PREVIOUS TRADING DAY EVENTS – 21 Sep 2023

“The situation allows us to wait for now and review at the next monetary policy assessment whether the measures we have taken to date are sufficient to keep inflation within the price stability range on a sustainable basis,” SNB Chairman Thomas Jordan told reporters.

Mr. Jordan still kept the prospect open of further hikes. “The battle over inflation is not yet over,” he said. “There is still an existing inflationary pressure, and we do not exactly know whether this inflationary pressure will increase again.”

“The Swiss economy is currently confronted with inflation and economic risks. By refraining from raising interest rates, the SNB has weighted economic concerns more heavily than inflation risks,” said Alessandro Bee, senior economist at UBS.

“There are increasing signs of some impact of tighter monetary policy on the labour market and on momentum in the real economy more generally,” the MPC said in a statement.

At 6.7% in August, inflation is falling towards the 5% level the BOE has predicted for the coming months. But it remains more than three times the central bank’s 2% target.

“The question now is firmly centred on whether this pause will remain or if another rate rise will be needed in November,” Frances Haque, chief economist with Santander UK, said. “Only time and further economic data will tell.”

______________________________________________________________________

News Reports Monitor – Previous Trading Day (21 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

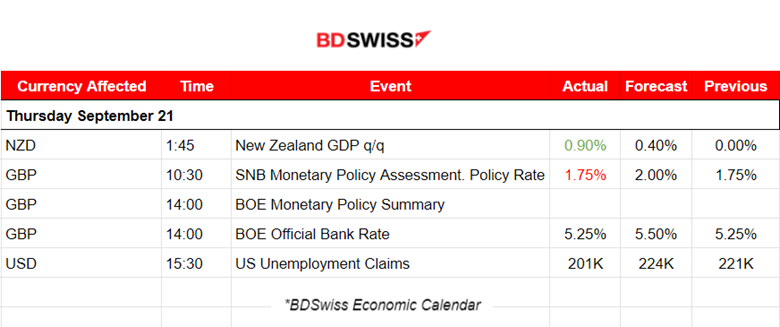

The quarterly report for New Zealand’s GDP showed a 0.90% increase beating economist expectations, pulling the country out of recession, and bringing the annual growth rate to 3.2%. No major impact was recorded at the time of the release for the NZD pairs.

- Morning–Day Session (European and N. American Session)

The Swiss National Bank (SNB) left the SNB policy rate unchanged at 1.75% according to the release today at 10:30. A shock for CHF pairs has initiated and currently causes the CHF to depreciate heavily against other currencies. USDCHF and GBPCHF for example have jumped significantly.

The Bank of England’s Monetary Policy Committee (MPC) voted by a majority of 5–4 to maintain the Bank Rate at 5.25%, surprising everyone. It was expected that there would be an increase to 5.5% instead, considering the fact that inflation is hard to be brought down. This ends a run of 14 straight interest rate hikes because of the latest report showing a cooler-than-expected inflation. A shock took place at that time affecting the GBP pairs with depreciation of the currency. GBPUSD fell about 60 pips at the time.

The unemployment claims for the U.S. at 15:30 were reported lower than expected indicating labour market strength, at 201K. That’s a significantly low number. The impact on the USD though was minimal at the time of the release.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

USDCHF (21.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced a shock at 10:30 when the Swiss National Bank (SNB) left the SNB policy rate unchanged at 1.75% according to the release. The USDCHF jumped because of CHF depreciation and found a resistance that stopped its momentum before eventually retracing back to the mean and the Fibo level 61.8 as depicted.

GBPUSD (21.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started early to move to the downside below the 30-period MA and experienced a significant drop around 60 pips during the BOE rate decision to pause rate hikes. This decision was taken after considering the big drop in inflation and economic conditions in the U.K. The pair found support at near 1.22390 and retraced soon back to the 30-period MA continuing with a sideways path around the mean.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

