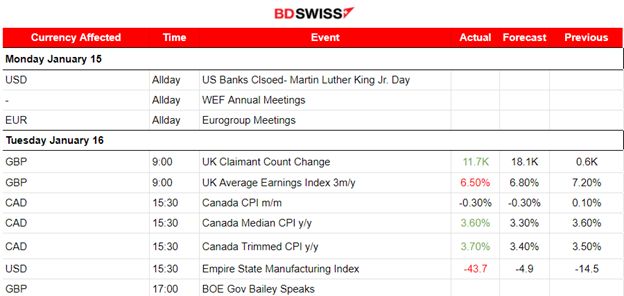

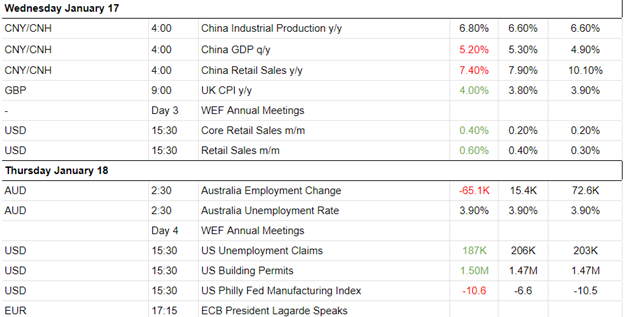

PREVIOUS WEEK’S EVENTS (Week 15-19.01.2024)

Announcements:

U.S. Economy

The U.S. Retail Sales figures reported last week indicated a surprising increase in retail sales in December showing signs of economic resilience.

Economists changed their economic growth estimates for the fourth quarter, casting further doubt on financial market expectations that the Federal Reserve would start cutting interest rates in March after taking into account the NFP/strong employment report and the recently released inflation report.

Most economists are confident the economy will avoid a downturn and that the economy might be just right for rate cuts in 2024.

The Unemployment Claims figure was reported surprisingly lower. New Claims fell to the lowest level in nearly 1-1/2 years, coinciding with the recently reported hot labour market data. The figure was reported to be 187K, an unusual drop below 200K, the level that served as a “support” recently.

Economists said the data was consistent with a fairly tight labour market. Strong retail sales growth in December was also reported, making it difficult for the Federal Reserve to start cutting interest rates in March as financial markets anticipate. The view that the Fed is likely to hold rates at current levels until the middle of 2024 is strongly supported.

The Consumer Sentiment and Inflation Expectations reports released on Friday showed that there is a significant improvement in the U.S. consumer sentiment in more confidence in January, reaching the highest level in 2-1/2 years amid growing optimism over the outlook for inflation and household incomes.

The University of Michigan reported a better-than-expected figure for consumer sentiment. The overall index of consumer sentiment came in at 78.8 this month, the highest reading since July 2021, compared to 69.7 in December. Consumers’ inflation expectations over the next 12 months were the lowest in three years.

Easing inflation expectations supports economists’ views that the U.S. central bank will start cutting interest rates in the first half of this year.

Australia Economy

In Australia, employment fell sharply in December after two months of surprisingly strong growth, while the jobless rate remained on the same level. Employed people were less by 65.1K in December from November, from a way higher revised change of 72.6K the previous month. Market forecasts had been for an increase instead of around 17.6K.

The jobless rate stayed at 3.9%. The participation rate dropped sharply to 66.8%, from a record high of 67.3%.

U.K. Economy

The U.K. Retail Sales report revealed a big decline in sales in December, with retail sales volumes falling 3.2%, raising the risk the economy entered recession late last year.

Canada Economy

Canadian retailers experienced an unexpected decline in sales, a 0.2% month-on-month decline in November led by a slowdown in sales of food and beverages. Core retail sales, which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers, fell 0.6% in November.

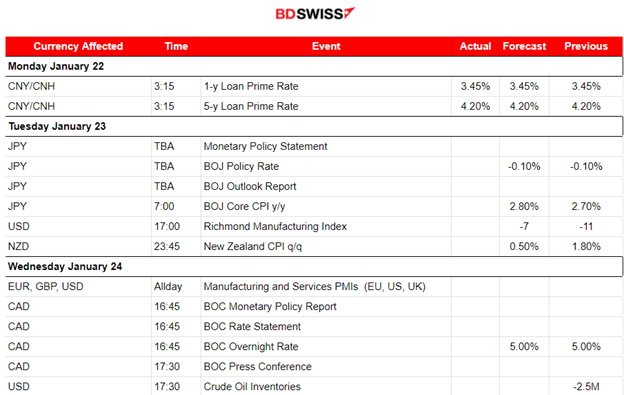

The Bank of Canada (BoC) is expected to hold interest rates steady next week as inflation remains above its 2% target, despite falling from last year’s peak and with signs of slowing growth. Markets and economists expect the BoC to start trimming rates during the first half of the year.

The advance estimate for December suggested a 0.8% increase in sales.

______________________________________________________________________

Canada Inflation

Canada’s inflation was reported higher than expected in December. Annual inflation rose to 3.4% in December from 3.1% in November giving no room for conversations around interest rate cuts.

The annual inflation rate was largely driven by higher gasoline prices compared with the same period a year ago.

U.K. Inflation

U.K.’s inflation figure was reported higher, rising to 4.0% from November’s more-than-two-year low of 3.9%. Expectations for when rate cuts could be implemented changed immediately. Inflation began to fall faster than expected in the latter months of last year, a surprisingly large drop giving the impression that it would be back at the BoE’s 2% target by April or May this year. However, these data change everything.

