PREVIOUS WEEK’S EVENTS (Week 19-23.02.2024)

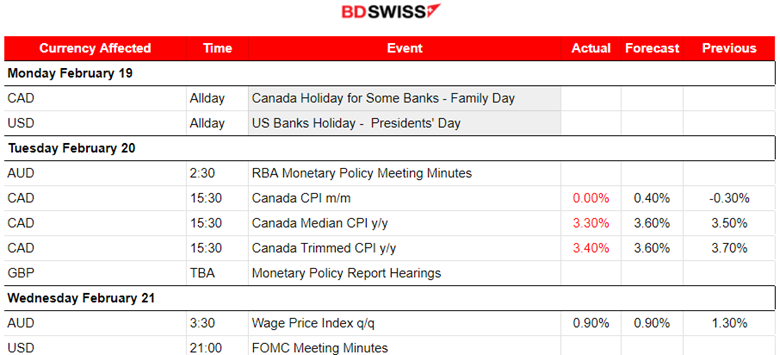

Announcements:

U.S. Economy

Global stocks rallied on the 21st Feb and after 22:00. All three benchmark U.S. indices experienced a big jump to the upside. The tech-heavy Nasdaq 100 index surged after the earnings announcement. The boss of Nvidia said artificial intelligence (AI) is at a “tipping point” as it announced record sales. It reported that revenues surged by 265% in the three months to 28th January, compared to a year earlier. Nvidia on Wednesday experienced shares up by 10% after-hours. The company’s success indicates that the AI boom is much more than just a stock market narrative.

The late-day stock jump pushed up the shares of other AI-related companies including chip designer Arm Holdings. Nvidia and other hardware suppliers linked to AI computing added $160 billion of combined stock market value.

Canada Economy

Canada’s December retail sales slightly beat expectations as people spent more during the holidays but they likely declined at the start of the year.

Retail sales grew by 0.9% in December from November, more than a forecast for a 0.8% gain, from a flat reading in November, which was upwardly revised from -0.2% previously.

The Canadian economy could slow further at the half of this year since the interest rates remain high affecting households and spending.

______________________________________________________________________

Canada Inflation

Canada’s CPI data release yesterday showed that Canada’s annual inflation rate slowed more than expected to 2.9% in January and core price measures also eased. Headline inflation has dipped below 3% and that prompted money markets to hike bets for a rate cut in April.

The Bank of Canada targets inflation at 2%. Two of its three core measures of underlying inflation also edged down. CPI-median slowed to 3.3%, the lowest since November 2021, while CPI-trim decreased to 3.4%, the lowest since August 2021.

The Bank of Canada’s next policy announcement is March 6, and expectations are that rates will stay on hold at a 22-year high of 5%. Analysts polled by Reuters had forecast inflation to tick down to 3.3% from 3.4% in December.

______________________________________________________________________

Sources:

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 19-23.02.2024)

Server Time / Timezone EEST (UTC+02:00)

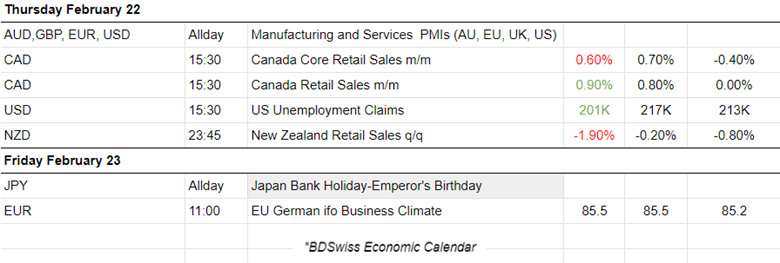

PMI releases:

Eurozone PMIs:

The French economy is in contraction with PMis improving. The downturn weakens noticeably. The private sector output levels fell at the weakest pace in the current nine-month period of decline. New orders fell at the softest rate since last May and employment rose for the first time since October 2023. Business confidence strengthened to a seven-month high.

