Tomorrow, on Wednesday, May 29, 2024, after the market closes, Salesforce (NYSE: CRM), a leading CRM company, will release its Q1 FY2025 results. A conference call to discuss the financial results will be held at 2:00 p.m. PT / 5:00 p.m. ET. You can access the live webcast and replay on the Salesforce Investor Relations website at www.salesforce.com/investor.

Tomorrow, on Wednesday, May 29, 2024, after the market closes, Salesforce (NYSE: CRM), a leading CRM company, will release its Q1 FY2025 results. A conference call to discuss the financial results will be held at 2:00 p.m. PT / 5:00 p.m. ET. You can access the live webcast and replay on the Salesforce Investor Relations website at www.salesforce.com/investor.

As of May 2024, Salesforce’s market cap is $264.46 billion, making it the 39th most valuable company in the world, according to companiesmarketcap.com.

Dividend Information

The dividend yield is 0.59%, with an annual dividend of $1.60. The ex-dividend date is March 13, 2024. Dividends are paid quarterly with a payout ratio of 38.10%. There’s no reported dividend growth. The buyback yield is 1.30%, resulting in a total shareholder yield of 1.89%.

Recent Development At Salesforce

Here are the latest updates from Salesforce :

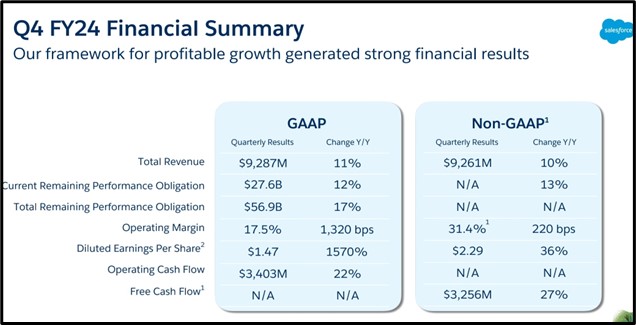

Q4 FY2024 Earnings Release Recap  Salesforce (NYSE: CRM) reported its fiscal fourth-quarter and full fiscal year 2024 results on February 28, 2024, for the period ending January 31, 2024. Here are the key highlights:

Salesforce (NYSE: CRM) reported its fiscal fourth-quarter and full fiscal year 2024 results on February 28, 2024, for the period ending January 31, 2024. Here are the key highlights:

Q4 2024 Performance:

Total revenue: $8.75 billion in subscription and support revenues, up 12% Y/Y, and $0.54 billion in professional services and other revenues, down 9% Y/Y.

GAAP operating margin: 17.5%; non-GAAP operating margin: 31.4%, negatively impacted by restructuring by 190 basis points.

GAAP diluted EPS: $1.47; non-GAAP diluted EPS: $2.29, with restructuring negatively impacting GAAP diluted EPS by $0.18.

Cash generated from operations: $3.40 billion, an increase of 22% Y/Y; free cash flow: $3.26 billion, up 27% Y/Y, with restructuring negatively impacting operating cash flow growth by 200 basis points.

Remaining performance obligation: Ended at $56.9 billion, up 17% Y/Y; current remaining performance obligation: $27.6 billion, up 12% Y/Y, and 13% CC.

FY2024 Performance:

Total revenue: $32.54 billion in subscription and support revenues, up 12% Y/Y, and $2.32 billion in professional services and other revenues, flat Y/Y.

GAAP operating margin: 14.4%; non-GAAP operating margin: 30.5%, negatively impacted by restructuring by 280 basis points.

GAAP diluted EPS: $4.20; non-GAAP diluted EPS: $8.22, with restructuring negatively impacting GAAP diluted EPS by $1.00.

Cash generated from operations: $10.23 billion, up 44% Y/Y; free cash flow: $9.50 billion, up 50% Y/Y, with restructuring negatively impacting operating cash flow growth by 1,500 basis points.

