PREVIOUS TRADING DAY EVENTS – 07 July 2023

The jobs figures “are good enough to give the green light for the bank to hike next week,” said Derek Holt, vice president of capital markets economics at Scotiabank. “We still have a jobs market that is holding on quite nicely.”

“The return to solid job growth in June should … lock in a second consecutive 25-basis-point rate increase next week as central bankers scramble to tamp down the surprisingly resilient economy and resultant excess inflationary pressures,” said Royce Mendes, head of macro strategy at Desjardins Group.

The BoC watches the average hourly wage closely, which rose 3.9% from June 2022, compared to a 5.1% year-over-year increase in May.

Higher borrowing costs are playing a huge role in the economy explaining the drop in job openings as per the relevant report (JOLTS) last week. However, the pace of job growth remains strong. There is also an acceleration in services sector activity, as per the PMI data, showing that the economy is far from a recession.

“The payroll numbers gave a whiff of weakening, but the labor market remains strong,” said Sean Snaith, the director of the University of Central Florida’s Institute for Economic Forecasting. “By no means is the Fed’s work done. We’re in a protracted battle against inflation, and nothing in today’s report suggests otherwise.”

“Companies are continuing to retain and add to their workforce, but are not increasing weekly hours,” said Selcuk Eren, senior economist at the Conference Board in Washington. “That’s consistent with CEOs in a slowing economy choosing to hold onto workers, potentially with reduced hours, rather than let them go for fear of future hiring difficulties.”

“Though demand for labour remains unmatched, the labour shortages that employers sighed over a year ago have definitely subsided some,” said Andrew Flowers, lead labour economist at Appcast. “This strong labour market has pulled workers in from the sidelines.”

Stocks on Wall Street were mixed. The Dollar fell against a basket of currencies while U.S. Treasury prices rose.

Source: https://www.reuters.com/markets/us/slower-still-strong-us-job-growth-expected-june-2023-07-07/

______________________________________________________________________

News Reports Monitor – Previous Trading Day (07 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, nor any significant scheduled releases.

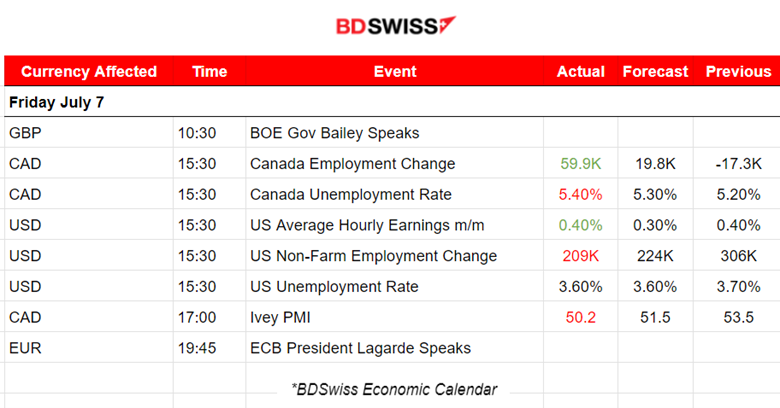

- Morning – Day Session (European and N.American)

The Canada Employment Change report showed a way-higher-than-expected positive change, 59.9K against 19.8K, while the unemployment rate increased by 0.20%. The change in the average hourly earnings increased significantly. With such strong data, a further Bank of Canada hike is quite possible for next week. The market reacted with a low effect on the CAD; some appreciation at the time was observed that soon faded.

The U.S. NF Employment Change and Unemployment Rate surprised the market with a heavy drop in the NF Employment change that caused the USD to depreciate greatly. The figure showed a change of just 209K more jobs against the previous 306K figure. The ADP Employment change figure was reported way higher the previous day, so between the actual ADP data and Actual NFP private employment, the average miss was great. In May, the difference between ADP and NFP private employment was -458K, in June it was +62K, and in July it was +383K. It is known that the ADP data reported earlier than the NFP are not necessarily a good predictor of NFP Private Employment Change. The unemployment rate was reported low as predicted, at 3.6%. The market reacted significantly to the data released at 15:30 with a high impact on the USD and USD pair depreciation pushing the EURUSD near 100 pips upwards after the release.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

USDCAD (07.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving sideways with low volatility while the market was waiting for the news to react at 15:30. The employment data for Canada and the U.S. caused the pair to drop significantly as USD suffered strong depreciation against other currencies. The NFP report showed significantly low numbers for employment, something that the Fed was expecting. Expectations shifted from hikes to a pause and the Dollar was not preferred anymore. The release showed quite the opposite picture from the ADP report and that is why, on the previous day, market participants had been preferring the dollar more, pushing its price higher. Now, they dumped it. Quite mixed data causing shocks and uncertainty. More hikes were expected from the Fed but now the expectation is fading. The Fibo tool depicted on the chart shows the possible retracement level.

