Rates as of 04:00 GMT

Market Recap

Asia is largely following along from New York’s “risk off” mood this morning, although both China and Japan are closed for holidays today. Stocks fell in New York on Friday thanks to increased US-China tensions. Seeking to divert attention away from his appalling failure to deal with the virus in a timely fashion despite repeated warnings that he totally ignored, Trump is apparently mulling retaliatory measures against China in response to its role in the outbreak. US Secretary of State Pompeo yesterday gave an interview on TV where he said there was “enormous evidence” to suggest the virus began in a laboratory in Wuhan – not what China wants to hear right now. Trump promised a “conclusive” report from the US government on the Chinese origins of the pandemic and said tariffs would be “the ultimate punishment.” He further said that the Phase 1 trade deal with China requires the country to purchase US goods and if they don’t, the US will terminate the agreement.

Also weighing on stocks Friday was the poor performance of the tech stocks that have been the driving force of the rally recently. Their quarterly earnings have been disappointing: for example, Amazon reported record revenues but disappointed on profits, while Apple didn’t provide earnings guidance for the current quarter for the first time since late 2003.

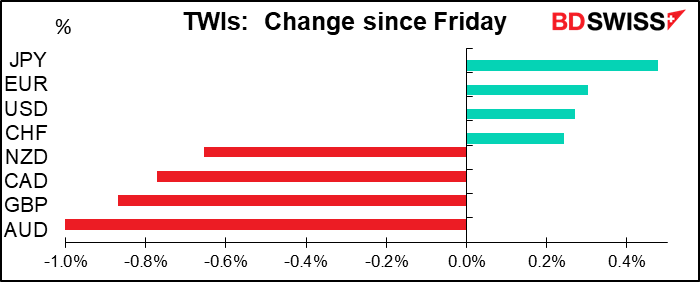

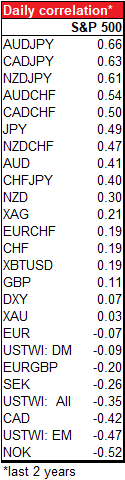

The FX market reaction to stocks was almost textbook. Here’s a table of the correlation of daily moves in FX rates with the S&P 500. (Those currencies for which only one currency is given are of course vs USD.) So today things went exactly as usual: JPY the #1 gainer, and AUD, CAD and NZD the losers, in that order.

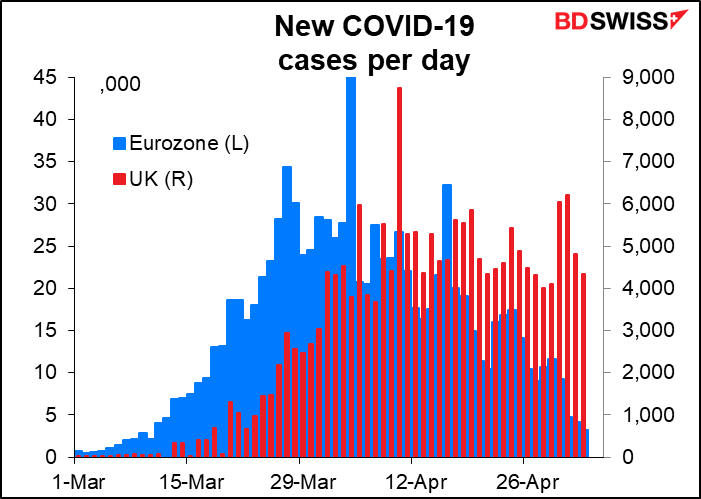

The only currency out of place then was GBP. I can’t find any specific reason for the move, although it doesn’t surprise me – I expect GBP to weaken further. Probably it’s due to the contrast between continental Europe’s progress on the virus and the UK’s lagging behind. Several continental countries are starting to emerge from lockdown now: Italy will allow manufacturing and construction to recommence today, as well as permitting some forms of social contact. Restaurants in Spain will be able to offer takeaway food and small shops in Greece will open. Britain however remains locked down as in the UK, the virus has plateaued but shows no signs of peaking yet.

