Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

Rates as of 05:00 GMT

A word of greeting

This is my last comment for the year, so today’s table includes all of this week’s important indicators. At the bottom I have a table with all of next week’s major indicators. Don’t worry, there aren’t many. There are also no central bank speakers on the schedule at this point, although the newspapers and magazines that come out on 1 January often have some important interviews with leaders.

I want to thank all my readers for bearing with me over the past year while I tried to make some sense out of what none of us have ever seen before. We use the knowledge and techniques that we learned in the past to understand the present, but what can we do in a situation like this, which none of us have ever seen before? If I have failed to understand some important points or made any mistakes that impacted your trading, I hope you will attribute it to the difficulty of the task at hand.

I look forward to continuing our dialogue on the markets next year.

Market Recap

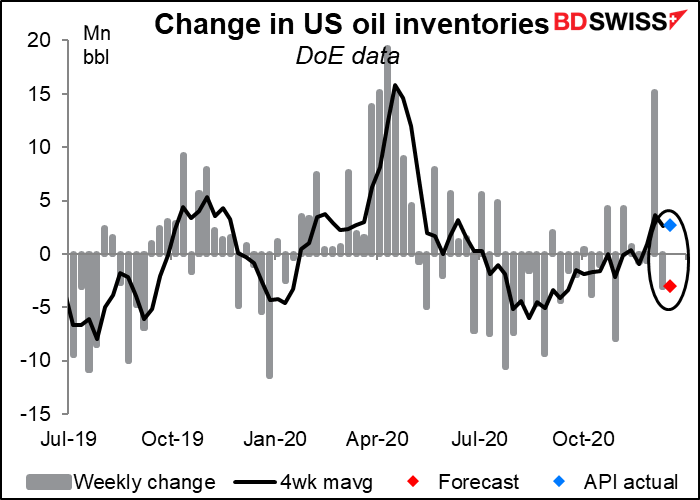

Another day of small movements in the FX market. It looks like a “risk-off” move, with USD and JPY gaining and the commodity currencies easing, on fears about what a more virulent strain of the virus might do to economic activity. Oil fell steadily for most of the day and got a kick lower later on after the American Petroleum Institute (API) reported a rise in US oil inventories, not the decline that market participants hat expected (see below).

In contrast to the risk-off tone in the FX market, stock markets in the US were mixed yesterday (S&P 500 -0.21%, NASDAQ +0.51%) and most markets in Asia are up this morning. This is despite the shocking news from the US, where that “very stable genius” Trump threatened to veto the pandemic fiscal support package. Tuesday evening US time he released a surprise four-minute video complaining about all the extraneous spending in the bill that wasn’t related to pandemic relief, such as foreign aid agreements and fish management, and said that if they didn’t raise the payouts to $2,000 per person from $600, the next administration would be dealing with the bill, not his.

I hate to agree with Trump on anything, but he is correct that the payments should be larger (especially mine please – I only got $11.55 last time). Even President-elect Biden called the bill “a down-payment” and said he would ask Congress for another major economic relief package once his term begins.

However a) it was Trump’s Treasury Secretary who suggested $600, b) the Democrats wanted to give more ($1,200 I believe) but the Republicans refused, and c) the parts of the bill that Trump objected to are not part of the $900bn covid relief agreement at all but rather included in other, separately negotiated parts of the legislation, including a $1.4tn omnibus appropriations bill and a measure authorizing $9.9bn in water projects. These bills and others were packaged together to help the pandemic relief pass a Republican Senate that doesn’t like giving money to anyone who needs it, only to millionaires who donate to the Republican Party.

Trump was stupid to weigh in at this point in the negotiations – he should’ve made his objections clear earlier on and instructed his Treasury Secretary to press these points – and he was really, really stupid to conflate the pandemic relief bill with the omnibus appropriations legislation. Will he be really, really, really stupid and veto the legislation? That could be a disaster. Even though Congress would probably just override his veto – the bill passed with enough votes on the first round to do so – it would still delay the whole process and cause a lot of trouble for a lot of people. The US “benefits cliff” is 26 December, i.e. Saturday, when the Pandemic Unemployment Assistance (PUA) and Pandemic Emergency Unemployment Compensation (PEUC) expire. That would mean around 14mn people will lose their benefits (the article linked to there is a month old and the figures are out of date).

GBP was once again higher on a “ray” of hope for a Brexit deal. The differences between the two sides seem to be narrowing down to fishing, and the amount of fish that they are haggling over is “minnow-scule” — some estimates are that it comes down to around EUR 30mn worth of fish, which is the going rate to transfer a football player from one team to another. Suggestions are being taken for whom they should give to France. The political editor at UK TV broadcasting company ITV tweeted that an agreement was possible today.

It’s noticeable though that the pound hasn’t benefitted that much from these rumors – either the news is fully discounted (what I expect) or no one believes them. I think too people are beginning to realize that a trade deal is the least of their worries. Deal or no deal there’s going to be chaos at the British borders from 1 January.

Where are we YTD so far?

