Previous Trading Day’s Events (04 Jan 2024)

Source: https://www.reuters.com/markets/us/us-private-payrolls-increase-december-adp-2024-01-04/

______________________________________________________________________

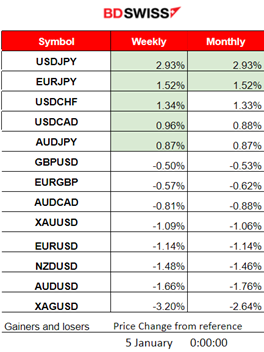

Winners vs Losers

The USDJPY remains on the top of the week’s gainers list with a 2.93% performance so far due to USD strengthening and JPY weakening.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (04 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

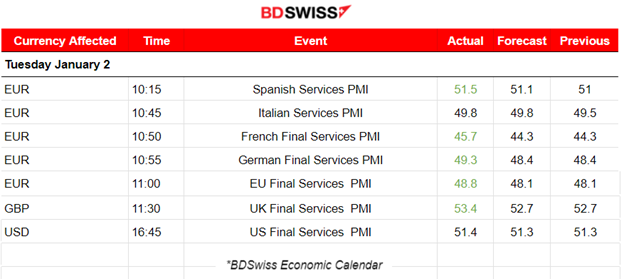

Services PMI releases:

The PMI figures were reported better than expected but again most were in the contraction area.

Eurozone:

The PMI report showed a figure over 50 indicating expansion. The report suggests that the Spanish services sector growth accelerated in December to a five-month high. Higher new business volumes, additional staff, and higher confidence levels for the future. Other economies in the Eurozone reported figures below 50.

The Italian service sector activity remained in the contraction territory in December, reporting 49.8 points PMI, extending the sequence of decline in activity to five months.

The French PMI was reported at 45.7 points, marking two successive quarters of sustained contraction as demand for services lowered significantly.

The German PMI was reported in the contraction area as well, with 49.3 points recording declines in both activity and employment in December.

In general, the Eurozone economy has been suffering a downturn that continued in December and the reports actually show devastating PMIs for both the manufacturing and the services sector. The services sector figures are closer to the 50 level though and a change in rate policy in the Eurozone might boost business activity in the sector greatly increasing the numbers over 50 in a very short period of time. However, we should not expect interest rate cuts in the Eurozone anytime soon. According to various sources, the ECB could start cutting interest rates in the second quarter of 2024 considering that inflation is near the desirable level.

Source: https://www.ft.com/content/3bdd81a0-e9d8-4f54-9ac5-8530d3fed1ad

U.K PMI:

The U.K. faces the fastest increase in service sector activity for six months during December according to the latest PMI report. The figure was released at 53.4 points in the expansion area, an improved figure compared to the previous 52.7.

U.S. PMI:

The U.S. service sector seems to expand as the PMI was reported to be 51.4 points. The sector faced stronger demand conditions as new orders rose at the sharpest rate since June.

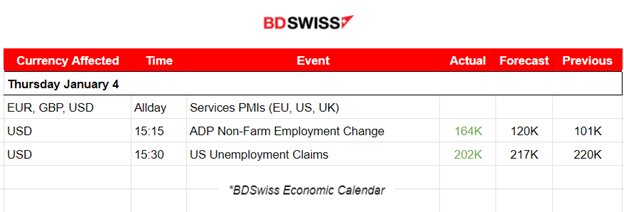

The ADP Non-Farm Employment Change report showed that the Private Sector Employment Increased by 164K Jobs in December, higher than the forecast, while annual pay was up 5.4%. The U.S. Unemployment Claims report showed a decrease of 18K from the previous week’s revised level. The figures did not have much impact on the market.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

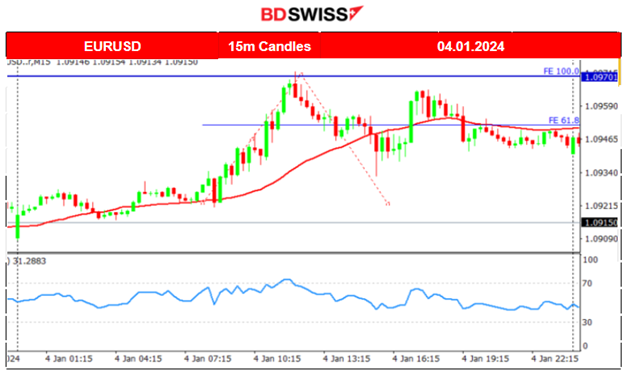

EURUSD (04.01.2024) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced an early upward movement since 8:00 reaching a strong resistance near 1.0970 before retracing to the mean. The volatility levels dropped after the retracement and the pair continued with the sideways movement around the 30-period MA. The labour market-related news for the U.S. seems that they did not have a significant impact. By looking at the dollar index chart it is clear that again the USD was the main driver of the pair’s path.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin recovered as the market remained optimistic as the U.S. spots BTC exchange-traded fund (ETF) approval despite the report on the 3rd Jan from Matrixport calling for a potential rejection or delayed approval. Its price has now reversed almost fully trading above 44K USD.

