Previous Trading Day’s Events (04.06.2024)

Job openings were down 296,000 to 8.059 million on the last day of April, the lowest level since February 2021.

Federal Reserve officials next week are expected to leave the U.S. central bank’s policy rate in the same 5.25%-5.50% range where it has been since last July. They have said a rate cut will likely wait until data shows inflation, after a stronger-than-expected run during the first quarter, is headed back down toward their 2% goal.

Source: https://www.reuters.com/markets/us/us-job-openings-fall-more-than-expected-april-2024-06-04/

______________________________________________________________________

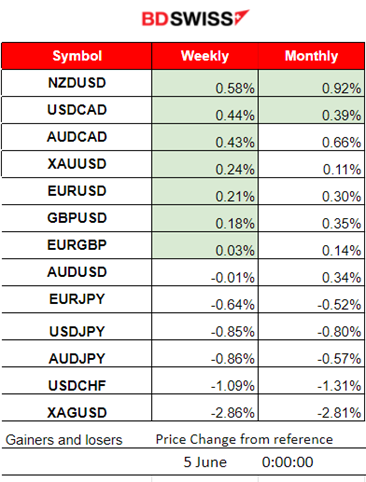

Winners vs Losers

NZDUSD is on the top of the list with 0.58% gains this week so far. CAD pairs (CAD as a quote) have moved to the top as CAD depreciated heavily yesterday.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (04.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

The Swiss consumer price index (CPI) increased by 0.3% in May 2024 compared with the previous month. The 0.3% increase compared with the previous month is due to several factors including rising prices for housing rentals and international package holidays. The CHF depreciated at the time of the release and USDCHF jumped around 35 pips before a reversal took place.

The JOLTS job openings report showed that the number of job openings in the U.S. experienced a decline for the second month in a row. There were fewer job openings (8.06M) than expected (8.37M) in the April JOLTS report. This makes sense as this figure’s direction coincides with other data such as the total nonfarm payroll employment that increased by only 175,000 in April. The USD actually appreciated for a short period of time upon release.

General Verdict:

__________________________________________________________________

__________________________________________________________________

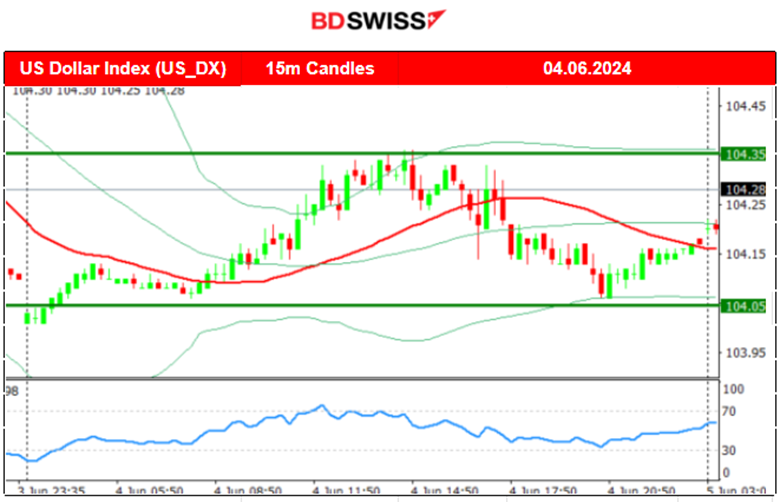

FOREX MARKETS MONITOR

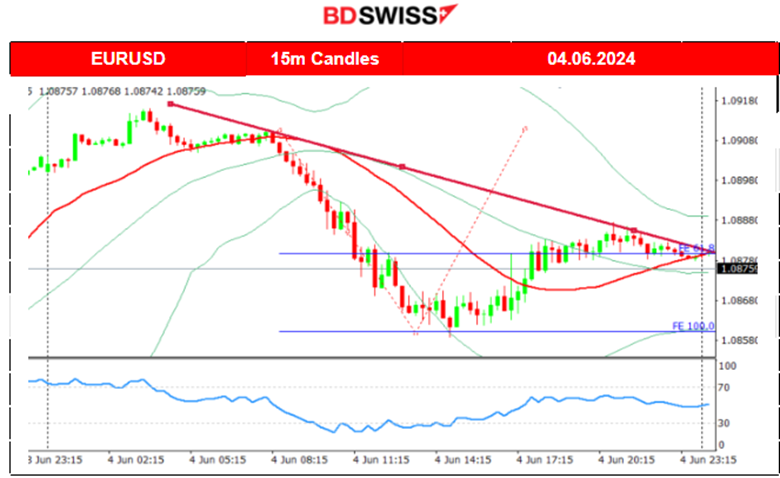

EURUSD (04.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It seems that the EUR started to weaken against the dollar amid the ECB rate decision release on the 6th of June. The pair dropped nearly 50 pips before retracement took place. The dollar helped with the drop as it experienced appreciation after the start of the European session and due to the fact that it weakened near the start of the N.american session. When volatility levels lowered, the EURUSD remained lower and stable until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

