Tomorrow, August 13, 2024, at 9:00 AM ET, The Home Depot, Inc. (NYSE: HD) will announce its Q2 2024 earnings, marking a key event for market participants.

Market Cap

€316.50 Billion in market capitalization positions Home Depot as the 27th most valuable global entity in terms of equity valuation as of August 2024.

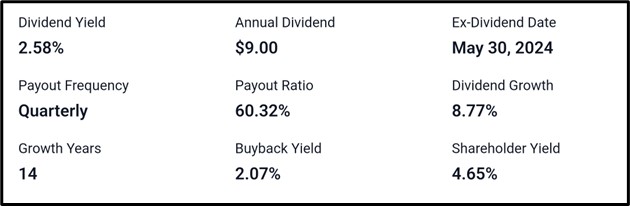

Dividend Information

The stock offers a quarterly dividend yield of 2.58%, with an annual payout of $9.00 and a 60.32% payout ratio, reflecting a solid commitment to returning capital to shareholders. With 14 consecutive years of dividend growth at a rate of 8.77%, the ex-dividend date was set for May 30, 2024. Additionally, a buyback yield of 2.07% complements the shareholder yield of 4.65%, indicating robust shareholder value through both dividends and buybacks.

Recent Development At Home Depot

Here are the latest developments at The Home Depot :

Strategic Investment: The Home Depot Foundation commits $9 million towards housing initiatives, benefiting over 3,400 homeless veterans.

Expansion Move: The Home Depot strengthens its market position by acquiring SRS Distribution Inc.

Proactive Preparedness: The Home Depot Foundation enhances disaster resilience in remote U.S. regions ahead of hurricane season.

Military Support: The Home Depot unveils a Military Moving Hub, streamlining relocations for service members.

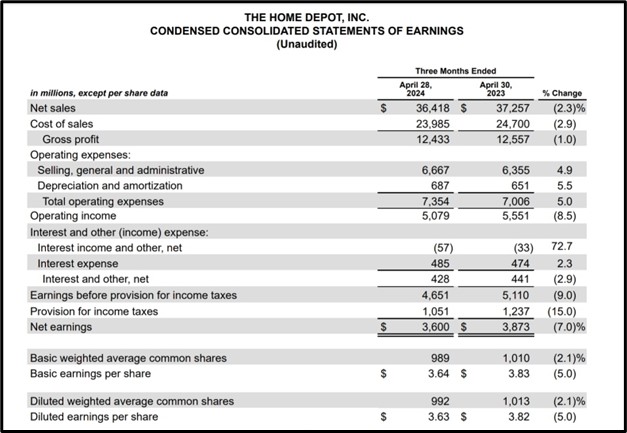

Q1 Earnings Report Recap

Sales Decline: Home Depot’s net sales dipped by 2.3% to $36.4 billion, reflecting a softer market environment.

Profit Margin Pressure: Gross profit fell by 1.0% as cost of sales outpaced revenue growth, indicating margin compression.

Rising Expenses: Operating expenses, particularly SG&A and depreciation, increased by 5.0%, contributing to an 8.5% drop in operating income.

Earnings Impact: Despite higher interest income, net earnings dropped 7.0% to $3.6 billion, with diluted EPS down 5.0% due to weaker overall performance.

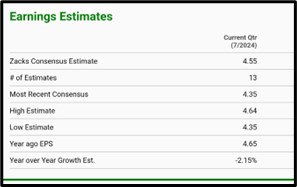

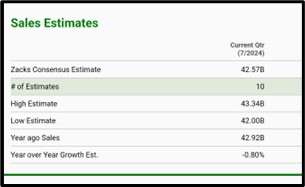

Q2 Earnings Report Analyst Forecast

For the current quarter, Zacks’ consensus places Home Depot’s EPS estimate at $4.55, slightly below last year’s $4.65, reflecting a projected decline of 2.15%. Sales estimates are pegged at $42.57 billion, with a modest year-over-year drop of 0.80%, highlighting cautious market sentiment amidst mixed earnings forecasts.

Investing.com projects Home Depot (NYSE: HD) to post an EPS of $4.54 and revenue of $42.6 billion.

TradingView projects Home Depot (NYSE: HD) to report an EPS of $4.54 and revenue of $42.58 billion.

Technical Analysis

Uptrend Line Rejection: The Home Depot (NYSE: HD) encountered resistance on its 1-hour chart at $341.53.

Bullish Scenario: If the rejection is confirmed, potential upside targets are $353.34 and $362.61.

Bearish Scenario: If the rejection fails, downside targets are $326.52 and $307.43.

Conclusion

Home Depot (NYSE: HD) has shown resilience with a solid market cap of €316.50 billion and a robust shareholder return strategy, including a 2.58% dividend yield and 14 years of consecutive dividend growth. However, recent performance reveals a 2.3% decline in Q1 sales and an 8.5% drop in operating income. For Q2 2024, analysts predict a slight decrease in EPS to $4.54–$4.55 and a minor drop in sales to approximately $42.6 billion. Technical analysis suggests potential price targets of $353.34 and $362.61 if resistance holds, or a decline to $326.52 and $307.43 if it fails.

Sources:

https://ir.homedepot.com/events-and-presentations

https://companiesmarketcap.com/eur/home-depot/marketcap/

https://stockanalysis.com/stocks/hd/dividend/

https://corporate.homedepot.com/news/company/the-home-depot-acquires-srs-distribution-inc

https://ir.homedepot.com/~/media/Files/H/HomeDepot-IR/press-release/q1-2024-earning-release.pdf

https://www.zacks.com/stock/quote/HD/detailed-earning-estimates

https://www.investing.com/equities/home-depot-earnings