-chat on Twitter, there seem to be two conflicting views on how Trump’s illness will affect Republican voters – assuming that he recovers enough to keep in the race.

Some Republicans believe it ends Trump’s chances, indeed it brings the entire Republican Party into disrepute, because the fact the White House is now infected shows that what the Democrats and science have said was true and that Trump was hiding the facts about the virus and endangering everyone’s lives for political purposes. I think this is correct. A poll taken after the news broke showed 70% of Republicans are now concerned about the virus, up from 52% two weeks ago. The number was unchanged for Democrats.

On the other hand, Trump’s supporters are renowned for their ability to tolerate cognitive dissonance. If he recovers, it will simply confirm that the virus isn’t so serious and that Trump is a strong, healthy guy. If on the other hand he’s too sick to stay in the job, then somehow they’ll blame the liberals for it.

Economics

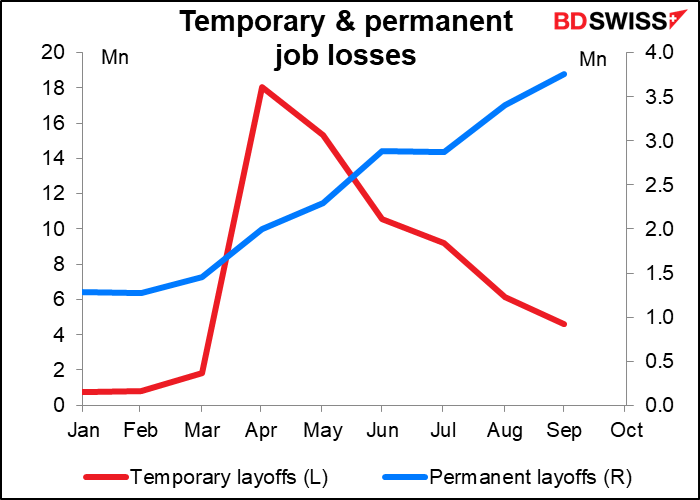

Friday’s nonfarm payrolls: I don’t usually like to spend much time going over the previous day’s indicators, because there are lots of other places where you can get that information and it doesn’t necessarily help you to face today’s market. But I would like to point out two important aspects of last Friday’s US nonfarm payrolls (NFP) that point to longer-term economic scarring that will make the recovery take much longer than elsewhere. I think this is a particular feature of the US, where the government has emphasized direct payments to people who’ve lost their jobs, as opposed to Europe and Japan, where the governments emphasized keeping the people in their jobs.

- While many of the people who were laid off temporarily have regained their jobs – temporary layoffs are down from a peak of 18.1mn in April to 4.6mn in September — the number of people who lost their job permanently has nearly tripled during the pandemic to 3.8mn. These are in many cases workers at businesses that have folded or downsized considerably. More such job losses are coming.

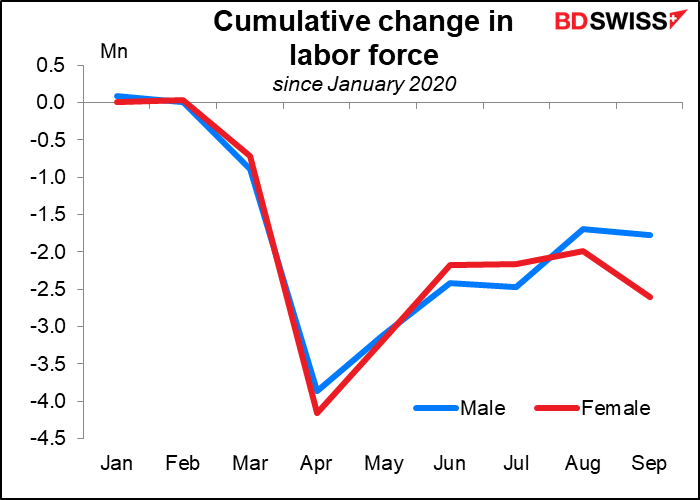

2. One big reason why the unemployment rate fell in September was that 617k women dropped out of the labor force, vs only 78k men. It’s probably not a coincidence that this coincides with back-to-school. Mothers are sacrificing their careers to take care of their children.

