Previous Trading Day’s Events (05.06.2024)

There were also no signs that inflation was picking up after a jump in prices at the start of the year, welcome news for Federal Reserve officials. Though financial markets expect the U.S. central bank to start cutting interest rates this year, the timing is uncertain because inflation remains high, with most of the price pressures coming from services.

“While the easing of price pressure and moderation in hiring tilt this report in a dovish direction, the Fed will ultimately want to see these developments translate to the hard data on inflation and job growth,” said Tim Quinlan, senior economist at Wells Fargo in Charlotte, North Carolina.

“The underlying trend suggests that services inflation will remain on a downward trend in the first half, with some risk that it may not cool as quickly as Fed officials would like,” said Oren Klachkin, financial market economist at Nationwide.

Sources:

https://www.reuters.com/markets/us/us-services-sector-cools-february-ism-survey-shows-2024-03-05/

______________________________________________________________________

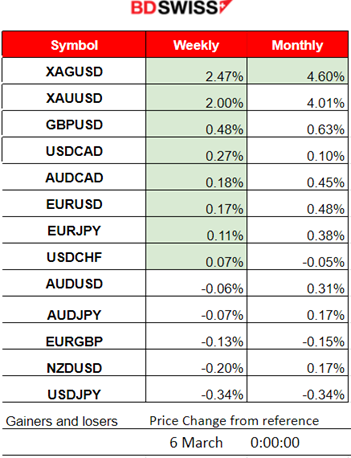

Winners vs Losers

Metals climbed to the top of the list. Silver (XAGUSD) is leading for this week and month. 2.47% gains this week and 4.60% gains for the month. Gold (XAUUSD) follows with 4.01% gains so far this month.

______________________________________________________________________

______________________________________________________________________

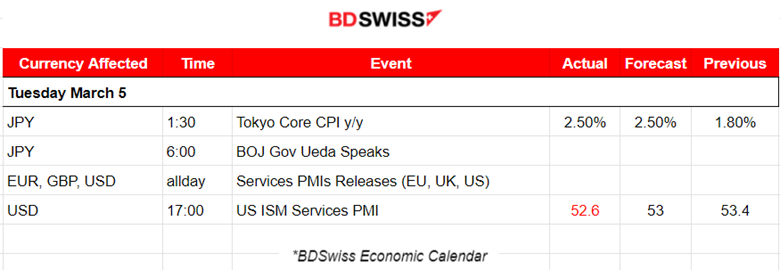

News Reports Monitor – Previous Trading Day (05 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Tokyo Core CPI figure was reported as expected. The annual inflation rate picked up from 1.6% to 2.6%. A low-level shock was recorded at that time at 1:30, with a sudden JPY depreciation, however the effect faded soon.

- Morning – Day Session (European and N. American Session)

Services PMI Releases:

Eurozone PMIs:

In Spain, the services sector is expanding as it recorded a positive performance in February with a good PMI figure of 54.7 points. Both activity and new business are rising at their best rates since May 2023. Expectations for the future are improved. Firms took on additional staff at a solid pace.

In February the Italian service sector showed sustainable growth with a PMI reported at 52.2 points. New business, increase in new work and rising activity. Improvement in demand conditions with new job creation.

The French PMI was reported in contraction but at least showed improvement. The service sector downturn cools with demand getting back on track. New export sales expanded for the first time since last May. More optimism towards the outlook for business activity, with growth expectations reaching a seven-month high.

Germany is suffering as services business activity remains under pressure. Reporting services PMI in contraction at 48.3 points. However, firms’ expectations for activity over the year ahead improved to the highest since last April resulting in job creation growth. Notable to say that rates of increase in input costs and output prices reached the highest for ten and six months respectively.

U.K PMI:

In the U.K. the service sector output growth was maintained in February. Reporting PMI at 53.8 in expansion. A sustained increase in business activity in February, supported by stronger new order growth and aided by another modest rise in employment.

U.S. PMIs:

Sustained expansion in February for the U.S. services sector with a recorded PMI figure at 52.3, an improvement from the previous period. Output rose for a thirteenth successive month. New business inflows have now risen for four straight months.