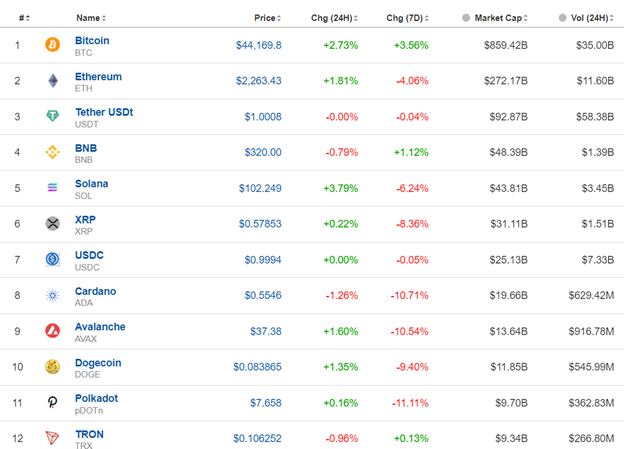

Crypto sorted by Highest Market Cap:

The crypto market seems to have recovered from Wednesday’s Matrixport report warning about a potential rejection of spot ETFs from the U.S. Securities and Exchange Commission (SEC).

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The US30 index is experiencing a significant movement to the downside as it breaks more and more support levels. It is actually quite resilient to the downside even if the market conditions changed after the holiday season and the U.S. stock market in general now suffers a downtrend. The price is moving around the 30-period MA which is showing a clear trend downwards. The index is volatile and currently broke the support at near 37425 USD, after testing it for a second time, signalling further movement to the downside, as depicted on the chart.

_____________________________________________________________________

_____________________________________________________________________

COMMODITIES MARKETS MONITOR

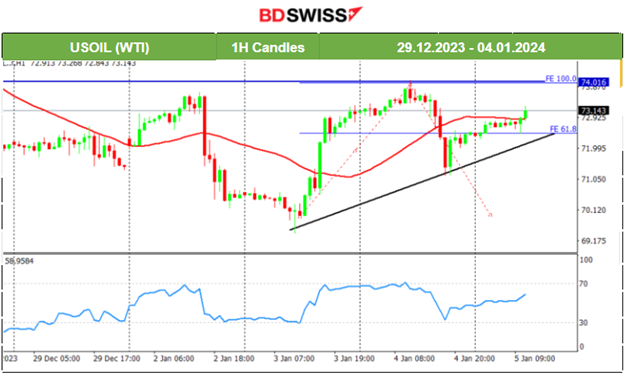

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The support at near 69.5 USD held quite strongly causing the price to reverse heavily on the 3rd Jan, crossing the 30-period MA and moving to the upside. We already mentioned that price volatility is high and for that reason, high deviations from the MA are expected. This reversal to the upside created a good opportunity for catching a retracement. The 74 USD/b level held as a resistance that proved to be strong enough for the price to retrace after reaching it on the 4th Jan. Crude Oil price dropped as demand seems to fade for now and volatility levels are lowering. This caused the price to form a triangle and we might see again the 74 USD/b resistance level to be tested. We are expecting that the triangle breakout will cause the price to move rapidly. On the upside, the next resistance should be near 75 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold experienced lower volatility levels after the drop on the 3rd Jan. That is the reason that a triangle formation is now apparent. The price seems to have broken the triangle to the downside but it could be a false breakout. The NFP report is taking place at 15:30 server time and could distort the expectation of a further drop in Gold’s price. Nevertheless, the next support is the one near 2030 USD/oz.

______________________________________________________________

______________________________________________________________

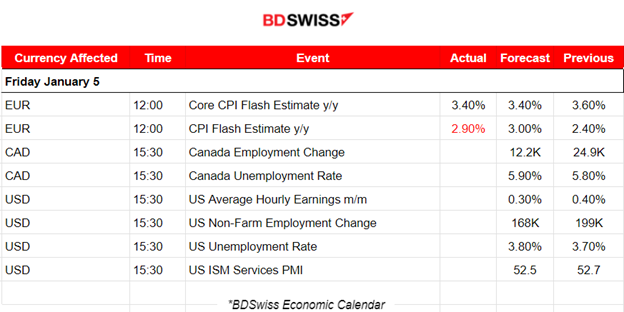

News Reports Monitor – Today Trading Day (05 Jan 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The Flash Estimate Figures for the CPI changes in the Eurozone seem to be reported as expected. The non-core figure was reported lower than expected, 2.9% vs 3% forecast, however, it was higher than the previous figure. The reaction in the market was moderate with the EUR not affected significantly from the report release.

At 15:30 it is expected that the USD and CAD pairs will be affected greatly by the employment data related to Canada and the U.S. The NFP report will shed some light in regards to how cool is the labour market in the U.S. The same applies to Canada since the expectation is lower employment change and higher jobless rate.

The figures and data so far are somehow mixed for the U.S. According to the JOLTS job opening figure there were fewer jobs reported for November as demand for workers fell. On the other hand, the U.S. firms actually added more jobs than forecast in December, according to the ADP data. Unemployment Insurance Weekly Claims saw a rise for the week ending December 30. Business conditions are obviously in contraction and the Fed is looking for data to support the view of interest policy change. NFP figures are expected to be reported lower along with a higher unemployment rate figure. We might see a surprise here due to the seasonality effect, despite the general labour market cooling. This could drive the dollar index upwards in the short term.

General Verdict:

______________________________________________________________