PREVIOUS TRADING DAY EVENTS – 07 June 2023

Announcements:

We have seen a lot of surprises lately. Another surprise took place just recently on the 6th of June with the RBA increasing the Cash rate to 4.10% against the expected unchanged 3.85%. Markets and analysts immediately forecast that there is going to be another increase from the BOC next month as Central Banks do not hesitate to act aggressively against stubborn inflation.

Following an increase in inflation in April and the fact that three-month measures of core inflation remained high, the Bank of Canada (BoC) said that “concerns have increased that CPI inflation could get stuck materially above the 2% target.”

“monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

“We expect another 25 basis points coming in July,” said Derek Holt, vice president of capital markets economics at Scotiabank. “It is like a bag of chips, you open one and just can’t have one.”

“The Canadian economy has shown remarkable resilience through 2023,” said Andrew Kelvin, chief Canada strategist at TD Securities, who also sees another hike in July. “To bring demand lower, which is the bank’s goal to achieve their 2% inflation target, we just simply need more tightening.”

The BOC: “will continue to assess economic indicators going forward to see if they “are consistent with achieving the inflation target.”

Source: https://www.reuters.com/markets/rates-bonds/bank-canada-hikes-rates-475-highest-22-years-2023-06-07

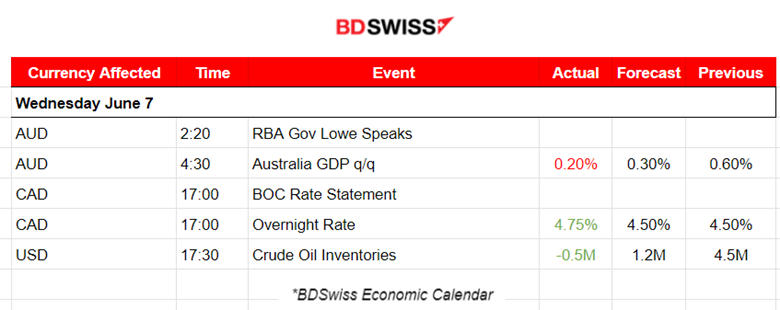

Released data showed that real gross domestic product (GDP) rose 0.2% in the first quarter, easing from 0.5% in the previous quarter. Annual growth at 2.3%, also missing forecasts for 2.4% expansion.

Katherine Keenan, head of National Accounts at Australia’s Bureau of Statistics, said: “This is the sixth straight rise in quarterly GDP, but the slowest growth since the Covid-19 Delta lockdowns in September quarter 2021.”

The Reserve Bank of Australia (RBA) has been engaged in a battle with inflation, while simultaneously trying to avoid bringing the economy down into a sharp recession.

https://www.cnbc.com/2023/06/07/australias-economy-expands-2point3percent-in-the-first-quarter.html

______________________________________________________________________

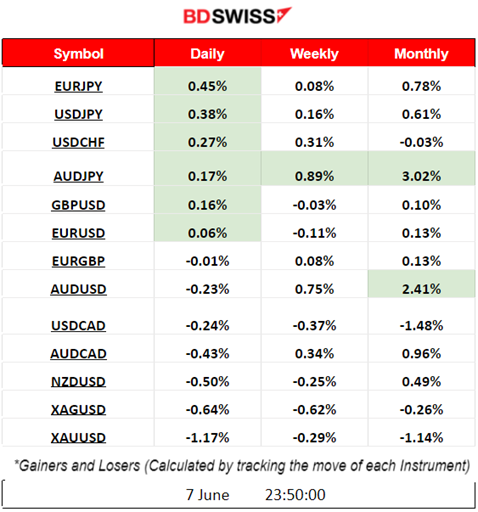

Summary Daily Moves – Winners vs Losers (07 June 2023)

- JPY pairs have climbed significantly to the top of the winner’s list. EURJPY led yesterday with a 0.45% gain.

- So far this week, AUDJPY is leading with a 0.89% price change and it is also the top winner this month with an overall 3.02% price change so far.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (07 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s first-quarter Gross Domestic Product (GDP) expanded by 2.3% year-on-year. On a quarter-on-quarter basis, GDP grew by 0.2%, compared to the 0.3% expected. A very low-level intraday shock on AUD pairs followed after the report.

