As we reach the midweek mark of our five active trading sessions, we’ll dive into the latest news driving movements in the financial markets.

Starbucks Appoints Chipotle Brian Niccol as New CEO

On August 13, 2024, Chipotle Mexican Grill (NYSE: CMG) announced that Brian Niccol, their Chairman and CEO since 2018, will transition to the same roles at Starbucks (NASDAQ: SBUX) effective August 31, 2024.

In response to the news, Chipotle experienced bullish trading, closing at $51.61, up from its opening of $50.69, but significantly down (-7.5%) from the previous day’s close of $55.87, with an intraday range of $48.01 to $52.06.

Similarly, Starbucks saw a strong bullish move, closing at $95.90 after opening at $90.98, sharply up (24.5%) from the previous day’s close of $77.00 with a high of $95.93,

Tech stocks drive rally as PPI data paves way for CPI

U.S. equities soared on August 13, 2024, as Wall Street reacted positively to unexpectedly tame inflation data, ahead of the July CPI release expected at 0.2% m/m and 3% y/y today at 12:30 pm GMT. Tech stocks fueled the rally, driving the Nasdaq Composite up by around 2.4%, while the S&P 500 gained approximately 1.7%, and the Dow Jones Industrial Average added about 1%. This marks the strongest five-day run since November for the Nasdaq Composite, Nasdaq 100, and S&P 500, each securing four consecutive gains.

Nasdaq Composite Up +2.4%

S&P 500 Up 1.7%

Dow Jones Up 1%

United States CPI News

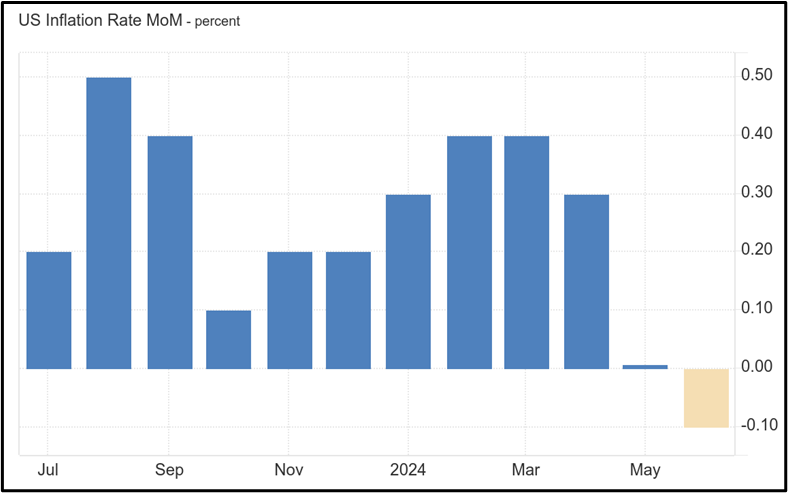

United States Inflation Rate MoM

The July CPI report, due at 12:30 pm GMT, is forecasted at 0.2%. June’s CPI fell 0.1% m/m, missing the 0.1% gain forecast. Gasoline dropped 3.8%, while food prices rose 0.2%. Core CPI edged up 0.1%, below the 0.2% estimate.

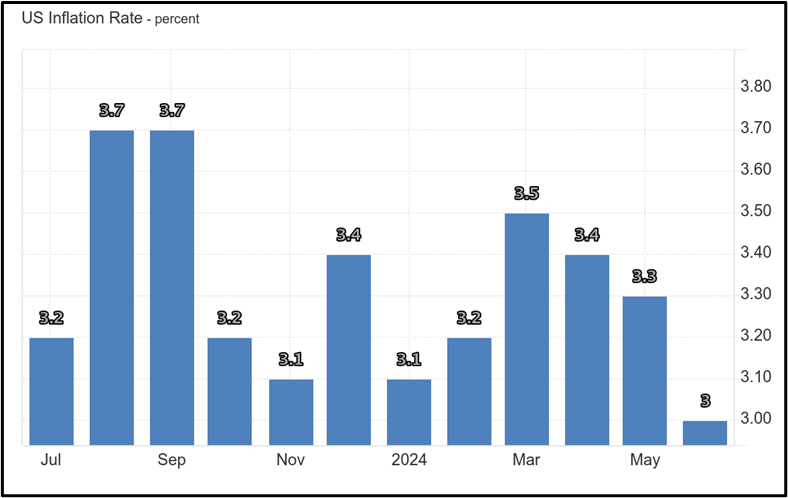

United States Inflation Rate YoY

July 2024 U.S. CPI expected to hold at 3% y/y, with a 0.2% m/m rise. Core inflation seen easing to 3.2%, with a monthly core rate of 0.2%.

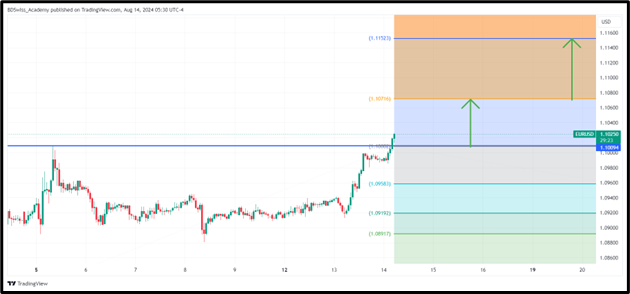

Technical analysis

EURUSD resistance breakout at 1.10082 on the 1-hour chart.

If breakout sustains, targets are 1.10716 and 1.11523.

If breakout fails, support levels are 1.09583 and 1.09192.

Apply Risk Management

Conclusion

In summary, as of midweek, Chipotle’s stock closed at $51.61 following Brian Niccol’s CEO transition to Starbucks, which saw its shares rise to $95.90. The U.S. equity markets surged, with the Nasdaq up 2.4%, the S&P 500 gaining 1.7%, and the Dow Jones increasing 1%. The July CPI is anticipated to hold at 3% y/y with a 0.2% m/m rise, while EURUSD faces potential moves between 1.09583 and 1.11523 based on the breakout at 1.10082.

Sources:

https://ir.chipotle.com/2024-08-13-CHIPOTLE-ANNOUNCES-CEO-DEPARTURE

https://www.tradingview.com/x/XKdAaDl9/

https://www.tradingview.com/x/2DiLfN5e/

https://www.tradingview.com/x/Bcrp1wSp/

https://www.tradingview.com/x/ecLTbTpO/