Rates as of 04:00 GMT

Market Recap

Yesterday’s US data was uniformly miserable, yet US stocks managed to close slightly higher (+0.6%) and Asian stocks are up across the board, even including beleaguered India. The reason? An encouraging report that a group of patients being treated in Chicago were “seeing rapid recoveries in fever and respiratory symptoms” after using remdesivier, a drug made by Gilead Sciences, a US medical company. The report is preliminary and the trial didn’t include a control group, but it looks pretty good – read it and judge for yourself.

If this is indeed a cure or at least a drug that makes a significant change in the mortality rate, it will allow the global lockdown to be lifted much earlier than people had feared and before much permanent damage has been done to the global economy. That would be wonderful. And I could go home to my wife & daughter.

After the US stock market closed, Trump announced some guidelines on reopening the US, but remember it’s up to the states, not the president. Given the total lack of leadership from the federal government, many states have banded together in groups and are trying to make regional decisions on these matters. So far they’re ignoring Trump; on the contrary, New York Governor Cuomo extended the state’s lockdown until 15 May, with neighboring New Jersey quickly following suit. S&P 500 futures are up 3.3% at the time of writing, aided by news that Boeing plans to restart manufacturing in the Seattle area next week.

While President Trump announced guidelines on easing restrictions, the UK announced it would extend its lockdown by 3 weeks to early May, while Japan’s PM Abe extended the country’s state of emergency to the entire country (previously it was just in seven of the 42 prefectures). On the other hand, Switzerland announced it will start to reopen some businesses and schools from 27 April. The country was one of the hardest hit in the world in relation to its population.

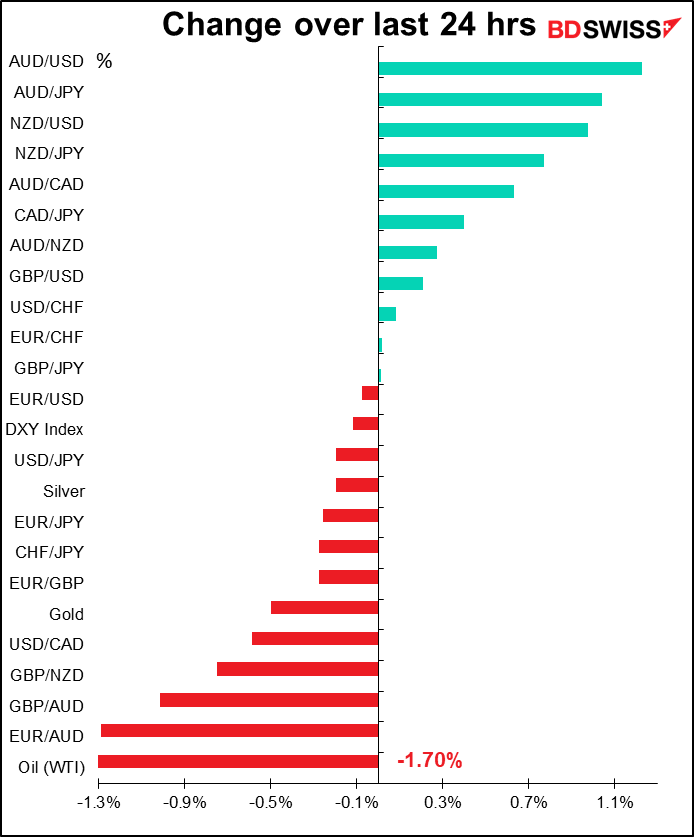

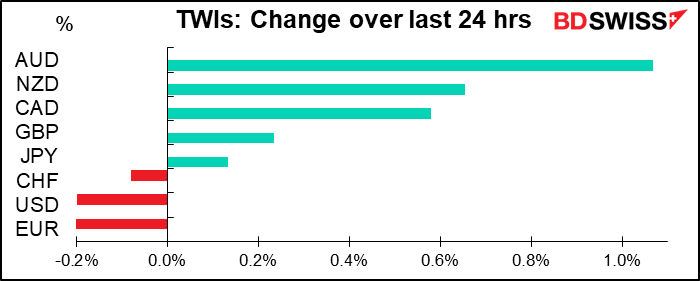

Note that USD came off in the risk-on environment. But CAD gained along with the other commodity currencies even though oil continued to fall.

EUR was weaker as French President Macron once again called for joint debt issuance – “coronabonds” – to fund the EU-wide response to the crisis. “We are at a moment of truth, which is to decide whether the European Union is a political project or just a market project. I think it’s a political project…” he said. If there is a medical cure for the virus, then the US may escape the worst implications of Trump’s appalling irresponsibility in dealing with the crisis and instead the focus could turn to the European project’s virtual disintegration in the face of a continent-wide challenge. The EU’s fiscal response will be a major topic of discussion at next week’s EU leaders’ summit.

And getting back to old familiar territory, the UK government not only refused to ask for an extension of the Brexit transition period, it even said it would refuse to extend it if Brussels asked. I still say this isn’t likely to end well for GBP.