- Morning – Day Session (European)

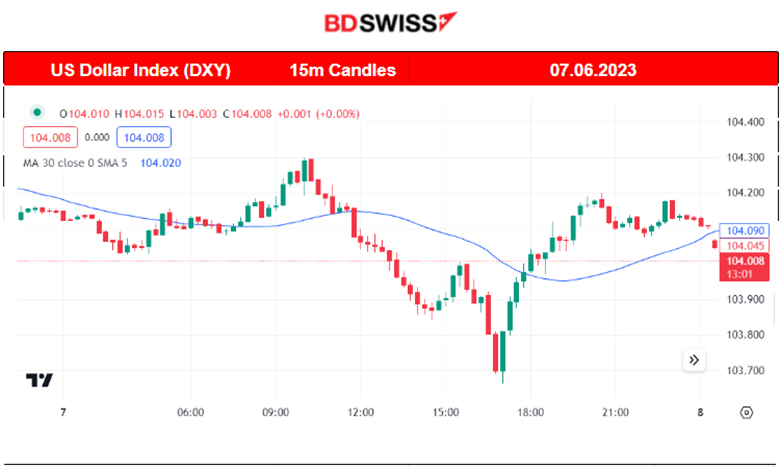

At 17:00 the Bank of Canada (BOC) hiked its overnight rate by 25bps to 4.75%. That was a surprise increase that caused the market to react significantly. The CAD appreciated greatly at that time bringing the USDCAD down to nearly 60 pips before retracing.

The USD after the BOC rate announcement showed great appreciation. The DXY moved with a steady pace upwards. This USD effect had an impact on the market for Gold and U.S. Stocks. Gold experienced a drop after 17:00 by nearly 28 USD/oz. NAS100 and S&P500 also experienced a drop after 17:00.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

USDCAD (07.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving around the 30-period MA with low volatility until the BOC rate announcement. At the time of the rate figure release, which was surprisingly higher than expected, the CAD experienced a strong appreciation against the U.S. dollar causing the pair to drop. It soon retraced back to the mean, and quite rapidly, due to the fact that the USD had appreciated significantly after the release.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 moved sideways this week with low volatility. Not much was happening since there were not many important scheduled releases and especially none for the USD. The 30-period MA was roughly getting flat while the RSI was showing lower lows. However, yesterday, the 7th of June, the index crashed after 17:00, near a 300 USD drop. This was after the BOC rate figure release at that time and the USD appreciation that followed immediately after. The S&P500 also experienced a similar drop after that time.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 4th of June, the OPEC-JMMC meetings took place, with OPEC+ announcing that it will limit combined oil production greatly in 2024, more than what was expected. On the 5th of June, the market opened higher as depicted on the chart but the price reversed crossing the MA, moving under it, testing the 70 USD/b price level. The price continued on a volatile sideways path around the 30-period MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the NFP report on the 2nd of June, due to high USD appreciation, Gold’s price fell rapidly reversing and crossing the 30-period MA, finding support at near 1938 USD/oz. On Monday, the 5th of June, the U.S. ISM Services PMI figure was released causing the USD to depreciate greatly, thus the Gold price to jump. With that boost, it crossed the MA and moved further upwards. It continued with a sideways path experiencing a period of consolidation until the 7th of June. Then, after 17:00, the USD appreciated greatly causing its price to crash and test the 1938 USD/oz support again.

It has not yet retraced fully back to the 61.8 Fibo level.

Breaking the support though instead would cause it probably to move further downwards to near 1932 USD /oz support level.

______________________________________________________________

News Reports Monitor – Today Trading Day (08 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Japan’s economy grew more than initially thought in January-March, revised data showed today, June 8th at 2. The pairs with JPY as quote currency started moving upwards with the opening of the European Markets. It was a steady upward movement for these pairs.

- Morning – Day Session (European)

At 15:30 the U.S. Unemployment Claims figures will be released, adding to the labour market data before the FOMC next week. The picture so far is that the labour market is hot enough and that the possibility of another Fed Rate Hike has increased since the latest relevant releases. The expectation is not very far from the previous figure, just 7K more, thus indicating that the market does not expect any deviations from the current picture. USD pairs will be affected but the degree of this impact will be based on the actual figure.

General Verdict:

______________________________________________________________