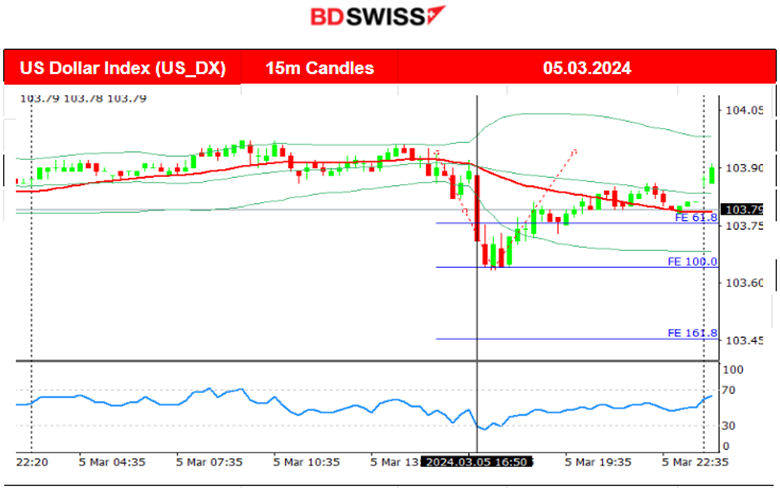

At 17:00 the release of the ISM Services PMI showed a registered figure of 52.6, formed after the nation’s purchasing and supply executives’ responses in the survey. According to this report, business activity and new orders improved. However, employment was particularly soft, dropping into contraction territory. The USD suffered depreciation at the time of the release because of a lower reported figure showing deterioration instead (52.6 versus 53.4). The dollar index dropped but soon after the news it reversed to the intraday mean.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (05.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved steadily around the 30-period MA with low volatility. The absence of significant news and mixed data for the services sectors in the Eurozone kept the EUR unaffected, slightly beaten against the USD. However, at 17:00 the USD depreciated heavily upon the services ISM PMI report and the pair jumped near 30 pips before reversing to the MA.

___________________________________________________________________

___________________________________________________________________

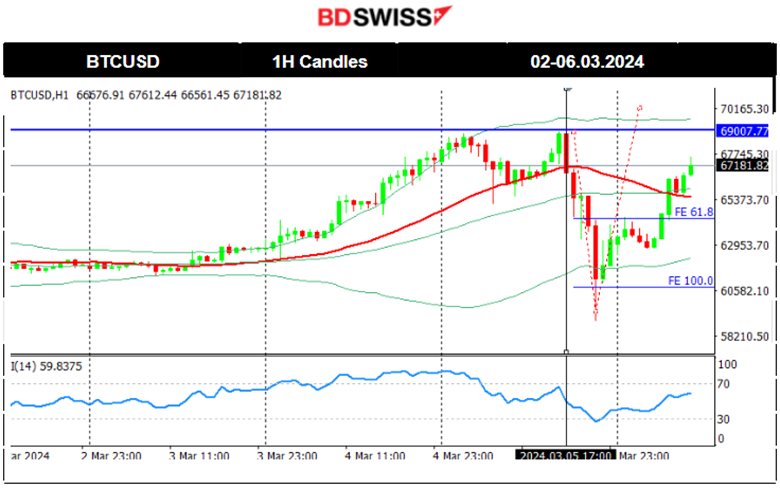

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin reached 69K yesterday after a long and rapid upward movement as institutional investors help Bitcoin sustain new heights. Excitement is probably driving the rally for the new U.S. spot bitcoin exchange-traded funds (ETFs) and expectations the Federal Reserve will begin cutting U.S. interest rates this year.

In February, software firm MicroStrategy said it had bought about 3,000 Bitcoins for 155 million USD, while social media platform Reddit disclosed it had bought small amounts of Bitcoin and ether.

Bitcoin’s price eventually retraced yesterday reaching the low of 59K before reversing fully again to the upside. Quite volatile moves. It currently trades above 67K USD.