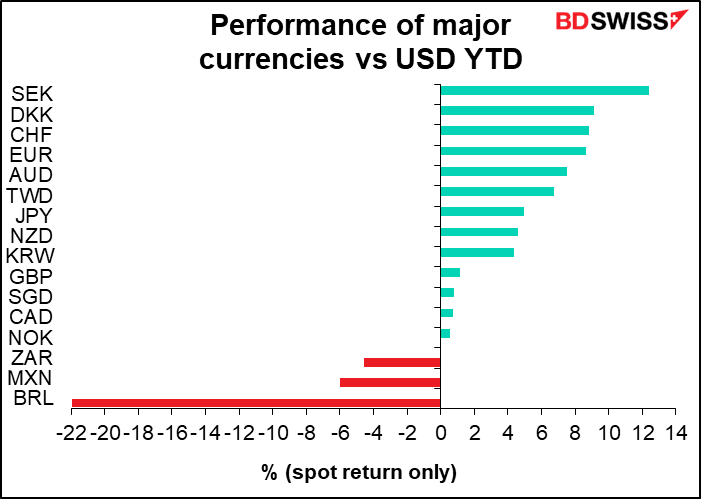

So far this year, the dollar has lost ground against all of its G10 counterparts. The real winners though were several emerging market currencies (as were the biggest losers, too). I’ll provide an update plus the consensus forecasts in the New Year.

Today’s market

There are a whole lot of indicators coming out today, mostly at 13:30 GMT. It’s going to be chaotic around that time as traders try to sort out the relative importance of various pieces of news that may well conflict with each other.

I’ll deal with them in the order of their importance as I see it.

The jobless claims figures are coming out a day earlier than usual. We’ve had two consecutive weeks of rising initial jobless claims. This week people are forecasting a tiny -5k decline. Does this reflect some data or some hope?

Continuing claims on the other hand are expected to rise by 52k, which is disappointing considering how many people have been falling off the unemployment rolls because they’ve been unemployed for too long. Continuing claims should be falling, not rising.

There will be another jobless claims figure out on Thursday, Dec. 31st, but we won’t be publishing then. That’s about the only US economic indicator of note being released the last week of the year.

Also on Wednesday we get the crucial US personal income & spending data for November. If you remember, the US retail sales figures for November fell a disappointing 1.1% mom. In other words, people in the US are cutting back on their spending – a reasonable response when they didn’t know if the federal unemployment benefits would be renewed. The wider US personal spending figure is expected to confirm this trend – it’s forecast to be -0.2% mom for November, the first decline since the plunge in April.

The grey personal spending dot is barely visible in the graph above because the forecast for personal income, the red dot, is almost the same at -0.3% mom. That’s worrisome too. It’s a result of lower government transfers. We’ll see much more of that in the new year, when the new parsimonious Pandemic Emergency Assistance payments kick in. Thanks to government assistance, aggregate incomes are currently higher than they were before the pandemic began despite the higher unemployment. That’s likely to change, and not for the better.

Spending on the other hand hasn’t yet recovered, and it’s not likely to if incomes fall.

The personal consumption expenditure (PCE) deflators are released at the same time. These used to be a biggie because they’re the Fed’s preferred inflation gauges, but nowadays inflation is slowly joining the trade figures and money supply data on the “dustheap of history” as yesterday’s crucial FX data. Central banks in general and the Fed specifically seem more focused on labor markets than inflation. Rather than fighting inflation, their role has turned around to fighting unemployment.

In any case, the rate of change of both the headline & core PCE deflators are expected to remain unchanged (+1.2% yoy and +1.4% yoy, respectively) so no big deal here regardless.

Durable goods are usually higher up in the order of priorities, but nowadays they’re not so indicative of the business cycle – the weekly jobless claims are a better indication of where the business cycle is headed.

Having said that, this month they’re forecast to show only a modest rise despite the expected recovery in Boeing aircraft orders. That’s not particularly encouraging.

Now let’s take a break from US statistics and go up north for Canada’s monthly GDP figure. Momentum in the economy is clearly fading as growth is expected to have slowed to the slowest since the recovery began in May. Energy output is up and construction is doing well, but manufacturing has yet to fully recover even though the Canada manufacturing PMI has been in expansionary territory since July.

It looks as if output in Canada is stagnating at below pre-pandemic levels – not unusual, but disappointing.

The University of Michigan’s consumer sentiment index is expected to be down only slightly. But yesterday’s Conference Board consumer confidence index unexpectedly fell to a four-month low instead of rising slightly as forecast (to 88.6 from 96.1, vs rise to 97.0 expected) so we may have a negative surprise from this one, too. Is it the virus or is it Trump spouting his nonsense about the election being stolen?

Sales of new homes in the US are expected to slip slightly (-0.5%), which would be less than the 2.3% mom fall that existing home sales showed in yesterday’s data. New home sales this year have far exceeded the levels of the previous two years so a modest dip is really nothing.

(By the way, my apologies — yesterday’s graph was mislabeled. It said new home sales, but showed existing home sales. In other words it was the right graph but with the wrong title.)

US oil inventories are forecast to fall by 3mn barrels in the latest week, but yesterday’s report from the American Petroleum Institute was a 2.7mn barrel increase in inventories, almost exactly in line with the four-week moving average (2.655mn bbl).

Then tomorrow, if you’re still active, we get Canadia building permits. Though they have a relatively high Bloomberg relevance score, I’ve looked at it and they don’t seem to be particularly relevant to USD/CAD. But here’s a graph anyway.

As for Friday morning’s Japan statistics, you’re not going to be trading then anyway so I won’t include anything about them. I did cover them in this week’s Weekly Outlook though if you’re interested – you can check it out here.

Here’s the rather empty calendar for next week.

See you next year!