Previous Trading Day’s Events (18.03.2024)

______________________________________________________________________

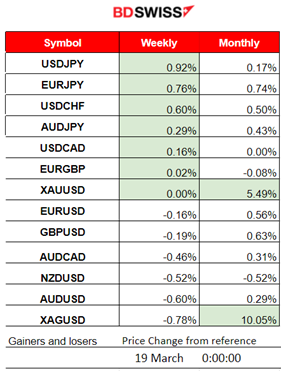

Winners vs Losers

USDJPY currently leads with 0.92% for the week followed by other JPY pairs (JPY as Quote) as the JPY is weakening as the Bank of Japan raised interest rates, a pivotal change in monetary policy.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (18 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

No important announcements, no special scheduled releases.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

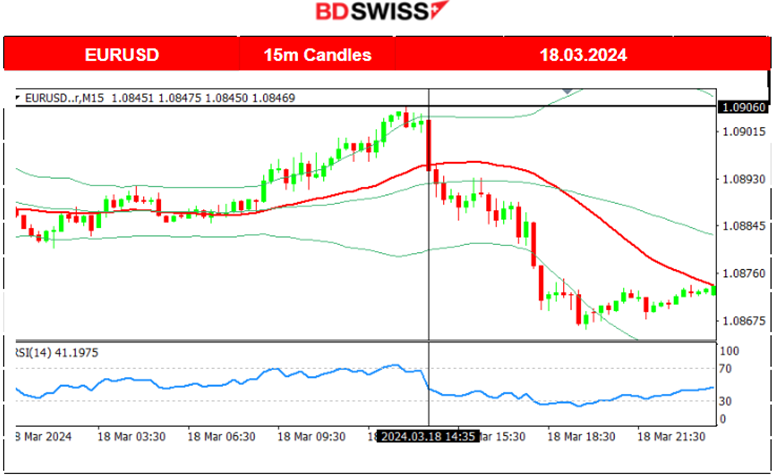

EURUSD (18.03.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair moved to the downside as the USD experienced high strengthening after 14:35. A reversal from the resistance at near 1.09060 took place with the pair diving lower, crossing the 30-period MA, a 40-pips downward sharp move. It seems that expectations for a delay in interest rate cuts are formed amid the FOMC statement that takes place tomorrow.

___________________________________________________________________

___________________________________________________________________

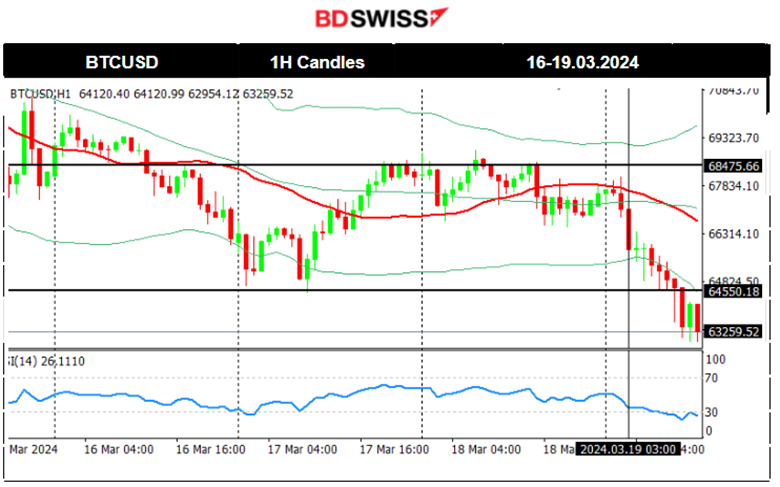

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin moved lower and lower after reaching the peak at 74K USD on the 14th of March. Big outflows move bitcoin’s price to the downside and that is quite apparent.

The price is currently below 64K USD as it retraced almost to the 61.8 fibo level of the Daily Chart starting the movement upwards from 42K which is the 0 Fibo level. 100 Fibo is 74K USD and 61.8 Fibo is near the 63K USD level.