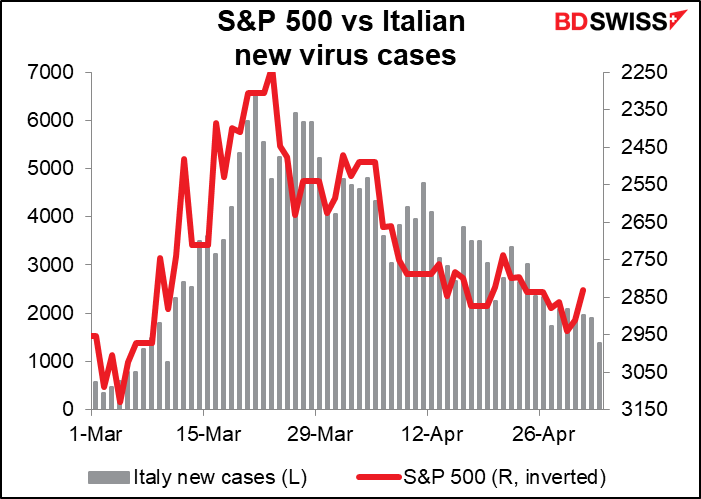

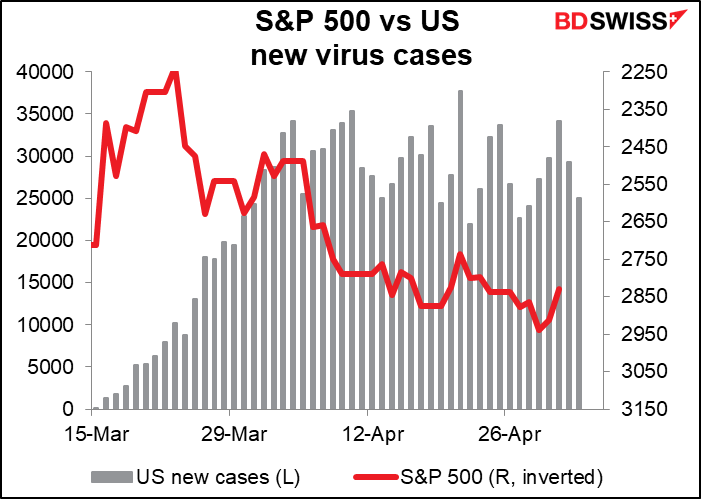

The US stock market still seems to be following Italy’s progress on the virus, although I’m acutely aware that there is such a thing as spurious correlation. (In fact there’s a whole website devoted to the topic, which is a lot of fun.)

Not the US, which isn’t doing that well. Nonetheless, some states are going to start lifting the lockdown. This has me worried about a “second wave” in the US, which is what I think will cause the dollar to plunge – when people see just how badly the Trump regime has managed this whole affair.

Kim Jong-Un resurfaced, but with a question mark: some people argued that it was actually one of his body doubles.

Commitments of Traders report

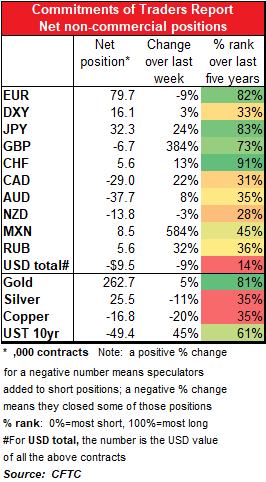

A little less bearish USD: specs increased their long DXY positions while simultaneously cutting their short USD positions (mostly by trimming long EUR, their biggest position in currencies by far). They also added to shorts in GBP, CAD and AUD. The only other currency they were noticeably bullish on was JPY, where longs increased considerably. The divergence between positioning in RUB (increased longs) and CAD (increased shorts) continues.

CHF longs are getting relatively high compared to positions in the past five years, but that’s only because positioning in the past five years hasn’t been very long. On an absolute basis, long 5,576 contracts isn’t very long at all.