The German economy is worsening. PMIs in contraction with the manufacturing sector suffering the most, a 42.3 points figure. A further drop in business activity across the eurozone’s largest economy, a slightly faster contraction led by a sharp and accelerated reduction in manufacturing output. Demand for goods and services continued to weaken, although employment held broadly steady.

The Eurozone PMIs show that it is the services sector that sees improvement. The reported services PMI figure was exactly 50 points, right on the threshold. The Eurozone downturn eased as output stabilisation in the service sector offset a further steep downturn in manufacturing. Business confidence about the year ahead improved.

United Kingdom PMIs:

In the U.K. the services sector is strong with business expanding at a steady pace as per the PMI figure of 54.3. This solid rate of service sector growth helps to boost U.K. private sector output. A solid improvement in customer demand and a sharp rise in new work.

United States PMIs

The U.S. manufacturing business expands at its fastest pace since 2022 according to the latest reports. It currently experienced stronger orders growth, orders climbed to the highest since May 2022. Factory output expanded the most in 10 months. Both the manufacturing and the services PMIs record figures over 50, showing expansion and leading in overall business performance compared with the other regions.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar index showed a downward trend last week. Intraday shocks were having a negative impact on the USD pushing the index to the downside. It however recovered multiple times and reversed to the 30-period MA as depicted on the chart. The USD reacted heavily to the CPI news for Canada on the 20th Feb and on the surge of high-tech stock surge during the 21st-22nd Feb. It however remained settled close to the MA. There is no clear signal of how the USD will be affected in the near future, however, the next important date is 20th March at which it is widely expected that the Fed will keep rates steady. The same applies even at the next meeting on the 1st of May with the probability for no change in rates currently reported at near 82%. This means elevated rates for longer causing the USD to keep its strength.

EURUSD

EURUSD

The EURUSD experienced the opposite path, an uptrend due to the overall dollar weakening and moderate EUR appreciation during the last week. It is clear that the intraday shocks presented on the chart are caused by effects on the dollar. The pair remains settled close to the 30-period MA.

USDCAD

USDCAD

The USDCAD moved sideways overall but with high volatility as several fundamental factors have affected the currency pair. On the 20th Feb, we saw an intraday shock at 15:30 from Canada’s CPI data release showing lower-than-expected inflation figures. This caused the CAD to depreciate instead of appreciating, while the USD was recovering, thus the pair rose moderately keeping its path above the 30-period MA. On the 21st Feb the pair started to move to the downside heavily, crossing the MA on its way down reaching the support at 1.34400 on the 22nd Feb. This was a direct result of USD depreciation which took place during the high-tech stock market surge. The dollar regained its strength soon and the pair returned to higher levels above the MA.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

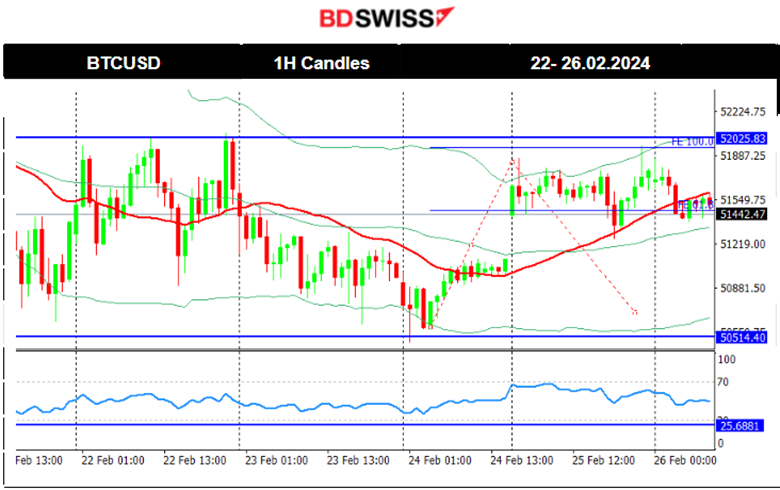

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin settled sideways for now but is governed with high volatility on its way around the 30-period MA. 52,000 USD seems to be the important resistance level. The support is apparently at 50,500 USD. On the 24th Feb, the price moved to the upside, reversing from the previous drop and after the retracement it settled near the 61.8 Fibo level near 51,450 USD. Considering recent data and its volatility, unless an important fundamental factor takes place, the price could move to the downside continuing the path around the MA, experiencing big deviations from it.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

