Previous Trading Day’s Events (31.05.2024)

Core PCE, subtracting food and energy prices, rose 0.2% month to month, less than the forecast repeat of March’s 0.3% rise. In the 12 months to April, the core index rose 2.8%, the same as expected and as last month’s rise.

Source:

______________________________________________________________________

Winners vs Losers

The USD pairs have reached the top of the list as the U.S. dollar strengthened after this week’s opening.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (31.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 2:30, inflation in Tokyo was reported to have accelerated in May, increasing chances for a rate hike from BOJ in coming months even as the economy continues to show signs of weakness. No major impact was recorded in the market at that time.

Disappointing China’s PMI figures were reported at 4:30 as manufacturing fell back into contraction. CNH depreciated at that time and the USDCNH jumped around 60 pips before reversing immediately.

- Morning – Day Session (European and N. American Session)

CPI data for the Eurozone were released at 12:00. Inflation in the eurozone rose to 2.6% in May according to the releases, however, the impact on the market was of no significance at all. Core inflation, excluding the volatile effects of energy, food, alcohol and tobacco, increased to 2.9% from 2.7% in April. Nevertheless, market participants still expect an interest rate cut from the European Central Bank next week.

At 15:30 the U.S. PCE price Index figure, the Federal Reserve’s preferred measure of inflation, the core personal consumer expenditure deflator, has come in at 0.2% month-on-month – the consensus had been swinging between 0.2% and 0.3%. This lower-than-expected figure has caused U.S. dollar depreciation at the time of the release and an intraday shock. The EURUSD jumped around 30 pips upon release but it reversed soon after when the U.S. Dollar started to appreciate again heavily.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

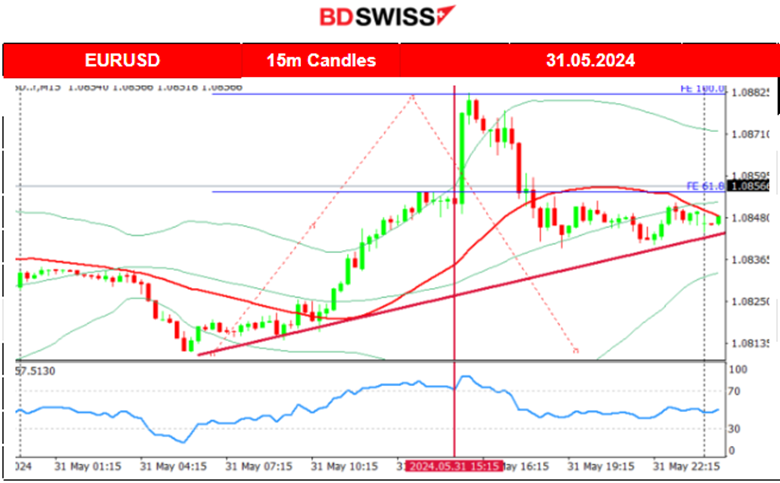

EURUSD (30.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move with high volatility after the start of the European session. With the U.S. dollar experiencing early depreciation the EURUSD started to move upwards aggressively despite the higher-than-expected reported CPI Flash estimate figure for the Eurozone. At 15:30 the core PCE Price index figure was reported lower than expected causing the market to react with U.S. dollar depreciation that lasted only for that period. The pair soon reversed as the U.S. dollar turned to heavy appreciation and retracement took place, eventually returning back and staying close to the 30-period MA for the rest of the session.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After a period of consolidation during the weekend when the price experienced low volatility, Bitcoin saw a jump on the 27th of May reaching 70,6K but soon reversed heavily to the downside. After finding support at nearly 67,500 USD it retraced to the 30-period MA and remained close, settling near the 68K USD level. Despite some high volatility on the 30th of May, the price still remained close to that level.

On the 31st of May, Bitcoin dropped after the U.S. PCE Price Index figure release reaching near the support at 65,500 USD before retracing to the 30-period MA. After a period of consolidation taking place over the weekend, the price broke the resistance and movies currently to the upside. It stalled at the resistance near 69K USD for now. The next level is at 69,500 USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The market remains volatile but in range. Currently, it sees some improvement this week. Let’s see if it is going to continue showing performance.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The wedge was broken on the 28th and the index moved lower to the support around 5,280 USD before reversing to the 30-period MA. A downward path continued on the 29th of May and with no signs of slowdown it continued all the way down until the 30th of May. The RSI was indicating a bullish divergence (higher lows) Price: lower lows, as mentioned in our previous analysis.

A jump occurred eventually on the 31st of May which was a huge reversal, crossing the 30-period MA on its way up potentially ending the downtrend. This was the confirmation of the bullish divergence. The index is near the upper band of the 50- period Bollinger Bands indicating resistance for moving further to the upside. Retracement to the 61.8 Fibo level (back to 61.8% of the total movement to the upside) is more probable, with a target Level near 5,265 USD. A less probable alternative scenario could be the breakout of the 5,300 USD resistance pushing the index more to the upside with a target level near 5,330 USD.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

OPEC+ is in the financial media’s focus, highlighting the probability of an extension of the voluntary cuts for the third quarter of the year, however, we have seen a remarkable drop in price since the 29th of this month.

That clear downtrend could end soon. We are 4 dollars down from that peak and even though we have 1 or 2 dollars downward potential, considering Crude oil’s volatility this year, it might be the time for a turn to the upside. The RSI is clearly showing a slowdown (bullish divergence). The OPEC+ meeting on Sunday was probably deterministic in regard to the direction of Crude oil’s price. Since OPEC+ decided to extend oil production cuts into 2025 the price will have a pressure to stay high.

Source:

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 30th of May, the price continued to the downside, testing the 2,320 USD/oz as mentioned in our previous analysis, however, it was unsuccessful. 2,340 USD/oz served as the mean price until the 31st of May with the price deviating around 20 dollars from that mean. The price broke the support at nearly 2,320 USD today and with the potential to move further downwards. However, it stalled after the breakout, indicating that there are upward pressures that keep the support strong.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (03.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

PMI data for the manufacturing sector are released today for the major regions and economies.

The leading indicator of economic health, ISM Manufacturing PMI, will be released at 17:00 and is expected to slightly improve. Recently we saw worsened figures since business seemed to cool down as we moved away from the start of the year. NFP reported just 175K in May.

General Verdict:

______________________________________________________________