Rates as of 05:15 GMT

Market Recap

We’ve seen a veritable parade of central bank and finance ministry (Treasury) actions around the world over the last few days to address liquidity and tightening financial conditions, on the one hand, and the fall-out of the need to shut down the economy temporarily, on the other. I think the most effective were the

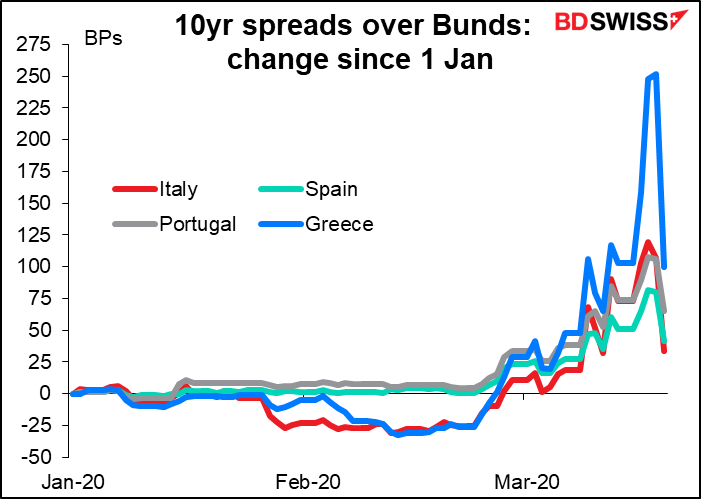

- The launch of the ECB’s €750bn Pandemic Emergency Purchase Program (PEPP) Wednesday evening and ECB President Lagarde’s commitments that there are “no limits” to what they will do to preserve the euro. In effect, the ECB is promising to buy everything that governments might issue in order to contain spreads, in contrast to Lagarde’s tone-deaf comment in the recent ECB press conference in which she said “we are not here to close spreads.” Apparently they are, and spreads came in accordingly (although that didn’t help the euro much!).

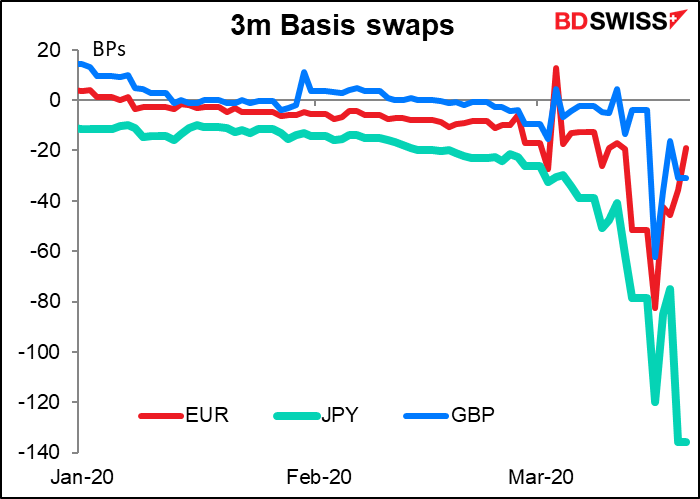

- Perhaps most powerfully, yesterday morning the Fed reopened temporary USD swap lines with nine additional DM and EM central banks to ease dollar funding shortages, probably the main thing that is causing the dollar to appreciate. This has taken some of the pressure off some currencies (notably KRW, see below) but not all, as the basis swap shows. The pressure remains particularly on JPY, which explains why USD/JPY is where it is despite the massive risk-off sentiment and the huge moves in GBP and NOK, for example.

- The Bank of England, which cut rates the other day to coincide with the Budget, held yet another emergency meeting yesterday and cut rates further (to a record low 0.10% from 0.25%) and restarted its QE program with GBP 200bn of purchases. Bank rate is now effectively at the lower bound, although the new BoE Gov., Andrew Bailey, refused to rule out further cuts. This is another astonishing record to fall: the Bank of England was founded in 1694, so this is the lowest bank rate in 326 years.