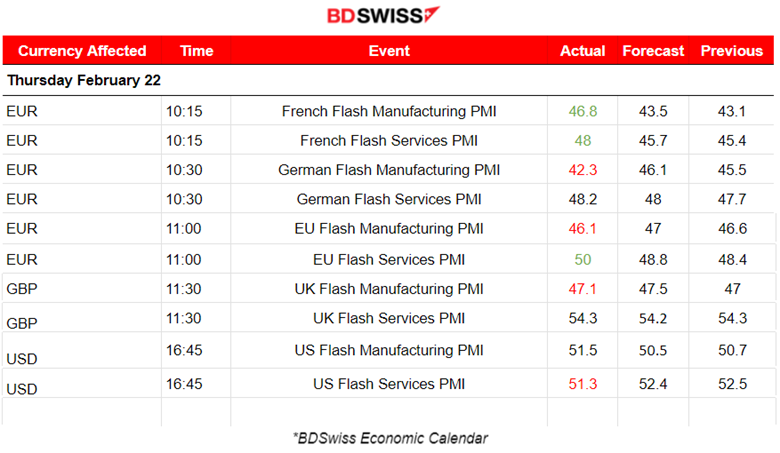

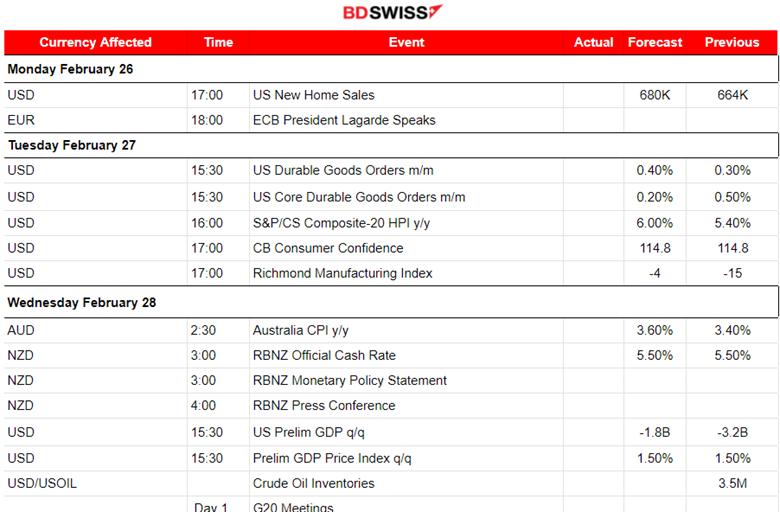

NEXT WEEK’S EVENTS (26.02 – 01.03.2024)

Coming up:

The Reserve Bank of New Zealand (RBNZ) is going to decide on rates this week.

Durable goods orders for the U.S. are going to be released expecting some moderate volatility.

PMIs for the Manufacturing sector will be released this Friday.

The Core PCE Price Index is going to be released this week, important for the Fed in making decisions, considering that it is relevant to inflation.

G20 Meetings are also taking place this week.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

