Previous Trading Day’s Events (30.05.2024)

GDP (Gross domestic product) grew at a 1.3% annualised rate from January through March, down from the advance estimate of 1.6% and notably slower than the 3.4% pace in the final three months of 2023.

The first-quarter growth downgrade suggests the U.S. central bank’s aim of gradually cooling the economy through high interest rates is having an impact, although it remains uncertain whether the weakening trend in inflation will continue.

“The downward revision to economic growth as well as smaller downward revisions to inflation make the Fed a little more likely to start reducing interest rates by September,” said Bill Adams, the chief economist at Comerica Bank. “With the economy operating in low gear, a margin of slack capacity is opening up, and consumers are feeling less flush.”

Source: https://www.reuters.com/markets/us/us-economic-growth-revised-lower-first-quarter-2024-05-30/

______________________________________________________________________

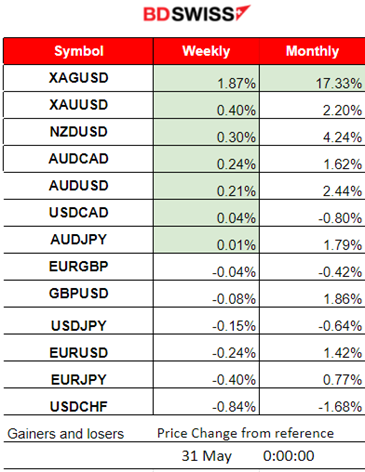

Winners vs Losers

Metals are losing some of the gains earned as we move towards the end of the week. Silver is at 1.87% price change and nearly 17.33% gains this month so far. The U.S. dollar experienced big swings in value the last couple of days, yesterday it was weakening.

______________________________________________________________________

______________________________________________________________________

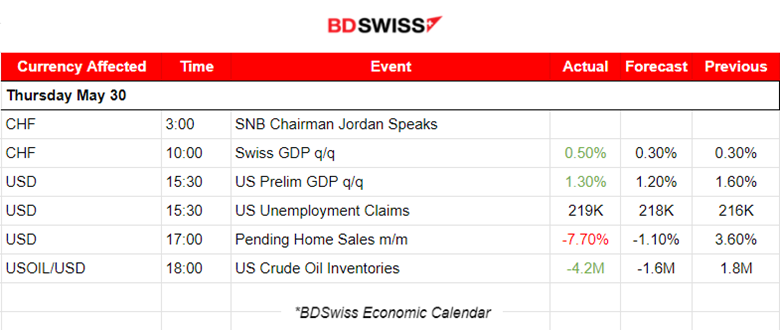

News Reports Monitor – Previous Trading Day (30.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

At 10:00, the quarterly Swiss GDP figure was reported hotter than expected at 0.5%. No apparent shock at the time of the release. However, the USDCHF was on an intraday downtrend mostly due to USD depreciation.

In the U.S. at 15:30 the second-estimate GDP was reported to have grown 1.3% in the first quarter, below the first-estimate of 1.6% and much weaker than the 3.4% gain in Q4 2023. That could have given a further push for USD depreciation yesterday since the dollar experienced a strong weakening until the end of the trading day.

U.S. Unemployment claims remained roughly at the same levels, 219K an increase of 3K from the previous week’s revised level. Notably, layoffs remain historically low in the face of lingering inflation and high interest rates.

The Pending Home Sales m/m figure at 17:00 was reported as negative, a way higher decline than expected giving some more push for the U.S. dollar weakening.

General Verdict:

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (30.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving with low volatility and close to the 30-period MA during the Asian session. After the start of the European session, volatility increased, and EURUSD moved steadily to the upside as the USD depreciated until the end of the trading day. The upward movement was rapid enough for a retracement to take place eventually after hitting resistance during the N. American session.

___________________________________________________________________

___________________________________________________________________

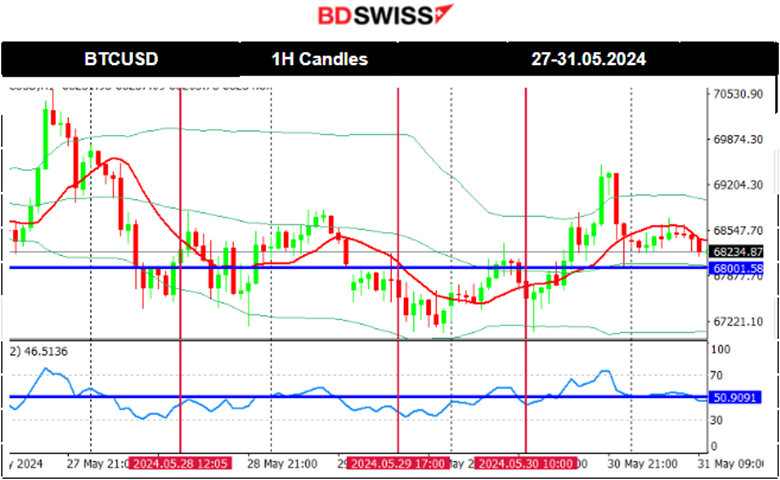

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin settled near 70K USD on the 22nd of May. That changed later with Bitcoin moving rapidly to the downside on the 23rd after 16:00. Many assets including stocks and commodities got affected negatively after that time. The price returned back and settled near the 67K USD level wiping out the gains since the jump on the 20th of May.

The price eventually jumped on the 24th of May and continued its upward movement until the resistance at near 69,600 USD. It retraced during the weekend when volatility levels lowered.