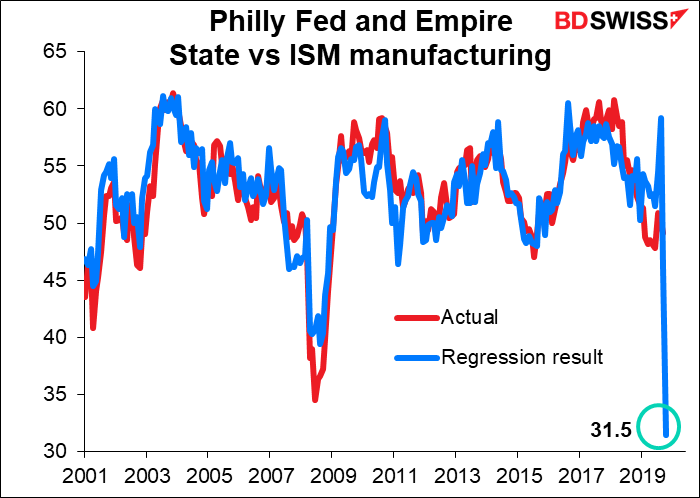

As for yesterday’s data, everything was pretty bad. Initial jobless claims came in much as expected at 5.25mn newly unemployed persons (5.5mn estimated). Remember that there’s still one more week’s jobless claims to go before the April survey week for the nonfarm payrolls, so millions and millions of people will be added to the ranks of the unemployed. The Philadelphia Fed business sentiment survey fell much more than expected (to -56.6 from -12.7). Taking the Empire State and Philly Fed surveys together, they imply a fall in the ISM manufacturing PMI to 31.5, which would be near its record low of 29.4 set in May 1980.

And overnight the China data was also mostly worse than expected: GDP was down 6.8% yoy vs -6.0% expected, probably the first quarterly decline in China’s GDP in 40 years. Industrial production was better than expected at -1.1% yoy (–6.2% expected), implying that the country is getting back to work more rapidly than people had thought. But both retail sales and fixed asset investment were weaker than even the relatively pessimistic forecasts. The lesson for the rest of the world is that it’s easier to get people back into the factories than it is to get them to go shopping again.

Today’s market

Not much on the schedule for today.

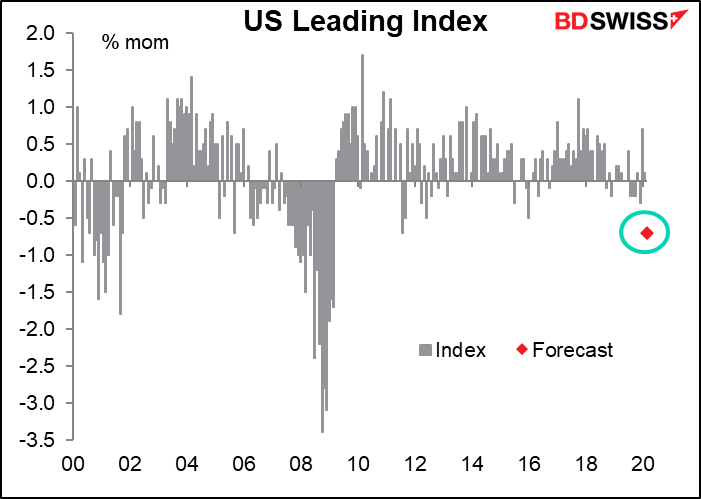

The US leading index is forecast to show a serious drop of -0.7% mom. It’s only fallen that much once since the Global Financial Crisis (GFC) of 2008/09. Having said that, it’s not expected to be anywhere near as bad as it was during the GFC (worst was -3.4% mom in October 2008), nor even the 1.8% fall in September 2001 (I don’t think I need remind you of what happened that month). Nor is it expected to match the -1.1% fall in May 2000 (which followed the 16% drop in the NASDAQ in April) for that matter. Having said that, remember that this is for March.

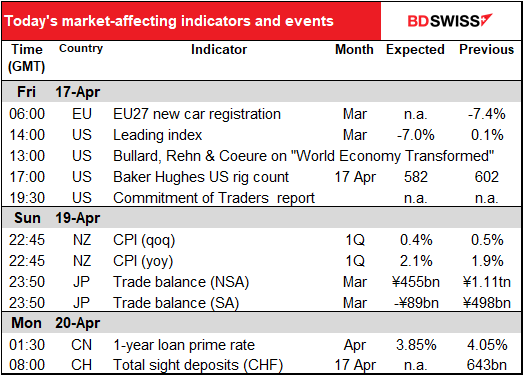

Monday morning New Zealand time, New Zealand inflation data will be released. Ordinarily this would be quite important, but at the moment I don’t think inflation is on anyone’s radar screen so it can probably be ignored.

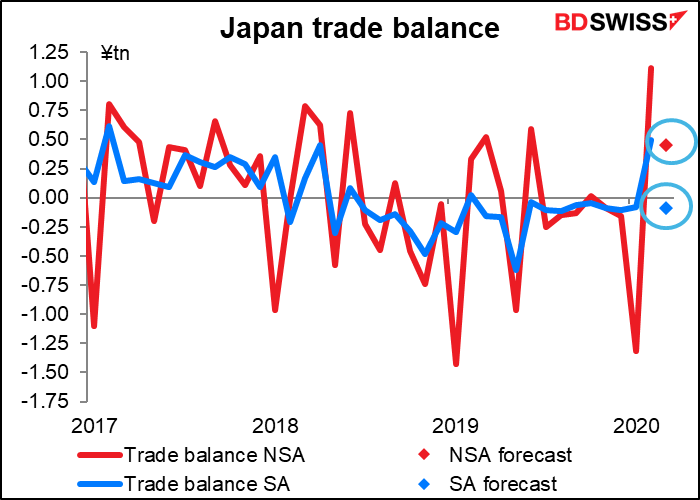

Japan’s trade balance is forecast to fall as exports are expected to fall at about the same pace as imports. Last month the surplus rose, but that was just because imports fell much faster than exports. Falling imports and exports is not a good sign.