Rates as of 05:00 GMT

Market Recap

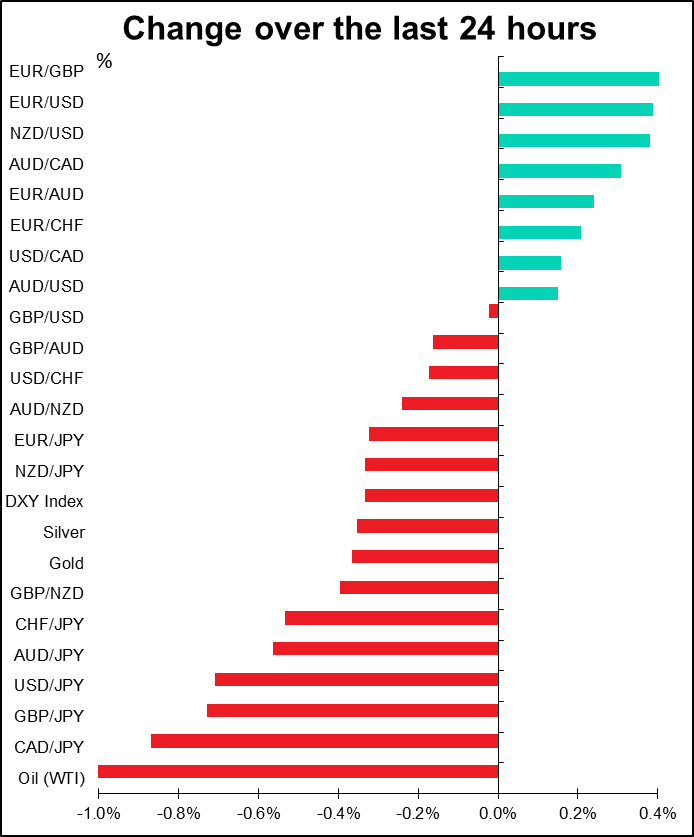

Worst day for stocks in around two years – US market down 3.35%, Tokyo down similarly this morning, and both Shanghai and Shenzhen down 2%. But oddly enough South Korea is up even though that country is increasingly under threat – Daegu, a city of 2.5mn people, is apparently under lockdown, and Hong Kong for example has stopped issuing visas to people from the country. A few other Asian stock markets are also higher.

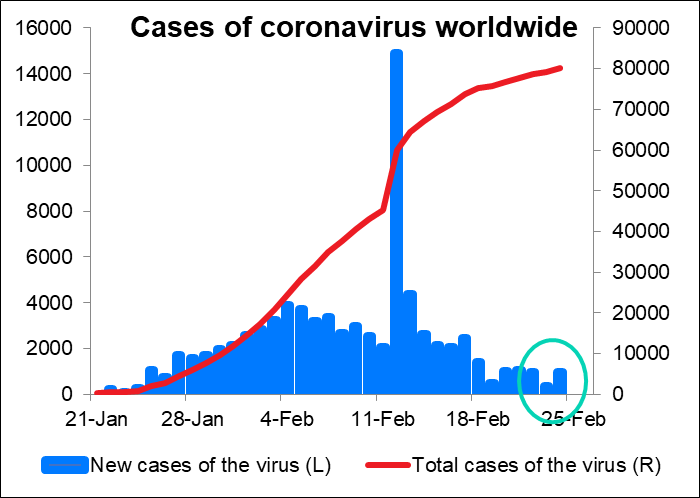

I’m not going to go into detail on the virus, news of which you can pick up anywhere, just to say that it seems to be spreading in Italy, South Korea and Iran. All we know for sure about the virus is that we don’t know anything for sure. The headline in the FT summed it up: “Sharp fall in coronavirus cases undermined by questionable data/Experts say decline in new infections is likely but official count also mired in politics”

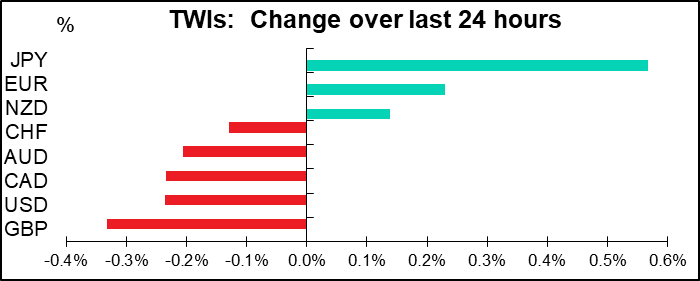

Clearly my thesis that the virus would cause the yen to weaken despite the latter’s known “safe haven” tendency isn’t correct, at least not yet. However, I’m still not turning bullish on the yen. Japan has the second-highest number of confirmed cases of COVID-19: 838, including four deaths, most of them from that cruise ship docked in Yokohama. Plus Tokyo has the third-largest number of Chinese tourists arriving, so I’m sure there are more cases to come, unfortunately. Moreover, the economy is closely tied with China’s. I think it’s just a matter of time before the Japanese economy, already hit by October’s consumption tax hike, begins to suffer and the yen suffers with it.