Another highlight this week: Eric Trump’s testimony: FYI, Trump’s son Eric must testify under subpoena from the New York Attorney General, Letitia James, by Wednesday. James is investigating whether the New York-based Trump Organization improperly inflated the values of several real estate assets on financial statements that were used to obtain loans, as well as to get economic and tax benefits related to those properties. Michael Cohen, Trump Sr’s former attorney, revealed the alleged scheme in his congressional testimony. It will be interesting to see if Eric inherited the famous Trump loyalty gene or if he rats out his father to save his own skin. I know which his father would probably do.

Depending on how things go, a Trump family member – up to The Donald himself, who was head of the organization at the time the alleged misdeeds took place — might be indicted just in time for election day. And since any fraud and tax evasion charges would come at the state level, they couldn’t be nullified by a presidential pardon if found guilty.

Today’s market

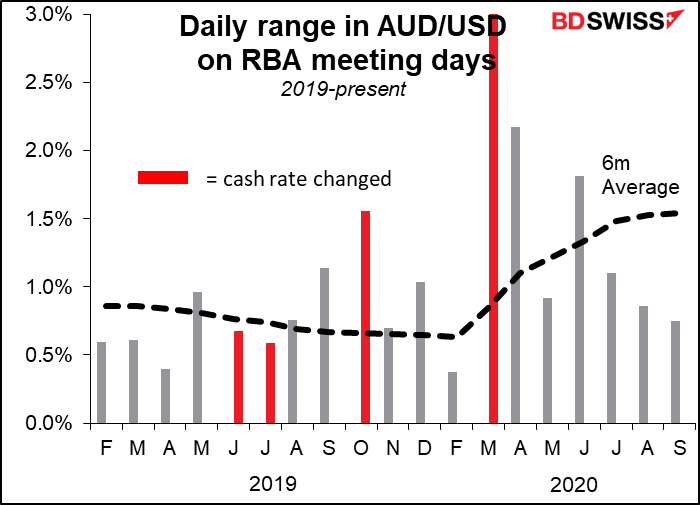

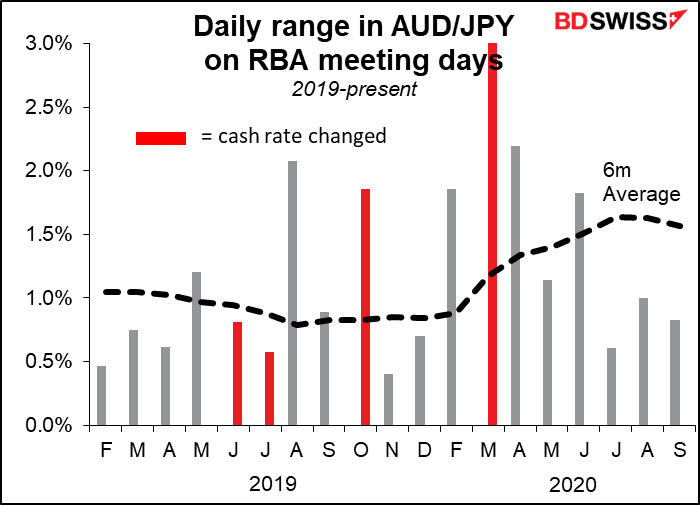

There’s a Reserve Bank of Australia (RBA) meeting overnight. I covered this in detail in my Weekly Outlook, so I won’t go through it in depth again, especially as 20 out of 24 economists polled on Bloomberg expect no change. I think there is a chance of a cut in the cash rate to 0.10% from 0.25%. If it does happen, it would be a surprise to the market and would be negative for AUD. Otherwise, no change will probably be neutral, as it’s so widely expected. (See the Weekly Outlook for details of why I think the RBA might cut.)

If they don’t change the cash rate, don’t look for any unusual volatility in the market. RBA days with no change in rates tend to be less volatile than average recently.

The day opens with the final service-sector purchasing managers’ indices (PMIs) for the major industrial economies for September. These aren’t usually revised very much, but recently there have been some significant revisions. We also get the service-sector PMIs for most of the other economies that Markit covers.