Core inflation – which excludes volatile food, energy, alcohol and tobacco prices – was unchanged 5.1% in December. Services inflation increased to 6.4% in December from 6.3% in November.

______________________________________________________________________

Source:

https://www.reuters.com/world/uk/uk-inflation-rate-rises-4-december-2024-01-17

https://www.reuters.com/markets/canadas-inflation-rises-34-dec-meeting-expectations-2024-01-16/

https://www.reuters.com/world/uk/british-retail-sales-slump-32-december-2024-01-19/

https://www.reuters.com/markets/us/us-consumer-sentiment-rises-solidly-january-2024-01-19/

https://www.reuters.com/markets/us/us-retail-sales-beat-expectations-december-2024-01-17

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 15-19.01.2024)

Server Time / Timezone EEST (UTC+02:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

A surprising upward and rapid path for the dollar index last week starting on the 15th Jan. A short-term upward trend that ended on the 17th Jan. The U.S. retail sales released on the same day, even though they caused some USD appreciation intraday, the dollar did not experience more strength but remained at the same high levels. The path changed sideways around the 30-period MA but experienced high volatility. Consumer expectations regarding future inflation are supporting the view that inflation will get to lower levels suggesting that rate cuts are on the way causing the dollar to lose strength. A downward wedge is currently formed as per the chart.

GBPUSD

The pair reversed from the downside on the 17th Jan. The sharp upward path is attributed mostly to GBP appreciation caused by the inflation report the same day. U.K.’s inflation was reported higher while the dollar started to lose strength during that period. The path remained roughly upward within a channel and around the 30-period MA. The Retail Sales report for the U.K. on the 19th caused the pair to drop but the impact was not strong enough to break the channel. It remained in range and currently tests the highs.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

After the Spot Bitcoin ETF approval from the SEC, Bitcoin saw an unusual fall in value. On the 18th Jan, it dropped heavily until the support near 40600 USD. Retracement followed but on the 19th it saw another drop to 40200 USD. On the same day, it recovered fully and on its way up it crossed the 30-period MA showing strength, settling at near 41600 USD. During the weekend the price experienced very low volatility but on the 22nd Jan, the price dropped heavily again reaching and testing the 40600 USD support once more. It is currently settled around that level.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

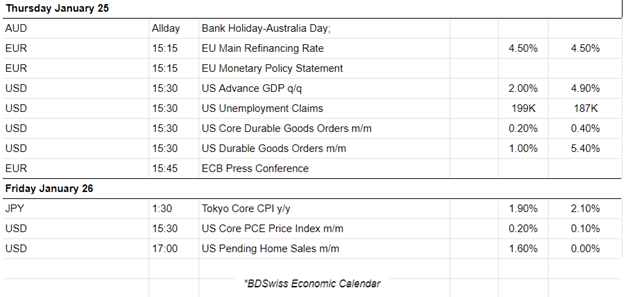

NEXT WEEK’S EVENTS (22 – 26.01.2024)

Next week we have the release of the monetary policy report and rate decision for the Bank of Japan (BOJ), Bank of Canada (BOC) and the European Central Bank (ECB).

We also have the release of the Durable Goods orders report for the U.S. which could cause higher volatility levels and add to the data of economic resilience.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

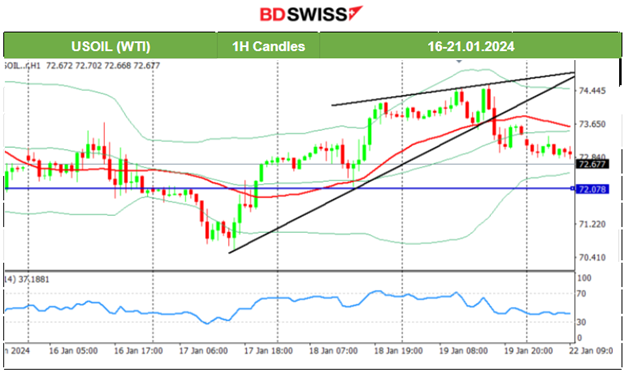

Crude oil experienced a short-term upward trend from the 17th to the 19th Jan. After the reversal to the upside on the 17th it crossed the 30-period MA on its way up and found strong resistance near 74.5 USD/b before reversing again to the downside heavily. It crossed the MA on its way down showing signs that the uptrend ended and a more probable sideways but volatile movement is following next. 72.5 USD/b seems to be the support at the moment that could drive the price back to the MA.

Gold (XAUUSD)

The price broke the support at near 2017 USD/oz on the 17th Jan, moving to the next at 2001 USD/oz. This short-term downward trend found an end as the price eventually retraced significantly. On the 18th Jan, the price moved to the upside, crossing the MA on its way up reaching the 61.8 Fibo level, as depicted on the chart. Seemingly, preference for Gold increased as currently the dollar value remains stable against other currencies. The upward movement found resistance on the 19th Jan near 2041 SUD/oz and the price reversed to the MA. The price continues sideways with high volatility around the mean currently.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

All benchmark U.S. indices moved to the upside quite rapidly in the past few days, particularly since the 17th Jan. The uptrend is clear with some retracements taking place every day, however not being complete as the path is quite strong to the upside. The 4H chart below shows why this is clear. Volatility levels are higher than usual. I am expecting a retracement soon. Upon NYSE opening it would be more clear if the index will move further to the upside or break the intraday support and eventually retrace to the 61.8 Fibo level as per the chart.

______________________________________________________________