A big question mark hangs over this summer’s Olympics in Tokyo. The head of the Japan Olympics committee last week said “we are not considering a cancellation or postponement of the Games.” But that was last week. We don’t know what it’ll be like next week, much less on 24 July, when the Games are supposed to begin. Some preliminary events, such as qualifying events and training for volunteers, are being delayed. That could make it difficult to hold the Games on time. One possible solution being mooted: hold the contests with no audience and let everyone watch from home on TV.

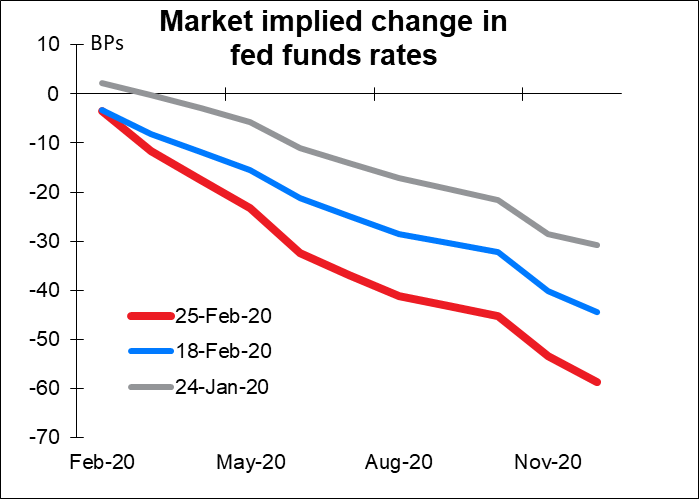

The market response to the virus has been to assume further easing. As the graph below shows, the market is now expecting the Fed to cut rates by 59 bps by next January, vs only 45 bps expected a week ago and 31 bps a month ago. There’s not such a big response in Europe, where the ECB already has negative rates, but investors are now assuming another 10 bps cut from the ECB as well.

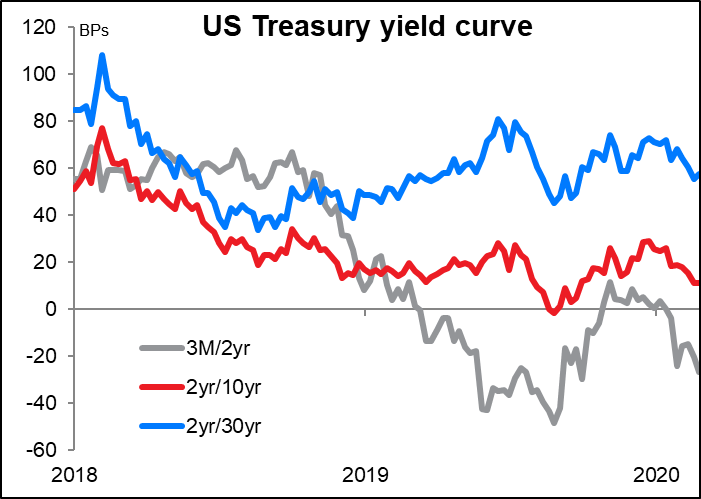

The 2yr/10yr US Treasury yield curve is at its flattest since October and seems on its way to inverting. This will make it more difficult for the Fed to resist a rate cut. But would a rate cut be bearish or bullish for USD? If it boosts the economy and the stock & bond markets, it could be bullish by bringing in more money from abroad and boosting confidence in the US economy.

