PREVIOUS TRADING DAY EVENTS – 05 July 2023

In that meeting, they agreed to pause interest-rate increases but committed to hike again later this month.

“It was a little surprising given that the decision was sold as unanimous from Fed officials,” said Lindsey Piegza, chief economist at Stifel Nicolaus & Co. “It’s pretty clear that there was a divergence of opinions, with some officials pretty clearly giving some reluctance for a one-month pause.”

Almost all policymakers agreed that more tightening will likely be needed this year.

“A strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year,” Powell said at a conference in Madrid hosted by the Bank of Spain last week. “Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go.”

The U.S. economy shows great resilience with a strong labour market. It is a positive sign that recession could be avoided. However, it raises concerns about how fast the inflation rate will drop, weakening the effects of hikes on inflation.

Russia-Saudi oil cooperation is still going strong as part of the OPEC+ alliance, which will do “whatever necessary” to support the market, Saudi Energy Minister Prince Abdulaziz bin Salman told at the conference yesterday. Saudi Arabia and Russia deepened oil supply cuts on Monday in an effort to set prices higher.

The United States, the biggest oil producer outside OPEC+, has repeatedly called on the group to boost production to help the global economy. OPEC says it does not have a price target and is seeking to have a balanced oil market to meet the interests of both consumers and producers. Prince Abdulaziz said that new joint oil output cuts agreed by Russia and Saudi Arabia this week have again proven sceptics wrong.

“Part of what we have done (on Monday) with the help of our colleagues from Russia was also to mitigate the cynical side of the spectators on what is going on between Saudi and Russia on that specific matter,” Prince Abdulaziz said.

“It is quite telling seeing us on Monday coming out with not only our (oil cut) extension… but also with validation from the Russian side,” he told a meeting of oil industry CEOs with ministers from OPEC and allies, known as the OPEC International Seminar.

The International Energy Agency: expects the oil market to tighten in the second half of 2023, partly because of OPEC+ cuts.

Source:

______________________________________________________________________

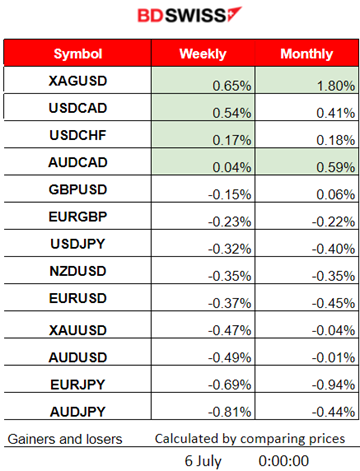

Summary Daily Moves – Winners vs Losers (04 July 2023)

- Silver (XAGUSD) is on the top of the week’s list of winners with 0.65%. USDCAD is next with 0.54%.

- This month silver is on the top so far with 1.80%.

______________________________________________________________________

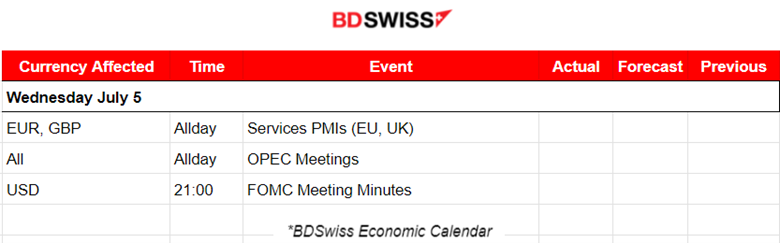

News Reports Monitor – Previous Trading Day (05 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news, no significant scheduled releases.

- Morning – Day Session (European)

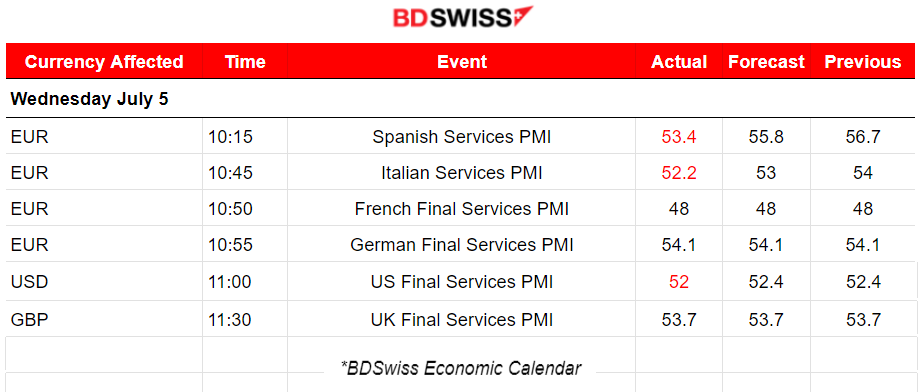

Services PMI releases as per below:

EU: The services PMI further signals that the Eurozone economy slows down in combination with manufacturing production fall.

UK: June Services PMI data indicated a sustained upturn in UK service sector output.

OPEC Meetings: Recent Crude oil output cuts act as evidence of the cooperation between heavyweight producers and allies Russia and Saudi Arabia. On Monday, Saudi Arabia spoke of extending the 1-million-barrel-per-day production cut it had initially flagged for July into August, while Russia announced a 500,000 barrel-per-day decline in exports next month. Prince Abdulaziz, Minister of Energy of Saudi Arabi said: “In the last move this week, yes, we are all continuing with our voluntary cut, but again, part of what we have had done with our colleagues from Russia was also to mitigate the cynical side of spectators about what was going on with Saudi Arabia and Russia.”

