Salesforce (NYSE: CRM) announced in a 7 August 2024 press release that it will report its Q2 FY2025 earnings after market close tomorrow, 28 August 2024, followed by a conference call at 2:00 p.m. PT / 5:00 p.m. ET / 9:00 p.m. GMT to discuss financials with investors. A live webcast and replay will be available on the Salesforce Investor Relations website.

Salesforce (NYSE: CRM) announced in a 7 August 2024 press release that it will report its Q2 FY2025 earnings after market close tomorrow, 28 August 2024, followed by a conference call at 2:00 p.m. PT / 5:00 p.m. ET / 9:00 p.m. GMT to discuss financials with investors. A live webcast and replay will be available on the Salesforce Investor Relations website.

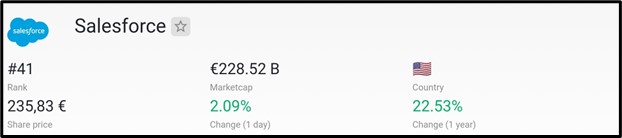

Market Cap

€228.52 billion marks Salesforce’s market cap as of August 2024, positioning it as the 41st most valuable company globally, according to companiesmarketcap.com.

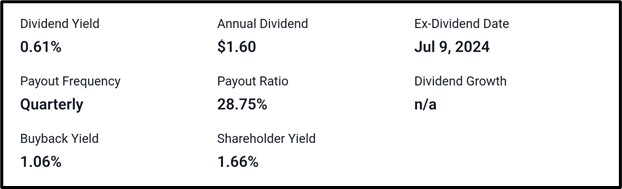

Dividend Information

As of the latest data, the company offers a 0.61% dividend yield with an annual dividend of $1.60, paid quarterly. The payout ratio stands at 28.75%, with a buyback yield of 1.06%, contributing to a total shareholder yield of 1.66%. The ex-dividend date was on July 9th, 2024, with no current data on dividend growth.

Recent Developments at Salesforce

Here are Salesforce’s latest developments:

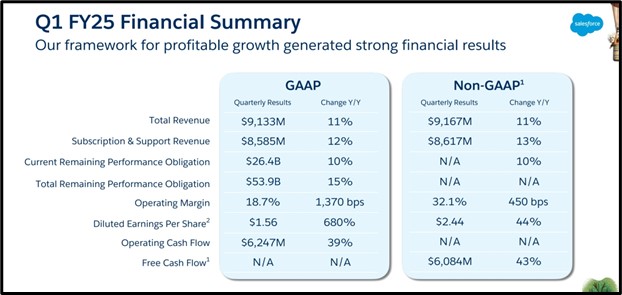

Q1 FY2025 Earnings Report Recap Salesforce’s Q1 FY25 total revenue surged by 11% YoY, hitting $9.133 billion and showcasing strong bullish momentum in subscription growth.

Salesforce’s Q1 FY25 total revenue surged by 11% YoY, hitting $9.133 billion and showcasing strong bullish momentum in subscription growth.

The operating margin expanded sharply, climbing 1,370 basis points under GAAP to 18.7%, reflecting solid margin expansion and profitability gains.

Diluted EPS skyrocketed by 680%, to $1.56 per share, underscoring substantial earnings growth potential and investor returns.

Free cash flow surged by 43% YoY, to $6.084 billion, signaling robust liquidity and capital allocation efficiency for future growth strategies.

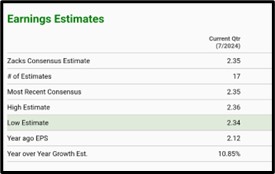

Q2 FY2025 Earnings Report Analyst Forecast

The current quarter’s Zacks consensus EPS estimate stands at $2.35, with year-over-year growth projected at 10.85%, indicating potential upside momentum. On the sales front, consensus targets $9.23 billion, representing a 7.28% YoY sales growth, supported by strong estimates ranging from $9.20 billion to $9.25 billion, showcasing tight trading ranges and market confidence in the company’s performance trajectory.

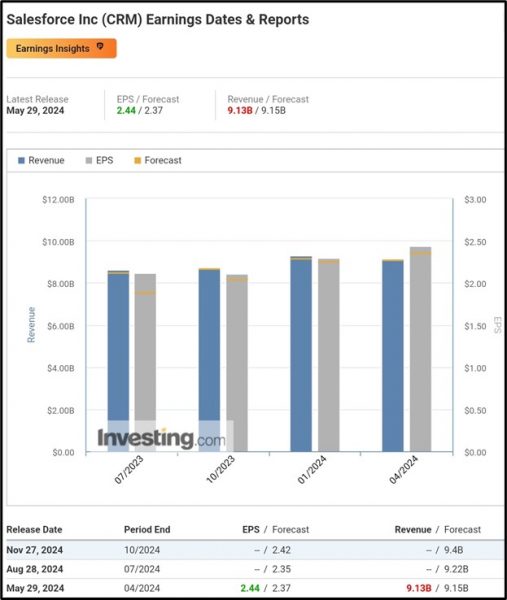

According to Investing.com, Salesforce (NYSE: CRM) is projected to post an EPS of $2.35, with revenue estimates pegged at $9.22 billion.

According to TradingView, Salesforce (NYSE: CRM) is projecting an EPS of $2.35 and revenue of $9.22 billion.

According to TradingView, Salesforce (NYSE: CRM) is projecting an EPS of $2.35 and revenue of $9.22 billion.

Technical Analysis

4HR Chart: Salesforce nearing potential resistance breakout at $265.

Upside Target: If breakout sustains, expect price movement towards $280.72 and $299.53.

Downside Risk: If breakout fails, anticipate a decline to $254.31 and $245.18.

Apply Risk Management

Conclusion

Salesforce’s Q1 FY2025 demonstrated strong performance with a significant 680% increase in EPS to $1.56 and 11% YoY revenue growth to $9.133 billion. For Q2 FY2025, analysts forecast EPS of $2.35 and revenue of $9.22 billion, reflecting continued growth. Technical indicators suggest a potential resistance breakout at $265, with possible price targets of $280.72 and $299.53, while failure to breakout could lead to declines towards $254.31 and $245.18.

https://companiesmarketcap.com/eur/salesforce/marketcap/

https://stockanalysis.com/stocks/crm/dividend/

https://images.app.goo.gl/QQwkXko8KHnYi68Y8

https://diginomica.com/workday-and-salesforce-ai-data-cloud-slack-cross-platform

https://www.salesforce.com/news/stories/einstein-sales-agents-announcement/

https://www.salesforce.com/news/stories/ai-tools-for-nonprofits/

https://www.salesforce.com/news/stories/connected-car-app-announcement/

https://www.salesforce.com/news/press-releases/2024/05/29/fy25-q1-earnings/

https://s23.q4cdn.com/574569502/files/doc_financials/2025/q1/CRM-Q1-FY25-Earnings-Presentation.pdf

https://www.zacks.com/stock/quote/CRM/detailed-earning-estimates

https://www.investing.com/equities/salesforce-com-earnings

https://www.investing.com/equities/salesforce-com-earnings