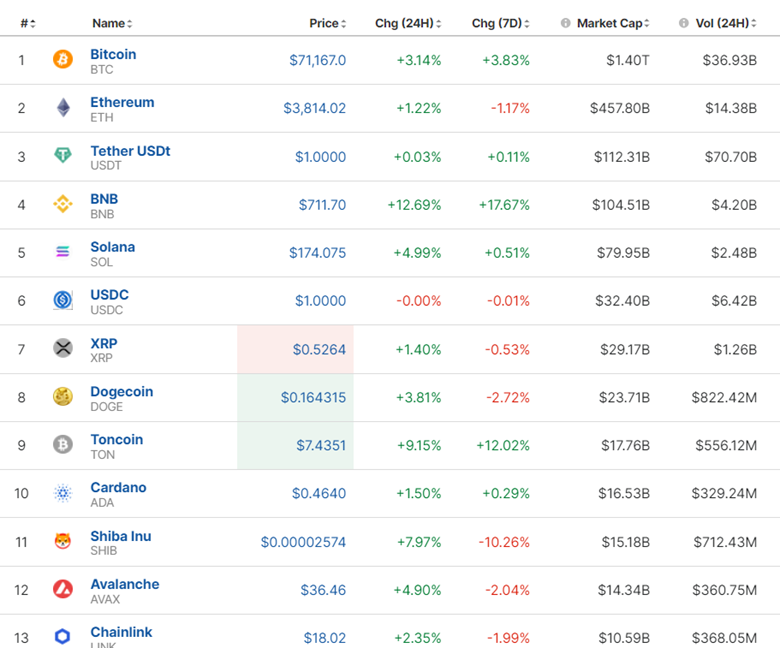

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 31st of May, Bitcoin dropped after the U.S. PCE Price Index figure release reaching near the support at 65,500 USD before retracing to the 30-period MA. After a period of consolidation taking place over the weekend, the price broke the resistance and moved to the upside. It stalled at the resistance near 69K USD even after the volatile market conditions that took place on the 3rd during the PMI releases. Since the 3rd of June, Bitcoin gained momentum and moved to the upside. It steadily breaks resistance levels, 68K, 69K, 70K and lastly 71K at the level that is currently settled. Quite an improvement ahead of major news announcements this week. Major central bank rate decisions and NFP.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

It is apparent that Cryptos see an improvement. The market is changing amid major releases this week. Almost all Crypto in the above list saw gains for the last 24 hours as prices gained momentum.

Sources:

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A jump occurred on the 31st of May which was a huge reversal, crossing the 30-period MA on its way up ending the long downtrend. Retracement to the 61.8 Fibo level (back to 61.8% of the total movement to the upside) eventually took place as mentioned in our previous analysis. The index even crossed the 30-period MA on its way down but reversed quite soon. A triangle formation started to form and on the 4th of June, a breakout to the upside took place.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Despite OPEC+ production cut extension oil prices fell rapidly on the 3rd of May. Around a 5-dollar drop was recorded in the price of Crude oil since the drop. However, retracement was only for a little amount, around 1 dollar. It seems that the price reached the 30-period MA and it could be the case that it will not retrace more. The H4 chart shows however that the price currently lies on the lower band of the 50-period Bollinger Bands indicating a strong support there. It could be the case that the price will see again the 74 USD/b soon.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The level 2,340 USD/oz served as the mean price until the 31st of May with the price deviating around 20 dollars from that mean. The price broke the support at nearly 2,320 USD and with the potential to move further downwards. However, it stalled after the breakout, indicating that there are upward pressures that keep the support strong. On the 3rd of May, the dollar suffered strong depreciation helping Gold to climb. Currently, there is high volatility with Gold moving sideways around the mean near 2,340 USD/oz and deviating 20 dollars from the mean currently.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (05.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

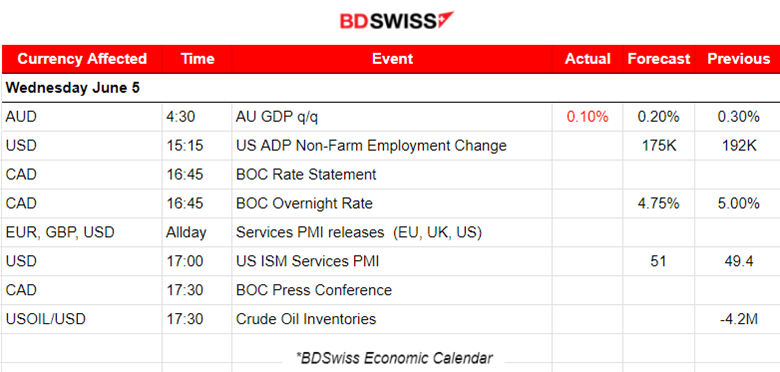

According to the report at 4:30, the Australian economy grew 0.1% in the March quarter of 2024. Gross domestic product (GDP) rose 0.1%. The figure was reported lower than expected. The initial reaction in the market was AUD depreciation causing a sudden but short drop in the AUD pairs, however, the effect soon faded.

- Morning – Day Session (European and N. American Session)

The ADP Non-Farm employment change figure will probably affect the USD pairs at 15:15. The shock however is not expected to be high as the market usually reacts heavily to the NFP instead.

The same day, the BOC will decide on interest rates at 16:45 and the market will have eyes on that event. Probably the USD pairs will indeed be affected by an intraday shock as much as the CAD pairs.

The U.S. ISM services PMI will be released also on the 5th of June and the market might not react heavily at the time of the release unless there is a surprise in the figure. The U.S. services sector is actually strong in the U.S. so the PMI is more likely to turn to expansion.

General Verdict:

______________________________________________________________