PREVIOUS WEEK’S EVENTS (Week 15 – 19.04.2024)

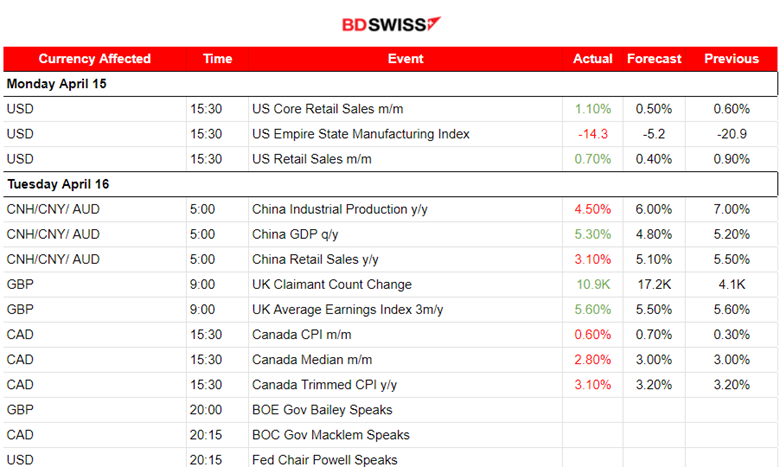

Announcements:

On April 13, Iran launched a large salvo of missiles and drones at Israel. Designated “Operation True Promise,” the attack reportedly included around 170 drones, 120 surface-to-surface ballistic missiles, and 30 cruise missiles.

A few days after, Israel launched an attack on Iran, US officials said on the 19th of April. US officials said overnight that an Israeli missile struck Iran in the city of Isfahan in central Iran while Iranian media also reported explosions. Israel has not officially commented on the attack, while Iran downplayed the reports. “Israel will defend itself”, ” Netanyahu says, as the West calls for restraint.

In both cases, commodity markets, including Gold and Crude oil, were shaken experiencing highly volatile conditions.

U.S. Economy

U.S. retail sales increased more than expected in March, further evidence that the economy ended the first quarter on solid ground.

Despite higher inflation and borrowing costs, spending is continuing to hold up, thanks to the resilient labour market.

Strong retail sales prompted economists at Goldman Sachs to boost their gross domestic product (GDP) growth estimate for the first quarter to a 3.1% annualised rate from a 2.5% pace. The economy grew at a 3.4% rate in the fourth quarter.

WorldView: The stronger economic activity remains, the later the Fed is to respond with cuts. Financial markets and most economists have pushed back their expectations for the first rate cut to September from June, and anticipate two rate cuts instead of the three envisaged by policymakers.

U.K Economy

The labour market in the U.K. still experiences wage growth. Regular wages excluding bonuses – which BoE is watching as it considers when to start cutting interest rates – grew by 6.0% compared with the same period a year earlier, only slightly weaker than a 6.1% rise in the November-to-January period. Core wages rose by the least since mid-2022 in the three months to February but remained strong by historical standards.

The unemployment rate rose by more than expected to 4.2% from 3.9%, also suggesting a loss of momentum in the jobs market.

Yael Selfin, chief economist at KPMG UK, said the rise in the unemployment rate and the latest slowing of pay pressure suggested the labour market was generating less inflation.

U.K.’s retail sales growth was reported at 0% in March despite high inflation easing recently, representing the first time that they have not grown in monthly terms since December.

Australia Economy

Australian employment fell in March after an enormous gain the month before, while the jobless rate resumed its uptrend. Net employment dropped 6,600 in March from February when it rose to a revised 117,600. The jobless rate climbed slightly to 3.8% from 3.7% the previous month, although that was under a forecast of 3.9%

______________________________________________________________________

Inflation

Canada

Canada’s annual inflation rate ticked up as expected to 2.9% in March. The acceleration in headline inflation was driven by costlier gas at the pump as supply concerns and voluntary production cuts pushed global crude prices higher.

Excluding gasoline prices, inflation slowed to 2.8% from 2.9% in February. Month-over-month, the consumer price index rose 0.6%, the largest increase since July 2023, but less than a forecast 0.7% gain. Inflation has stayed under 3% since January and is in line with the Bank of Canada’s forecast for it to remain near that level in the first half of 2024.