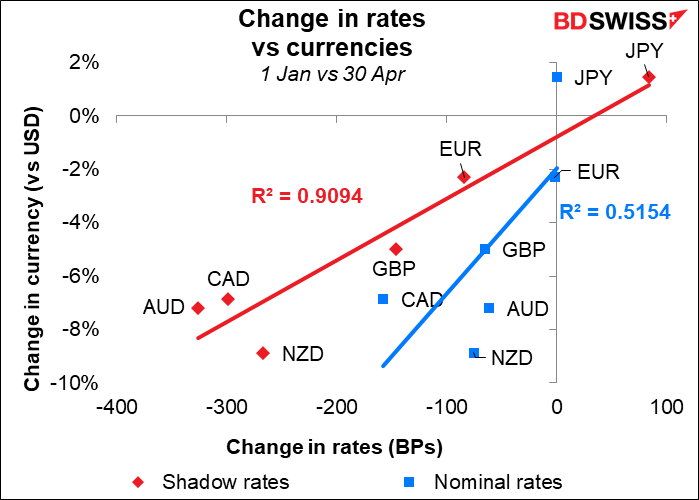

Update on shadow policy rates

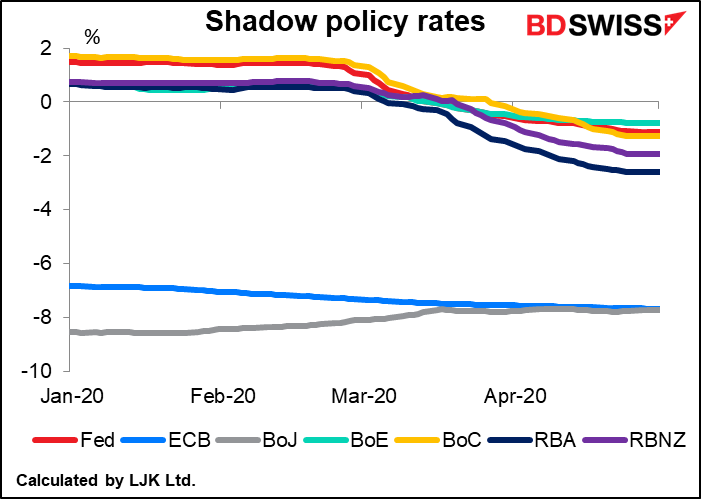

Once interest rates hit zero, they can no longer be cut further (well, not much further). Instead, central banks turn to quantitative easing and other unconventional policy measures to continue their efforts to loosen monetary conditions. Using various mathematical techniques that I don’t even pretend to understand, economists have developed ways of assessing the impact of these unconventional measures and converting them into effective interest rates in order to summarize the macroeconomic effects of the unconventional monetary policies. These measures are called “shadow policy rates.” The original work was done by Jing Cynthia Wu (then a professor at University of Chicago, now at Notre Dame) and Fan Dora Xia (then a rates strategist at Bank of America/Merrill Lynch, now at the BIS) in a 2015 paper, Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound. Their work is being carried on by Leo Krippner, a researcher at the Reserve Bank of New Zealand (RBNZ), who updates the results at the end of every month on his personal website.

What we see now is:

- CAD, AUD and NZD joined the ranks of currencies where the shadow rate is lower than the nominal rate.

- JPY and EUR still have far and away effectively the loosest monetary policy, despite the fact that the Fed has been inflating its balance sheet like a teenager on Viagra. However, the BoJ and ECB’s recent efforts have had little marginal impact on their shadow rates

- For that matter, the Fed’s recent actions have had surprisingly little impact either.

Australia’s shadow policy is noticeably lower than Canada’s although the nominal rates are the same, and despite the fact that Canada has expanded its balance sheet much, much more than Australia has this year (191% vs 47%). (Data for the Reserve Bank of New Zealand is only available up to end-March.) It’s clear then that the way a central bank implements policy is as important in its macroeconomic effect as the quantity of ammunition is.

Note that when rates are above the zero bound, the shadow rate is the same as the nominal rate. Therefore the end-February rates for AUD, NZD and CAD here are the nominal rates.

The shadow rates explain the movement of currencies between the beginning of the year and now much better than the change in nominal rates does (R2 of 0.91 vs 0.52). In both cases, those currencies whose rates fell the most also saw their currencies fall the most, as one would expect.

Today’s market

The main point of interest over the next 24 hours will be the Reserve Bank of Australia (RBA) meeting. I dealt with it in detail in this week’s Weekly Outlook. To summarize, I expect little out of this except a reaffirmation of their existing policy.

On the one hand, the Reserve Bank Board’s members think the Cash Rate is “now at its effective lower bound” and that they have “no appetite for negative rates.”

On the other hand, RBA Gov. Lowe recently said he expects the unemployment rate to “remain above 6% over the next couple of years” and headline inflation go negative in Q2 and “to remain below 2% over the next couple of years.” Meanwhile, the RBA has repeatedly pledged not to increase rates “until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.” In other words, no rise in rates is likely for “the next couple of years.”

If the RBA felt the need to take any more action, it would probably increase the size of its purchases of government bonds. However, at this point it’s satisfied with what it’s doing – it’s even started reducing its balance sheet a little.

In short, I would expect the RBA simply to reiterate that its policies are currently working but if they prove insufficient in the future, it stands ready to do “whatever is necessary.” I don’t expect the meeting to have much effect on AUD.

The RBA’s Statement on Monetary Policy comes out on Friday. This usually contains the RBA’s forecasts. However, I fail to see how anyone can make any reliable forecasts in today’s environment. The market could react to the forecasts, but then again, I’m not sure anyone believes any forecasts now.

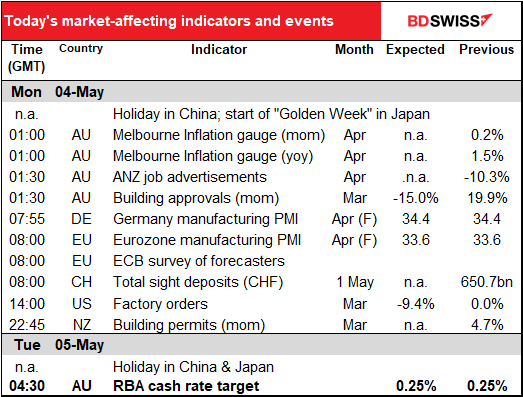

Aside from that, there’s not much on the schedule today. The manufacturing PMIs for most countries come out today, including the final versions for the major industrial countries that have preliminary versions released.

After that, US factory orders generally follow US durable goods orders, so no big surprise if they collapse this month, as durable goods orders were down 14.4% mom. The forecast decline of -9.4% would not be the biggest decline on record, but the other bigger declines immediately followed months of very high gains – in Aug 2014 they were down 9.7% mom, but that followed a 10.4% mom rise in July. Similarly, in July 2000 they were down 8.4% mom following a 10.2% mom rise in June. During the 2008 Global Financial Crisis the biggest decline was 7.7% mom, but of course that was in the middle of seven consecutive months of mom decline, so the total fall was quite severe.