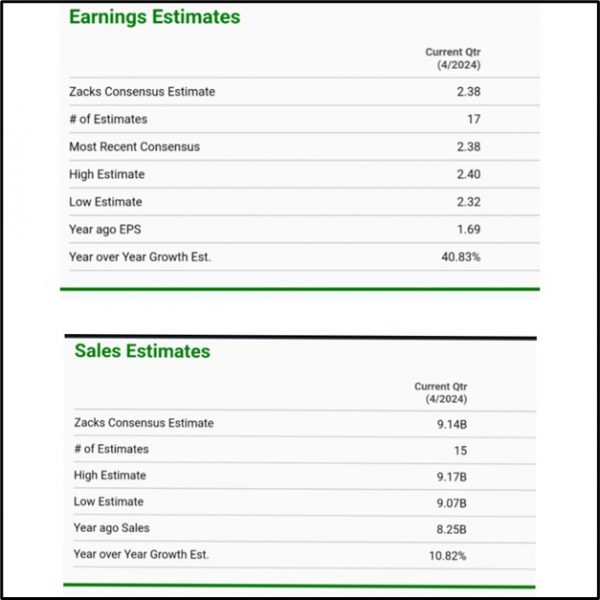

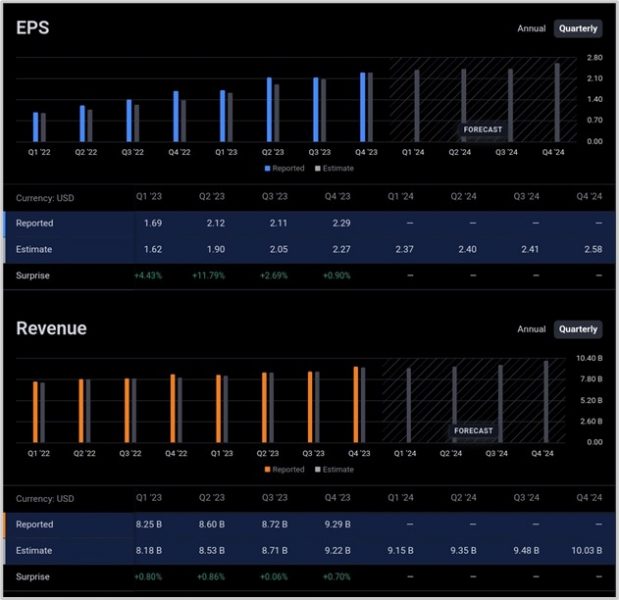

Q1 FY25 Earnings Analyst Forecast

For the current quarter, the Zacks Consensus Estimate for sales is $9.14 billion, with 15 estimates ranging from a high of $9.17 billion to a low of $9.07 billion, indicating a year-over-year growth estimate of 10.82%. On the earnings side, the Zacks Consensus Estimate is $2.38 per share, based on 17 estimates, with the most recent consensus matching at $2.38. The high estimate stands at $2.40 per share, while the low estimate is $2.32 per share. Compared to the previous year, earnings per share are expected to increase by 40.83%.

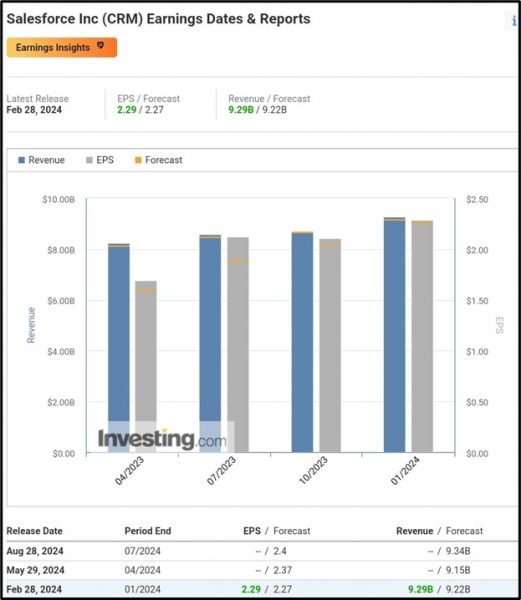

According to Investing.com, Salesforce Inc (NYSE:CRM) is forecasted to reach an earnings per share (EPS) of $2.37, with an anticipated revenue of $9.15 billion.

According to Tradingview.com forecasts, Salesforce Inc (NYSE:CRM) is projected to attain an earnings per share (EPS) of $2.37, alongside an estimated revenue of $9.15 billion.

Technical Analysis

From a technical analysis perspective, a descending triangle pattern has been identified on the 4-hour chart of Salesforce Inc (NYSE: CRM), indicating a downtrend. A downtrend line drawn from $311.62 rejected the price at $290.22 after retracing from $267.92. The downtrend persisted to $267.92 before experiencing rejection, with the current price around $272.45. If the support rejection holds, there is a high likelihood of the price ascending to the downtrend line. Conversely, if the downtrend line is breached to the upside, there is a strong possibility of further price appreciation. However, if the support rejection is breached to the downside, there is a high chance of further price depreciation.

Conclusion

Overall, Salesforce Inc. (NYSE: CRM) has showcased impressive performance in Q4 FY2024 and full fiscal year 2024, with significant revenue growth, strong operating margins, and robust cash flow generation. The initiation of a quarterly dividend and the expansion of the share repurchase program reflect the company’s commitment to enhancing shareholder value. Looking ahead, the company’s Q1 FY2025 earnings forecast indicates continued growth momentum, supported by optimistic analyst estimates and technical analysis pointing towards potential price appreciation. With recent developments such as new product introductions and strategic partnerships, Salesforce is well-positioned to capitalize on market opportunities and drive future success.

Sources:

https://companiesmarketcap.com/salesforce/marketcap/

https://stockanalysis.com/stocks/crm/dividend/

https://www.salesforce.com/news/press-releases/2024/05/22/einstein-copilot-marketing-commerce-news/

https://www.salesforce.com/news/stories/connections-commerce-cloud-news-2024/

https://www.salesforce.com/news/press-releases/2024/05/21/ibm-salesforce-ai-data-partnership/

https://www.salesforce.com/news/stories/ai-for-channel-managers/

https://images.app.goo.gl/2sC4k5MUTSrq4PpG8

https://investor.salesforce.com/financials/default.aspx

https://www.salesforce.com/news/press-releases/2024/02/28/fy24-q4-earnings/

https://www.zacks.com/stock/quote/CRM/detailed-earning-estimates

https://www.investing.com/equities/salesforce-com-earnings