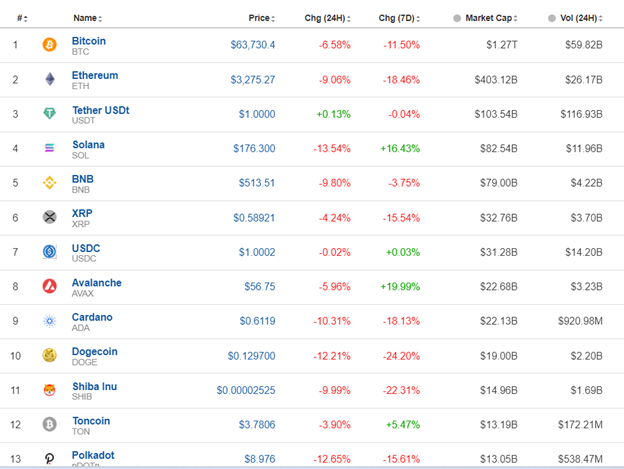

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Crypto market suffers ahead of the FOMC report and potential USD strengthening.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 13th of March, the upward wedge was broken to the downside and the index dropped until the support at near 18,040 USD, moving below the 30-period MA on its way down. With the dollar appreciating further the drop continued on the 14th of March reaching the support near 17,950 USD before retracing to MA again. The 15th March noted the confirmation of a downfall for U.S. indices as fears that there will be a cut delay grew, with borrowing costs to remain high in the future, and amid the U.S. dollar strengthening. On the 18th of March though, the index moved rapidly upwards and then retraced again to the MA. Currently, the lows are about to be tested again, however a sideways movement is more probable before the FOMC statement takes place tomorrow.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 13th of March, Crude started to see a rise in price that was kept steady for two consecutive days causing the price to reach a peak near 81 USD /b. Retracement followed, back to near 80 USD/b. On the 14th of March, the price continued to show that the trend was likely to continue upward and after reaching the resistance near 81 USD/b it retraced to the 30-period MA. On the 18th of March, the price reached the next resistance at near 82.5 USD/b before retracing again to the MA. A clear short-term uptrend that might end soon as the RSI shows a slowdown.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold will be pushed to the downside only if the Fed hints that there will be cut delays, following the higher-than-expected inflation. Gold remained high as it moved to the upside on the 13th of March. The U.S. dollar weakened and Gold moved to the upside crossing the 30-period MA on its way up. A triangle formation was visible as volatility is lowering for Gold. Despite recent strong USD appreciation, Gold remains high and sees resilience for the downside.

______________________________________________________________

______________________________________________________________

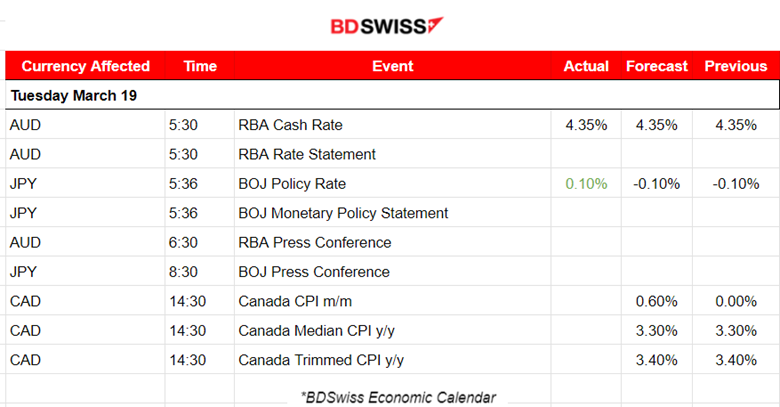

News Reports Monitor – Today Trading Day (19 Mar 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

The Reserve Bank of Australia (RBA) decided to leave the cash rate target unchanged at 4.35%. Inflation continues to moderate but remains high, they said in their statement. Recent information suggests that inflation continues to moderate, in line with the RBA’s latest forecasts. The market reacted with strong AUD depreciation at the time of the decision release.

The JPY is weakening as the Bank of Japan (BOJ) ended eight years of negative interest rates making a historic shift away from its focus on reflating growth with decades of massive monetary stimulus.

This is Japan’s first interest rate hike in 17 years. The shift makes Japan the last central bank to exit negative rates. Fragile economic recovery forces the central bank to go slow on further rises in borrowing costs, analysts say.

“We reverted to a normal monetary policy targeting short-term interest rates, as with other central banks,” BOJ Governor Kazuo Ueda said at a press conference after the decision.

“If trend inflation heightens a bit more, that may lead to an increase in short-term rates,” Ueda said, without elaborating on the likely pace and timing of further rate hikes.

The central bank also abandoned yield curve control (YCC), a policy in place since 2016 that capped long-term interest rates around zero, and discontinued purchases of risky assets.

- Morning–Day Session (European and N. American Session)

The Canada Inflation figures will be released at 14:30 and it is expected to be reported higher on a per month-to-month calculation. Just like in the case of the U.S. we see high employment thus it might have kept prices sticky so the end result could be a surprise increase. The market’s reaction though is still a bit uncertain upon release and CAD might not appreciate as expected if we take into account how the market reacted to similar, data-related releases.

General Verdict:

______________________________________________________________