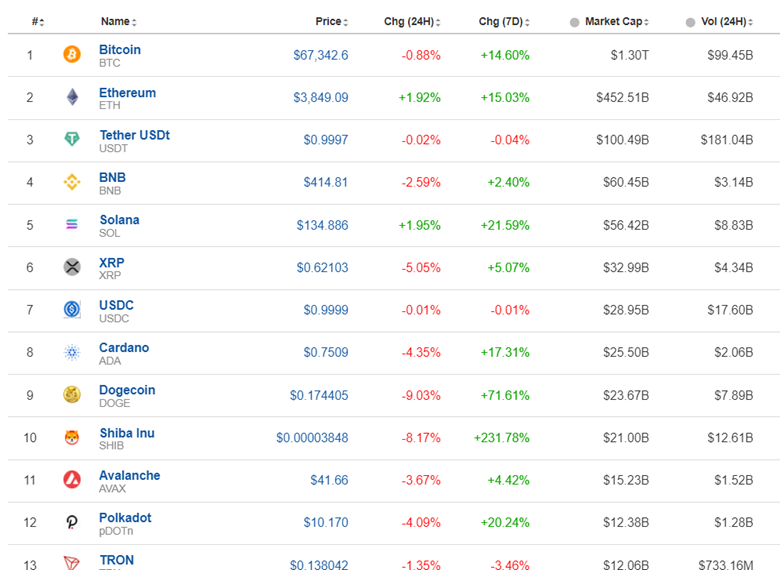

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market saw a surprising uptrend as institutional investors stepped in the markets aggressively. Yesterday the markets saw a slight correction causing small losses. Shiba Inu remains the top performer with 231.78% gains just in the last 7 days followed by Dogecoin with nearly 71.61% gains in the same period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 4th March, the index retraced to the 30-period MA. Soon after it crossed it on the way down showing signals that the uptrend ended. Before any intraday notable retracement to occur yesterday, 5th March, stocks dropped upon exchange opening. All three U.S. indices retreated more than 1%, with weakness in mega-cap growth companies such as Apple Inc and the chip sector. Fed Chair Powell Testifies at 17:00 today. It will be critical in determining if the index will retrace to 18,060 USD or suffer a drop below the support of 17,800 USD. Obviously, high borrowing costs for longer than expected are affecting business negatively and the market participants are expected to react heavily to Powell’s statements.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 1st of March, the price jumped high reaching the resistance at 80.3 USD/b before retracing back to 79.3 USD/b. On the 4th of March, it eventually reversed fully back to the support at near 77.9 USD/b. Crude oil price fell further on the 5th March reaching the next important support at 77.5 USD/b as OPEC+ extends output cuts. More supply in place puts pressure on prices to drop further. A breakout to the downside might trigger a rapid drop. Currently though the price retraced to the 30-period MA and settled near 78 USD/b again.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The surge continued breaking significant resistance and jumping more than 20 USD upwards as expected. Gold reached remarkably at the level 2,140 USD/oz. Will this time Gold experience a significant retracement? It is on an uptrend with the RSI showing a bearish divergence as highs get lower and lower while the price has higher highs. However, the price is still above the 30-period MA. The USD will probably be affected greatly soon by Powell’s statements at 17:00 and this will affect Gold’s price, potentially causing a drop if the dollar appreciates due to hints of any further delays on interest rate cuts.

______________________________________________________________

______________________________________________________________

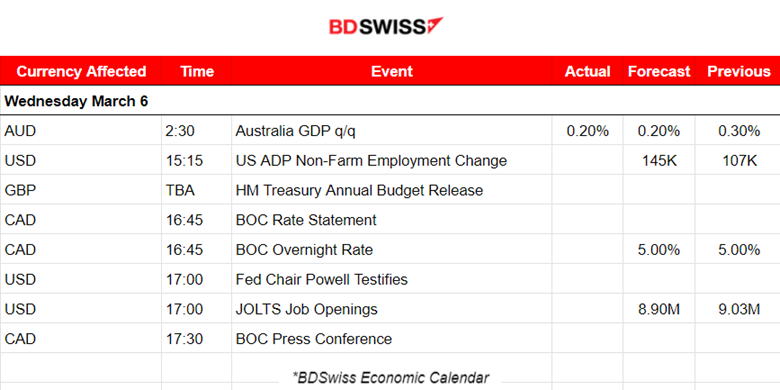

News Reports Monitor – Today Trading Day (06 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Australian GDP rose 0.2% in Q4 and as expected according to the report released at 2:30. No major impact was recorded in the market.

- Morning – Day Session (European and N. American Session)

The ADP report and JOLTs report, labour data releases, are going to be released today affecting the USD at 15:15 and 17:00 respectively. This is a first look at how the labour market is progressing since the beginning of the year. The ADP is for January while the JOLTS job openings figure is reporting for Dec. The ADP Private sector employment is expected to be reported higher indicating a tight labour market view for early this year.

The Bank of Canada (BOC) will decide on interest rates on the same date and will potentially affect the CAD The press conference at 17:30 might cause more volatility pushing the pairs in one direction.

Fed Chair Powel will proceed to statements this week twice starting from March 6th. USD will probably be affected much by these and their effect could reach the stock market as well causing high volatility.

General Verdict:

______________________________________________________________