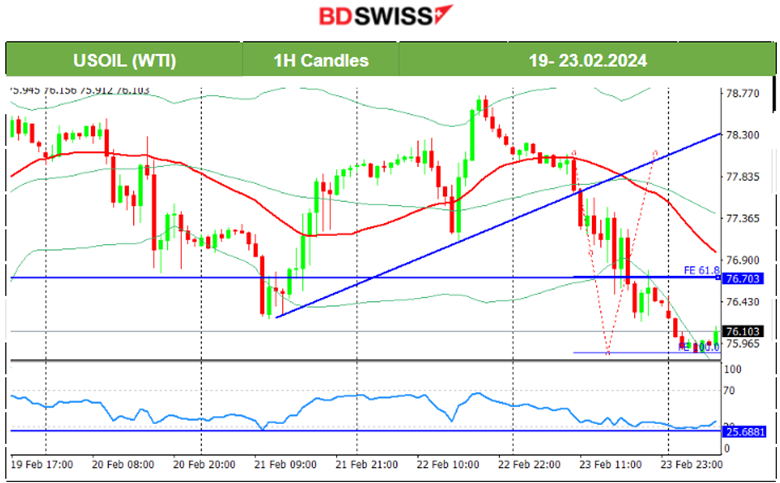

U.S. Crude Oil

On the 21st the price continued with the drop but stopped when it reached the support near the 76.20 USD/b level. It soon reversed to the upside heavily, crossing the 30-period MA on its way up and reaching above 78 USD/b. The 22nd Feb was quite volatile. The price reached the resistance near 78.7 USD/b before reversing fully to the downside. On the 23rd Feb, the price moved below the MA and dropped heavily, reaching the support near 75.85 USD/b. A retracement is possible as depicted on the chart. The alternative scenario which is less probable, could cause the price to drop to 75.5 USD/b.

TradingView Analysis:

https://www.tradingview.com/chart/USOIL/BC3M2BwO-USOIL-Post-Reversal-26-02-2024/

Gold (XAUUSD)

Gold (XAUUSD)

The divergence eventually led to a drop back to 2020 USD/oz on the 21st Feb as stated in our previous analysis. After the drop, Gold reversed to the upside as the dollar depreciated heavily. On the 22nd, Gold experienced a significant drop, finally settling below the MA signalling finally the end of the uptrend. However, on the 23rd Feb, Gold moved to the downside, finding support at 2016 USD/oz and in a short period of time reversed significantly to the upside crossing the 30-period MA on its way up reaching the resistance at 2041 USD/oz. That signalled a new uptrend perhaps. The market opening found the price at the retracement level of 61.8 Fibo near 2033 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

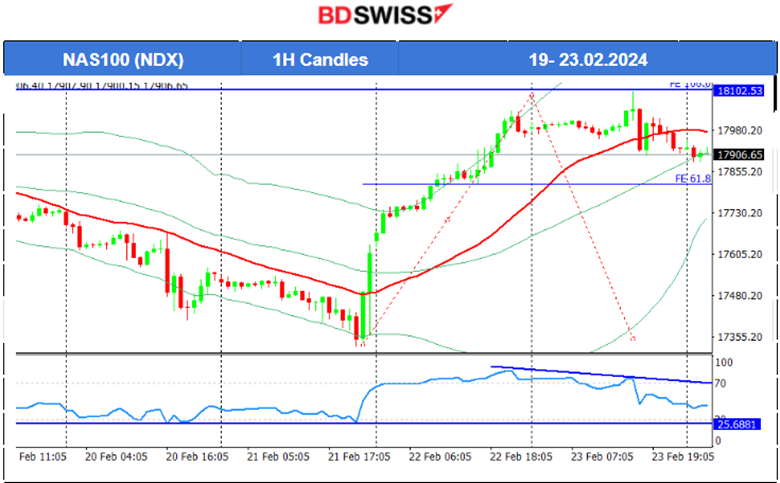

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

Global stocks rallied on the 21st Feb and after 22:00. All U.S. indices experienced a big jump to the upside. The tech-heavy Nasdaq 100 index jumped over 1.8%. The boss of Nvidia said artificial intelligence (AI) is at a “tipping point” as it announced record sales. It reported that revenues surged by 265% in the three months to 28th January, compared to a year earlier. On the 23rd Feb, the index moved to the upside further, breaking the 18,000 resistance level and reaching the one near the 18,100 USD before retracement took place. The RSI was showing bearish signals and according to the Fibo levels, it might drop lower to reach the 61.8 Fibo level. The other two benchmark indices have eased as well and are testing lower levels currently.

______________________________________________________________