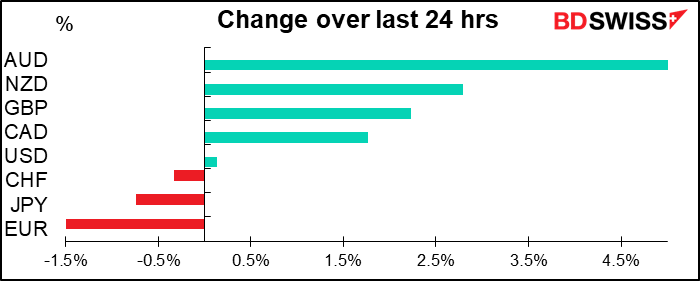

The actions have managed to stabilize the markets somewhat. US stocks closed up 0.5% yesterday in the first move of less than ±1% in 13 days. Futures indicate the S&P up about another 0.3% this morning. Most Asian markets are higher too, some by significant amounts (+6.6% in Taiwan, +4.9% in South Korea). The currency markets are showing a definite “risk on” mood, with AUD up and JPY down.

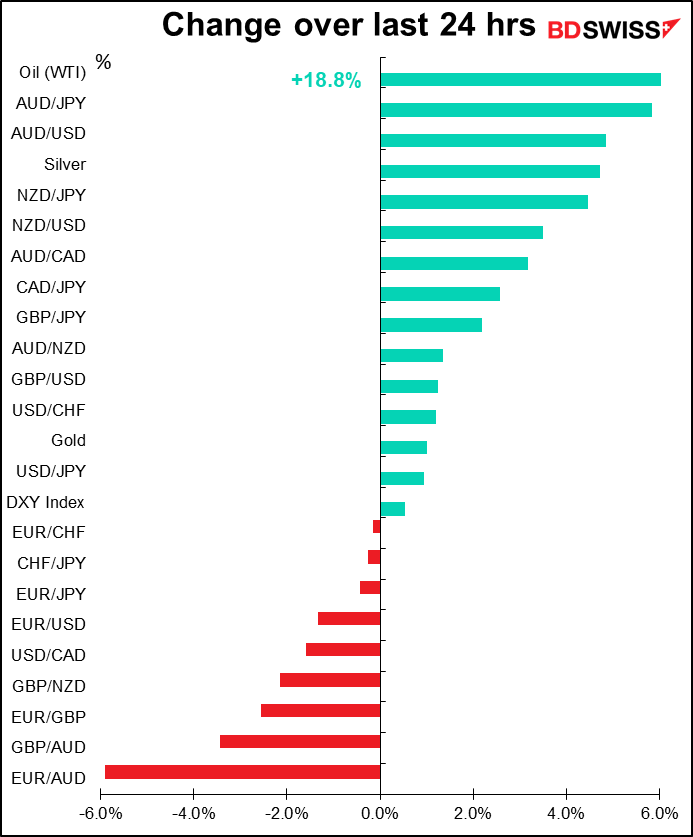

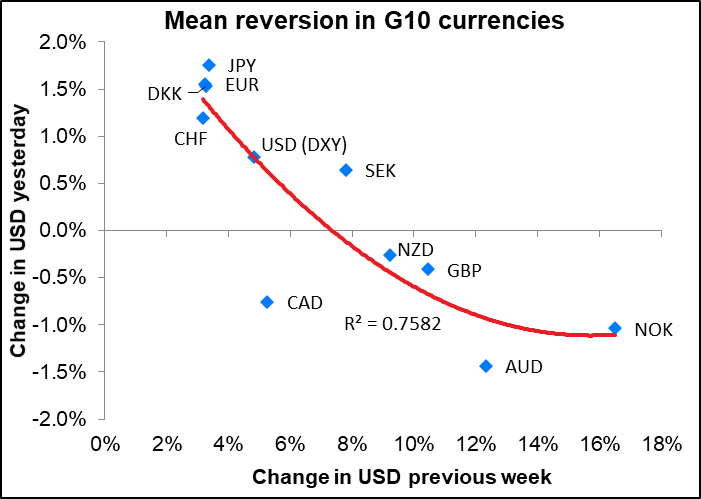

The moves allowed the FX market to reverse some of the recent action. The currencies that gained the most overnight were generally those that lost the most over the previous week. The biggest winner though (not shown) was the South Korean won (KRW), which gained thanks to the reopening of the swap facility between the Fed and the Bank of Korea. That’s a perfect example of how the establishment of the swap facilities should take some of the pressure off of the funding market for now.

