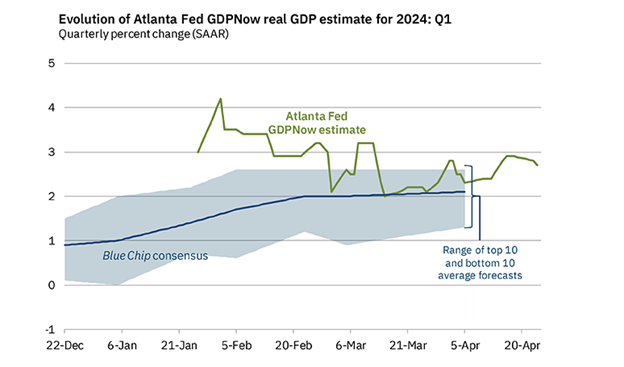

According to forecasts, the US GDP data can show an increase of 2.5% on Thursday, April 25th. However, many analysts predict an increase in the figure, impacting the overall dollar story.

Not too soft, not too hard

According to the estimates, GDP growth is expected to slow in the first quarter. Expectations are for a 2.5% increase quarter over quarter.

However, it can grow by around 2.9%. That would mark the seventh straight positive figure for real GDP. That isn’t a hard or soft landing. Consumer spending, which is an important component of GDP, is projected to increase by 2.8% in the first quarter of 2024, down from 3.3% in the fourth quarter of 2023.

The US economy’s recent strong performance indicates substantial productivity, employment growth, and strong demand. This can be concerning for the Fed’s rate cut story.

The data dependency approach

Recent comments from the Fed, including Chair Jerome Powell, have urged the need for patience and a data dependency approach.

After the high CPI, the Fed is cautious. Another important event after GDP will be the Core PCE, the Fed’s preferred inflation measure. The Federal Reserve is not likely to change its plan for an earlier rate cut, as the expected monthly rate is 0.3%, which is considered high.

What to expect?

Geopolitical tensions in the Middle East last week were intense. Now, we are focused on the dollar’s reliance on economic data, with Thursday’s GDP figures likely to impact the dollar’s value.

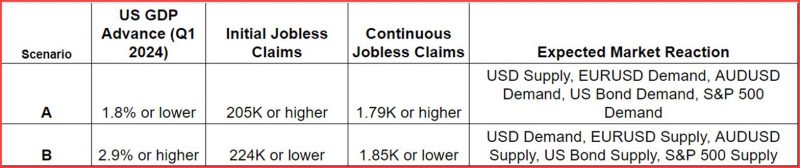

A stronger-than-expected first-quarter GDP report may strengthen the notion of a strong US economy capable of enduring high interest rates. This should keep the Feds focused on inflation management (higher than their 2% target), boosting the dollar bulls. In this case, the DXY can trade above 106.50.

A lower-than-expected GDP report may lead to concerns about how inflation affects consumer spending, weakening the dollar. In this situation, DXY can be below 105.50.

GDP figures can impact FX rates, but significant FX movements can also be caused by PCE, employment data, or the Fed’s communication.

Sources:

Sources:

https://finance.yahoo.com/news/slow-solid-us-economic-growth-040630174.html