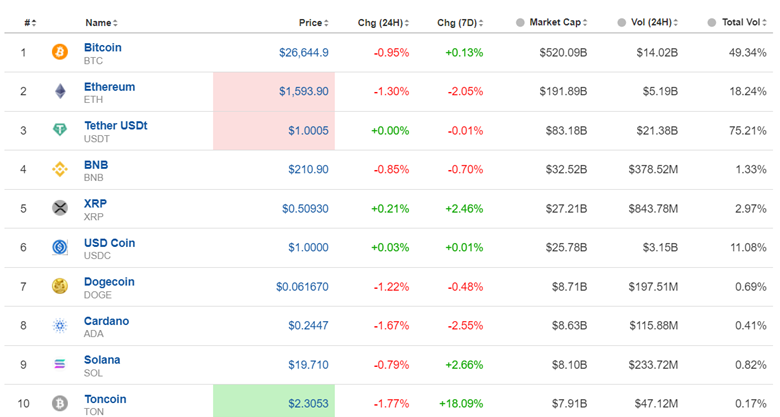

Bitcoin broke the triangle formation that was mentioned in our previous report and moved to the downside rapidly. It was breaking important support levels continuously and reached even the support near 26360 before eventually retracing back to 26640.

Crypto sorted by Highest Market Cap:

It is quite obvious that most Crypto had experienced a drop in value the last 24 hours with Toncoin being affected the most in this list.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the release of the Fed’s decision the index finally moved out of range and broke the support on its way to the downside. The other benchmark indices have similar paths. The USD experienced strong appreciation while the U.S. stocks lost significant value in general as per the chart. Yesterday 21st September the index moved even lower rapidly. This downward movement is high enough to suggest a downtrend. However, the RSI suggests also that some retracement should take place. Since the price is already touching the mean it is not quite clear if the index will retrace more.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

An ascending triangle was formed and this was broken on the 19th September, eventually causing the price to move significantly to the downside justifying the indication of a bearish divergence. Since then the price remained on a downward path that did not last too long. Crude is moving with high volatility and yesterday 21st September it showed that it is reversing while it crossed the 30-period MA on its way up. It recently passed again the psychological level 90 USD/barrel and tested the resistance 90.70 twice remaining on the sideways path settling near that resistance.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold started to move significantly upwards since the 14th, reversing and crossing the 30-period MA as it went upwards. Technically, the RSI was showing lower highs indicating a bearish divergence that eventually seems to hold. On the 20th Sept, Gold moved to the upside because the market caused USD depreciation before the Fed reports. Later though when the release of the Fed Rate took place, the USD weakened heavily and the Gold price dropped moving downwards towards the support near 1923 USD/oz. Yesterday it further dropped to the support near 1914 USD/oz and retraced back to the 61.8 Fibo level as depicted on the chart.

______________________________________________________________

News Reports Monitor – Today Trading Day (22 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

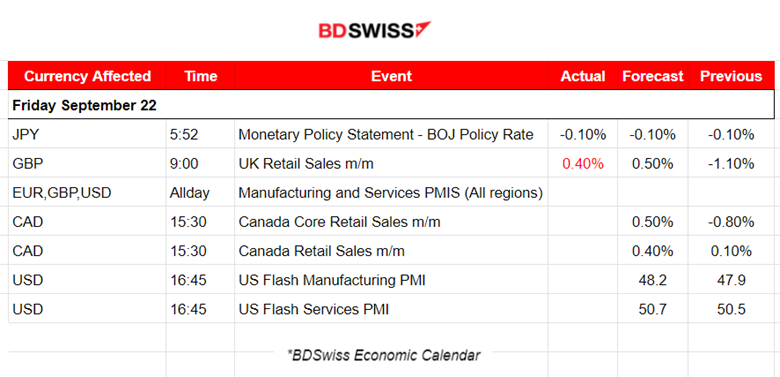

The Policy Board of the Bank of Japan leaves rates unchanged, maintaining ultra-loose monetary policy as per the report at 5:52. It maintains the short-term interest rates at -0.1%, and caps the 10-year Japanese government bond yield around zero. The impact in the market was not a shock but rather a slow depreciation of the JPY currency at the time. USDJPY moves to the upside currently.

https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/k230922a.pdf

- Morning–Day Session (European and N. American Session)

According to the report at 9:00 the U.K. retail sales volumes are estimated to have risen by 0.4% in August 2023, partially recovering from a fall of 1.1% in July 2023 (revised from a fall of 1.2%). The market responded with some increased volatility but not a significant shock. Since the European market opening the GBP depreciates though steadily and is further affected similarly by the PMI releases. The same happens to the EUR.

At 16:45 the USD pairs would probably experience increased volatility and an intraday shock possibly because of the PMI release.

General Verdict:

______________________________________________________________