Expect terrible economic indicators from now

We saw some terrible US economic indicators yesterday, and we’re going to get even more in the future. Initial jobless claims surged from 211k to 281k (220k expected! Hahahah!) while the Philly Fed index showed a record drop of 49.4 points to -12.7 from 36.7 (+8.0 expected). We can look forward to more misses like that (or worse) as no one really knows how this unprecedented event is hitting the economy.

A word about oil

The wild volatility in oil continued. After hitting the lowest close since 2002, WTI futures sprang back with a record 23.8% gain after Trump said something about intervening in the price war between Saudi Arabia and Russia. “At the appropriate time I’ll get involved,” he said.

Trump could lean on Saudi Arabia by using the US security arrangements for the Kingdom as leverage. However, given his sycophantic attitude towards the Saudis (remember Jamal Khashoggi?) I doubt if he’d be willing or even able to make waves there (although maybe if it’s in Russia’s interest he could be convinced to do it.) He’s already ordered the Strategic Petroleum Reserve to buy up as much as 77mn barrels of oil over time. That sounds like a lot, but if Saudi Arabia goes ahead with its plan to increase production by more than 2mn b/d, it’s only 38 days of Saudi Arabia’s excess production. What happens on Day #39?

Personally, I think this is just a throw-away comment from a blowhard who claims to be an expert on everything but actually knows nothing about anything. It’s particularly odd, because what’s happening is not just a price war between the Saudis and the Russians, it’s also – perhaps mainly — a price war between the Saudis and the Russians on one side and the US shale producers on the other. Saudi Arabia and Russia want to knock the US producers out of the market as much as (or more than) they want to knock each other out.

I was amused to see that oil industry leaders wrote to Trump asking for his help ensuring “restoration of a functioning, stable, global market for oil.” What they really mean is that they want him to resurrect the cartel that was artificially holding down production among low-cost producers and propping up prices so that their unlimited production of high-cost oil can be profitable. Welcome to Capitalism American Style, where free-market capitalism is only for workers and government-run socialism is only for companies.

One thing that would help oil: apparently, Texas’ main oil regulator is considering whether the state should curb crude production. It hasn’t done that since 1972, but it is legally possible. In other words, the US could surreptitiously join OPEC+. That would possibly do the trick. But is it politically feasible?

Virus update

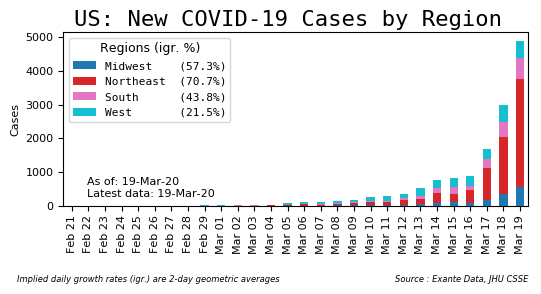

Exante Data, a firm formed by former Goldman, Sachs FX guru Jens Nordvig, published the following graph of US virus cases. Note the exponential curve. He comments: “Not pretty, and testing is still in the ramp-up phase.” The sudden increase is probably due to more testing, not more people getting sick. Nonetheless, it points the way for what we can expect in the next few weeks in the US. As physics great Prof. Al Bartlet said, “The greatest shortcoming of the human race is our inability to understand the exponential function.”

