Following solid US ISM Manufacturing PMI economic data released on April 1, 2024, concerns arose regarding the Federal Reserve’s interest rate trajectory. Shortly after, on April 2, 2024, Asian stocks experienced a downturn in response to Taiwan’s most powerful earthquake in at least 25 years, occurring around 23:58 GMT. This seismic event led to a cascade effect, with equities in China, Hong Kong, and Australia all witnessing declines, exacerbated by halts in operations at Taiwan Semiconductor Manufacturing and United Microelectronics, resulting in the evacuation of some staff members. Meanwhile, Nigeria, the largest oil producer in Africa, initially anticipated the release of its Q4 employment rate data on April 3, 2024, but this was subsequently postponed to April 29th, 2024. Despite the delay, Nigeria’s economy remains poised for potential growth, particularly with the commencement of production at the Dangote Refinery and Petrochemical Company in January 2024, aimed at reducing imports and unemployment. Furthermore, with global oil prices, particularly WTI, surging to around $85.00 per barrel, Nigeria anticipates a surge in revenue from oil exports, potentially catalyzing job creation and alleviating unemployment concerns.

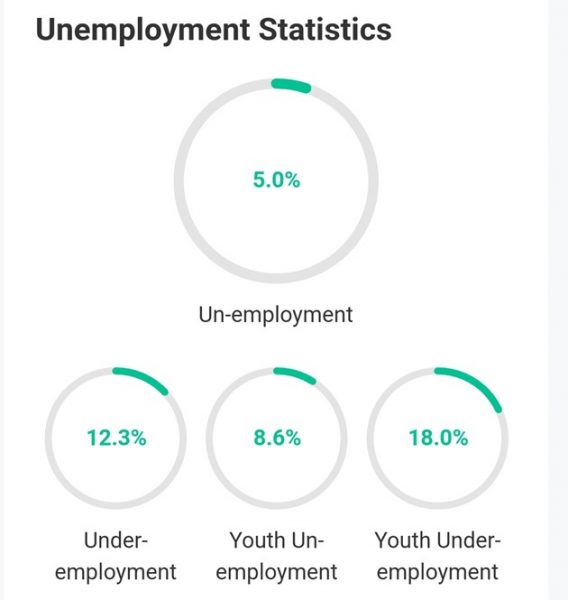

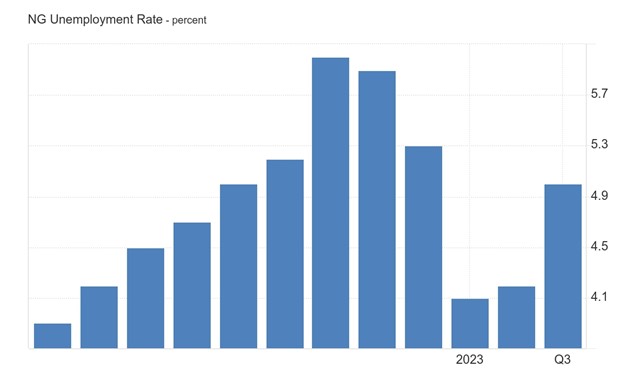

In the third quarter of 2023, Nigeria’s unemployment rate rose to 5%, up from 4.2% in the previous period. Among young people aged 15-24, the jobless rate surged to 8.6% from 7.2%, reflecting a concerning trend. Additionally, unemployment in urban areas marginally increased to 6% from 5.9% in the previous quarter. This increase follows a historical pattern, as the Unemployment Rate in Nigeria has averaged 4.19% since 1991. However, it reached an all-time high of 6.00% in the fourth quarter of 2020, emphasizing the challenges faced by the labor market.

Earlier today, USOIL maintained its position around $85.643 per barrel, hovering close to its highest level in over five months. This stability followed OPEC+’s decision to maintain output policy during yesterday’s ministerial panel meeting, as oil prices approached $90 per barrel. Additionally, US government data on crude oil stockpiles, released yesterday, remained steady at 3.2 million barrels, mirroring last week’s figure. Last week, inventories experienced a notable decrease of 2.3 million barrels, surpassing Reuters’ forecast of a 1.5 million barrel decline.

Market participants have grown increasingly concerned about potential disruptions to oil supply following Iran’s announcement of retaliation against Israel for an airstrike on its embassy in Syria. Meanwhile, Mexico’s state-controlled oil company, Pemex, has outlined plans to reduce crude exports in the forthcoming months.

From a technical analysis perspective using the 4-hour chart of USOIL, it’s evident that the price has been following an upward trend.

An uptrend line, originating from $80.338, rejected the price at $82.208 after a retracement from $83.190. Subsequently, the price continued its upward movement, reaching $85.618, which currently acts as resistance, following the rejection by the uptrend line. Presently, the price hovers around $85.087.

If the price breaches the uptrend line to the downside, there is a high probability of further downward movement. Conversely, if the price is rejected by the uptrend line, there is a high likelihood of an upward movement towards the resistance level. Moreover, if the resistance level is breached upwards, there is a high probability of further upward movement in price.

Sources

https://focustaiwan.tw/business/202404030010

https://www.nigerianstat.gov.ng/

https://www.forexfactory.com/calendar?day=mar26.2024

https://www.reuters.com/markets/commodities/mexicos-pemex-cancel-up-436000-bpd-crude-exports-apr-document-2024-04-02/#:~:text=MEXICO%20CITY%2C%20April%202%20(Reuters,seen%20by%20Reuters%20on%20Tuesday.