Bank of Canada (BoC) Governor Tiff Macklem: “As expected headline inflation came in close to 3%. … Importantly, though, measures of core inflation did tick down again and that does suggest that underlying inflationary pressures are continuing to ease,” he said.

United Kingdom

Inflation was reported lower for the U.K. but higher than the forecast. The slowdown in the fall in Britain’s inflation rate follows an acceleration of headline price growth in the United States which rose for a second month in a row to 3.5% in March.

Bank of England (BoE) Governor Andrew Bailey, who said British inflation was “moving in the right direction” for a rate cut last month, also said last week that different inflation dynamics in the U.S. and Europe could lead to other paths for interest rates.

“The chances of interest rates being cut for the first time in June are now a bit slimmer,” she said.

Services inflation, an indicator of domestic price pressures which the BoE also watches closely, eased only slightly to 6.0% from 6.1%.

International oil prices climbed last month amid growing tensions in the Middle East.

The BoE is concerned that the rapid wage growth, which makes up much of the inflation rate in the services sector, could sustain inflationary heat across the economy.

“Inflation is in retreat but the Bank of England cannot yet be sure that it is beaten,” said Ian Stewart, chief economist at Deloitte.

______________________________________________________________________

Sources:

https://uk.news.yahoo.com/live/iran-israel-attack-missile-live-news-war-064111345.html

https://www.reuters.com/world/uk/uk-retail-stagnated-again-march-ons-says-2024-04-19/

https://www.reuters.com/world/uk/uk-regular-wages-grow-60-3-months-february-2024-04-16/

https://www.reuters.com/markets/us/us-retail-sales-beat-expectations-march-2024-04-15/

https://finance.yahoo.com/news/australia-march-employment-unexpectedly-falls-014147419.html

https://www.reuters.com/world/uk/uk-inflation-rate-slows-32-march-2024-04-17/

_____________________________________________________________________________________________

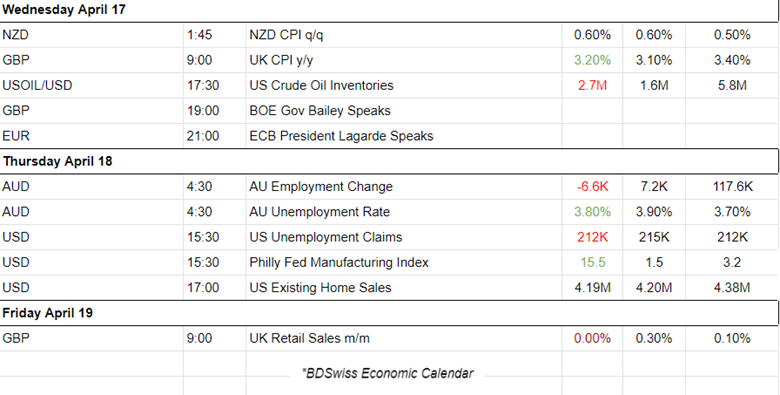

Currency Markets Impact – Past Releases (Week 15 – 19.04.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The index moved to the upside on the 15th of April after the retail sales figure releases since they had a positive impact on the U.S. dollar. Since then though, with the absence of further major news related to the dollar, volatility levels started to drop and a triangle formation took place as depicted on the chart. The higher-than-expected U.S. inflation figure release had already caused the dollar index to reach high levels last week and a less volatile period followed after that event, for this index.

EURUSD

EURUSD

This pair is experiencing a triangle formation, mirroring the USD path, since volatility levels dropped and the U.S. dollar is not affected much by the news after the 18th of April. U.S. dollar depreciation from the 17th of April to the 18th of April, caused the pair to move to the upside heavily until it reached the resistance at 1.06880. After that, a reversal took place, the triangle started to form and a period of less volatile conditions started. It is obvious that the dollar is the main driver, however, as June gets closer the central banks, especially the ECB could make statements about interest rate cuts that could push the EURUSD to drop further. Eyes though should be on the technicals as well and to consider the triangle breakout in future price/pair direction speculation.