Today’s market

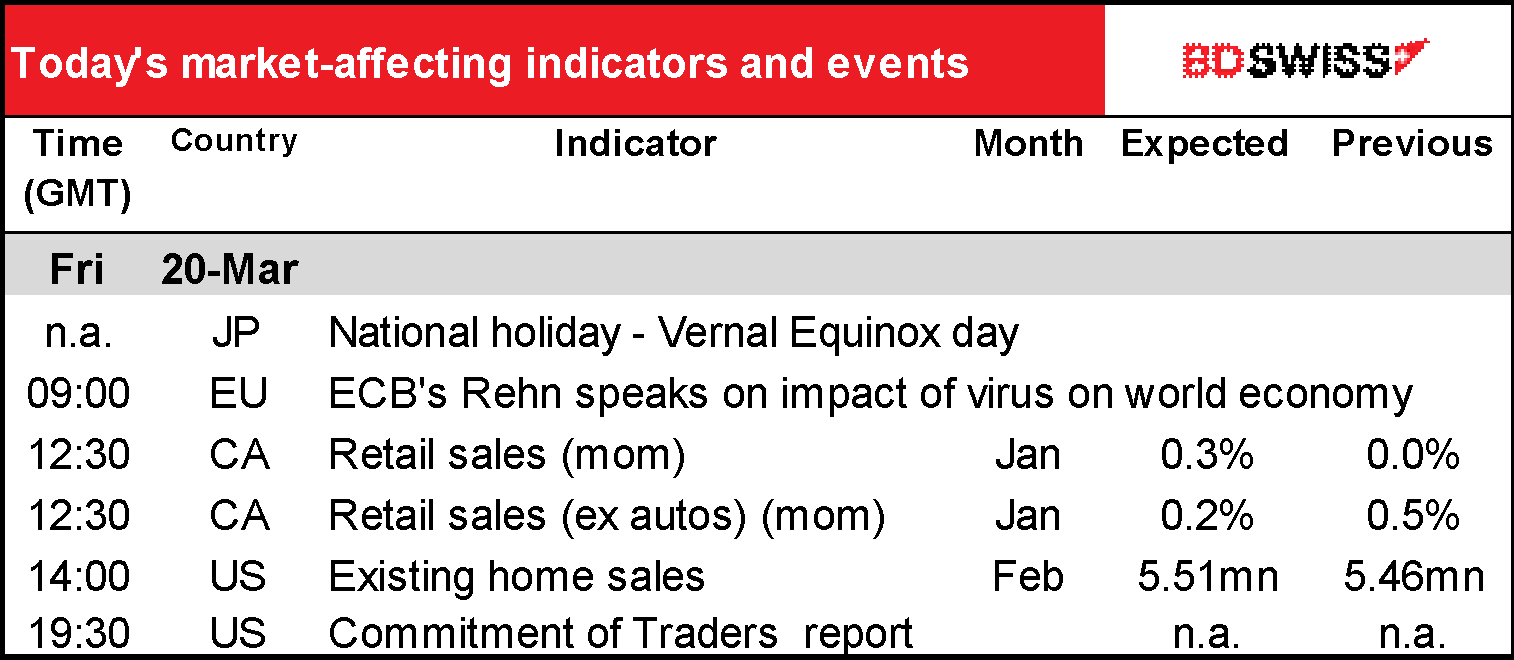

Another relatively quiet day for indicators.

Bank of Finland Gov. and ECB Governing Council Member Olli Rehn will speak at a press conference on the economic impact of the coronavirus pandemic in Finland and the world. My guess is he’ll think it’s bad. Just how bad is of some interest to the markets. ECB President Lagarde Wednesday estimated that it might cause EU output to contract by around 2% a month for a total hit to output of 5% or so over the duration of the lockdown, but that was a second-hand report. We’ll be interested in hearing a first-hand report of what the ECB is thinking – although their thinking is just a guess, just like everyone else’s.