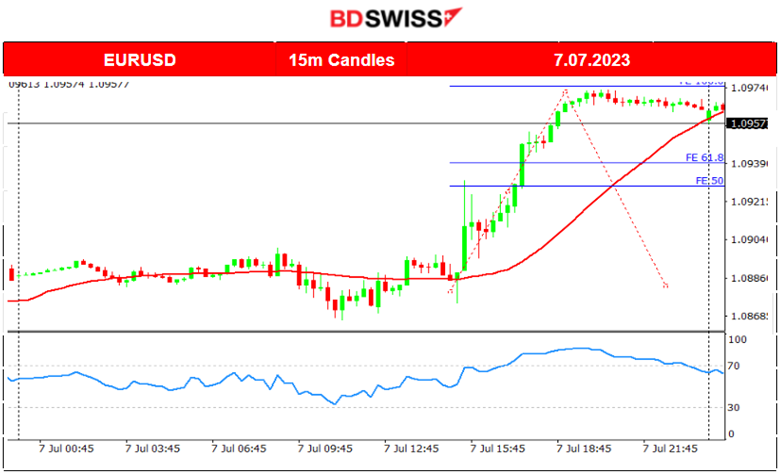

EURUSD (07.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD shows that the USD is driving the markets as well. Since USD is the quote currency, the pair moved upwards after the news release at 15:30. USD depreciation against other currencies caused the pair to move upwards, near 100 pips. A retracement is possible and the potential retracement level of 61.8 FE is depicted on the chart.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. Stock market noted a drop in the short term again. The data finally signal the beginning of a downward trend. The U.S. employment data were released on Friday and the USD depreciated heavily. All U.S. benchmark indices moved higher due to the shock but later reversed significantly. Now, resilience to the upside is obvious. The index now stubbornly wants to remain below the 30-period MA. 14980 support is broken and I am curious to see what will happen on the NYSE market opening at 16:30 today. An initial drop will probably be sustainable.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

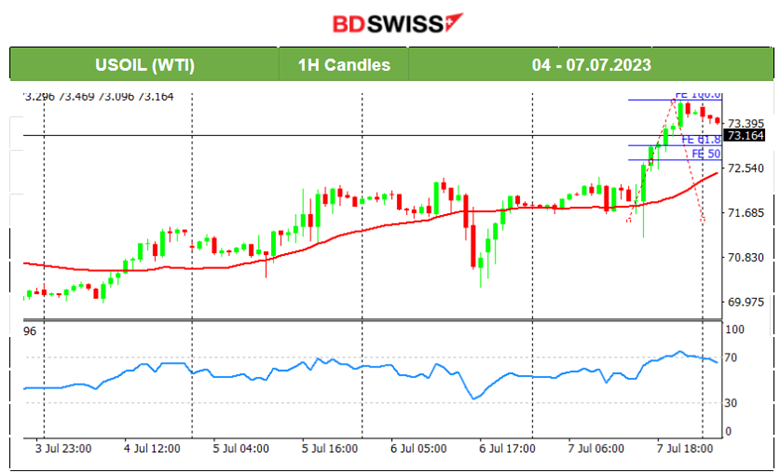

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD was significantly affected by the ADP Employment data report on the 6th of July with an appreciation. Crude fell dramatically at the time of the release. However, its price fully retraced in the end. On the next day, the 7th of July, the NFP caused Dollar depreciation and Crude moved upwards before eventually retracing. Overall, we see that our initial expectation, that the oil price will eventually follow an upward path formed by the OPEC meetings’ recent statements, holds.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The 6th and 7th of July were having a great impact on Gold due to the USD-related reports. The ADP and the NFP Employment data had an effect on the USD which in turn had an effect on the XAUUSD (Gold) price. On the 6th of July, the price dropped since the high ADP figure caused USD appreciation. However, on the 7th of July, the NFP figure was way different, causing USD depreciation, thus Gold jumped before eventually retracing back to the mean.

______________________________________________________________

News Reports Monitor – Today Trading Day (08 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

No major news announcements, nor any significant scheduled releases.

General Verdict:

______________________________________________________________