USDJPY

USDJPY

JPY weakening and USD strengthening with a stable path sideways last week kept the USDJPY in the uptrend. On the 19th of April, Israel’s attack caused the markets to shake starting around 4:00. The USDJPY dropped 100 pips before reversing to the upside. Eventually, the pair remained above the 30-period MA showing that the path is likely to remain an uptrend.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

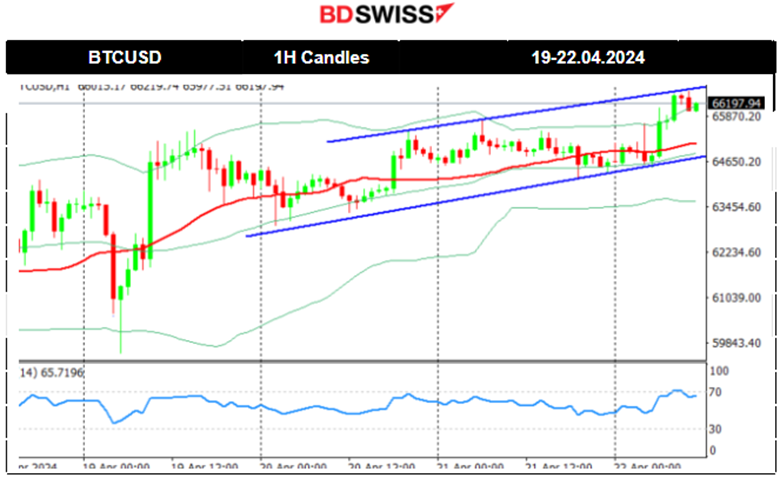

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin halving took effect late on Friday 19th April, cutting the issuance of new bitcoin in half. It happens roughly every four years, and in addition to helping to stave off inflation, it historically precedes a major run-up in the price of Bitcoin.

Its price started slowly to move to the upside and experienced an uptrend during the weekend with 66K USD being the critical resistance level for now.

Source: https://www.cnbc.com/2024/04/21/bitcoin-miners-get-into-ai-to-survive-halving.html

_____________________________________________________________________________________________

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (Week 22 – 26.04.2024)

Coming up:

The Bank of Japan will decide on interest rates.

Manufacturing PMI releases will shake the markets a bit during the European session on the 23rd of April.

Inflation report for Australia

Canada’s retail sales report and U.S. Durable goods orders report.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Since the 16th of April, the market has shown that volatility lowers and this was the cause of a triangle formation to appear. A breakout occurred on the 17th of April eventually causing the drop of the price to 82 USD/b. On the 18th of April, the price broke the support end and reached the next support at 81 USD/b before retracement took place. On the 19th of April the news regarding the Israel attack in Iran, caused the commodity prices (Gold and Oil) to jump but only to reverse soon after fully. Currently, lower volatility levels form a triangle formation, and a breakout to the upside (which is possible considering the apparent bullish divergence) could lead the price to reach the 83.5 USD resistance. The 50-period Bollinger Band’s upper band supports the possible next target resistance to be at that level.

Gold (XAUUSD)

Gold (XAUUSD)

On the 17th of April Gold moved lower as it broke the apparent upward wedge formation reaching the intraday support at 2,355 USD/oz before returning to the 30-period MA. On the 18th of April, Gold stayed in range, flirting with the 2,390 USD/oz at some point but remaining close to the MA. On the 19th of April the news regarding the Israel attack in Iran, caused the commodity prices (Gold and Oil) to jump but only to reverse soon after fully. Gold retreated eventually lower reaching the support at 2,350 USD/oz and it is estimated to continue sideways.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

After a period of consolidation, on the 17th of April, it broke the support at 5,040 USD and moved lower to the next support at 5,000 USD before retracing. On the 18th of April, the market remained below the 30-period MA but a breakout did not occur. The breakout of the 5,000 USD level eventually caused a sharp drop on the 19th of April as mentioned in our previous analysis. Volatility levels dropped until the end of the day and week with an apparent triangle formation in place. It seems that on the SPX500 the critical resistance is at 5000 USD. The index was on a downtrend recently as borrowing costs are expected to remain high, plus geopolitical tensions having an impact on expectations and a change to a risk-off mood. A breakout to the upside could lead to a jump of 130 USD while a breakout of the triangle to the downside can lead to the reach of the depicted support levels below.

______________________________________________________________