After a period of consolidation during the weekend when the price experienced low volatility, Bitcoin saw a jump on the 27th of May reaching 70,6K but soon reversed heavily to the downside. After finding support at near 67,500 USD it retraced to the 30-period MA and remained close, settling near the 68K USD level. Despite some high volatility on the 30th of May, the price still remains close to that level for now.

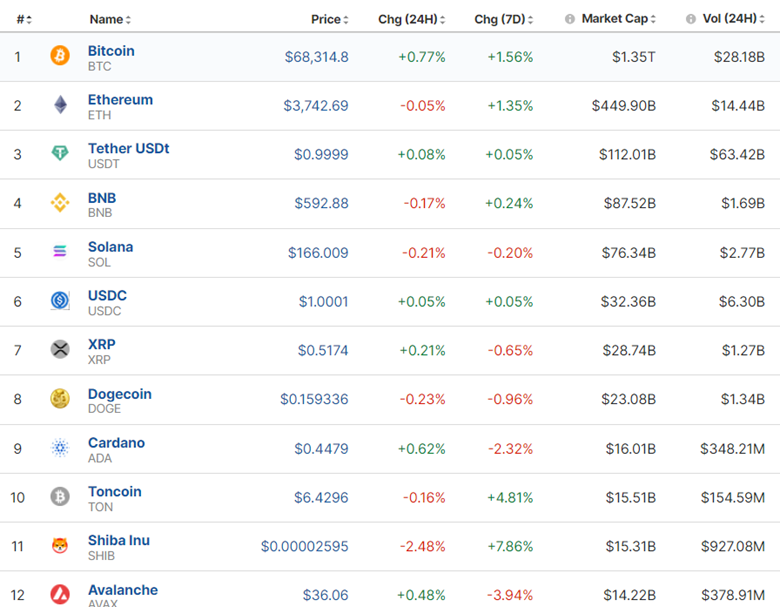

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Despite some volatile movements the market has not improved much and remains at the same levels for now.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 27th of May, it was a holiday in the U.S. and the stock market was closed. Indices did not experience much volatility, S&5P500 moved however slightly higher forming an upward wedge. The wedge was broken on the 28th and the index moved lower to the support around 5,280 USD before reversing to the 30-period MA.

A downward path continued on the 29th of May and with no signs of slowdown it continued all the way down until the 30th of May. The RSI is indicating a bullish divergence (higher lows) Price: lower lows.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

OPEC+ is in the financial media’s focus, highlighting the probability of an extension of the voluntary cuts for the third quarter of the year, however, we have seen a remarkable drop in price since the 29th of this month. The series of voluntary cuts from 2022 are due to expire at the end of June this year. It might be the reason for the price drop currently. OPEC+ will begin a series of online meetings at 1100 GMT on Sunday.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 24th of May, the price moved only slightly upwards but the potential for a further upward movement still remained as mentioned in our previous analysis. The price moved to the upside and completed the retracement to the 61.8 Fibo level and reached near the target of 2,360 USD/oz on the 27th of May. After finding resistance close to that level the price seems, on the 29th of May, to turn to the downside upon channel breakout as depicted on the chart. On the 30th of May, it continued to the downside, testing the 2,320 USD/oz as mentioned in our previous analysis, however, it was unsuccessful. 2,340 USD/oz seems to be the mean price for now.

______________________________________________________________

______________________________________________________________

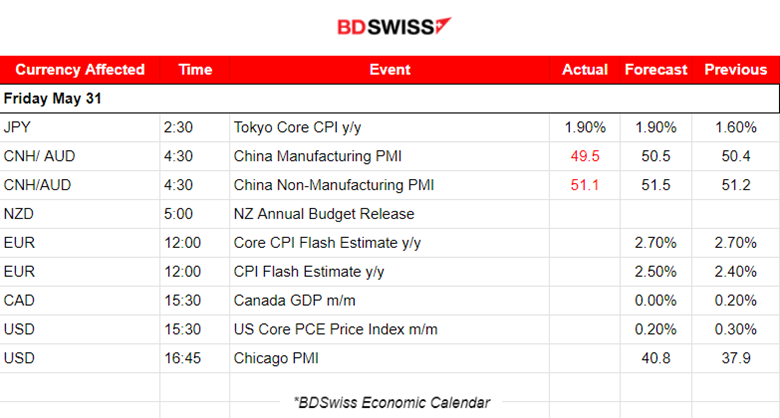

News Reports Monitor – Today Trading Day (31.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 2:30, inflation in Tokyo was reported to have accelerated in May, increasing chances for a rate hike from BOJ in coming months even as the economy continues to show signs of weakness. No major impact was recorded in the market at that time.

Disappointing China’s PMI figures were reported at 4:30 as manufacturing fell back into contraction. CNH depreciated at that time and the USDCNH jumped around 60 pips before reversing immediately.

- Morning – Day Session (European and N. American Session)

CPI data for the Eurozone will be released at 12:00. Inflation in the Eurozone cooled significantly and is very close to the target level. Expectations show that the figures will not change but remain steady. EUR pairs could see some higher volatility than normal in case of a surprise increase.

At 15:30 the U.S. PCE price Index figure will be released and it might cause an intraday shock for the USD pairs if the figure is reported higher than expected. The monthly CPI figure was last reported lower and the annual figure lowered as well by 1%. So expecting a lower PCE price index figure makes sense.

General Verdict:

______________________________________________________________