In a press release dated August 20, 2024, Target Corporation (NYSE: TGT) announced that it will webcast its Q2 Earnings Conference Call today, August 21, 2024, at 7:00 a.m. Central Time (12:00 p.m. GMT). Investors and media are invited to tune in via the company’s investor relations website at Corporate.Target.com/Investors.

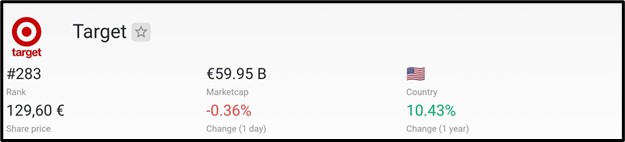

Market Cap

€59.95 billion in market capitalization places Target at position 283 in the global market capitalization rankings as of August 2024, according to companiesmarketcap.com.

Dividend Information

This stock delivers a 3.13% dividend yield with a $4.48 annual payout, distributed quarterly. A 50.23% payout ratio signals dividend sustainability, with an ex-dividend date on August 21, 2024. Its 53-year dividend growth streak, paired with a 1.84% growth rate, highlights stability. A buyback yield of 0.09% and a shareholder yield of 3.22% underline solid shareholder returns.

Recent Development At Target Corporation

Here are some of the latest developments at Target Corporation :

Target collaborates with Shopify to broaden product selection for shoppers on Target.com.

Target launches its first denim recycling event, offering 20% discounts on new styles for old denim exchanges.

Target introduces advanced GenAI technology across its stores to assist employees.

Target appoints Amy Tu as Chief Legal and Compliance Officer.

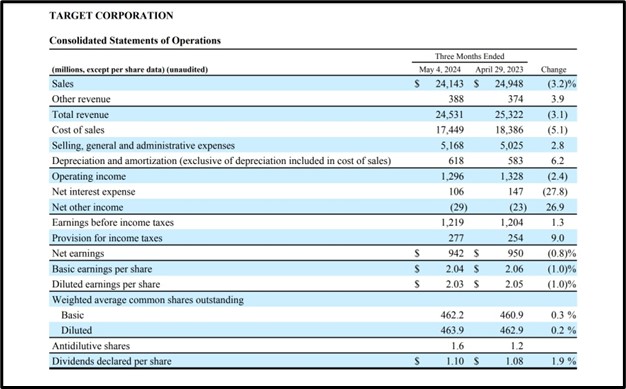

Q1 Earnings Report Recap

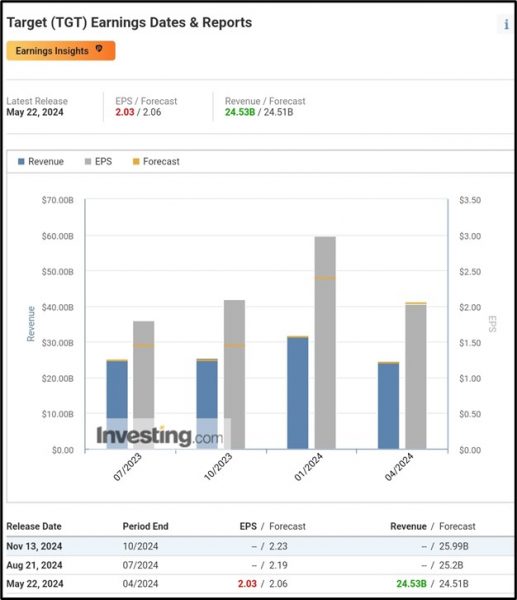

Q1 sales and total revenue saw declines of 3.2% and 3.1%, respectively, with sales at $24.14B and total revenue at $24.53B.

Cost of sales dropped 5.1% to $17.45B, while SG&A expenses and depreciation increased by 2.8% and 6.2%, respectively.

Operating income decreased by 2.4% to $1.30B, though pre-tax earnings saw a modest 1.3% growth to $1.22B.

Net earnings fell by 0.8% to $942M, with basic and diluted EPS slightly declining around 1%, while dividends per share increased by 1.9% to $1.10.

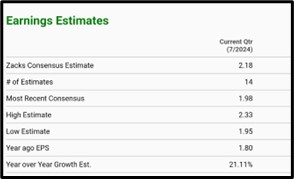

Q2 Earnings Report Analyst Forecast

For the current quarter, Zacks Consensus pegs EPS at $2.18, with 14 estimates ranging between $1.95 and $2.33, reflecting 21.11% year-over-year growth from last year’s EPS of $1.80. On the sales front, the consensus estimates total revenue at $25.23B across 12 forecasts, with a high estimate of $25.64B and a low of $24.90B, representing a modest year-over-year growth of 1.86% from $24.77B.

According to Investing.com, Target Corporation (NYSE: TGT) projects its EPS to hit $2.19, with revenue forecasts reaching $25.2 billion.

According to Tradingview.com, Target Corporation (NYSE: TGT) projects an EPS of $2.18 and forecasts revenue of $25.19 billion for the upcoming quarter.

According to Tradingview.com, Target Corporation (NYSE: TGT) projects an EPS of $2.18 and forecasts revenue of $25.19 billion for the upcoming quarter.

Technical Analysis  Potential down trendline breakout identified on the 4HR chart at $147.83.

Potential down trendline breakout identified on the 4HR chart at $147.83.

If breakout holds, price targets are $155.18 and $160.95.

If breakout fails, price may decline towards $138.50 and $126.62.

Apply Risk Management

Conclusion

Target Corporation has shown mixed performance with a 3.2% drop in Q1 sales and a 3.1% decline in total revenue. However, operating income saw a slight improvement, and despite a 0.8% dip in net earnings, dividend growth remained steady with a 1.9% increase. Looking forward, Q2 projections are more optimistic, with an anticipated EPS growth of over 21%, reaching $2.18, and revenue forecasted at $25.2 billion. This suggests a potential rebound in financial performance, with technical indicators showing key breakout levels for possible price movement.

Source:

https://corporate.target.com/investors/events-presentations

https://companiesmarketcap.com/eur/target/marketcap/

https://stockanalysis.com/stocks/tgt/dividend/

https://images.app.goo.gl/hKUocLXZwUXWqkUh8

https://corporate.target.com/press/release/2024/05/target-corporation-reports-first-quarter-earnings

https://www.zacks.com/stock/quote/TGT/detailed-earning-estimates