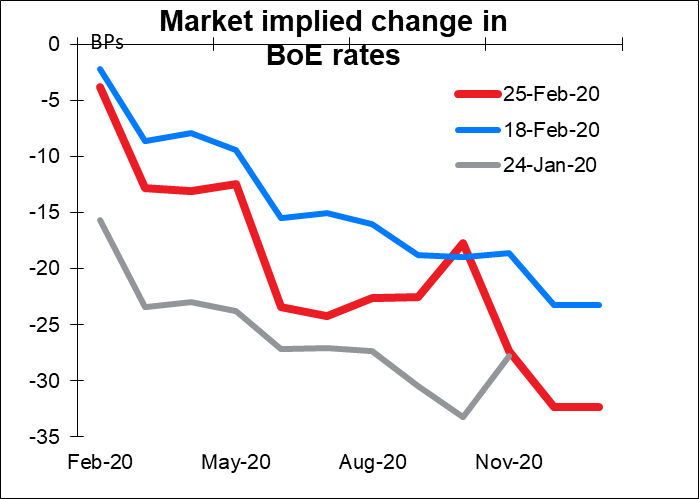

There were similar reactions in many other countries. In Britain, continued fears about Brexit plus heightened speculation about a cut in UK rates helped to push GBP lower. Notice how the market is now pricing in a 25 bps cut in rates by August, whereas a week ago it hadn’t been pricing in a full cut until February next year.

Today’s market

Not much on the schedule today indeed.

The final version of Germany’s Q4 GDP isn’t likely to hold any surprises. In fact even the initial version didn’t, because they announce their whole-year GDP first before they announce Q4, but people can back out the Q4 figure from the whole year one. So this is a snore.

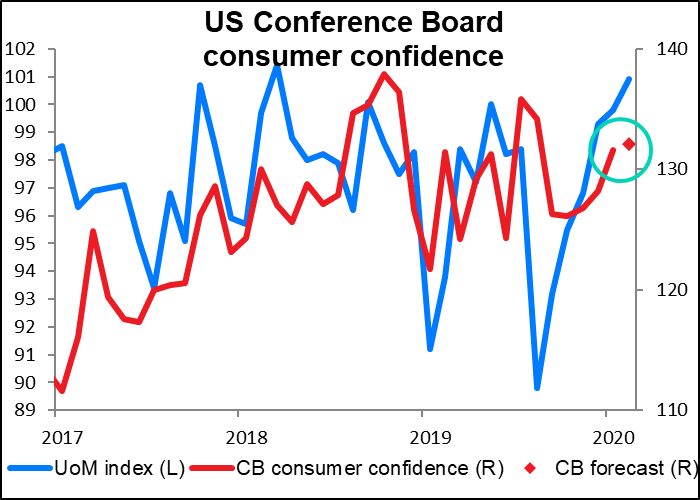

After that we just wait till the US opens for business and the Conference Board consumer confidence figure is released. It’s expected to rise a bit – not as much as the U of Michigan index has risen recently, but still, higher is higher. The Conference Board measure is more heavily weighted towards the labor market than the Michigan measure is, so its gyrations may reflect the contrast between still-robust job gains (as shown by the nonfarm payrolls) vs a falling number of jobs on offer (as shown by the Job Openings and Labor Turnover Survey). Nonetheless, the steady rise in confidences since the recent low in October should reassure markets that consumer spending can remain solid and keep underpinning the US economy, as the Fed has argued. USD-positive

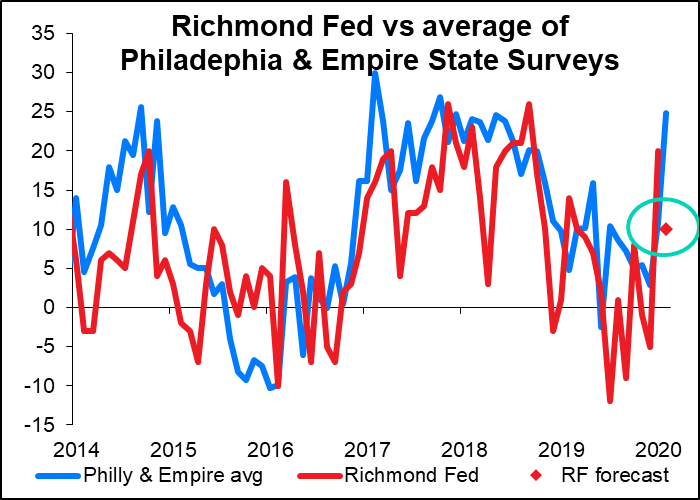

The only other indicator on the schedule is the Richmond Fed survey. I’m not sure how closely the market watches it, but investors certainly should: my research shows that among the five regional Fed surveys, it’s the best correlated with the Institute of Supply Management (ISM) manufacturing survey, which is what people are trying to forecast. (It doesn’t have much power at explaining the Markit manufacturing PMI however – the only one that’s good at that is the Empire State survey.) It surged last month to +20 from -5, so economists are expecting some mean reversion back to 10 – still in expansionary territory and so still positive for USD, I’d think.