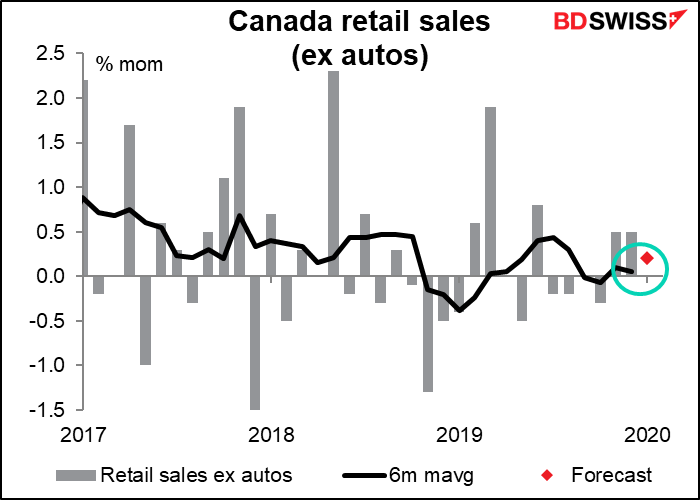

Canadian retail sales are expected to have risen in January. Wonderful. I’m really happy for them. Good job!

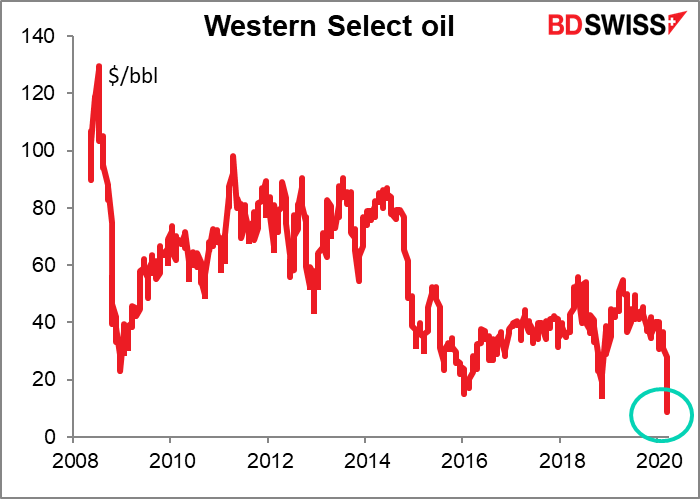

However, I’m not sure it matters. With Canada’s Western Select oil was recently trading below $10 a barrel, I’m not sure January’s data is particularly relevant anymore. I haven’t seen an oil price with a one-digit handle since…well, for WTI the last time was December 1973. Western Select trades at a spread under WTI (currently $13.40 under, more or less) so it’s not like WTI is trading in single digits, but still…

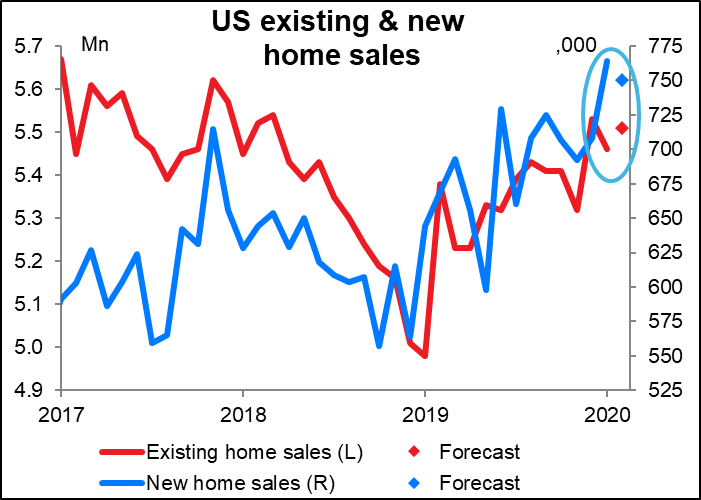

Similarly, US existing home sales are expected to do pretty well – in fact they’re forecast to rise from the previous month. New home sales, which come out next week, are forecast to fall a bit, but that’s from January’s rate, which was the post-GFC high. (It dawns on me, we’re going to have to think up another term for “crash,” to differentiate which crash we mean: the 2008/09 Global Financial Crisis or the 2020 Coronavirus Crash.) However, I’m not sure what this portends for house sales going forward. What I’ve seen on Twitter – which admittedly is not a scientific survey by any means – is that no one is looking at houses nowadays. What with cities on lockdown and layoffs soaring, I don’t know how many people are looking to buy a new house just now. House sales are usually a function of consumer confidence and that’s bound to take a hit.