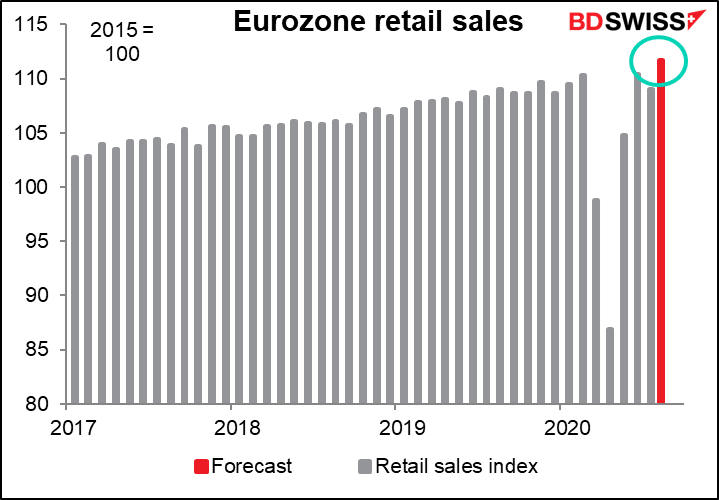

Eurozone retail sales are not normally that closely watched, but nowadays everyone is watching retail spending closely. They’re expected to be up 2.5% mom in August after July’s 1.3% mom fall. This would leave them 1.7% above the average of January and February. That’s similar to what we’ve seen in the US (1.8%) and Australia (1.9%) but below Britain’s 3.7% bounce. As such I’d say it’s about par for the course and EUR-neutral.

The Institute of Supply Management (ISM) September non-manufacturing index is expected to fall slightly, as did the Markit version of that index. But that’s to be expected, given the relatively high level of the index and isn’t cause for concern.

Australia’s trade surplus is expected to rise slightly, but that isn’t necessarily good – it’s just because imports are falling more (-4.4%) than expected (-1.7%). Although the report comes out just a couple of hours before the RBA meeting, it can still move the markets.

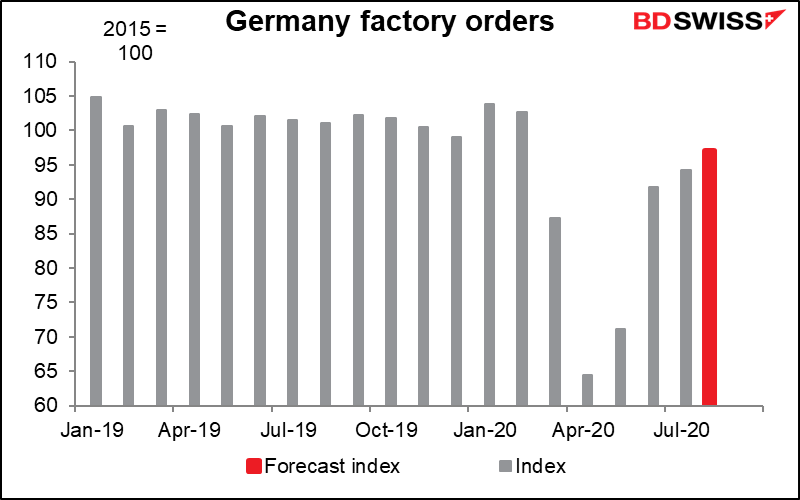

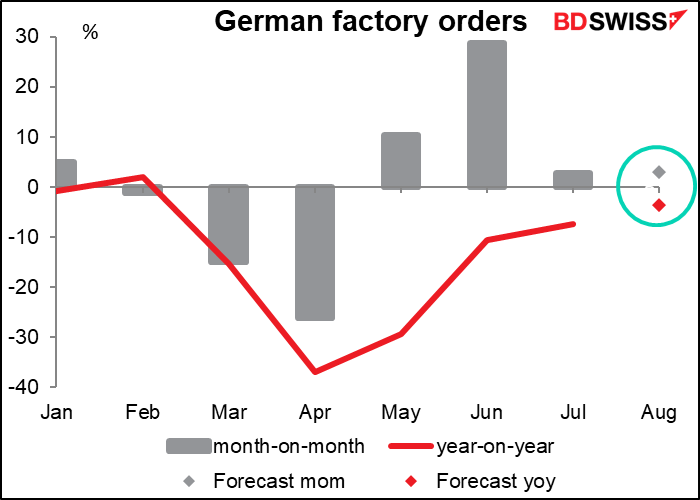

Finally, in the early early morning, Germany announces its factory orders. They’ve returned to a more normal level of volatility. They’re expected to rise at a slightly faster pace of increase than the month before, which is a good sign.

Still, they’re expected to be 6.1% below the pre-pandemic average, which suggests that the recovery still has a ways to go.