Market Recap

No market recap section today.

Commitments of Traders (CoT) report

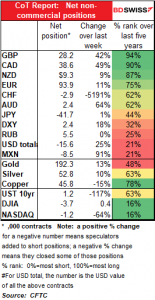

Specs once again increased their short USD position. This week most of the action (in absolute terms) was in EUR, which is somewhat unusual as that’s been pretty quiet recently. The rest was mostly GBP and CAD, with a little AUD and NZD. On the other hand, the increased their short MXN positions and went from flat CHF to short.

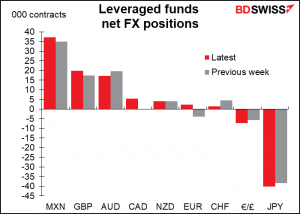

Hedge funds also increased their short USD positions, including flipping from short EUR to long EUR. Here though they decreased long AUD and increased short JPY.

Specs increased silver longs, but gold longs were once again pretty much the same.

Today’s market

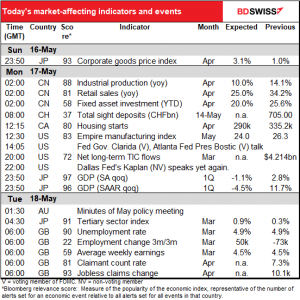

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore, there can be discrepancies between the forecasts given in the table above and in the text & charts.

The Swiss sight deposits suddenly got interesting last week, when they jumped by CHF 3.6bn. That was the biggest change in either direction since last July, when, as the graph shows, EUR/CHF was a lot lower (1.0629 vs 1.0955 last week). Perhaps the Swiss National Bank is trying to keep the pair above 1.10?

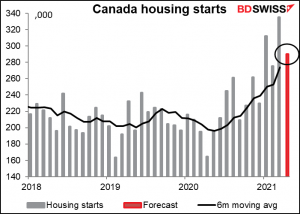

Canadian housing starts are expected to fall back after last month’s record pace. Still, the trend remains upward. The market estimate of 290k is above the six-month moving average of 274k. As the Bank of Canada said after its April meeting, “Housing construction and resales are at historic highs, driven by the desire for more living space, low mortgage rates, and limited supply. The Bank will continue to monitor the potential risks associated with the rapid rise in house prices.” More houses may temper those risks, but I’d prefer to think that they’re a sign that demand remains strong – which is positive for CAD.

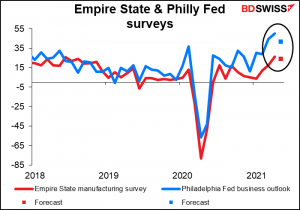

The market is expecting a small decline in both today’s Empire State survey and Thursday’s Philadelphia Fed survey. But they’re both at such high levels and the expected decline is so minimal that I’m not sure it really matters. USD-neutral.

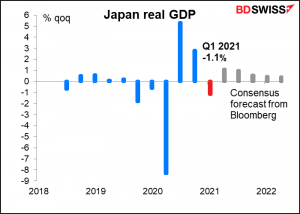

Overnight, Japan announces its Q1 GDP. It’s expected to show a decline in output, as the government declared a “state of emergency” in various parts of the country in January.

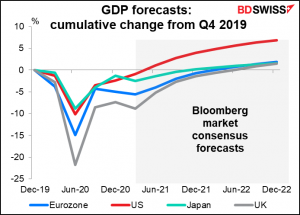

At that pace, Japan is on schedule to recover to pre-pandemic levels of output by Q4 this year, vs Q2 for the US, Q1 2022 for the EU and Q2 2022 for the UK.

The Reserve Bank of Australia (RBA) releases the minutes of its May meeting. As you may remember, if indeed you follow such things, they decided at that meeting to put off until their July meeting two important decisions: a) whether to retain the April 2024 bond as the target for its yield curve control (YCC) program or extend that to the November bond, and b) what to do about its bond purchase program once the current AUD 100bn program expires around September. The question is, why July? The consensus was that they’d decide this in August. We hope to find a clue as to why July.

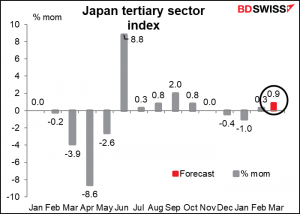

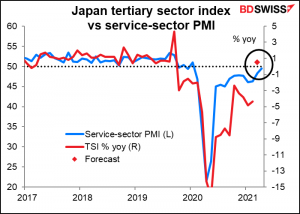

I’m sure you have no interest in Japan’s tertiary sector index – in fact, a lot of people don’t even know what the tertiary sector is, much less care (primary sector = agriculture, secondary sector = manufacturing, tertiary sector = services).

This is Japan’s version of the service-sector purchasing managers’ index (PMI), and as you can see, it follows the service-sector PMI pretty closely, or at least it did until recently.

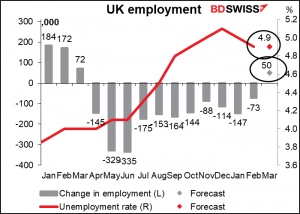

Then we wait until morning has broken over London and the UK announces its employment data. The unemployment rate is expected to remain at 4.9%, thanks to the furlough scheme, which is keeping about 10% of the labor force employed. The good news should be a small rise in the number of people employed, the first such rise since the pandemic began. That would be positive for sterling, I should think.