FOMC Meeting Minutes: More rate hikes are expected from almost all members for 2023. “…all participants continued to anticipate that, with inflation still well above the Committee’s 2% goal and the labour market remaining very tight, maintaining a restrictive stance for monetary policy would be appropriate to achieve the Committee’s objectives”.

General Verdict:

____________________________________________________________________

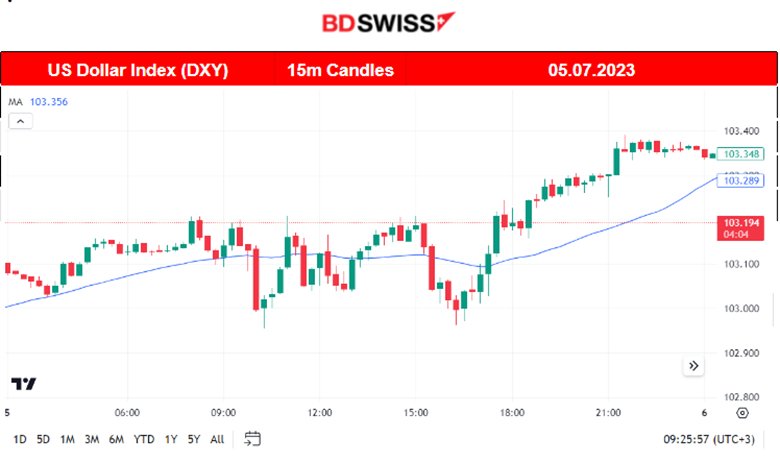

FOREX MARKETS MONITOR

EURUSD (05.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair has moved around the 30-period moving average (MA) for most of the trading day. During the American session, the Dollar strengthened causing the EURUSD to steadily drop and move below the 30-period MA with signs of support that might cause it to retrace the next day.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index eventually broke the support yesterday at 15170 causing a strong one-direction and rapid movement on the downside reaching the next support at 15116, the 61.8 Fibo Level calculated by taking into account the previous rapid movement upwards on the 30th of June. After testing that level yesterday, the index finally reversed significantly, crossing the 30-period MA on its way up, reaching the resistance near 15288 before retracing again back to the mean. 15116 acts as an important support level to have our eyes on since the breakout could cause the index to drop significantly, even back to 15000. It all depends on the Employment data for the U.S. and the NFP release. The market will react to it with significant moves.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 4th of July, Crude reversed, crossing the 30-period MA on its way up and following an uptrend. A channel is formed as Crude’s price climbs while being above the 30-period MA. Crude reached 72.20 USD/b this week so far. Cuts in the production of oil are on the talks (OPEC Meetings) and are probably going cause the continuation of a steady upward trend adding to increasing costs of doing business, thus rising prices. Taking this into consideration is really puzzling since Central Banks are busy using rate increases to fight inflation.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Employment data for the U.S. will have a strong impact on the USD and thus XAUUSD. 1931 serves now as a strong resistance and 1920 as a support that was broken yesterday, causing the price to move further below the 30-period MA. The RSI was already showing signs of leaving the overbought territory and the price eventually fell. Now retracement back to the mean follows.

______________________________________________________________

News Reports Monitor – Today Trading Day (06 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

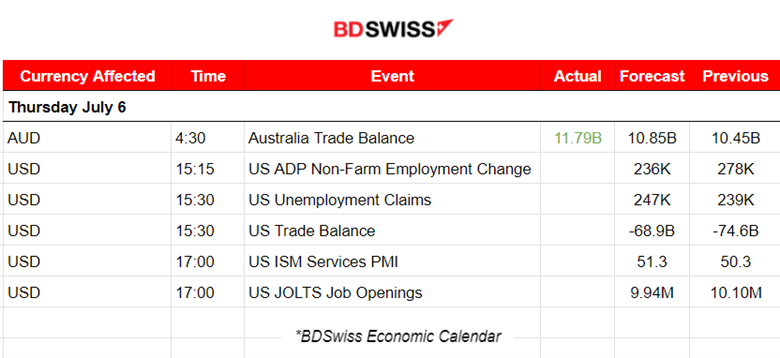

No major news, no significant scheduled releases except a release at 4:30. Australia’s seasonally adjusted balance on goods and services surplus increased by 1,337M USD in May. Some AUD strengthening was observed around that time but it soon faded with pairs retracing. However, the upward momentum continued again during the European session.

- Morning – Day Session (European)

Today, The ADP NF Employment Change and Unemployment claims along with the Trade Balance for the U.S. will be released today causing probably intraday shocks for the USD pairs. The market usually waits for the NFP data to react greatly but if the surprises from the actual figures are high enough, the shocks will have a significant impact on the pairs.

At 17:00 the USD will probably show more volatility and further deviations from the mean with the release of the ISM Services PMI and the JOLTS Job Openings report. While expected jobless claims are higher, the job openings figure is expected to be lower, thus data show labour market cooling. The Fed members are more likely to hike but wait for the employment data to support their decisions. The market is also waiting for this confirmation in order to proceed with more activity and an expected USD strengthening.

General Verdict:

______________________________________________________________